Operating as an industry leader, the advantages that stem from using Bitsgap are substantial. Before we provide a full review of Bitsgap, let’s start with a brief summarization of some of Bitsgap’s core features.

The advantages that radiate from Bitsgap serves as a testament to their integrity.

As an industry leader, Bitsgap features some must-have features:

- One Spot: Access to over thirty crypto exchanges all in one platform. Including Bitstamp, Binance, Kraken, BitFinex, Gate.io, and more.

- Bitsgap Bot: Automate your trading with proven back tested strategies.

- Asset Diversity: Over 10,000 trading pairs are available.

- Trade Insights & Performance: Extensive and precise portfolio evaluations are autonomous; therefore, freeing you from manual tracking setups.

- Trade Price Differences (Arbitrage): Fast data calculations occurring within six milliseconds with 1-click arbitration through Bitsgap’s inter-trading platform is active.

- Security & Encryption: All user data, login attempts (checked and verified), two-factor authentication, advanced algorithms for password encryption, and more are available through the presence of Bitsgap’s EV SSL Certificate and 2048-bit encryption.

- Theft Control: Traders may turn off transfers that serve as an increased security protocol against any potential misuse of your Bitsgap trading account.

As cryptocurrency continues to become more mainstream, the demands for technological-adept trading platforms that provide advanced analytical trading tools, technical indicators, and customized investment integrations continue to rise.

Bitsgap trailblazing multi-exchange arbitrage example has influenced other crypto competitors such as Coingy and TradingView, to participate in crypto arbitrage.

Unlike competitors such as TradingView, Bitsgap continues to attract traders through its simplistic trading platform.

For example, Bitsgap allows traders to manage both trade information and setups through one platform.

This structure provides a significant advantage over having to navigate multiple exchanges each time a trading opportunity presents itself.

Despite starting as a small startup from Estonia, Bitsgap continues to pioneer the crypto trading industry. This feat is mainly in part because of the rich assortment of trading tools and resources provided to day traders.

At its core, Bitsgap is deemed by many as a next-generation platform.

Catering their services and platform for crypto traders, Bitsgap delivers a level of trade sophistication that outperforms most competitors while surpassing the trade ingenuity sometimes seen in forex, CFD, stocks, and commodity trading.

Headquartered from Estonia, Bitsgap Holding OU. employs a mixing pot of professionals that possess decades of experience within the following fields:

- Trading

- Investments

- Asset Management

- Marketing

- Start-ups

- Project Management

- Blockchain Technology

- Cryptocurrencies

Bitsgap also employs 12 full-stack developers where every team member possesses designated roles.

As Bitsgap continues to grow, so does their customer support team to meet demand.

Here is more information regarding the board members:

Range of Cryptos

Bitsgap offers traders access to over 10,000 trading pairs.

Bitcoin, Litecoin, Ethereum, and major altcoins are supported.

There are many crypto pairs given that over thirty exchanges contribute to the asset pool available to day trade.

Charts and Trading Platform

Bitsgap features a fully functional and sleek trading interface.

Featuring quick maneuver tabs, Bitsgap empowers traders with the following abilities:

- Seamless manual trading

- Custom trading bot employment

- Utilize trading signals from various exchanges

- Perform crypto arbitrage trading

- Extensive portfolio management

Bitsgap has made considerable improvements since its debut in 2018.

Day traders using Bitsgap manual trading platform may notice how the platform reflects a similar structure and functionality to that of MetaTrader4 (MT4).

Additionally, an arsenal of analytical trading tools and technical indicators is now available within the platform.

Diving deeper into the trade interface will reveal several platform options for traders.

Centered on the screen is a price chart that reveals which crypto platform and trading pairs are actively reflecting priority.

From there, traders can click on “Options” to reveal the following integrations:

- Time Frame

- Chart Style

- Indicators

- Signals

- Screenshot

- Investment Tools

Traders may also enhance the visual feed of the middle chart by enlarging to full size while some other noteworthy platform features include:

- The order book shares market insight about the quantity of buy and sell orders for each price level in continuous real-time. The order book is at the top-left of the platform.

- Trade alert and orders enable traders to instantly manage trade setups such as limit order, market order, shadow order, and stop-limit while inputting your exchange’s API key support coin swaps. This option is at the lower-left of the platform.

- Trade oversight reveals open order, trade balances, trade positions, trade history, pricing alerts, and messages. This option is at the lower-right of the platform.

- Primary trade menu reveals a cryptocurrency pair’s price, 24-hour growth percentage, crypto pair favorites along with recent trades. The main trade menu is at the top-right of the platform.

Bitsgap is consistently addressing trader requests while providing platform improvements.

For example, in 2018, Bitsgap implemented the compare function tool, which enabled traders to compare the market movements of two or more different instruments simultaneously.

More recently, in 2019, Bitsgap bridged trader requests with innovation and debuted the Bitsgap Bot in 2020.

Bitsgap Trading Plans & Pricing

There are three subscription-based trading plans available at Bitsgap.

Basic – $19/month

The basic account has two active trading bots, supports demo trading and trading signals, provides portfolio access, more order types, unlimited cryptocurrency exchanges, and a $25,000 monthly trading limit. If billed annually, the plan drops to $15 per month.

Advanced – $44/month

The advanced accounts have five active trading bots, arbitrage trading, and a monthly trading limit of $100,000. If billed annually, the plan drops to $35 per month.

Pro – $110/month

Includes Advanced plan features, up to 15 active trading bots, take profit for bots, priority trader support, and no monthly trading limit. If billed annually, the plan drops to $88 per month.

Each plan offers a free trial while traders wishing to use trading bots and perform crypto arbitrage must have an Advanced or Pro trading plan.

To note, Bitsgap does offer a Free Plan, although platform features will be limited while trading bots and arbitrage trading won’t be available.

Portfolio and Statistics

When traders input their exchange’s API keys, trade portfolios become available.

A nice feature with the Bitsgap trade portfolio would be how day traders can extract their trade portfolios onto their operating systems.

Monitor your portfolio value in real-time while analyzing your portfolio performance across varying periods.

Traders can also narrow down reports to reflect values for specific exchanges.

Should day traders have only one exchange integrated, then the portfolio will reveal a breakdown of the digital coins.

Market participants can export files from your PC or Cloud to the Bitsgap platform.

Traders can also access open orders, trade history, and analyze investment positions.

Other accessible stats include:

- Crypto Pairs

- Type of Trade

- Which Exchange

- Trade Volume

- Entry Price

- Accrued Value

- Trade Status

- Date

- Profit/Loss

Bitsgap Crypto Trading Bots Review

Bitsgap has placed extraordinary emphasis on advancing their trade technology.

By implementing automated trading bots powered by a high-frequency trading algorithm, Bitsgap has brought to market three versatile trading bots:

- SBOT

- Scalper Bot

- Trailing Bot

Bitsgap SBOT

The newest addition to Bitsgap’s trading bot arsenal would be the SBOT.

The SBOT works with the grind investment distribution framework.

Technically, the SBOT seeks to maximize returns on bullish and neutral trends while minimizing losses on a bearish trend.

First debuted in March 2020, the SBOT has since experienced a few integrations that include merging the functionality of the Scalper Bot with SBOT while rendering day traders with new trade options and break-even close bot ability.

Before the innovations, the SBOT supported grid spacing as low as 0.1%, but now day traders can create the SBOT with 0.01% grid spacing.

Throughout any price range, up to 180 open orders may be active.

A new performance window can help traders see how capable the bot is.

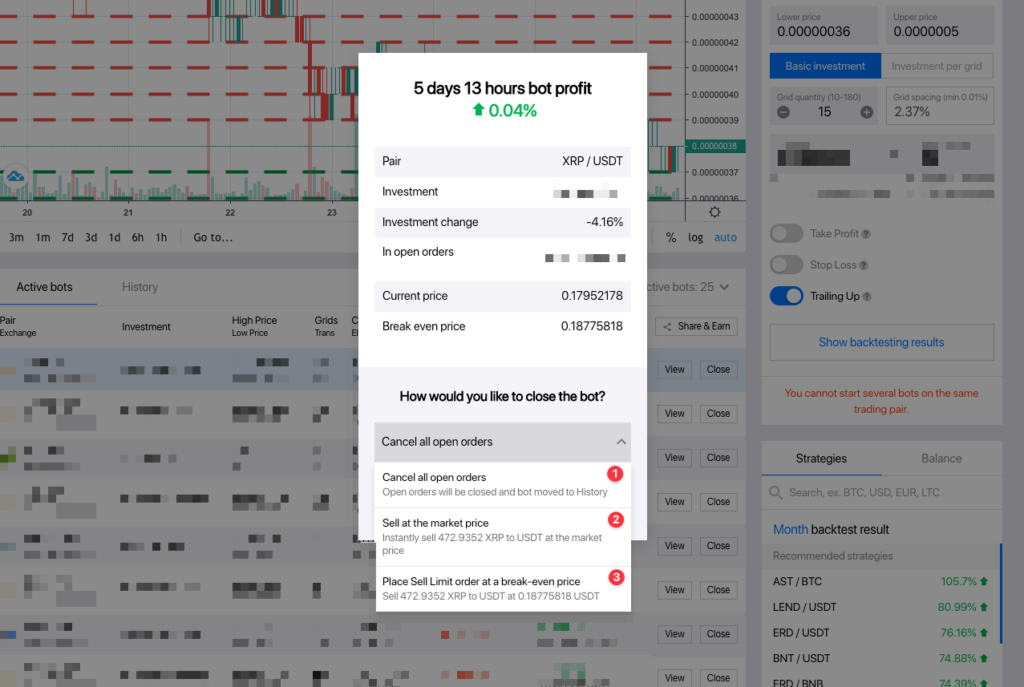

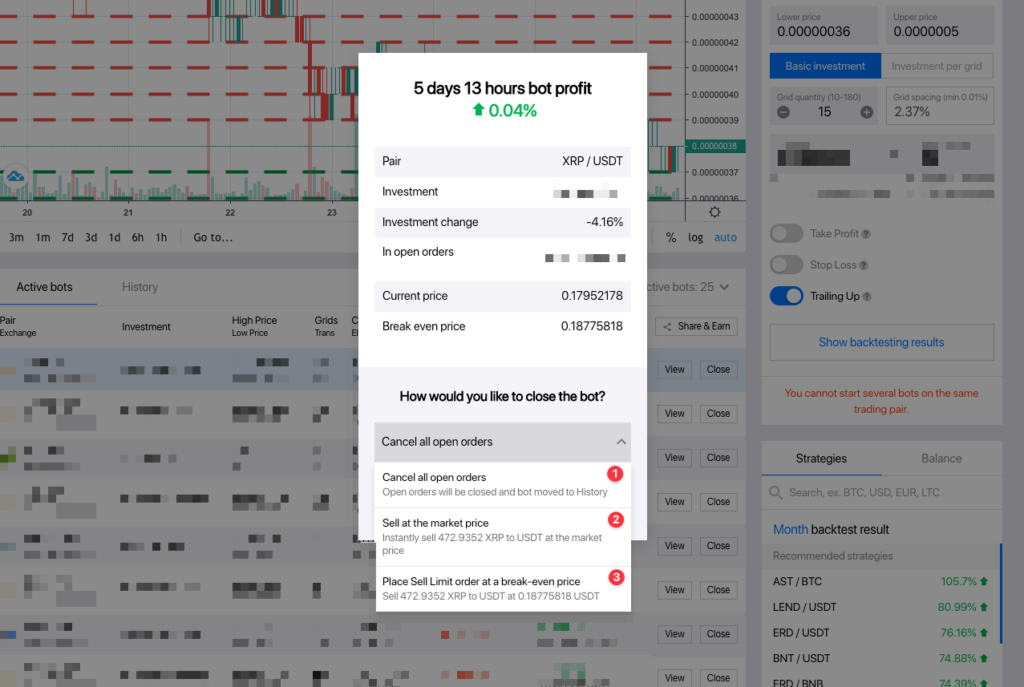

The last improvement made to the SBOT would be the option to close the bot.

The three options that appear when closing the bot include:

- Sell it at the market price.

- Cancel all open orders and receive base currency back.

- Set a break-even option where the bot will close upon reaching a fixed price.

Generalized FAQs

Q: Are these changes available for my current bots?

A: Yes, all updates are available on all active bots.

Q: Does it mean that now the activity of my active bots will affect monthly trading limits?

A: Yes, given how high-frequency trading requires ample technical power, day traders’ monthly trading limits will be affected.

Q: What is going to happen with my currently active Scalper Bot?

A: Old Scalper Bots can remain busy. Traders are not able to start new Scalpers as the Scalper Bot’s functionality is with the SBOT now.

SBOT Core Features

- SBOT will follow the original investment when possible, rendering more control to traders.

- The trailing function is as low as ten levels (use to be 20 levels).

- The quantity of grid orders when using trailing options remains the same, although readjustments will not decrease now (it used to less than half.)

- Up to 200 grid levels now supported for Binance users (the previous grid-level cap was 99).

- Employ backtested and optimal trade strategies that vary with market conditions

Scalper Bot

The Scalper Bot features a high-frequency trading function that benefits from minuscule price movements.

Limit sell and limit buy orders with Scalper Bot enables traders to minimize price spreads regardless of the strength of price movements.

This bot attempts to accumulate profits by selling the base cryptocurrency as price moves upwards. In contrast, in the event of a market crash, the bot minimizes total losses through the offset of incoming profits generated by the bot.

The two programmed goals of the Scalper Bot would be to maximize profit in a bullish market that is followed with automated trailing while compensating losses in a downtrend.

The Scalper’s default programming creates 200 orders.

Some trades are entered around the starting price to maximize high-frequency trading.

This programming provides the bot with enough wiggle room to generate profits from tiny price movements while helping keep the bot stable should price depreciate.

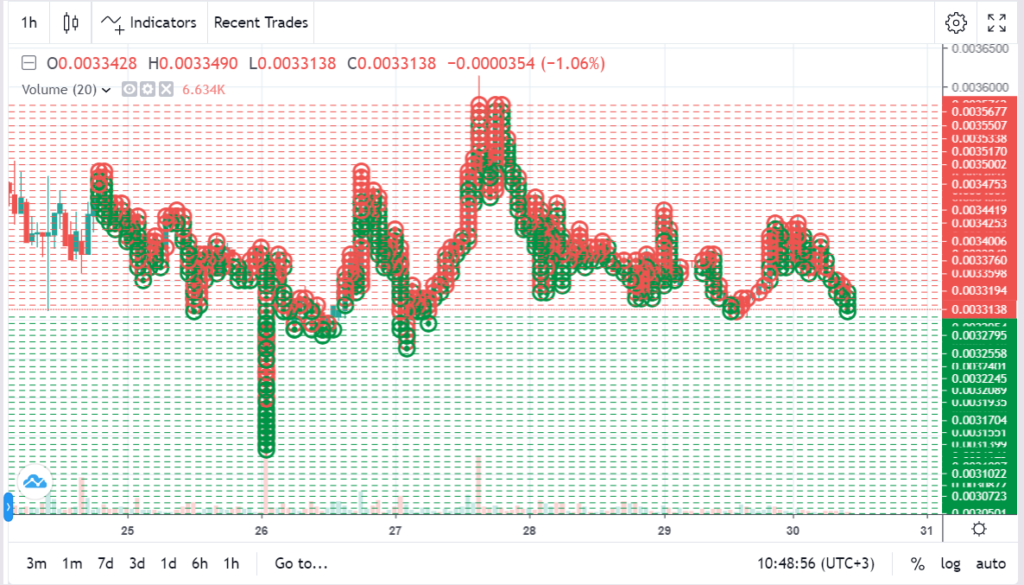

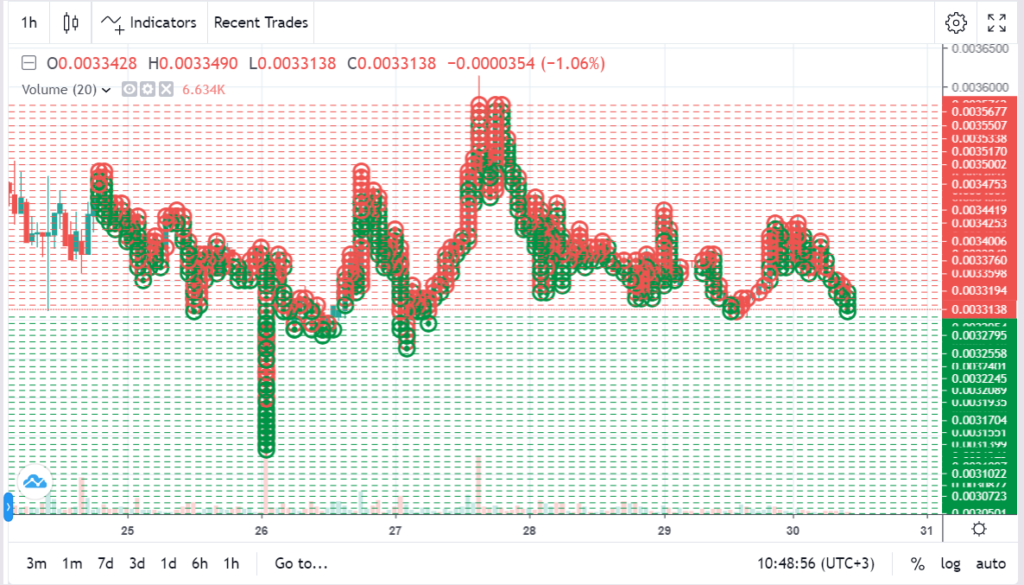

Featured in the illustration below, traders can better understand how the Scalper Bot performs when a bearish market takes root and then bounces back to the starting point (all while adjusting open orders to meet new market conditions).

In the scenario above, the Scalper Bot utilized its cost averaging feature to buy more base currency at a lower price to generate profits from a trend reversal.

Utilizing both the base and quote currencies of a digital coin pair, the central ideology behind the Scalper Bot is to amass returns of the quote currency since traders typically hold quote currencies for a better price.

By using the investment change parameter, traders can deduce how much their bot has invested along with how much your investment plus bot profit is worth in real-time all in the form of the quote currency.

For instance, if you started the Scalper Bot with a $5,000 investment and the base currency price drops and now the currency investment value reads $5,250, then your investment change is +5%.

The Scalper Bot is an investment safety tool.

Still a critical Bitsgap trading bot component, the Scalper Bot advantages are available with the SBOT.

For traders who have been using the Scalper Bot, don’t fear, your active Scalper Bots will remain active, although no new Scalper Bots will be available.

Trailing Bot

The Bitsgap bot integrates a “trailing” feature that enables the trading bot to move levels should the price of the cryptocurrency appreciate and cross the upper threshold. In turn, increases in the profitability of the bot occur through the natural process of following price action above original parameters.

By utilizing the grid strategy, the Bitsgap trading bot is capable of automatically buying and selling cryptocurrencies within a fixed price range that is trader-defined by a set upper and lower limit.

Similar to the Scalper Bot ideology, the trailing feature of Bitsgap’s bot is to generate profits in the form of the quote currency.

The bot will specify the number of currency pairs needed.

Traders may receive a prompt to buy missing volume or sell assets to reach the required available capital for arbitrage.

Essential facets of the trailing function include:

- Should the price of the base currency appreciate, the bot will use both your original investment sum along with the available account balance.

- Should insufficient funds be the case, the number of grids will decrease to adjust to new market conditions.

- Traders can use a trailing option with no less than 20 grids. Some traders recommend at least 40 grids.

- The trailing bot acts as a self-recovering system that performs regular system checks to ensure stable performance, should an order be dropped or unable to be placed, the bot will attempt to restore it by executing new orders.

- The trailing function solely works when the price is continually increasing. If the price drops, then the trailing service stops working while the bot continues to amass profits in the new grid.

- Should Stop Loss be enabled, it will use a set percentage below the lower border of the grid to follow the trailing grid.

Trailing Bot Example

The trailing option of the bot will be enabled once the price crosses the upper price threshold and continues in a bullish direction.

From there, the bot will automatically move the lower grids of buy orders to the top position of the grind, which allows the bot to function within the new range while using the same grid distance.

In the scenario above, to place new orders, the bot will utilize the initial investment:

Buy 2 ETH at 150 EUR (total of 300 EUR of quote currency)

Buy 2 ETH at 200 EUR (total of 400 EUR of quote currency)

Since these settings require more volume than available in one grid, Bitsgap will automatically close the necessary quantity of grids from the bottom to release the required funding.

See the Bitsgap video how it works.

Bitsgap Arbitrage Trading Review

Have you seen price differences between two different exchanges and wondered if there was a secure method of trading those differences?

Well, there is, and it’s known as arbitrage.

Generally, an arbitrage trade consists of a set of trade transactions of the same pair (or any financial instrument) that occur at the same time but on different exchanges in the attempt to benefit from price differences between the two platforms.

More specifically, arbitrage trading typically occurs through buying a currency in one market while simultaneously selling it in another market at a higher price, therefore profiting from the price difference.

While this process may sound tedious and a hassle to most, Bitsgap has managed to simplify arbitrage trading through their one-click trade mechanism, which makes capitalizing on price differences much less complicated.

To add, a complimentary bonus of the Bitsgap trading interface would be how straightforward, and comfortable crypto arbitrage trading is through their software.

A few main attractions of Bitsgap includes traders ability to:

- Spot arbitrage pairs

- Compare other exchange’s buy price

- Assess trading volume

- Check exchange’s sell prices

- See Profit Percentage

Each arbitrage pair and exchange represented is supposed to reflect the best price differentials available.

At the same time, traders may elect to use 15%, 25%, 50%, 75%, or 90% of their balance.

Arbitrage traders have an Advanced or Pro trading account when using Bitsgap.

How Can You Start?

To begin using Bitsgap arbitrage trading features, traders will need to connect or open accounts with several cryptocurrency exchanges then ensure they possess enough capital on each exchange.

Both must occur while being “okay” with having to monitor their platforms regularly.

Traders that are ready to perform crypto arbitrage can quickly deduce expected profits as the Bitsgap arbitrage platform automatically calculates the costs of fees and shows profit potential, which can vary when traders fluctuate the trade balance percentages supported for arbitrage.

Sadly, Bitsgap did not support automated arbitrage trading.

They do offer cloud-based trading bots capable of generating profits in fluctuating market swings through high-frequency trading.

How Can This Occur?

Investopedia dives into arbitrage, stating that it exists as a byproduct of market inefficiencies.

Since none of the financial markets are perfectly efficient, inefficiencies occur within every financial market where the natural effects of decentralization and weaker market development allot for arbitrage trading.

Advances in technology continue to take away arbitrage opportunities.

Despite the bad news, there will always be arbitrage investments due to market inefficiencies.

Can it be considered arbitrage made easy?

We believe so, given how much time Bitsgap has put towards simplifying and more effectively managing crypto arbitrage trading within the dashboard.

What’s Missing?

Bitsgap has chipped away, tirelessly upon platform improvements.

Once not supporting API key trading, Bitsgap has bridged that technological deficiency and now requires API keys for crypto arbitrage.

This all-in-one trading hub has also since then integrated decentralized crypto exchanges to their platform while bringing to market a high-caliber automated trading bot.

Where Bitsgap could improve upon would be bulking up their Knowledge Base, which provides advice and answers from the Bitsgap Team, while also integrating an educational hub where traders could learn the ins-and-outs of cryptocurrency trading.

Bitsgap operates entirely as a crypto trading platform.

Should instances occur that deter consumers from cryptocurrencies, then Bitsgap will be hit as a business.

Is Bitsgap Safe & Secure?

Bitsgap goes above-and-beyond for their site and traders’ security.

Bitsgap also states that using their system is safer than your internet banking system because most banks use what is known as RSA 1024, whereas Bitsgap uses the encryption known as RSA 2048.

RSA 2048 is said to be twice as secure as RSA 1024.

Explained in more depth, Bitsgap states, “when traders add an API key to Bitsgap, the browser already initiates an encryption process on your side and delivers your API to our server already encrypted. To put it in numbers, if a person chooses to “crack” your API key, it will take him well over a hundred lifetimes to go through every possible combination.”

Despite Bitsgap’s impressive security protocol, some traders still may raise concern regarding how Bitsgap has only been in the industry for a couple of years as opposed to long-time competitors who possess a firm foundation of operational transparency.

In response to this, Bitsgap explains:

“Trustworthiness is something every start-up is going through. We believe you won’t have any doubts adding your personal and credit card information to any old financial service like transferwise because they are well known and can be trusted, even though they don’t have a clear statement what do they do with your information and how they are planning to protect it. And this is absolutely normal; an old service provider means they can be trusted. This is exactly what we need to prove during the next years.”

Bitsgap continues to uphold its integrity.

In our eyes, Bitsgap does an excellent job of addressing and seeking out security concerns.

They emphasize using only secure network structures that only a few people have access too.

Their service mentions that their servers reflect IP addresses of whitelisted exchanges.

Additionally, Bitsgap mentioned that all login attempts are secured while two-factor authentication is a must. To learn more, you may visit the frequently asked questions center answered at Bitsgap’s Knowledge Base.

When researching into Bitsgap, we asked for an official reaction to security concerns that traders might have, and here is how Bitsgap replied stating how they protect both your account and API key:

- Speaking of hacking your account, we record all unauthorized attempts and notify our customers about suspicious activity (for instance, if an account initially registered in the US is trying to log in from India – we deny access and send a confirmation letter to the owner). Secondly, you have an option to set a 2-factor authorization – self-explanatory, one of the best methods to protect your account.

- RSA 2048 encryption – it would take a wall of text to explain how this encryption method works. But long story short, this encryption method is even more reliable than any online bank you are using right now. Whenever a user enters an API key, the user’s browser makes encryption of this number and only then sends it to our server. So all your API keys stay encrypted on our side, to crack any single one of them – it would take a lifetime to go through every possible combination.

- Limited API settings – to use Bitsgap, we only need permission to read your history of trades, account balance, and place orders. Our system won’t allow adding your API key if the withdraw option is enabled. There is no way someone outside or inside Bitsgap can access your funds and take them.

- Security inside – Only crucial personnel have access to servers, and it would require multiple confirmations internally to access to all the data.

Bitsgap also added that:

“We are trying our best to shape the industry of crypto trading so you will have more free time to spare, and don’t worry about how your coins are doing.”

To Wrap Up

As a whole, our investigation and findings of Bitsgap have been encouraging.

Some of you still may be pondering whether Bitsgap is a scam if Bitsgap is trustworthy, or safe to use.

To sum up, we believe Bitsgap is a legitimate platform composed of a strong team of entrepreneurs, investors, and software engineers.

Before we depart and to recap, Bitsgap provides traders with analytical trading tools and vital information such as:

- Fully automated, high-frequency trading bots

- Ability to easily trade a myriad of coins and exchanges from one hub

- Real-time market information and basic and advanced trading insights

- Access to trade history, statistics, and simplified portfolio management

- Ability to perform one-click cryptocurrency arbitrage trading

- Safe, secure, and fully encrypted system