Three Indicators of “Crypto Winter” Softening

This year has only just begun, yet the crypto market has already been surging, rising by a whopping 30%! Of course, there may be some ups and downs in the near future, but looking ahead, there are three clear indications that the crypto market has already reached its bottom.

| Instrument | Entry | TP/SL | Long/Short | Duration |

| Ethereum (ETH) | $1.45k-$1,65k | $2,300/$800 | Long | Up to 45 days |

| Cordano (ADA) | $0.25-0.37 | $0.8/0.18 | Long | Up to 45 days |

| Bitcoin (BTC) | $18k-$21k | $28k/$35k | Long | Up to 45 days |

| Binance (BNB Coin) | $275-$305 | $350/$180 | Long | Up to 45 days |

1. Plenty Has Been Endured, But the Situation Seems to be Softening

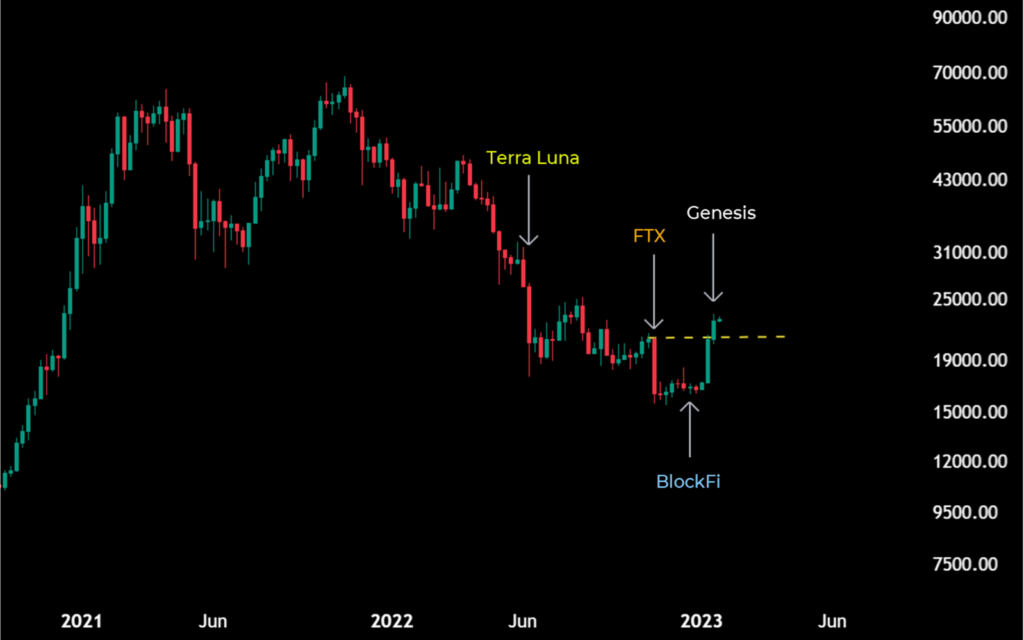

Last year, the market was incredibly over-leveraged. Not only retail investors, but also enormous crypto funds such as Three Arrows Capital (3AC) and Alameda Research had leveraged to the max. When prices increase, this plan can be profitable, however, when they fall, investors are compelled to abandon their positions suddenly. Furthermore, Terra Luna, a $60 billion blockchain, experienced a complete collapse in May, with its UST stablecoin dissociating from the US dollar.

Many powerful investors had a direct or indirect relationship with Terra and were taking advantage of the high-risk financial opportunities it offered. It seemed as though the entire crypto-lending/borrowing system was caught up in the same unrealistic hype. Unfortunately, this led to the downfall of prominent crypto firms such as Voyager and Celsius, who declared bankruptcy during the summer.

The November collapse of FTX, one of the biggest digital asset exchanges, marked the “Lehman Moment” of the crypto world, sparking widespread panic and causing Bitcoin to plummet to $15,500. Fortunately, when BlockFi and Genesis, two major crypto lenders, filed for bankruptcy more recently, Bitcoin held its ground and is now trading above its pre-FTX levels (yellow dotted line).

The news may not be great, but prices aren’t reacting as harshly as before, which may be indicative of the market already having accounted for the damage. It could also mean that a lot of the irresponsible traders and financial schemers have been cleared out and what remains are those striving to reconstruct.

2. Bitcoin’s Ahead of the Pack

As bitcoin is the largest and most liquid crypto asset, it often sets the tone for the digital asset market. Looking back at past bear market bottoms, it’s clear that bitcoin needs to take the lead if there’s to be a rebound. So, it’s a safe bet to say that the ‘king’ of cryptocurrencies will be driving the next wave of victory – and that’s what will give altcoins the opportunity to benefit from the liquidity influx!

Since November, Bitcoin has seen a huge surge of around 50%, snatching a 5% market share and dominating the rest of the crypto market – reminiscent of its rise during the 2018-19 bottom. This impressive feat can be attributed to Bitcoin’s dominance.

3. Marco Situation is Improving

Last year, crypto bears had good reason to leave their winter slumber and emerge – thanks to skyrocketing inflation levels that hadn’t been seen in decades and the Fed and other major central banks increasing interest rates to try and contain it. This trifecta of high inflation, higher interest rates, and an ailing economy was a nightmare waiting to happen for growth-oriented investments like tech stocks and crypto.

Crypto bears had a strong cause to wake up from hibernation in 2020 – inflation had finally surged after so many years, and the Federal Reserve and other worldwide central banks commenced with a number of interest rate hikes, aiming to control it. This combination of high inflation, heightened interest rates and an ailing economy was a major threat to flourishing assets such as technology stocks and cryptocurrency.

The US yearly inflation rate has been steadily declining since its peak of 9.1% in June, dipping all the way to 6.5% in December. Although still nowhere near the Fed’s 2% target, an analysis of the monthly inflation rates reveals that the rate has only risen by 0.9% over the last six months – changing the narrative and suggesting positive movement.

The Federal Reserve has been hoping to land softly on the rate hikes, increasing enough to keep inflation in check but not so much as to cause an economic recession. Although a gentle touchdown may be on the horizon, there is a still a chance that a contraction in economic activity might be driving the lowering of inflation, a sign of an upcoming recession. Nonetheless, it is more likely that the Federal Reserve will reduce the rates to boost the economy, and that could be a positive for Bitcoin and other cryptocurrencies.

Possible Crypto Bets

It’s anyone’s guess if the crypto market has already hit rock bottom – but if, like us, you’re of the opinion that it’s likely, some “longs” are long (pun intended) overdue.

Keep in mind, though, bear markets have those occasional rallies and bull markets will have drops, so you’d be better off buying those dips than being tempted to FOMO into rallies. Need some help deciding what to buy? Here’s a handy guide to get you started.

Safe Trading ❤️🇺🇦

Team of Elite CurrenSea

Leave a Reply