Company background

Markets.com is daughter company of Playtech and at the moment of this review was regulated in Cyprus & South Africa. The company was acquired by Platech, a software developer in the gambling industry, which is listed on the London Stock Exchange and owns markets.com since 2015. The acquisition seems to have positively affected Markets.com desire to become a trustworthy Forex & CFD broker.

As a plus

The company offers an affordable access to a wide-range of CFDs on stocks, forex, indices and cryptos, as well as negative balance protection. The onboarding is fast and affordable with only $100 minimum deposit recruitment.

On the flip side

Despite being around for a while, Markets.com has generated some complaints around forums and user-generated websites. Although it does offer Cyprus Security and Exchange Commission (CYSEC) & African regulations, the broker is still to obtain a license from tier-one regulating body.

Our verdict:

Yes, in our view Markets.com can be safely used for trading the financial markets. This is especially true if you want to start trading CFDs quickly without any hassle.

Methodology

For this review, we tested Markets.com standard account, plus we collected secondary information from reputable sources.

Regulation

The CYSEC (Cyprus Security and Exchange Commission) has an extensive history as a regulatory body but has a lot of catching up to do for allowing mischievous Binary Option providers and several dishonest brokers to rip of clients. At the moment, CYSEC is attempting to improve the grip over these doubtful ventures.

On the bright side, according to industry standards Markets.com reputation has not been stained as much, plus the company seems to be taking a right course / correction ever since the acquisition by Playtech. Here is how Elite CurrenSea understands the company structure:

Parent Company

Playtech is known for its gaming and gambling solutions, and for its purchase of Markets.com trademark from TradeFX, owner of Investment Limited, that currently run Markets.com operations.

Despite the lack of a banking background, the parent company’s status of a publicly listed UK firm ensures transparency over markets.com operations. This has been evident from a significantly improved coverage of the company in global media outlets.

Beware though, markets.com is not directly listed on the stock exchange and at the time of this review had not been in possession of a UK FCA regulation.

Negative balance protection

Markets.com offers negative balance protection to its clients, which means that you won’t lose more funds that you have. This is, unfortunately, not always the case in the industry.

| Clients from |

Protection Amount |

Regulator |

Legal Entity |

| Europe and other eligible countries |

€20,000 |

Cyprus Securities and Exchange Commission (‘CySEC’) |

Safecap Investments Ltd |

| South Africa |

No protection |

Financial Services Board (‘FSB’), South Africa |

Safecap Investments Ltd |

Customer Service

The customer service (support) is available in three languages: English, Spanish and Italian.

Our experience was positive: Markets.com support chat was quick and responsive and the account manager was helpful over basic questions related to fees and account opening procedures. Despite eagerness to sell, the support was polite and to the point.

When trying to contact markets.com over email we spent slightly more time discussing similar matters.

Overall, the client service was good, it didn’t strike us as exceptional, but we got the help we needed in a reasonable time. And that’s what matter most. We encourage you to leave your comments below, if you had different experience.

Products/CFD Portfolio

Beware, Markets.com is a CFD broker. Hence no other asset types are available – so no ETFs, real stocks, bonds, etc.

This being said you can trade most of the assets the above represents by using markets products built around CFDs. So, if you see that markets.com offers “stocks” trading, don’t be surprised, what they mean is that they offer CFDs on stocks, ETFs, Indices, crypto and currencies.

| Product |

Markets.com |

Admiral Markets |

FXDD |

| CFDs on Stocks |

1:10 |

– |

|

| CFDs on Forex |

1:300 |

1:500, 1:10 |

4 |

| CFDs on Commodities |

1:200 |

1:500 |

1:200 |

| CFDs on ETFs |

1:100 |

|

– |

| CFDs on Indices |

1:150 |

1:500 |

|

| Crypto |

limited up to the total position value of $2,000 |

1:2 – 1:5 |

1:10 |

Stocks

Keeping the clarification on Markets.com “stocks’ offering in mind, we believe that the selection is quite vast and features some of the lesser-known local stocks. For example, you will find over 200 UK stocks, while Italian, German Japanese stock CFDs are available to a smaller extent. A pleasant surprise is an availability of such stock exchange product as Hungary, Poland & Russia.

To wrap it up, most likely you will find the stocks you want to trade with Markets.com CFDs offering. However, if you are looking for a really small stocks on large exchanges or stocks on small exchanges you might first need to check with markets instruments overview. At the moment of the review leverage available for trading CFDs on stocks was 1:10

ETFs

Markets.com offers 39 ETFs, which is a mid-range quantity. But more ETFs could be added soon… At the time of review, Markets.com was planning to add more so keep an eye on the offering. At the moment of the review leverage available for trading CFDs on ETFs was 1:100

Indices

As of 2018, you can find around 27 indices to trade as CFDs. This includes the largest stock markets and indices. At the moment of the review leverage available for trading CFDs on indices was 1:150

Commodities

Traders are able to trade traditional commodities such as oil, copper, silver and gold. At the moment of the review leverage available for trading CFDs on commodities was 1:200

Forex

A total of 55 currency pairs are available, ranging from major to some exotic pairs. At the moment of the review leverage available for trading CFDs on Forex was 1:300

Cryptocurrencies

This solution is available since 2017. You can trade with Bitcoin, Dash, Ether, Litecoin and Ripple. All of them can be traded against the USD and EUR, with the exception of Ripple. Paypal deposits are also supported. Finally, the exposure on crypto cannot exceed limited up $2,000 per position.

Fees & Commissions

Markets.com offers a simple fee structure: it does not charge any trading fee or commission. Basically, everything is included in the spread you pay.

Such a fee structure puts Markets.com relatively high in spreads, but you should keep in mind that many brokers include additional commissions and fees on top of spreads.

| Spread |

Markets.com |

Admiral Markets |

FXDD |

| EURUSD (pips) |

2 |

1.2 |

1.5 |

| Apple (USD) |

0.35 |

6 |

4 |

| BMW (EUR) |

0.2 |

1 |

– |

Non-trading fees

When it comes to non-trading fees, Markets.com charges a “financial fee” for an overnight rollover. It is quite hard to find the rollover fees, as we were not able to find a calculation method on the website. The only way to find the actual financing fees is by examining each individual instrument via right click.

The financing fees are in line with the average rates of the industry. The actual financing rates of Markets.com (compared with IG and eToro) in the time of our review are as follows:

| Yearly financing rate |

Markets.com |

IG |

eToro |

| EURUSD |

3.1% |

0.5% |

1.8% |

| Apple |

6.2% |

3.7% |

4.9% |

| BMW |

6.2% |

2.1% |

6.9% |

On the bright side, the broker takes responsibility for the costs connected to deposits and withdrawals. You’d be surprised but little brokers afford their clients such a luxury.

Trading Execution

Markets.com is a market-maker broker, which means it provides execution in a way that relies on its own ability and willingness to execute your order, compared to agency brokers that rely on third-party market-makers.

Consequently, the appeal of this broker relies on execution quality. Although spreads are slightly higher, they are most of the time fixed which provides a good environment for traders interested in a more stable environment.

The primary concern about Market-Makers is the potential for a conflict of interest, however Markets.com, as a daughter company of a publicly traded enterprise, does need to get involved in fraudulent activities with execution-mendling, etc. If there is any proof of such activity, please contact the team of Elite CurrenSea immediately!

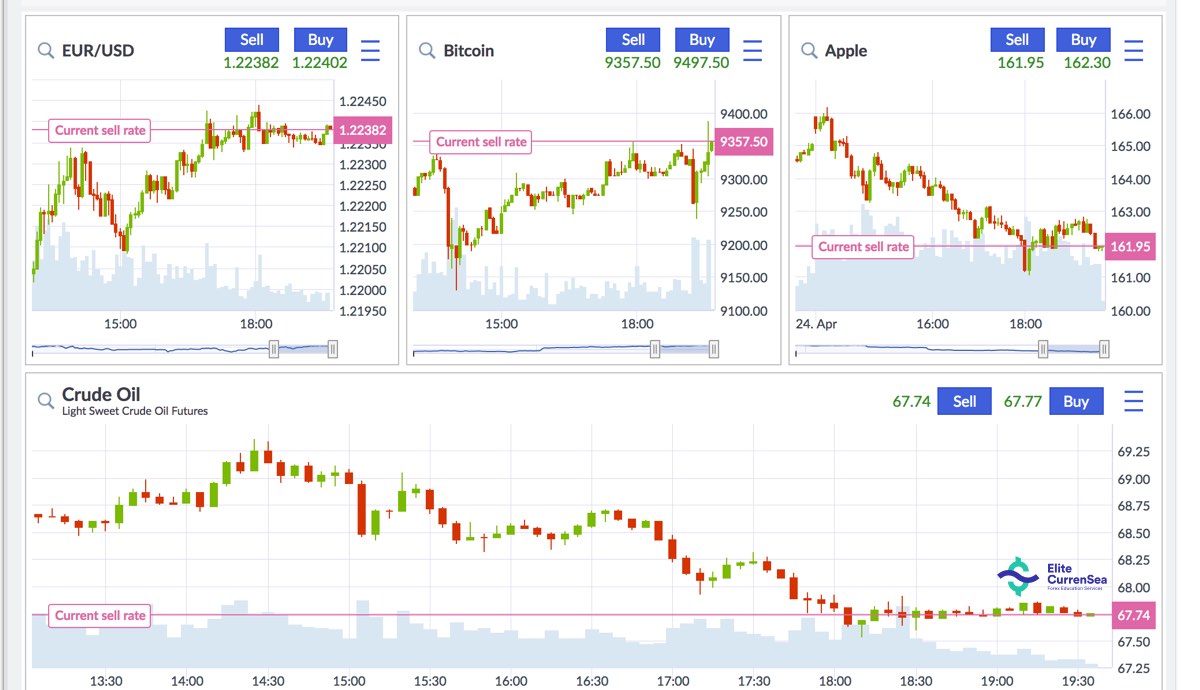

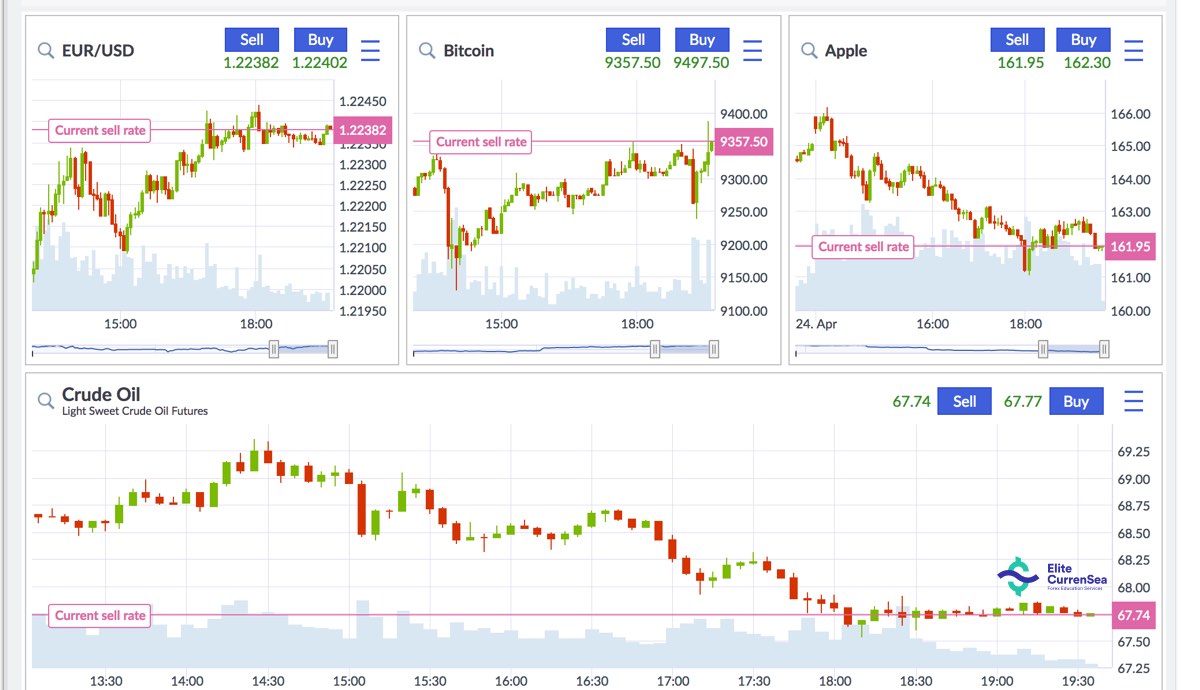

Platforms

Markets.com offers its Web Trader platform (also available in mobile form), where the most comprehensive range of its product offering can be found, including 55 forex pairs and a total of 2,002 CFDs (!). All of it is nicely packaged in an innovative user interface.

Markets.com main platform is its proprietary Web Trader platform (accessible via mobile). Although, scarcely mentioned, Markets.com also offers the popular MetaTrader 5 (MT5) software by MetaQuotes Software Corporation. Unfortunately we were not able to find MT/45 for Mac solution. Contact us if you are looking for an MT4/5 brokers that offers native Mac OS support or take a look at the providers we have reviewed.

After a short test, Markets.com Web Trading solutions seem to be an improvement when compared the popular Plus500 platform. The platforms has a similar way of displaying instruments, plus offers the same ease and simplicity with its interface. This is mainly due to adherence to HTML5 format, which handles responsiveness on mobile and general stability of the platform.

When it comes to research and analysis, we noticed that Markets.com offers over 90 indicators (!). This is highly appreciated by the Elite CurrenSea team as not all brokers offer such a variety.

As a true HTML5 web-platform, the platform feels fast and light. There are few interesting design choices that show Markets.com is paying attention to customer experience. For example, charts can be observed in nearly every view to help keep you concentrated on both previous and current price action.

Traders looking for MT5 experience might find a lower number of instruments than on proprietary technology, but there’s no reason to dismiss the MetaTrader 4 platform if it is your preference. Although it does not match the MT4 Supreme from Admiral Markets, traders should still be well-equipped to trade with Elite CurrenSea’s wizz, Camarilla indicators and SWAT or CAMMACD tools.

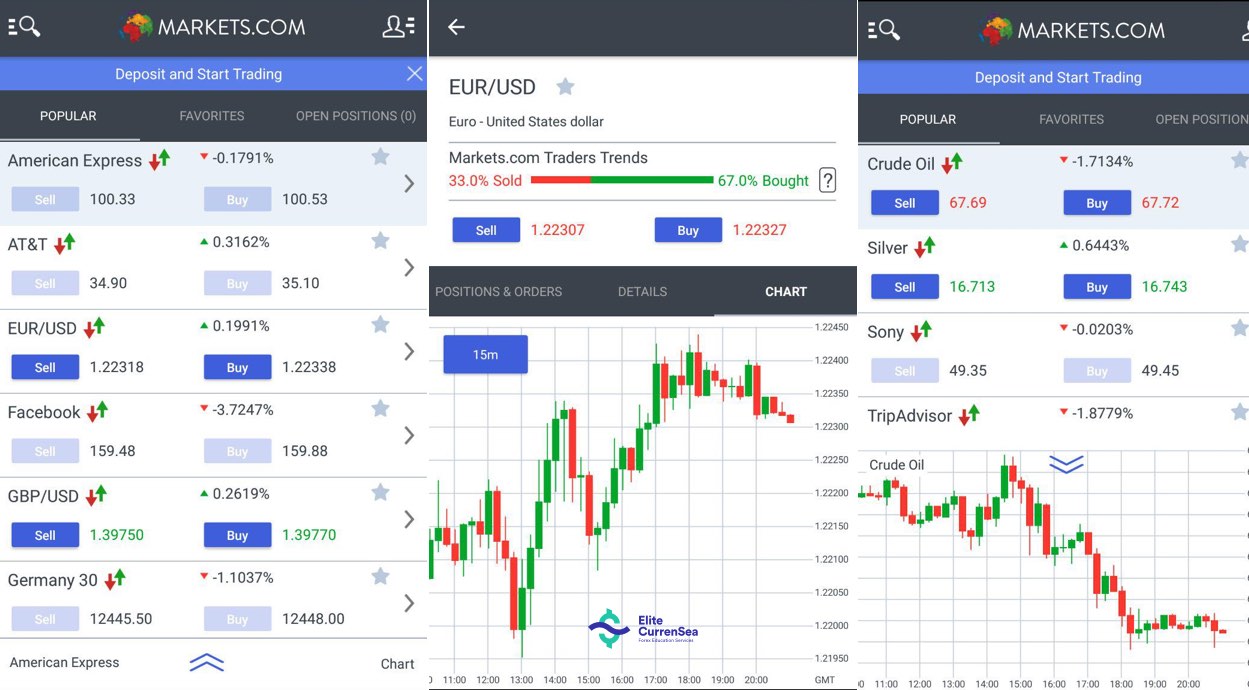

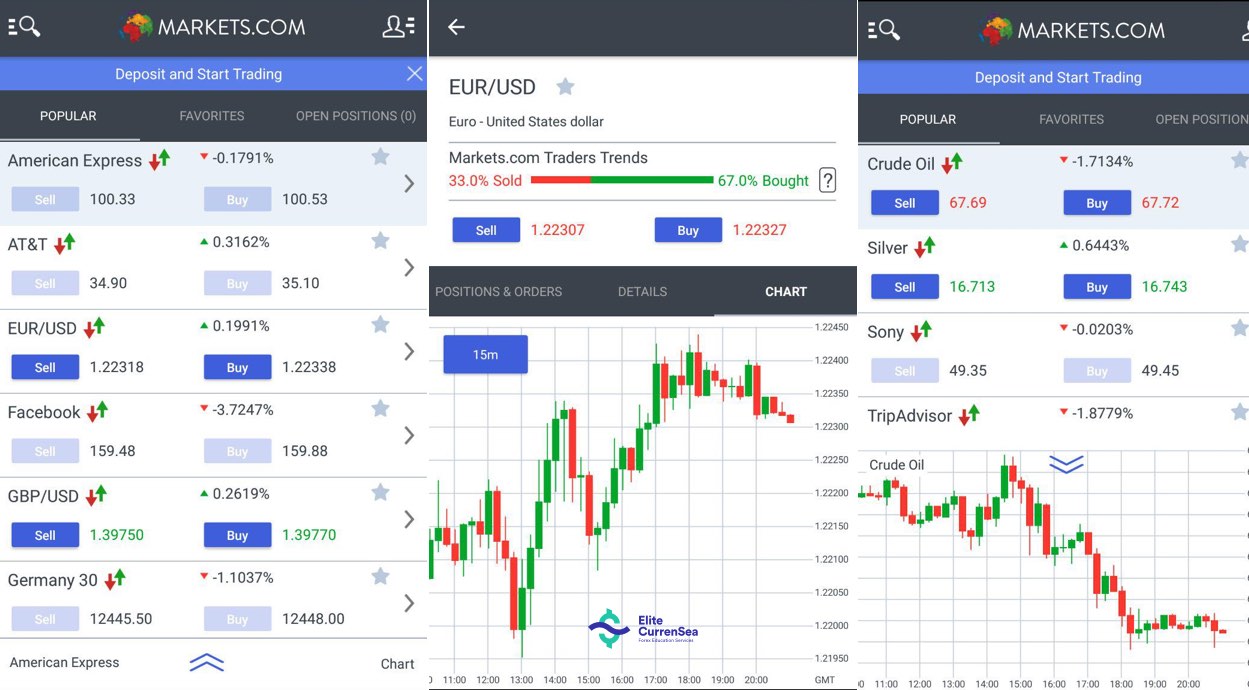

Mobile Trading

Besides the MT5 mobile application, the broker also offers a proprietary app for iOS and Android. The app resembles the features for Markets.com Web-Trader. Hence, you will find its charting solution, research and tools interface, Watchlists familiar. The platform appeared stable and did not lack key features for comfortable trading.

The limitations of the mobile app are the usual for this landscape: there’s lack if indicators and charting solutions. You can stay on top of your trading by joining our telegram membership group (10% off for Markets.com clients) with timely trading alerts, analysis and useful information on the markets. All in all, the platform is suitable for trading on the go, but with several additions it can stand-out and compete with well-recognized multi-asset brokers.

To sum up:

While the Markets.com mobile experience is solid, a few upgrades would be welcome such as adding alerts, drawing tools, indicators, and a syncing watchlist. This would help the broker better compete with its multi-asset brokerage competitors.

Research

Markets.com’s research tools are more than what some discount brokers provide, but Elite CurrenSea cannot characterize the provided research offering as very deep.

To extend the number of tools at your disposal feel free to take a look at our free forex & cfd blog to stay in touch with financial markets.

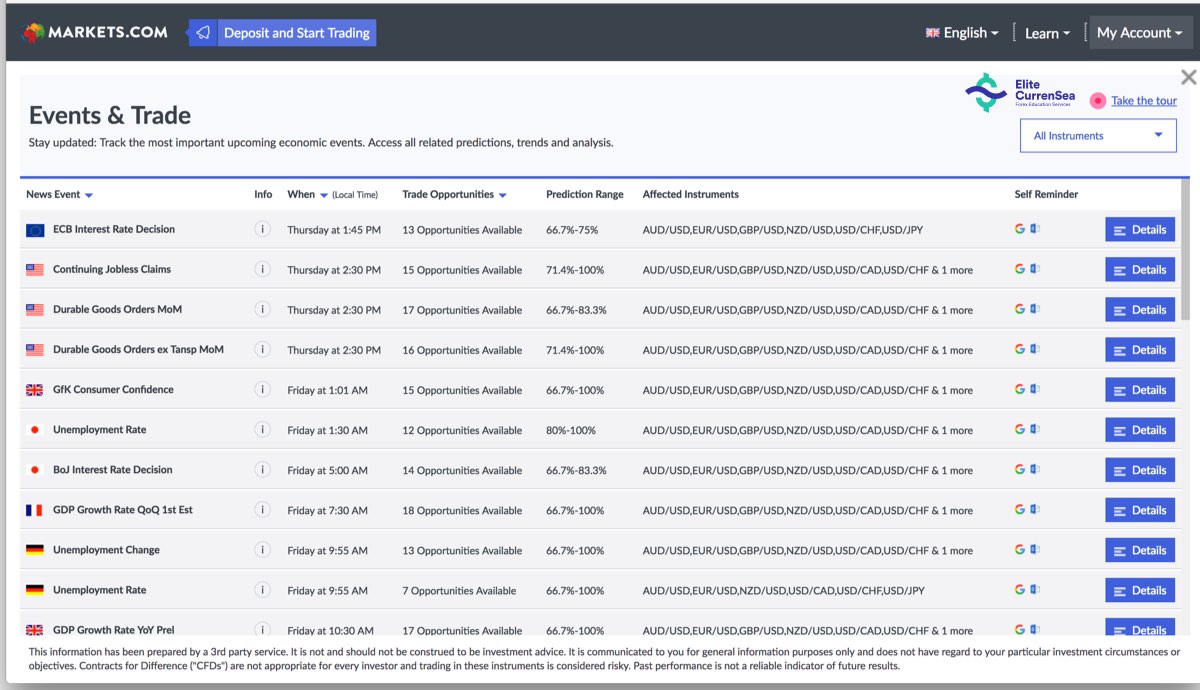

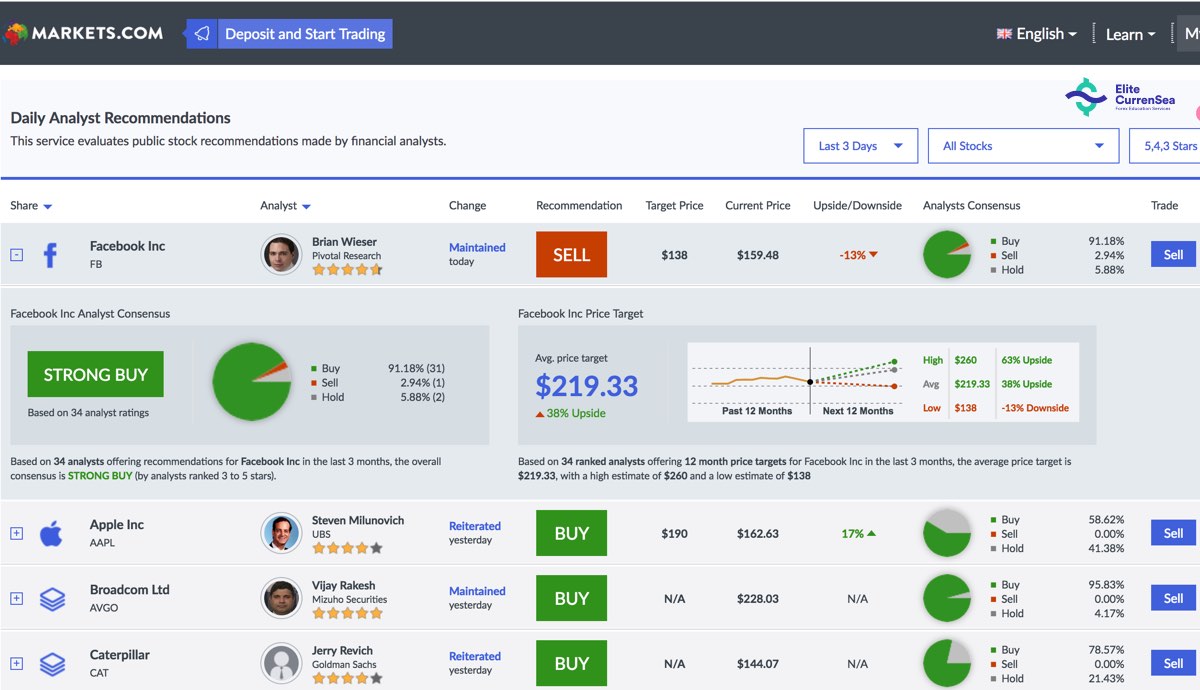

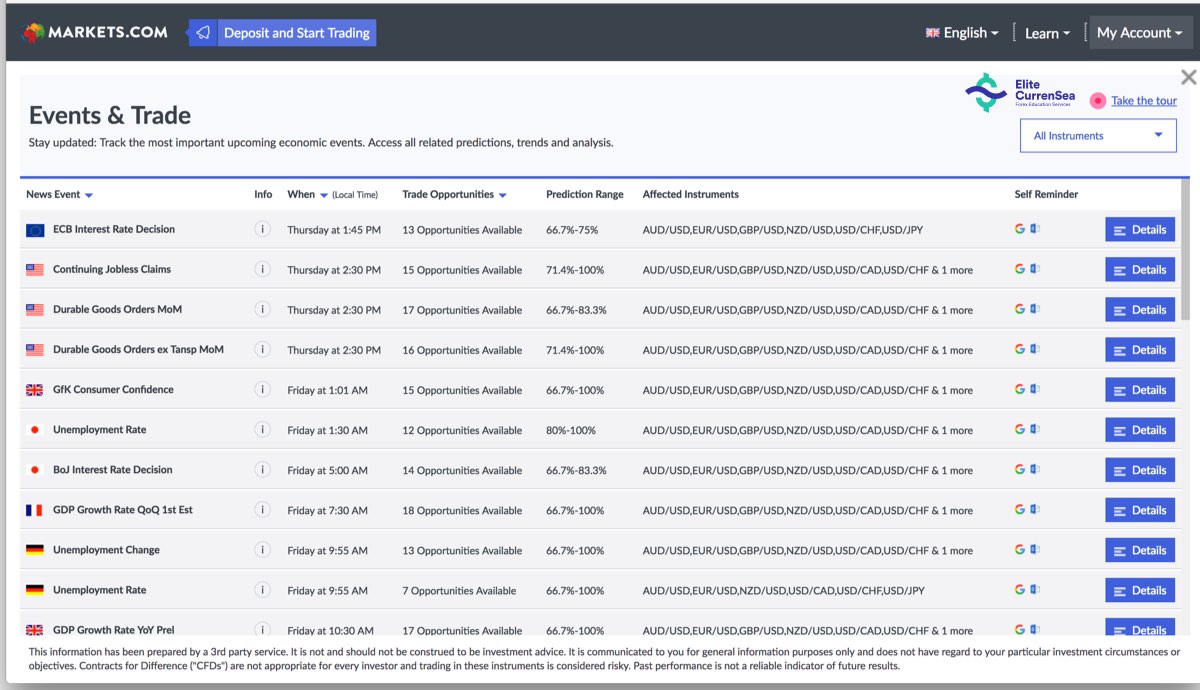

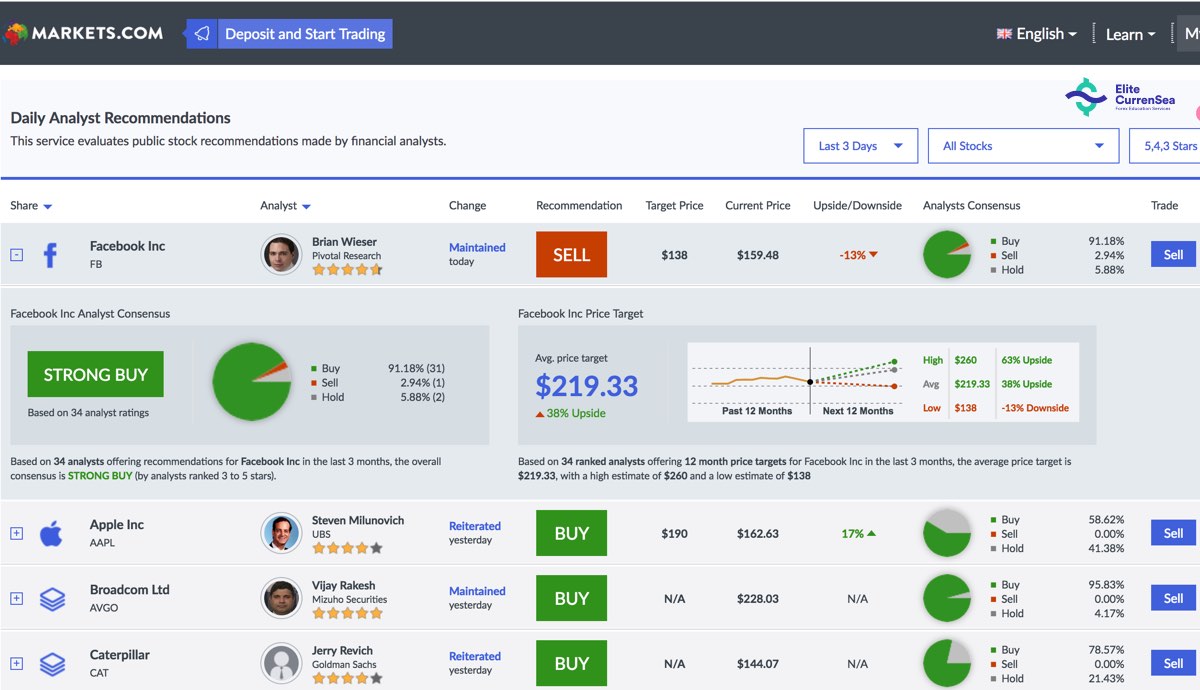

We couldn’t find fundamental reports and were not completely sold on Markets.com technical analysis. The company, however, does provide some solutions though:

- There is a smart economic calendar under the trading tools menu point. The economic calendar shows how affected currencies pairs reacted to the specific event when the event’s result outperformed or underperformed analyst consensus.

- Analyst recommendations from top banks on 15 shares. The recommendations revolve around buy/hold/sell direction, target price, and analyst consensus. There is no info about the methods behind the analysis.

- There is an investing.com news feed available.

- Pop-up alerts are available too.

Overall, Markets.com has a solid foundation for research. However, there’s still room for improvement, especially given the amount of research available with other top-tier multi-asset brokers. If interested, Elite CurrenSea research and tools could complement Markets.com in-house solutions well.

Education

We have found webinars available in local languages, however, education appears to be of a lower priority for Markets.com. Take a look at our free education, if you are looking for a place to start or get better. Or, go check our trading strategies, tools and analysis to get professional help for free.

Fly or Frie Verdict

Despite its rocky journey to become a truly multi-asset broker, Markets.com can be a suitable choice for traders seeking a prompt access to a wide-range of markets with an affordable fee structure and tier-two regulatory status. It’s proprietary Web & Mobile platforms provide a good mix of thoughtful design, functionality and research tools.

Traders with execution sensitive strategies should find this broker appropriate as market-makers tend to execute the price faster and with more precision. If on the other hand, your strategy relies on low-spreads, then first take a look at the exact commissions and see how it compares to other offers.

Research done by Chris Svorcik and Nenad Kerkez Co-founders of Elite CurrenSea, Chris is an award-winning trader with over 10 years of technical analysis and teaching experience. Chris also offers education and technical analysis on top industry websites and constantly works on his proprietary trading system based on wave analysis – ecs.SWAT.