Best AI Stock Pickers

The advent of artificial intelligence has spurred numerous debates regarding the future of work and finance, and the world of investing has been at the forefront of AI advancements for the past few years.

With the stock market becoming increasingly automated and efficient, the investment process has followed suit – with AI stock picking services that leverage machine learning to analyze stocks using a variety of categories, such as industry, market capitalization, trading volume, technical indicators, PE ratio, etc.

The stock market is home to thousands of stocks and AI stock pickers can help traders narrow down their search and arrive at a shortlist of a handful of candidates that match their desired criteria.

AI stock pickers differ considerably in terms of their service packages, features and pricing and it can be hard for traders to pick the right one in an increasingly saturated market.

If you are interested in AI stock picking services and would like to know which ones stand out – this Investfox guide is for you.

What Are AI Stock Pickers?

AI stock pickers are platforms or tools that use artificial intelligence to analyze markets based on a number of factors, such as financial data, market trends to help traders avoid problems in picking stocks daily.

AI stock picker software typically comes with a range of important features, such as:

- Data analysis – AI stock picking services gather and analyze vast amounts of financial data, including historical stock prices, trading volumes, earnings reports, news articles, and more

- Pattern recognition – machine learning algorithms can identify patterns and trends in data sets that may not be so apparent to the human eye. This may include technical indicators and chart patterns that signal overbought or oversold conditions, etc

- Sentiment analysis – Some AI stock picking services also perform sentiment analysis on news articles, social media posts, and other textual data to gauge market sentiment and its potential impact on stock prices

- Portfolio management – AI may analyze stock portfolios and give feedback to the user about points where they may need some rebalancing to reduce overall risk exposure

- Predictive modeling – The AI algorithms build predictive models based on historical data to forecast potential future stock price movements and then use this data to predict buy and sell conditions in the future

- Risk assessment – AI algorithms can assess the risk associated with specific stocks or investment strategies by analyzing historical volatility and other relevant risk factors

Danelfin

Danelfin is a fintech platform that uses “explainable AI”, which describes its own work process. Danelfin’s AI assigns a numerical rating from 1 to 10 to individual stocks and breaks down the criteria that is used in its analysis. Each criteria is assigned a numerical value based on the AI’s analysis, which adds up to an average score for the stock.

Users can decide whether to invest in the stock or not, based on the AI’s rating.

How It Works

As already mentioned, Danelfin uses an AI rating system to assess the risk and potential benefits of investing in a particular stock. Here’s how it works:

- The user types the ticker of the stock they are interested in

- On the individual page of the stock, the user can view the overall score assigned by the AI (scale of 1 to 10), as well as the breakdown of said score by factors, such as Fundamental, Technical, Sentiment, and Risk

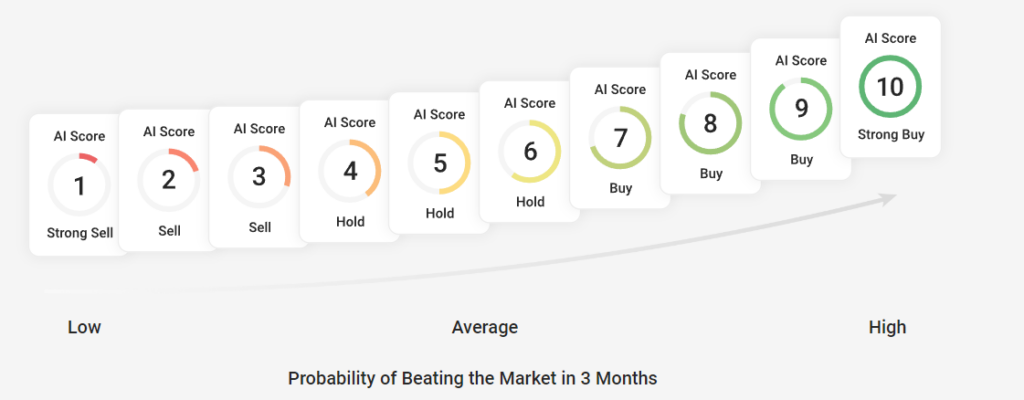

- The user can also view the AI’s buy or sell rating, which is also graded on a scale of 1 to 10, from 1 being a very strong sell, and 10 being a very strong buy

- The user can now choose whether to base their trade decisions on Danelfin’s AI score

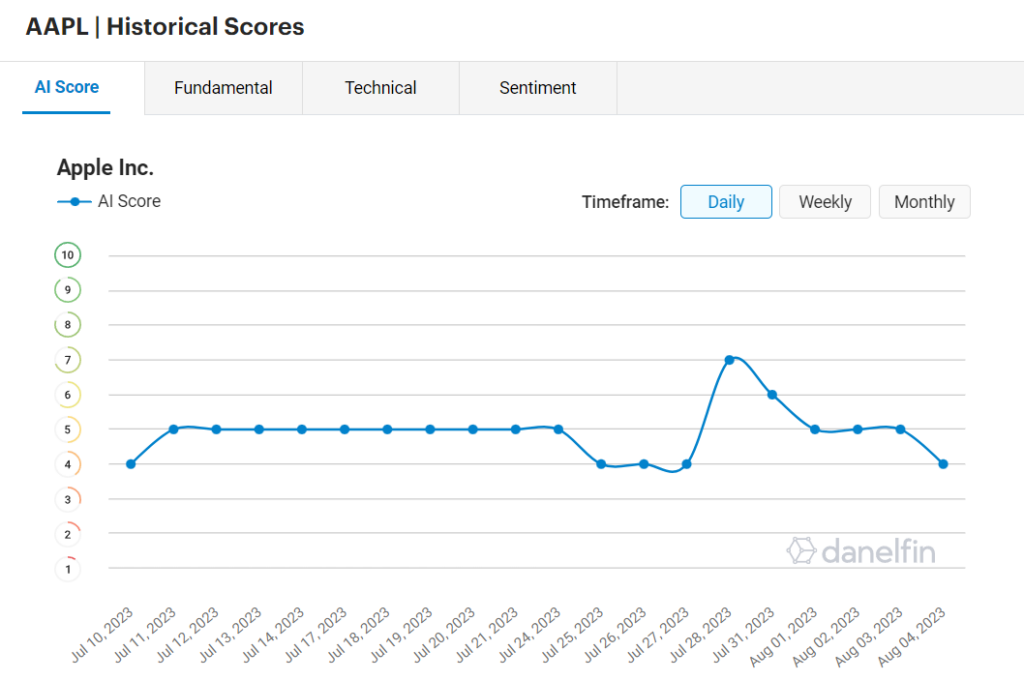

For example, Danelfin’s AI rates Apple stock (AAPL) as a 4/10 and suggests investors to hold the stock. While the Fundamentals get a solid 8/10, Technicals and Sentiment lag behind at 5/10 and 6/10, respectively.

Danelfin uses over 600 technical indicators to analyze charts and generate these scores, including the RSI, MACD, market capitalization, revenue growth, net margins, etc.

Aside from the base AI scoring, Danelfin also allows users to view the AI score history for each stock to get an idea of how the stock has fared over a period of time, according to the AI.

Danelfin’ platform covers thousands of stocks and ETFs, while offering additional features in the Plus and Pro payments plans, such as individual alpha signals and unlimited trade ideas.

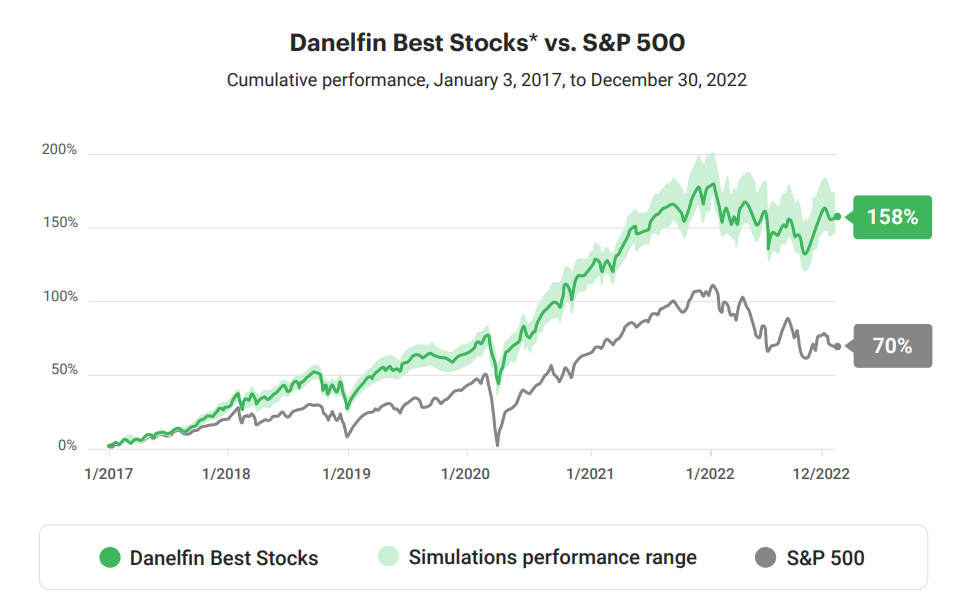

Danelfin’s website also claims that its picks have returned 158% between January 3, 2017 and December 30, 2022 – as opposed to the 70% returned by the S&P 500 over the same period.

Pricing

Danelfin offers three different subscription options – Free, Plus, and Pro. The Plus subscription adds more trade ideas, portfolios and overall alphas signals, while the Pro subscription grants access to the full package with unlimited usage.

Candlestick.ai

Candlestick.ai is a mobile-only service that offers both Android and iOS apps to its users. Candlestick provides three stock picks a week via push notifications on the user’s phone.

The AI also explains how it got to the trade idea and only gives out push notifications for stocks that align with the user’s risk tolerance.

How It Works

Users will have to download the Candlestick.ai app on their Android/iOS devices and tailor their stock picks by their preferences. Candlestick also offers model risk profiles for users to choose from.

Users can choose from over 6,000 stocks available via Candlestick’s app and the platform explains its rationale for each stock pick, assuming the user shows interest in the pick.

The user can ask the AI advisor to provide more information on their stock pick, to which the AI will answer in greater detail to explain their choice.

The AI’s picks have returned 23% in 2022, which is far greater than the 18.11% decline shown by the S&P 500.

Candlestick.ai is a relatively new player on the AI stock picker market and is planning on introducing its conversational AI advisor that will be built on GPT-4 and provide users with earnings analysis and answer various financial questions.

Pricing

Candlestick.ai operates on a single pricing structure – with $9.99/month for its AI services, which is one of the most affordable offers on the market.

Tickeron

Tickeron’s AI scans markets and looks for trading signals for its users. The platform covers stocks, crypto, and forex. Tickeron offers different strategies based on the risk tolerance of its users. Providing crypto and forex trading signals is what sets Tickeron apart from other AI stock pickers.

How It Works

Tickeron’s AI searches the markets continuously to find trade ideas and present them to its users, who can choose a strategy based on their risk tolerance and instruct the AI to follow a set of criteria.

Tickeron also offers a host of additional features, such as:

- AI Pattern Search Engine – for end-of-day patterns and breakout prices

- AI Trend Prediction Engine – for entry and exit prices and confidence levels

- AI Stock Screener – entry and exit prices for stocks

- AI Real Time Patterns – entry and exit prices and confidence levels

Aside from this, Tickeron also offers the Investors Club, which is a community of Tickeron clients where they can share investment ideas. The Tickeron website also hosts an academy and expert blog for beginners, with plenty of insightful materials.

Users can also choose model portfolios curated by Tickeron and integrate 401(k) portfolios from a list of over 80,000 U.S companies.

Pricing

While signing up for Tickeron is free, its paid subscription will set you back $90/mooth, or $45/month if purchased annually. While not the cheapest offering, Tickeron makes up for its price point by the sheer number of features available on its platform.

AltIndex

AltIndex uses AI to gather data from social networks to provide users with an overview of stocks that are being mentioned most frequently. The AI analyzes engagement on social media posts and the number of mentions of a stock’s ticker or company name to provide users with data that is structured into categories to determine whether the sentiment is positive or negative.

How It Works

AltIndex assigns an AI score between 0 and 100 to measure social sentiment surrounding a particular stock. The closer the score is to 100, the more positive the discussions around the stock are.

The AI analyzes a large number of data sources, such as social media, traditional news media, job postings, new articles, etc.

AltIndex specializes in U.S stocks, where such data is plentiful and easy to aggregate.

Users can set up alerts that will be sent to their email address once the algorithm finds a suitable stock pick. The number of picks received by users can be inconsistent, with some days having no picks at all.

Pricing

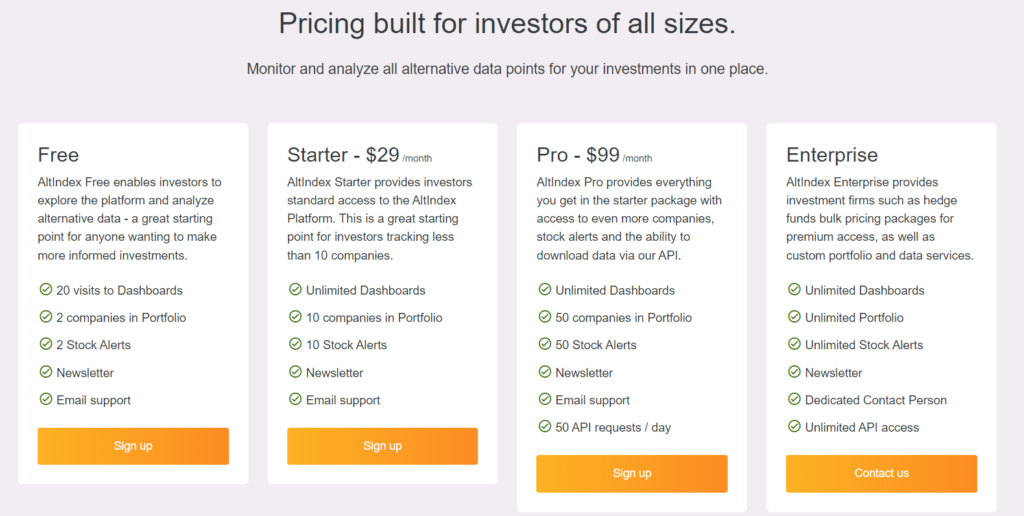

Prices for an AltIndex subscription are divided into three tiers – Free, Starter ($29/month), Pro ($99/month) and Enterprise, the price of which depends on the number of required alerts and is the most customizable option.

Kavout

Kavout leverages machine learning and AI to build long-term stock portfolios. Users can choose between two strategies, based on their individual risk tolerance.

How It Works

Kavout’s offerings are divided into two investment strategies – Kai Equity, and Kai Dynamic Asset Allocation.

Kai Equity is suited for high-risk investors, while Kai Dynamic Asset Allocation is more pragmatic with an 14.2% annual returns, as opposed to 25% for Kai Equity.

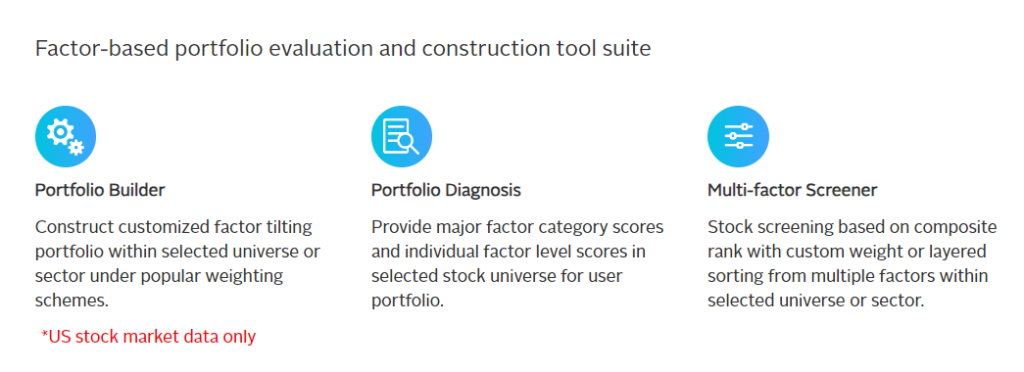

Kavout also offers additional features, such as a portfolio builder and tracker, diagnosis and risk assessment tools, as well as a multi-factor stock screener.

Pricing

Kavout’s portfolio toolbox package costs $49/month, with $7 for the first month. However, Kavout has a $100,000 minimum investment threshold, which may bar some investors from using the service.

FAQs On The Best AI Stock Pickers

Are AI stock pickers legit?

Yes. AI stock pickers are pieces of software that use machine learning and artificial intelligence to analyze the stock market and pick the stocks that match the user’s desired criteria. Most Ai stock pickers also come with a wide range of additional features, such as portfolio analysis and rebalancing tools, screeners, model portfolios, etc.

Can I make money with AI stock pickers?

Ai stock pickers often state that their returns are well above the S&P 500. However it must be noted that these returns were generated by the best-performing picks and market-beating returns are not 100% guaranteed.

How do AI stock pickers work?

AI stock pickers go through mountains of data to analyze stocks and assess their rating between Buy, Hold, and Sell.

Some AI stock pickers also offer automated portfolios and advisory services, among others.

Leave a Reply