4 Step Guide Explains Unique Approach to Trade Management

Dear Traders,

Do you find it difficult to determine when to exit the trade? When should you cut the loss on an open trade, move the trail stop loss, and exit with a profit?

Once the trade setup has been entered, it is time to either manage the open trade (active trade management) or leave it as it is (passive trade management).

This article explains the pros and cons of both styles and also explains an in depth approach to active trade management with 4 steps: loose, tight, loose, and tight.

Active vs Passive Trade Management Explained

Active trade management means that a trader could:

- Move the original stop loss to reduce the stop loss size.

- Move the original stop loss to lock in profit (never to increase the stop loss size).

- Change the take profit to a closer or further spot.

- Scale out the trade (close part).

- Close the trade (market exit).

Passive trade management means that a trader:

- Not change the original stop loss or take profit.

Pros and cons of Passive management

Passive trade management is easier for beginners because the main rule is not to intervene in the setup in any way. The disadvantage is that new available information after the trade has been opened is not used or analysed in any way.

Pros and cons of Active management

Active trade management requires more time and attention because traders are regularly analysing the information from new candles (at appropriate times, not too soon or late). The advantage is that they can adjust their trades and find better exits based on that new information.

Ideally traders do use active trade management – if they can manage to combine it with their daily work and activities – because it is a waste not to use the new information that the market offers. In a way, all new candles are communication that traders can use for their trading plan.

The danger of active trade management is that the trader intervenes in the wrong way and at the wrong spot. A trader either acts too soon or too late and finding the optimal spot requires practice.

Best approach for Active management

The best approach for active trade management is that traders start with patience and become more active in their trade management at the end of the trade. The longer the trade is open without price going into the expected direction, the higher the chance that volatile price action will take place and hit the stop loss.

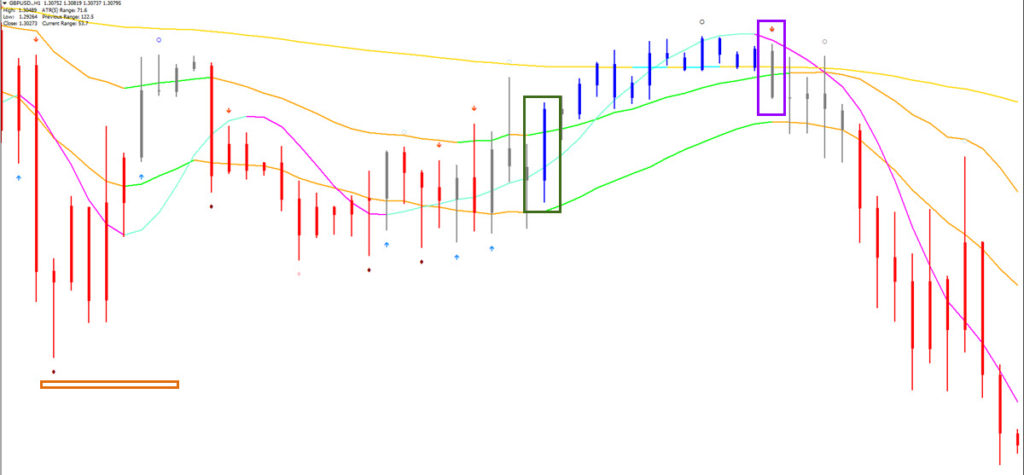

Our ecs.SWAT approach therefore identifies 4 distinct phases of trade management:

- Wait – patience

- Tight – more aggressive

- Wait – patience

- Tight – more aggressive

All of this is explained in our course called SWAT – simple wave analysis and trading.

Phase 1: wait

The wait phase means that we are patient. We do not want to intervene in the trade setup unless there is a very specific reason. It is usually not done and any change is an exception.

The reason is simple: we just entered the markets based on our analysis and/or strategy. There is no need to change the parameters of a setup if we placed a trade properly based on the plan.

At this point, you need to trust your analysis and not second guess yourself. If you do feel unsure, then you might want to re-analyse why you entered in the first place.

Traders often make the mistake of zooming into lower time frames, which makes them fearful. Or they expect trades to develop quickly and hence they lose patience with their setup. Many times it is internal thoughts like this (trading psychology) that work against us.

The best advice is to use the same time frame or higher for monitoring the chart. Then try to not intervene in the trade for at least 4-5 candles after entry. An entry on the H1 chart means that we should at least wait for 4-5x hourly candles before judging or analysing whether the new information has changed the original setup in any way.

Only when more information is available, such as 6-7 candles which is 1-2 candles on a higher time frame, will traders get a better picture of whether their original analysis is working or not. At that point, they could consider using the approach mentioned in phase 2. Of course, how long traders choose to be patient is their choice and could depend on whether their stop loss is far away or if there are strong reasons for taking the trade setup. But in any case showing some patience at the start of a trade helps a great deal.

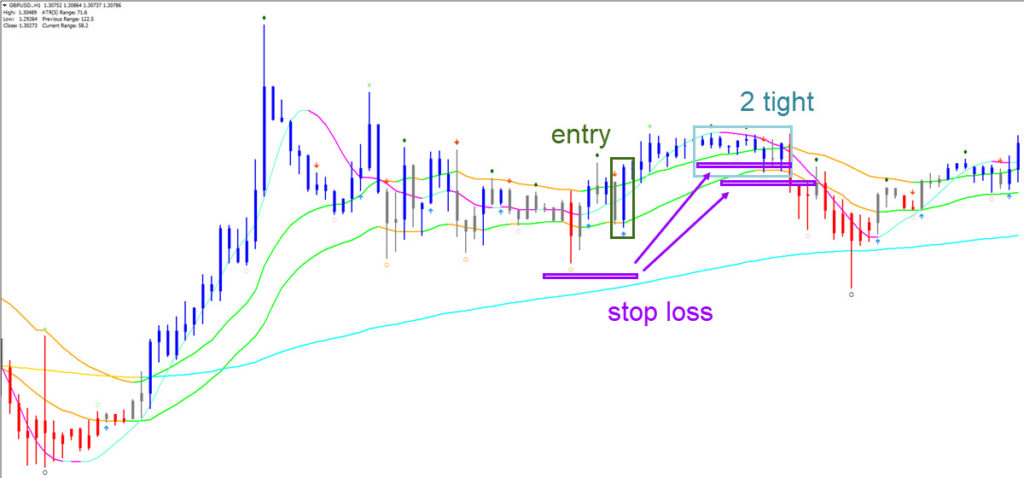

Phase 2: tight

In this phase, more information is finally available and it makes sense to check how the trade has developed. New candles shed a light on whether the analysis and trade have worked out as expected or not.

After being patient at the start of the trade and waiting for the trade to develop, It is now time to seriously consider being less patient with the trade management. It could now be the time to act on the new information because six to seven candles can seriously change the outlook and analysis of the trade setup in a good and bad way. This is not a must and sometimes we wait longer for a trade to develop. But if we do act, then we apply a range of techniques:

- Move trail stop loss to reduce the loss

- Move trail stop loss to lock in profit

- Change target

- Scale out (partial market close)

- Market close

This is the moment when traders want to reduce their risk and exposure to the market if and when possible. Traders do not want to hang in there and hope for the best at this moment but rather choose the best way to reduce the risk while still giving the trade a chance to develop (unless a market exit is taken).

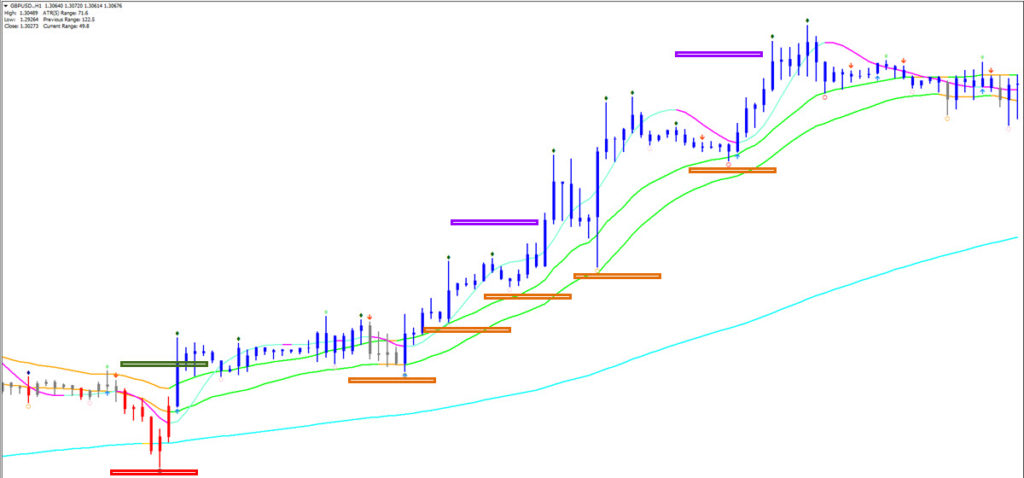

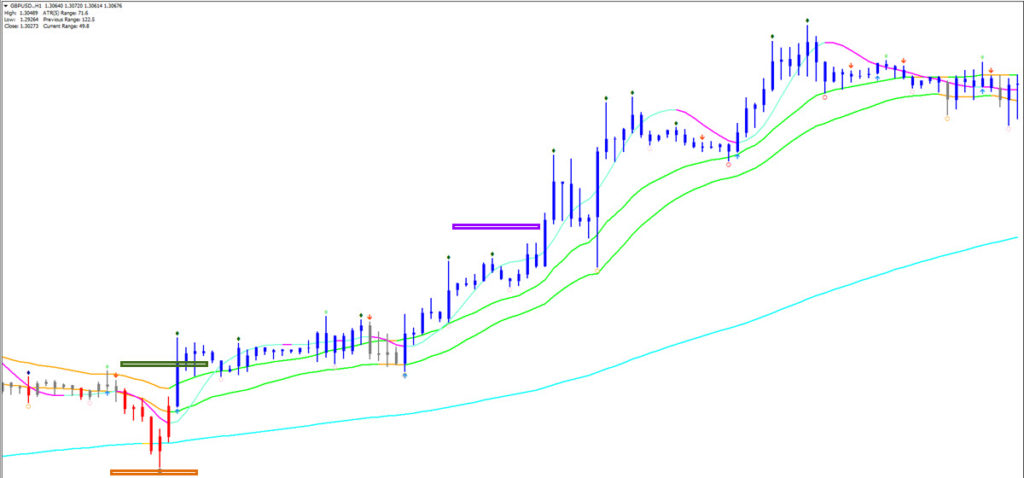

Phase 3: wait

Now that the risk has been reduced, removed, or profit locked-in, it is time to take a deep breath and sit back again. Now it is time to be patient again. Let the market speak and wait for new information to arrive. This is a phase where we do not want to reduce our chances of catching a full win. If our risk is less or some profit is in the pocket, then it is ok to be patient and wait for price to develop towards our original target.

In this phase, traders tend to get greedy or too nervous. If the trade goes into the expected direction and profits are visible, traders often close (too) soon to grab the profits immediately. If the trade does not go their way and a trade could end up closing for a small loss, then traders tend to want to avoid losses at all costs, even miniscule losses. From a psychology point of view, accepting any type of loss, even small ones, is difficult.

The best approach just after phase 2 is to be patient. Wait for your target to get hit and give the trade some time (at the very least a candle or two).

Phase 4: tight

Finally, the last phase has arrived. We have been patient, tight, and patient so far. Now it’s time to be tight again, which can translate into this:

- Using a very tight trail stop loss

- Scaling out

- Exiting at market

There are usually two scenarios at this point. The trade setup is either going sideways or the market is moving nicely into the expected direction and target. Trades that went against us have already closed for a loss, small loss, break even, or small win by this point of time.

If a trade is moving sideways, then it’s really a 50-50% chance whether price is going to move into our direction or not. At that point, it could make sense to be more tight and think carefully if and how to stay in that trade.

If the trade is going into our direction, then it could be a good time to lock in profits. Traders are often greedy and think that they can catch more than the market might be willing to offer. If the market is moving (again) into your direction, then it might be a good moment to grab the profits before the market reverses.

For more information, free analysis, webinars, videos, tools, systems, and methods for trading stocks, cryptos, Forex and options, please check out our website www.EliteCurrenSea.com.

Wish you good trading,

Chris Svorcik

Leave a Reply