Is Bitcoin About To Break(out)?

Bitcoin has been behaving like a stablecoin lately, with its price remaining calm at around $19,000 a coin. But now is not the time to get complacent on the OG crypto: a big move is likely brewing.

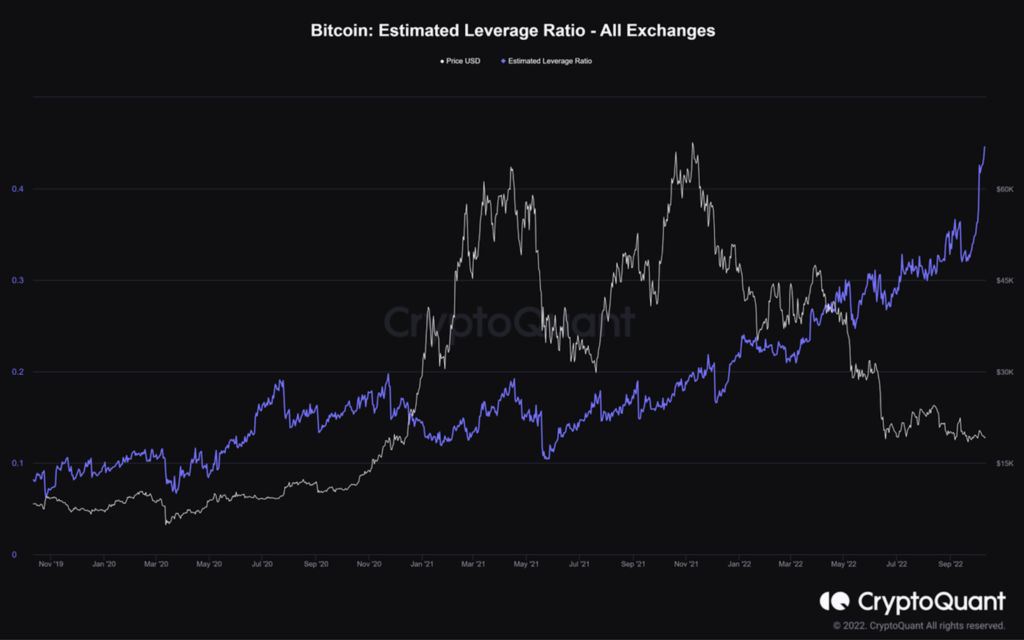

This chart indicates bitcoin’s price, as well as its leverage ratio (purple line), which is an estimate of the average leverage currently being used by bitcoin derivative traders.

That’s calculated by taking the amount of open bitcoin derivative contracts (the open interest), and then dividing it by the total amount of bitcoin held on the exchanges where those derivatives are being traded. The leverage ratio is now higher than ever, meaning your average bitcoin derivatives trader is leveraged to the hilt.

As bitcoin eventually breaks out of its dull range (which it will), you can expect to see a massive cascade of liquidations. This is where highly leveraged traders are compelled to exit their positions as the price moves against them. It’ll be like throwing gasoline on top of a small fire.

Of course, the move could go either way. The ratio includes both long and short positions, so if the price moves up and starts to liquidate the shorts, those traders will be forced to buy bitcoin back at higher prices to close out their positions, which could make for an explosive rally. Of course, the opposite is true if the longs get liquidated – they’d become forced sellers and drive the price deeper down into the crypto abyss.

Don’t be surprised if the key US inflation report (CPI) on Thursday (see our take) sets off a firestorm. As for Bitcoin, you may want to check out our wave analysis earlier this week.

Safe Trading ❤️🇺🇦

Team of Elite Currensea

Leave a Reply