Risk Warning: Remember, financial trading is highly speculative & may lead to the loss of your funds. Monthly returns are calculated based on the historical performance of our services.

Risk Warning: Remember, financial trading is highly speculative & may lead to the loss of your funds. Monthly returns are calculated based on the historical performance of our services.

Equity

Across managed accounts

Targeted Yearly

Across active methods

Expected DD

Based on moderate risk

Markets

Through CFDs

Managed by:

Assets:

Currencies, Indices, Commodities & Cryptocurrencies1,110%

110%

25%

Start investing in a high-yielding Flag method. You’ll need to connect a supported broker(s) and finance the account(s).

We will help guid your registration every step of the way, including a broker account(s) creation, funding and investment tracking.

Looking to squeeze the most out of this method? VIP clients will be able to maximize the returns while lowering the fees.

To become eligible for lower profit shares, and higher expected returns, a capital of at least €30,000 will be required.

Managed by:

Assets:

Forex525%

95%

35%

Let us maximise Athena EA returns for you. You’ll only need to either fund directly via an our account area or join through a supported broker.

To help you every step of the way, you’ll get a dedicated account manager, as well as an access to an account area with the relevant info on your active investment(s).

Prefer to run Athena EA on your own? You’ll be able to choose your preferred broker, play with the risk, while avoiding any profit share fees.

Works best for traders who knows their way around Forex Expert Advisor and looking to maximise yearly returns, as well as looking for extra freedom with Expert Advisor settings.

To reach targeted returns it’s recommended to invest equally across all active methods.

| Flagship | Athena EA | Mixed | |

|---|---|---|---|

| Targeted Yearly Profit | 130% | 95% | 120% |

| All Time High | 1,100% | 425% | 850% |

| Expected DD | 20% | 35% | 25% |

| Profit Share | 50% | 30% | 40% |

| Assets: | Currencies, CFDs on Commodities, Indices, Stocks, Bonds | Currencies | Currencies, CFDs on Commodities, Indices, Stocks, Bonds |

Answer a couple of questions to help us recommend you a suitable investment.

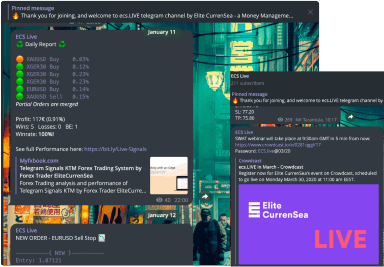

Get a taste of our algo trading

by joining signal service channel.