How to Spot and Use Bitcoin Bear Traps to Your Advantage

Bitcoin can be a tricky investment to navigate, especially given its volatile nature. However, it’s essential to stay on top of its fluctuations to make informed decisions about when to buy, sell, or hold. One of the most important things to be aware of when investing in Bitcoin is the bear trap. In this post, we’ll explore what a bear trap is, how to spot one, and how to use it to your advantage.

What’s a Bear Trap?

A bear trap is when the price of an investment looks like it could drop significantly lower, but instead, it unexpectedly rises. As a result, it traps the bears who shorted or sold the investment at the worst possible time.

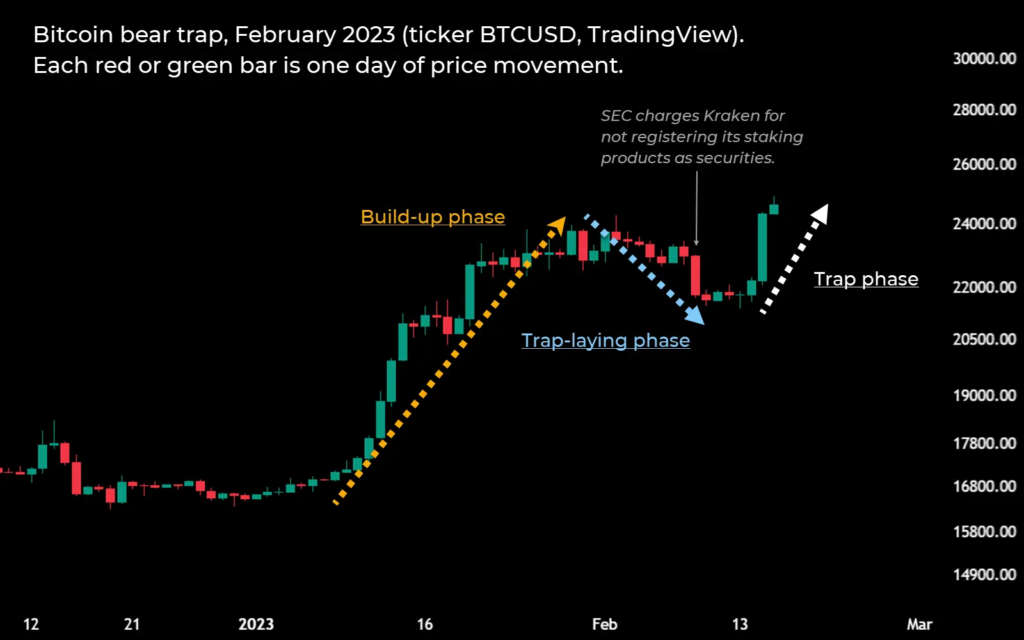

Bear traps typically play out in three phases. First, there’s the build-up phase, where the investment is trending upward, and everyone who owns it is making good money. Then there’s the trap-laying phase, where the uptrend slows down and then drops hard and fast. This phase often comes with some kind of bad news catalyst, which draws all bears out from the woods. Finally, there’s the trap phase – and that’s when the price quickly jumps higher. This forces short-sellers to exit their trades for significant losses and entices investors who sold their holdings (in the trap-laying phase) to buy back in at higher prices.

How to Spot a Bear Trap in the Making

Spotting a bear trap is not easy, as it’s meant to trick investors. However, there are several ways to detect potential bear traps:

1. Bollinger Bands

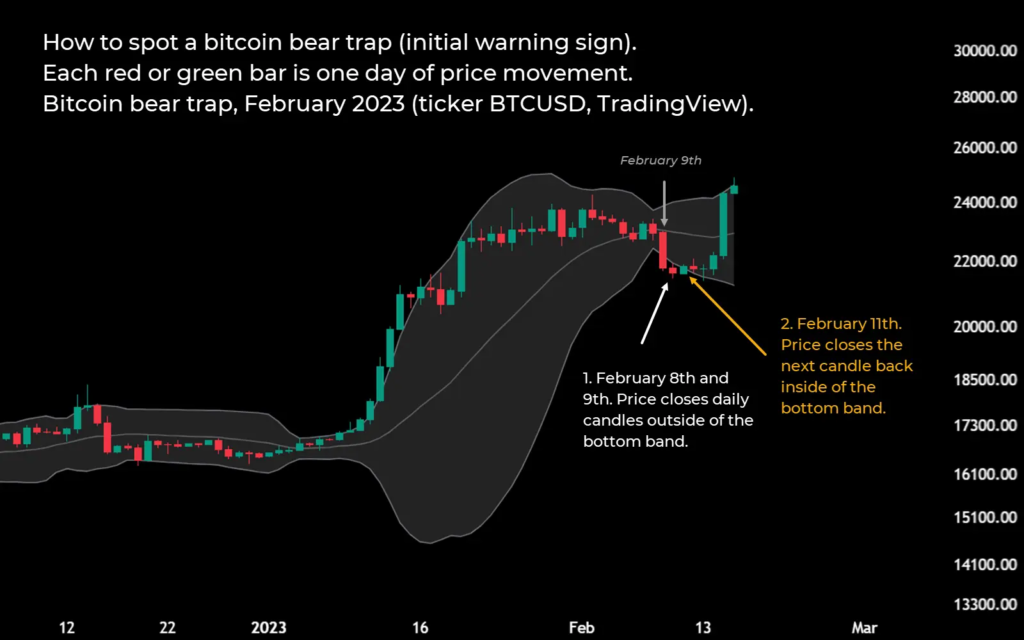

A simple Bollinger band strategy can be pretty good at alerting you when there might be a bear trap underfoot. Bollinger bands get wider when an investment gets more volatile and narrower when it gets less volatile. You can use Bollinger bands to spot potential bear traps in the making. Daily candle closures back inside the bottom band can be an early warning sign of a bear trap.

2. Bad News Catalysts

As mentioned earlier, bear traps often come with some kind of bad news catalyst. It’s crucial to keep up with relevant news regarding Bitcoin and other investments to spot potential bear traps.

How to Use a Bear Trap to Your Advantage

If you’re a true-blue, long-term Bitcoin believer, you might see bear traps as an opportunity to top up your position. It can also be less risky than buying just after the price has spiked higher in the short-term – a scenario more prone to bull traps. Those are good for snaring late buyers (instead of sellers), and you’ll want to steer clear of them too.

Conclusion

Navigating the world of Bitcoin can be a challenging task, but being aware of bear traps is essential. By using Bollinger bands and keeping up with relevant news, you can spot potential bear traps in the making.

And if you’re a long-term investor or a trader, bear traps can present an opportunity to top up your position or enter a short trade. So, the next time you see a potential bear trap, don’t panic – instead, use it to your advantage.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply