How to Evaluate Forex Signal Providers?

Nowadays, technically, it’s as easy as ever to get quick access to Forex signals, but has it gotten any less fraudulent than in the hay days of Forex? Real-time signal providers propose precise transaction information to beginner traders using trading signals.

When it comes to Forex signals, the finest ones will explain their reasoning, thus providing a foundation for understanding the underlying principles of the Forex signals landscape.

This knowledge should help you to incorporate the best of the other people trading methods, while also providing a simple gateway to trading ideas you’d like to bet on. Below you will find several aspects and criteria to consider when analyzing and identifying the top Forex signal providers, and avoiding scams.

What defines the best FX signal Provider?

For good reason, forex signal providers might be tough to discover. There are several solutions available, some of which may be fraudulent.

When making their decisions, beginners should differentiate between free and paid Forex trading signals. Because there are two distinct items, a direct comparison is difficult; thus, this is an important first step.

This data may then be evaluated using data supplied by signal sources. These considerations will include the cost of a paid trading signal membership, seniority, and the availability of a certified track record. This should be one of the most important requirements for free forex trading signals from the best forex signal providers. The results must be independently verified and made available to the general public by a third party.

It’s also a good idea to read as many customer reviews as you can about the service provider you’re thinking about using to get a feel of what other traders think of them.

Examine their websites carefully to determine whether they have any reliable backtests. Make sure to also check forex peace army and Trustpilot, google “signal provider + name or scam” and that the provider has a live account that verifies performance. When it comes to evaluating the best Forex signal provider there are some important things to look at, including Cost, Accuracy and Analysis.

Cost

If someone tells you that there are some free Forex signals available, it is most likely a scam or a lie. The major reason for this is that Forex signal providers make money by charging consumers yearly, monthly, or daily fees. On average, a reputable service from a Forex signal provider will cost you somewhere from 50 to 100 dollars per month. But be sure there can be reliable sources for Forex signals for free as well, but they might be filled with promotional content (to keep the signals free of cost) and are not going to be as frequent as the paid ones. Often time companies also have promotional offers if you sign up through a specific brokerage, in this case, also make sure the promoted broker is not itself fraudulent.

Accuracy

One of the soundest criteria to choose the best Forex signal providers is to test their accuracy. To begin, examine the signal’s historical performance. The previous performance of a signal makes it simple to determine whether it is automated. The signal is computed here by the system’s backend processes. A live test may also be performed to see the signal in operation and assess its accuracy.

To optimize your earnings, you must first understand the various factors that go into the computations. Only a few examples include risk-adjusted returns and profit factors. It doesn’t matter whether you’re receiving a free or paid forex signal; make sure you request this crucial technical information.

If you employ a signal created for a $2,000 account with a $100 balance, your risk is increased. Finally, determine whether the signal is only applicable to forex or if it can be applied to other things as well. Make sure your broker is reliable and supports your signal provider strategy

Analysis

Forex trading signals are classified according to the specific purpose they perform and how they normally work. In the Forex market, there are two types of FX signals: Human-Generated Forex Signals and Algorithmic Forex Signals

Human-Generated Forex Signals

To make a final choice on whether to buy or sell a currency utilizing human-generated Forex trading signals, a trader must sit in front of the computer for a long amount of time. A trader’s judgments are entirely dependent on his or her interpretation, which may be a lengthy process. Manual trading and the usage of Forex trading signals are intertwined.

There are times when the foreign currency market moves in a way that computers can’t fathom, and human traders know this and can close positions. A trader has the ability to tell whether a deal is going to be lucrative or not based on their own knowledge and experience, rather than relying only on automated methods. Be sure to know various human-generated FX signal providers have expert traders behind them doing all of the work for you. In terms of costs, these types of providers are much more expensive.

This is where a user should research the background of the signal provider, check for a live track record and ask around. A good signal provider is a gem, after all.

Algorithmic Forex Signals

The term “algorithmic” refers to signals generated when a trader instructs their trading program to hunt for certain signals. There is no human emotion engaged in the process at all. Because of this, the program will know exactly what action to take on your behalf (i.e. to buy or sell a currency pair). This method of using Forex trading signals may be quite accurate if it is created by a professional.

When it comes to Automated Forex Signals, both MetaTrader 4 and 5 Signals services offer Forex trading signals from a plethora of trading strategies. The main catch is that the signals are executed on your trading account automatically, which makes it an ideal option for traders who do not have enough time to dedicate to day trading.

Benefits of Expert Advisors

- Never stops

- Can take into account more data

- Not prone to emotions (rage trading, etc)

Disadvantages of Expert Advisors

- Can easily ruin an account when its strategy rules don’t apply

- Does require some trading knowledge to maintain

Forex signals on Telegram

One of the most popular ways to get access to FX signals is via Telegram. There are lots of signal channels available on this platform. One of the top Forex signal channels operating on Telegram is ECS.LIVE curated by Elite CurrenSea, one of the leaders in Forex Education and technology.

This Telegram signal channel provides 196% account growth potential with trade setups, market research and mentoring. ECS. LIVE offers 3 different subscription plans. The starter plan is billed monthly for just €109 with full access to all of the features provided by the channel. The loyalist plan is billed quarterly for €295 (which comes to €98 per month). Last but certainly not least is the Live for Life plan which is billed annually for €899 which comes to €64 per month.

This Telegram signal channel provides 196% account growth potential with trade setups, market research and mentoring. ECS. LIVE offers 3 different subscription plans. The starter plan is billed monthly for just €109 with full access to all of the features provided by the channel. The loyalist plan is billed quarterly for €295 (which comes to €98 per month). Last but certainly not least is the Live for Life plan which is billed annually for €899 which comes to €64 per month.

All of the plans mentioned above have wave analysis, chart analysis, different alerts and on top of that educational courses to deepen your understanding of Forex. The company also offers a free 3 to 6-month version of ECS.LIVE if you are going to join with KTM or XM broker sponsorship.

Where to Find the best Forex Signal Providers?

Now that you are familiar with what makes one the best FX signal provider, the next step is to know where to start looking for one. There are plenty of sources on the internet that are filled with various lists, Forex Signal reviews, and other content that might not be as legitimate as it might seem at the first glance.

Etoro

One of the leading social trading and multi-asset brokerage company, eToro offers Copy Trading services to customers. Copy Trading helps traders to copy positions opened and managed by brokerage companies. eToro’s CopyTrader argues to help traders to earn up to 30.4% average yearly profit by automatically copying top-performing traders.

One of the leading social trading and multi-asset brokerage company, eToro offers Copy Trading services to customers. Copy Trading helps traders to copy positions opened and managed by brokerage companies. eToro’s CopyTrader argues to help traders to earn up to 30.4% average yearly profit by automatically copying top-performing traders.

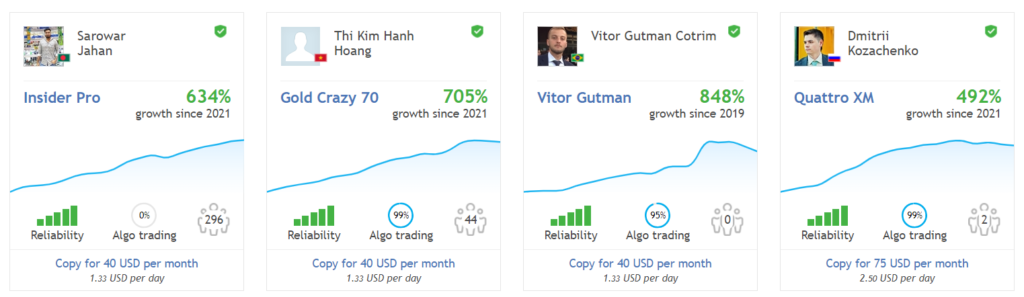

MQL Community

The MQL community has a wide range of different brokers and traders to receive signals from. The website offers various filters to help you find the ideal trader to copy from, such as

- Reliability

- Profitability

- Growth rate

- EA solutions

- different budget ranges.

Speaking of budget, MQL is best suited if you are searching for free signals due to the huge amount of different signals providers they have on the platform.

Different Brokers

eToro is not the only brokerage offering Forex signals to traders. Most of the brokers do follow eToro’s model of Copy Trading but there are also others who provide the signals directly which tends to be more popular in the Forex market.

Vantage is a brokerage company that offers its customers Forex signals via email feature with the addition of different tips that helps to improve the trading account. Another famous brokerage, XM, offers free Forex Signals from experts in the field to their live account holders.

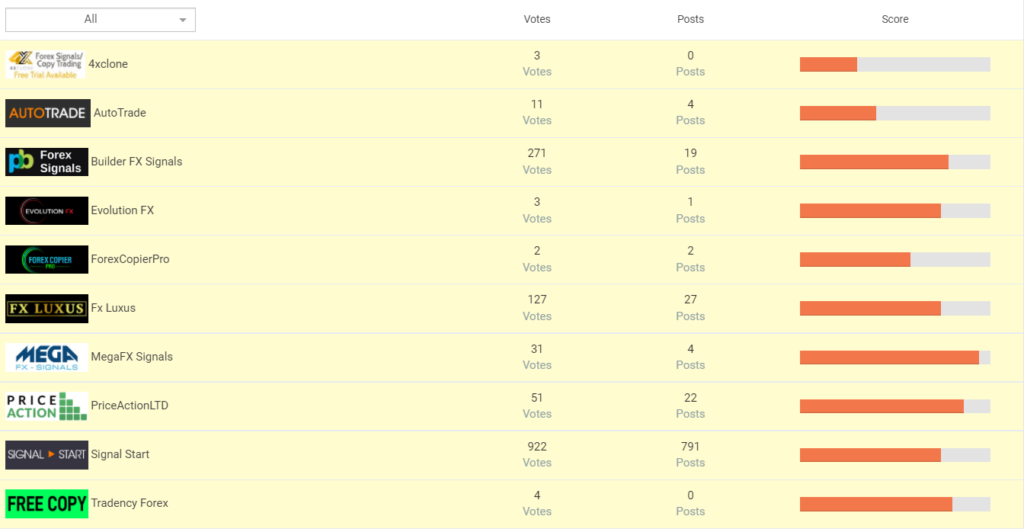

Myfxbook

Myfxbook is known to be the go-to website for checking the live performance of different brokerages and algorithmic trading robots. The website also curates a list of Forex signal provider reviews where you can see the number of votes given to a particular signal provider and posts made by the provider. Myfxbook also has a score calculator which lets individuals evaluate a signal provider by profitability, pricing, platform and customer service.

ZuluTrade

Zulutrade is a Forex Signal provider auto trading platform that is MetaTrader 4 suitable. The company offers numerous signal providers for investors to copy from. You can join ZuluTrade by either opening a real or demo account. If you open a real account with a partner broker, all of your past history of trades will automatically transfer automatically. Also, know that the demo accounts have few restrictions such as the maximum number of open trades at the same time and a minimum waiting time of 15 seconds between two orders.

FAQ

How do you know which Forex signals provider to choose?

The best way to choose a provider is to look at their previous profitability rates, costs and accuracy of the trades. Depending on what you are looking for in terms of those criteria the answer might vary from one provider to another.

Are forex signal trading companies a scam?

Just like any other service provider in the world, there is a chance that you might encounter scam Forex signals. The concept of Forex signal is not a scam, there are numerous legitimate FX signal providers with credible sources. To avoid scamming signals, make sure to see if it’s verified by a third party live trading record, research personal and professional profiles of the provider and research forex peace army. Ensure the provider doesn’t have multiple verified live accounts to confuse you with the actual performance. Be wary of the suggested future gains, number signal providers tend to do better. Research license or another legal footprint of the signal provider company.

Why do I have to use Forex signal providers?

Forex signals ultimately help traders to save time and money. Good signals act as a trigger and give traders suggestions such as when to buy/sell or enter or stop. They are a great informational asset to increase overall returns and minimize the time spent working to find the right time to make a trade.

Leave a Reply