Forex and CFDs on Stocks, Cryptocurrencies, and Indices are the core of Milton Prime’s business.

Regulated by multiple high profile jurisdictions (CySEC, FSA), Milton Prime signifies accountability at providing regulated access to financial markets.

Forex and CFDs on Stocks, Cryptocurrencies, and Indices are the core of Milton Prime’s business.

Regulated by multiple high profile jurisdictions (CySEC, FSA), Milton Prime signifies accountability at providing regulated access to financial markets.

👍 We recommend Milton Prime for manual and EA Forex trading, as well as short term trading via contracts for future difference (CFDs) on Stocks, Commodities and Cryptocurrencies. As of late 2020, it is also one of the few brokers that offers native macOS Metatrader support and Managed Account Trading via PAMM/MAM.

At Milton Prime, we have evolved into a zero commission charge business model.

| Assets | Fee Level | Fee Terms |

| CFDs on US Stock | Average | |

| CFDs on EU Stocks | Average | |

| EURUSD | Low | |

| Inactivity FEE | High ($30) | A Maintenance/Inactivity Fee will be taken from all Accounts that do not trade for 60 days. The Maintenance/ Inactivity Fee will be deducted every month until there is trading activity. The fee is $30, €30, ¥3000. |

Let’s first go through the fess terminology:

To put things in a proper context we compare Milton Prime with the competing services, based on product offering, fee structure and customer profile.

| Milton Prime | XM | Axi | |

|---|---|---|---|

| Account fee | No | No | No |

| Inactivity fee | $30 after 60 days | No | No |

| Withdrawal fee | $30 from the second withdrawal of the month | $0 | $0 |

Overall, non-trading fees are low and if played right – are almost non-existent. You won’t be charged for inactivity up to 60 days.

At Milton, “Trading Account” holders do not pay any additional fees on trading execution, just the spread and financing fees (“swaps” – also known as leverage fee)

Comparing trading fees among CFD brokers may get convoluted pretty quickly, for the purpose of making things more straightforward, we’ve decided to showcase all fees for trading the most common set of products using the stanadrd Milton Prime account type. The leverage we used is:

We define a typical trade as a $2,000 and $20,000 (0.2 lots) buy position for stock & forex respectively, held and sold after 7 days.

The benchmark fee takes into account commissions, spreads and financing costs (swaps). Below is the result for Milton Prime.

Forex Fees are low in comparison to XM & AxiTrader.

| Milton Prime | XM | AxiTrader | |

| EUR/USD benchmark fee | $8.91 | $17.1 | $13.8 |

| GBP/USD benchmark fee | $7.33 | $13.8 | – |

| AUD/USD benchmark fee | $6.98 | $13.9 | $9.5 |

| EUR/GBP benchmark fee | $11.49 | $12.2 | $11.0 |

Stock & Index CFD are similar to XM & AxiTrader.

| Milton Prime | XM | AxiTrader | |

| Apple CFD benchmark fee | $9.1 | $3.4 | – |

| Vodafone CFD benchmark fee | – | $5.6 | – |

| S&P 500 CFD Benchmark | $2.2 | $2.4 | $1.7 |

| Europe 50 CFD Benchmark | – | $2.4 | $1.2 |

These fees occur when you decide to hold your position. The longer you stay in CFD or FOREX trade, the more fees will accumulate.

| Milton Prime | XM | Axi | |

|---|---|---|---|

| Apple financing rate | $255.5 | $3.4 | - |

| Vodafone financing rate | $5.6 | - |

Focused on CFDs & Forex Milton Prime will only let you trade CFDs on Stocks & ETFs, Commodities, Crypto and Indices.

| Milton Prime | XM | Axi | |

|---|---|---|---|

| Stock | - | - | - |

| ETF | - | - | - |

| Forex | 89 | 48 | 34 |

| Fund | - | - | - |

| Bond | - | - | - |

| Options | - | - | - |

| Futures | - | - | - |

| Cfd | 72 | 122 | 51 |

| Crypto | 3 | 5 | 3 |

Milton Prime offers a great number of CFDs, and most of the traders will find the most popular instruments around here.

⚠ Keep in mind, CFDs are complex instruments and are usually traded with leverage, which significantly increases the chances of losing money. At the time of the review 56% of retail investor accounts were losing money when trading CFDs with this provider. It’s your responsibility to understand the inner workings of CFD instruments and understand the underlying risks.

At the time of the review Milton Prime hasn’t offered any stock and ETFs directly.

The account is usually ready within the same day – without complicated procedures and quick response rates.

You are fine as long as you don’t currently reside in the following countries:

Depending on your country, a minimum deposit may or may not apply. Contact your local sales team for more info.

Milton basically offers one account type, who’s spread fees will get smaller once you start trading higher volumes or deposit according to the following logic:

| Deposit | Spread Majors (pips) | Extras |

| < $300 | 0.8 | Award Winning Signals, MT4 Systems. |

| $300 – $10,000 | 0.5 | All of the above + VPN, Personal Account Manager. |

| > $10,000 | 0.2 | All of the above + Redueced Money Management Fees. |

The account opening is very straightforward and mild when it comes to identity verification and money operations.

You’d need to:

Available via several options, the deposit & withdrawal (d/w) process is quick and inexpensive (except for digital wallets).

Transfer options are:

| Milton Prime | XM | Axi | |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

You can only d/w from entities on your name. Digital wallets deposits arrive instantly, whereas wire transfer might take up to 3 business days.

There are no withdrawal fees after $300, while the funds can only be requested via a wire transfer.

| Milton Prime | XM | Axi | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

| Withdrawal fee | $0* above $300 | $0 | $0 |

Milton Primes offers a basic version of MetaTrader 4/5 and comes without a native macOS support.

MetaTrader is the most popular forex and CFD platform, available in multiple languages and supported by the largest FX community.

Unfortunately, the platform is quitecomplex when compared to more simple day-t0-day Web Trading platforms.

The website and back office offer a comfortable browsing experience at the first glance. Most of the information is easy to find.

Despite a somewhat outdated MetaTrader 4/5 experience, it still packs an impressive set of features and rich communityity. Traders looking for a simplified interface may find the web version of the platform more to the point.

Unfortunately, unlike other trusted brokers on the website, Milton Primes MetaTrader experience doesn’t pack any added value features, however, it does support MetaTrader for macOS Catalina & Big Sur via Milton Prime MT4/5 macOS.

Therefore, you will be limited to the following order types:

MetaTrader allows you to configure the following notification:

Although Milton Prime rarely calls for support, their levrel of email and knowledge-base support in very clear and concise.

Milton Primes support is available to you 24/5, over the phone, live chat, and email in Japaneses, English, Russian, Spanish & Chinese.

Random check of Milton Primes CySEC support chat via phone and live chat, left us satisfied in terms of response time, quality of answers and general tone of communication.

Research and education are well structured, easy to comprehend, and useful for any novice and intermediate traders.

Alhough not a “Bloomberg” in Forex, Milton’s trading and education rooms are led by experienced traders with multiple awards, and offer clear trading ideas and strategies for the week ahead.

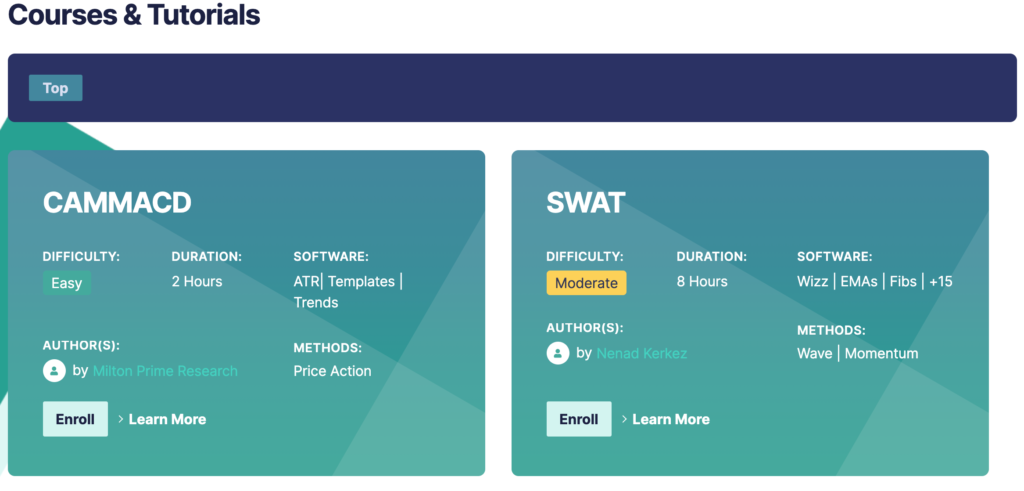

Milton does go an extra mile when it comes to educational course. At the time of the review, all Live Account holders were eligible for two comprehensive Education + MT4/5 Softwate course ealing with Wave Analysis & Monentum Trading. Both courses were prepared by multiple award-winning traders.

An extensive and easy-to-navigate library of articles and tutorials that should be usefyl to both beginners and intermidiate traders.

An extensive and easy-to-navigate library of articles and tutorials that should be usefyl to both beginners and intermidiate traders.

Charting tools are quite robust, packing over 20 indicators. Surprisingly, you won’t be able to save the chart settings for later.

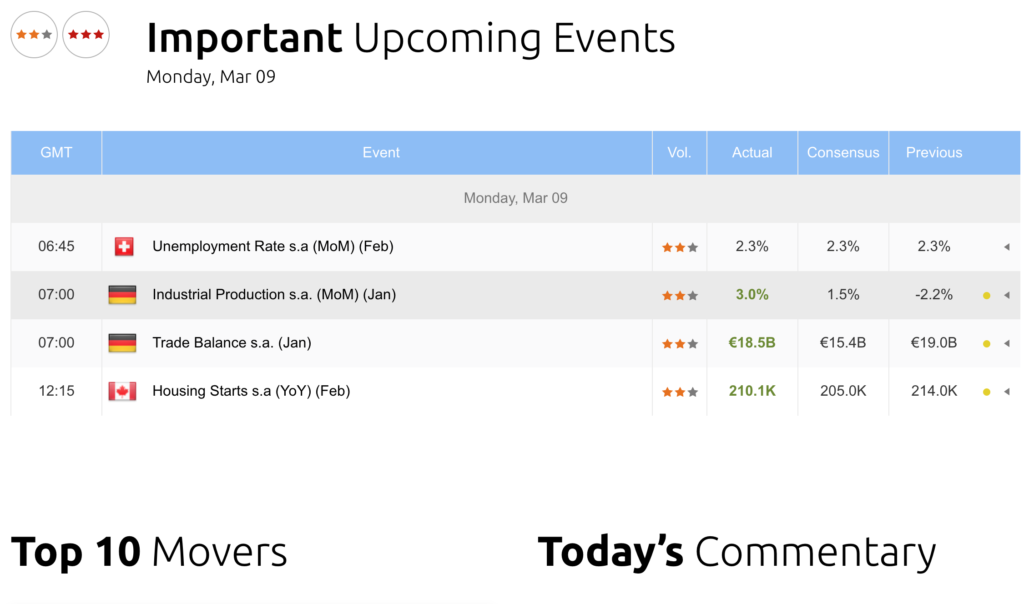

You won’t find much besides an economic calendar – which, to Milton Prime’s credit provides an easy access to a comprehensive amount of reviews.

Milton Prime’s research tools are limited to the following types

All perform basic functions and will come handy as a point of reference. For more comprehensive analysis you might want to look at other brokers or service providers.

You should be safe with Milton Prime, as it’s regulated by 2 authorities around the world, including FSA and CySEC.

Established in 2015, currently Milton Prime operates under two legal entities, Holiway Investments Ltd. (CySEC, Cyprus), Holiway Global Ltd. (FSA, Seychelles)

To make sure your branch offers a required level of protection contact the local client service.

| Milton Prime legal entities | |||

| Client country | Investor protection amount | Regulator | Legal entity |

| European Union Clients | 20,000 EUR | Cyprus Securities and Exchange Commission (hereinafter the “CySEC”) with license no. 248/14. | Milton Prime (Europe) Ltd |

| Clients outside of Europe | Depends on the case | Seychelles Financial Services Authority(FSA) with license number SD040. | Milton Prime Ltd (Seychelles) |

Despite its limitation in product offering, Milton Prime offer a well-balanced access to Forex & CFDs without limitting retail traders on leverage or payment methods.

It’s commission structure, research tools, well-executed web/mobile platforms & low deposit/withdrawal fees puts it in the basket of the best European brokers.

| 🏛 Country of regulation | Cyprus, Seychelles |

| 💸 Trading fees class | Low |

| 💸 Inactivity fee charged | Yes |

| 💸 Withdrawal fee amount | $30 from the second withdrawal of the month |

| 💸 Minimum deposit | $300 |

| ⏰ Time to open an account | 1 day |

| 💳 Deposit with credit card | No |

| 👛 Depositing with electronic wallet | Available |

| 💱 Number of base currencies supported | 3 |

| 🎮 Demo account provided | Yes |

| 📊 Products offered | Forex, CFDs on Crypto, Stock CFDs and Commodities |