Both research and education are well organised, easy to comprehend, and useful for any type of trader.

XTB’s trading education offers a clear-cut path to important trading principals, and can be sorted by experience levels and subjects.

Each lesson is followed by relevant quizzes and offers an opportunity to leave feedback and ask questions.

XTB’s webinars provide an opportunity to learn from experienced traders, as well as interact with the whole class – including the mentors and XTB account managers.

The number of tools, news feed, and built-in recommendations make XTB one of the best brokers in that regard.

XTBs xStation recommendations

You will find recommendations on major events quoted from Morgan Stanely, and Reuters, as well as YouTube daily reports on major forex & CFD instruments.

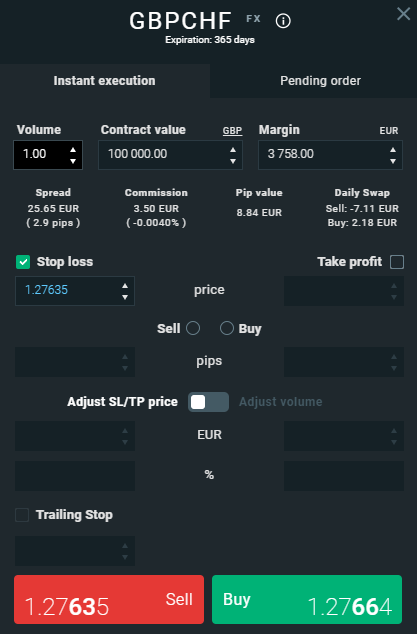

In the paid price section, you would find the info on the average price paid per stock by XTB’s users. You can also benefit from buy/sell analysis rating, a feature native to TradingView and alike.

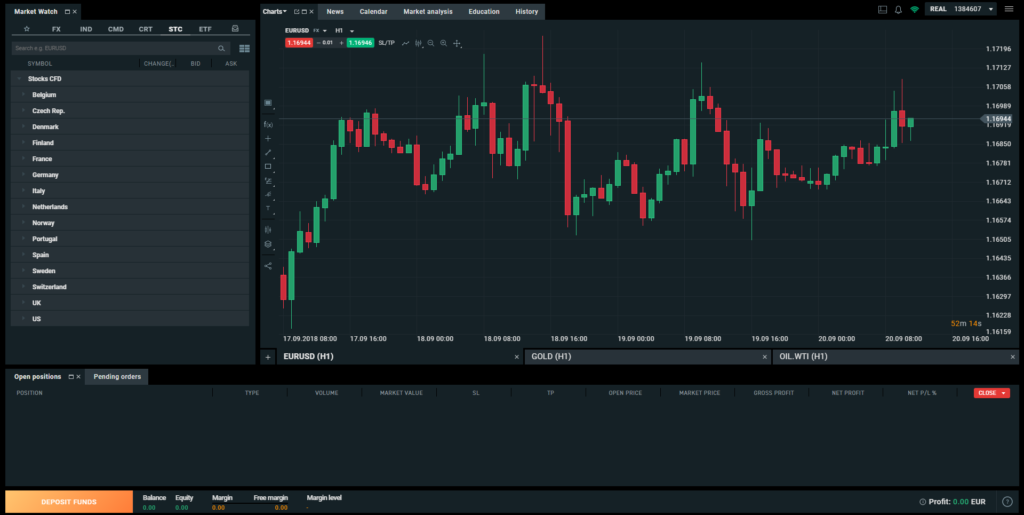

Charting

Charting tools is quite robust, packing over 20 indicators. Surprisingly, you won’t be able to save the chart settings for later.

Fundamental Reports

Basic information is limited to P/E ratio – you won’t find the information usually available through other premium brokers.

Other Research Tools

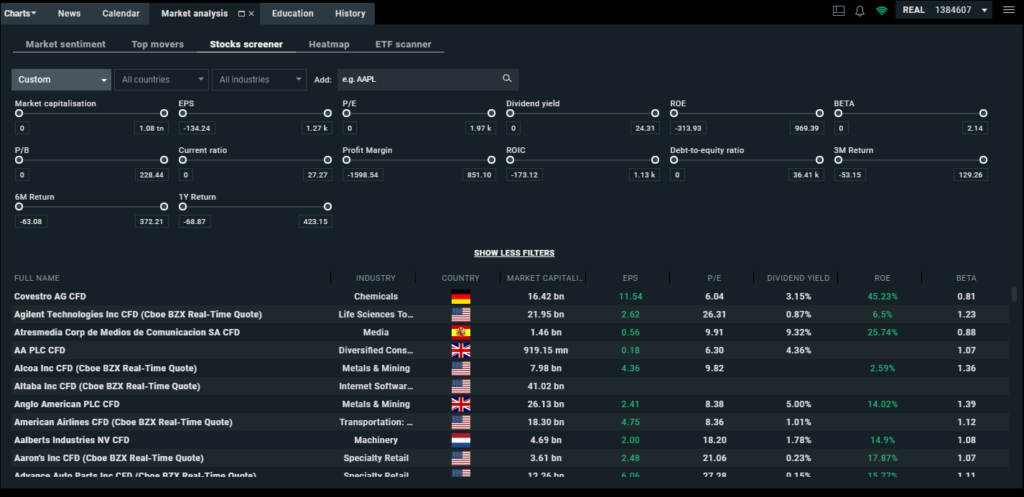

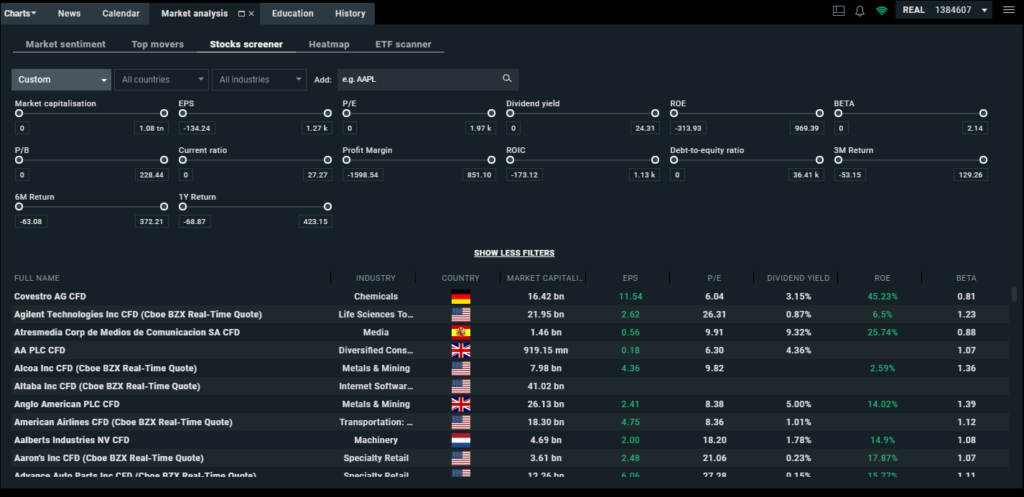

You will find market sentiment features that allows you to see other XTB clients position. There are other features such as an overview of winners and losers and the heat map function. XTB manages to offer enough complementary features to convince a trader to switch to xStation.

Finally there are Stock and ETF scanners, which will help you filter the assets by type and industry, as well as access basic intelligence.

News Feed

The News feature is a proprietary development that was awarded the Best EMEA FX Forecaster by Bloomberg in 2018.

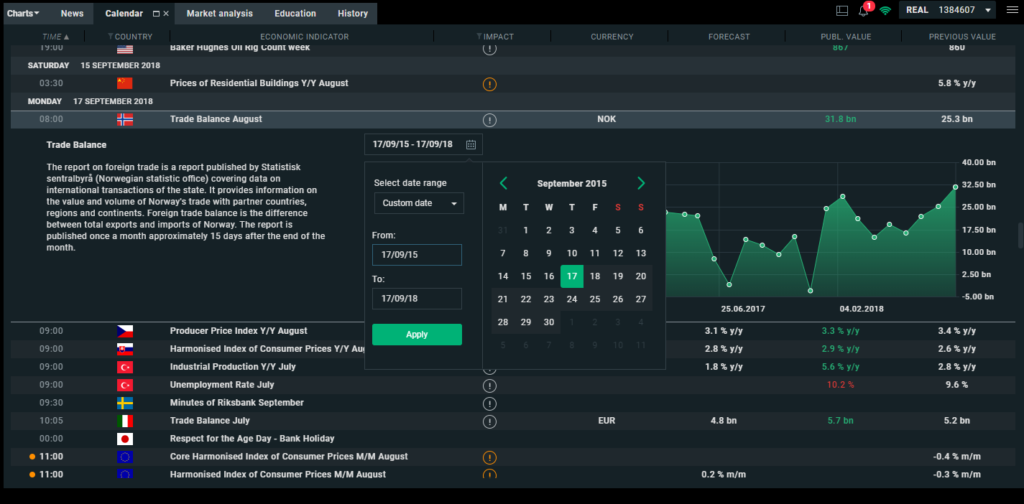

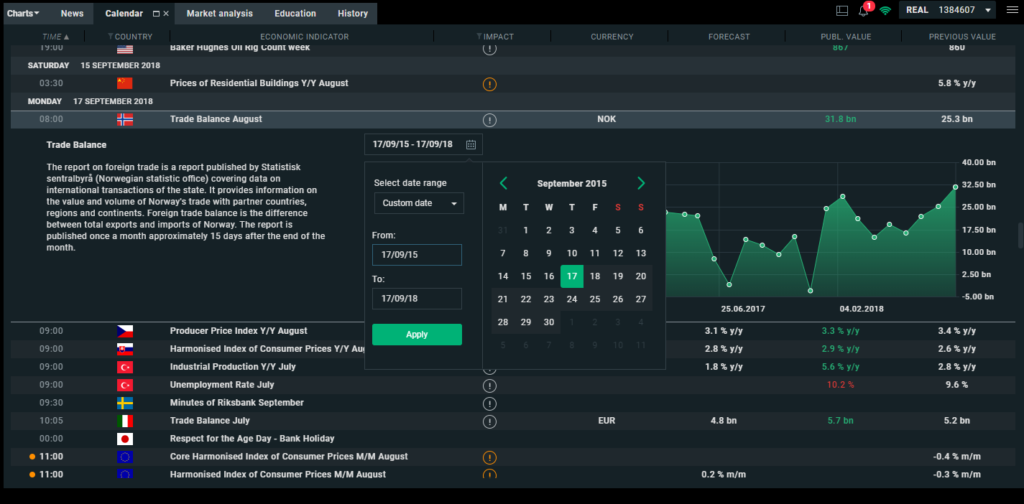

Together with economic calendar this modules allows you to quickly collect the necessary information.