Background on the Founders

Kirk Du Plessis, a skilled trader based in Indiana, USA, formed the Option Alpha Company. He began his career with Deutsche Bank as an investment financier. He then went to work as a financial analyst at BB & T Capital Markets. Following that spell, he committed his full time to Wall Street trading on his personal account. In just three years, he achieved a trade growth rate of more than 2,000%. Based on everything, Kirk may truly be regarded as a financial market guru.

On the website sections dedicated to tracking his success, Kirk openly discusses his current transactions. He illustrates and discusses several elements, such as transactions that have produced the highest profits and the possibility of success in this or that agreement. More crucially, he discusses topics like trading methods, risk management, psychology, option pricing, and portfolio allocation.

How does the Alpha Options Operate?

The main focus of the platform is to provide traders help with Backtesting and automating trading techniques.

To get started, you may select from a library of bot templates. These templates are provided by the platform and other traders. You may modify the bot to suit your needs and put it to use.

Here are a couple such examples:

- Range Breakouts

- Earnings IV Crush

- Pre-Earnings Run

With the help of highly customized interface you may use basic natural language to command the bots what to look for, how to enter and exit positions, and more.

The bots make data-driven judgments in milliseconds, reducing the possibility of human mistake and allowing you to focus on what is essential to you.

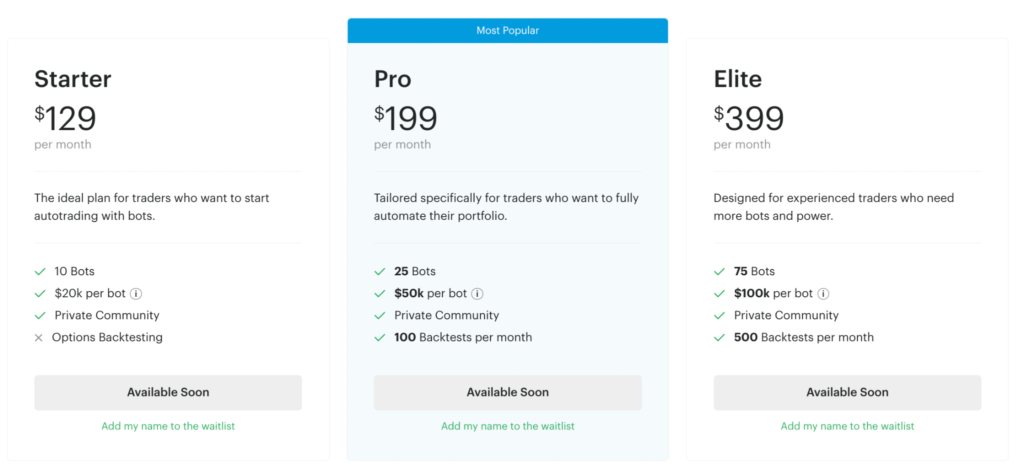

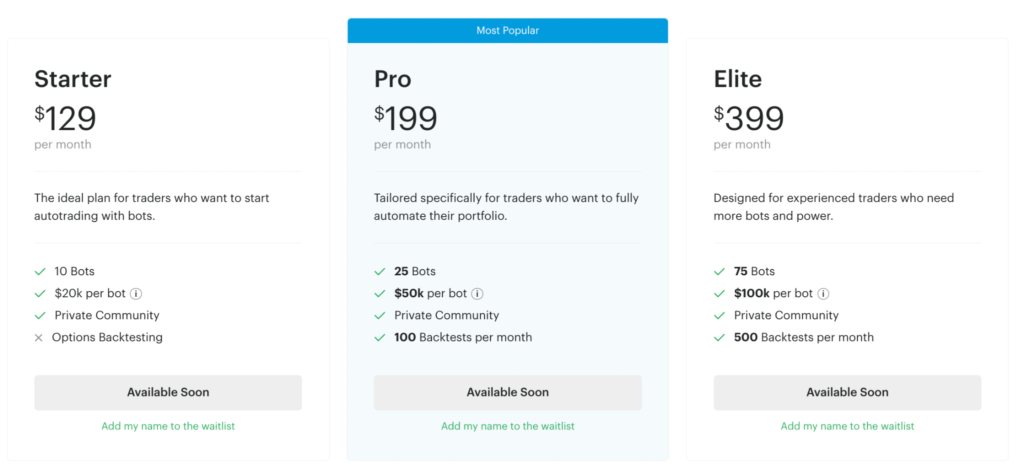

Pricing

Though the website already provides a separate page for pricing and different plans to join in the application is still in development. If you want to be notified when the platform will be available you can gain access to the site by joining up for the waitlist, which now has over 500,000 traders on it.

| The Lite plan is an entry-level bundle for basic trading methods. You’ll have access to a few bots. This strategy is ideal for inexperienced traders or those with tiny balances. |

The Pro plan is intended for traders who wish to completely automate their trading portfolio. This package allows you to operate many bots at the same time and includes access to the backtester tool. |

The Elite Plan is designed for experienced traders who want additional bots, power, and capital limitations. This package includes the most bots and the most advanced automation options. |

Main Features of Option Alpha

Are you considering joining the waitlist or still not sure? Read more about the exciting features of Option Alpha to make your decision precisely.

Trading Robots

Bots are the platform’s main feature. You may begin using templates or design your own. These bots include the rules that drive the automation of your trading strategy. The nicest aspect about this functionality is that it requires no coding knowledge. You will never need to learn how to code to utilize it.

Bots respond to market conditions faster than you could. Bots allow you to test your activities in real time to ensure their efficacy. Option Alpha employs a patented system called SmartPricing, which uses scheduled intervals and dynamically modifies price to maximize your trades. This technique assesses bid-ask spreads in real time rather than following the market.

Flexible risk controls enable you to reduce the amount of risk that each bot assumes. You may also establish position constraints for the day or for the whole year.

Integrations

Option Alpha has worked with industry leaders to provide automated trading capabilities. The present list of integrations is not large, but it is expanding. Ameritrade is the only active broker integration at the moment. However, agreements have been reached with Tradestation and Tradier, with full integrations expected soon.

Users can request integrations with other brokers, such as Tastyworks, Interactive Brokers, and Robinhood, through a variety of channels. They are hoping to integrate with them shortly.

Backtesting

The Backtester tool allows you to evaluate the performance of the given strategies based on previous market performance also referred to as historical data. This tool will allow you to test tactics before implementing them in actual trading.

Here are a handful of the tool’s features:

- Optimization of allocation

- Various testing periods

- Changing the trade frequency

- Ratios of performance

- Metrics for win/loss

- Examine several situations and more

Copy Trading with Alpha Signals

Members of Option Alpha receive access to the trading service’s notifications. It can help users plan and execute their deals. The Signals report is built on rigorous back-testing of the most important technical indicators to identify the most predicted situations and provide the most easy analysis settings.

University

Option Alpha University is one of the platform’s top features. Self-paced guided classes will show you how to trade and use the platform’s automation capabilities. In addition, the organization provides both live and on-demand training courses. The Handbook serves as a digital encyclopedia for anything training-related.

Watchlist

You may use the Watchlist to keep track of your favorite stocks and ETFs. You may search your watchlists for changes in momentum, volatility, earnings, and other factors. The app also includes curated watchlists to assist you in identifying opportunities rapidly.

Customer Service

Users can contact the Options Alpha staff using the website’s query form. Kirk values prompt and comprehensive responses. He usually responds personally the same day. The FAQ section is missing from the website. Users may, however, discover practically all info on the website’s pages as well.

FAQ

Is Option Alpha legit?

Option Alpha is a legitimate trading system that has numerous trading features and excellent customer service. The platform is yet to be launched but there are over 500 k people waiting to join in.

Who is the founder of Option Alpha?

Kirk Du Plessis is the founder and a CEO of Option Alpha. The company has amalgamated with Alta5, a technology business created by Jack Slocum that focuses on developing powerful end-to-end automation solutions for options traders. The company’s headquarters are presently in Miami, Florida. Option Alpha now offers a one-stop shop for retail investors and traders, with first-rate education, breakthrough research and data analysis, integrated backtesting and crowdsourcing intelligence tools, and the industry’s first end-to-end automation technology for options trading.