Should you cash in on Coinbase? Make the most of your opportunities!

This pioneering crypto exchange found itself dragged all the way down as digital asset prices headed lower. Coinbase (COIN) made its Nasdaq debut during the euphoria of a crypto bull market. But little more than a year later, With Coinbase’s stock now 85% cheaper than when it listed, I’ve looked into whether it’s a bargain at these prices – or if it’s cheap for a reason.

Is Coinbase generating enough revenue?

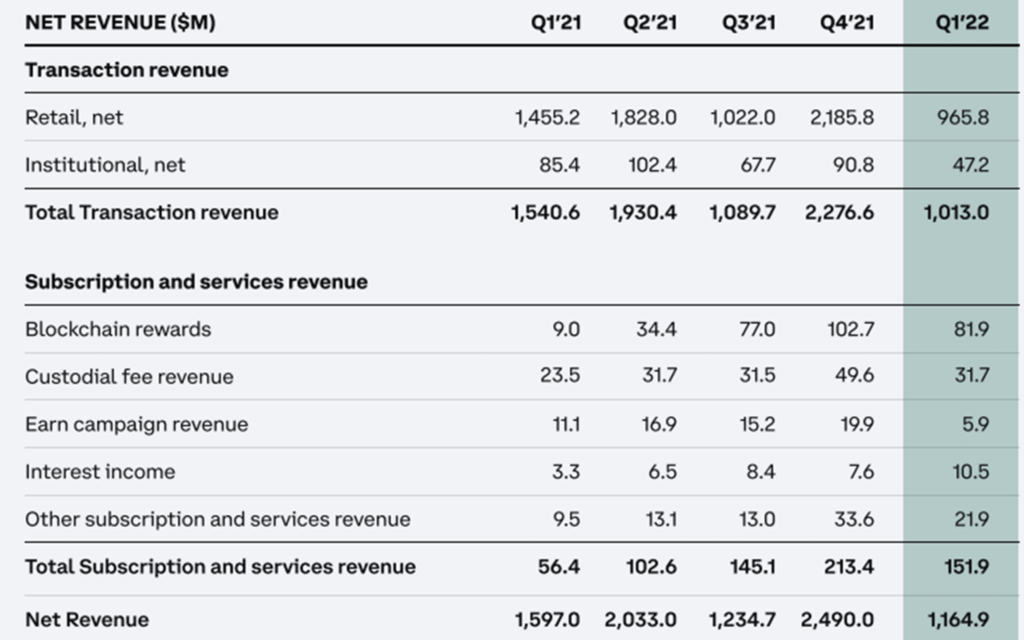

Coinbase’s latest quarterly report came out this month, and at first glance, the results weren’t great. Last quarter, the exchange generated net revenue (sales less direct expenses related to them) of $1.16 billion. That’s less than half what it raked in the quarter before ($2.49 billion) and worse than any other quarter before that. Source: Coinbase Q1 2022 shareholder letter.

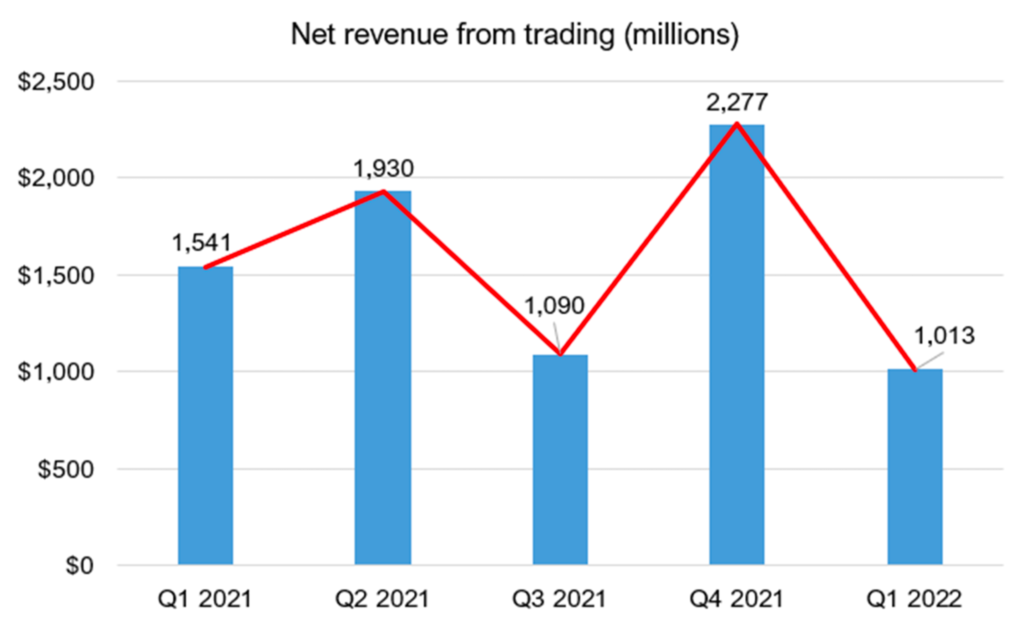

Coinbase has two sources of revenue: trading (total transaction revenue) and other products and services (total subscription and services revenue). As you can see in the chart below, revenue from trading dipped by about 55% last quarter and seems to be trending down overall. That’s to be expected – we are in a crypto bear market, after all, and there are fewer traders buying and selling crypto. However, revenue from other products and services has remained relatively stable.

Coinbase net revenue (revenue less direct expenses related to obtaining that revenue). Source: Coinbase Q1 2022 shareholder letter.

Although trading revenue fell last quarter, the exchange is still building its income streams from other sources. Net revenue from non-trading activities dropped by less last quarter (about 35%) but is still higher than the first three quarters of last year. So despite last quarter’s fall, the overall trend looks to be upward.

Net total revenue for Coinbase by quarter (excluding trading) sourced from the Coinbase Q1 2022 shareholder letter.

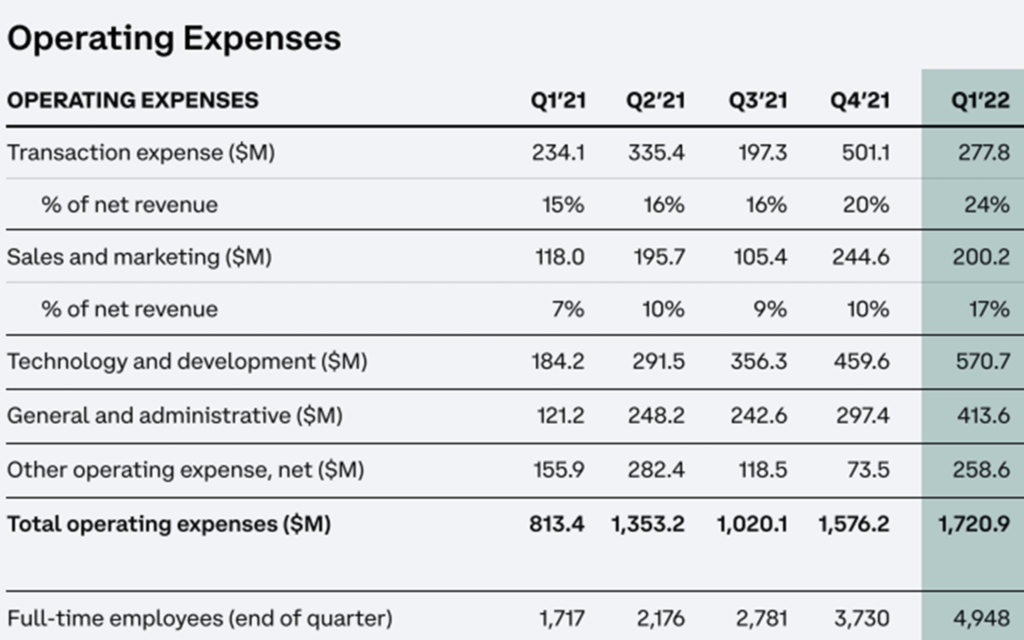

Is Coinbase spending beyond its means?

Coinbase’s spending last quarter totalled $1.7 billion, more than any of the four quarters before it. Here’s a breakdown of where that money went:

Digging into the numbers, you can see that Coinbase is building for future growth. Employee headcount increased by around 33% over the quarter, and the company spent 24% more on technology and development. It also has about $6 billion in cash, which it can use to keep building if the bear market route continues. All in all, those things could pay off in the long run.

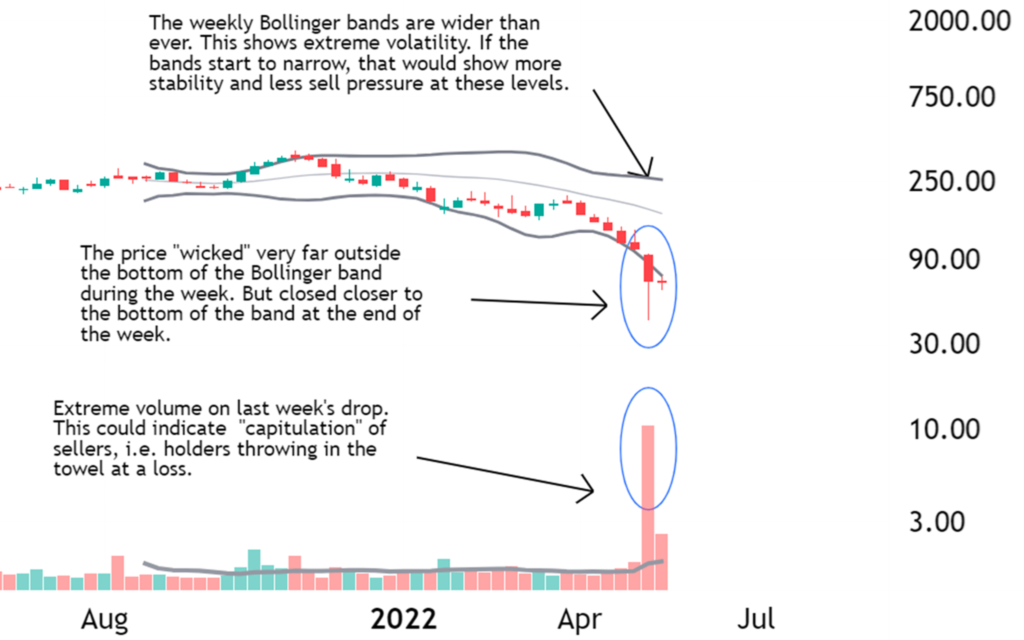

Has Coinbase’s stock hit bottom?

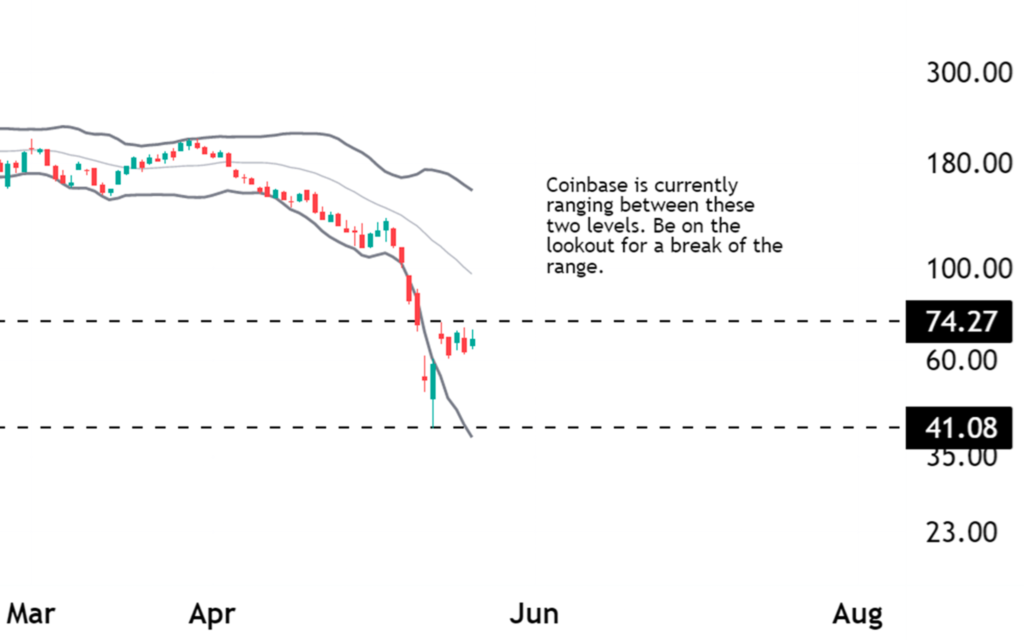

The chart below depicts the price movement of the stock over the last week, with each bar indicating one week. It implies that investors “capitulated” (threw in the towel) and liquidated their equities for large losses last week. This is common when the price is reaching the bottom.

The Coinbase stock price is represented in US dollars, with each bar representing one week’s worth of price action. The chart is drawn with TradingView.

Three things suggest that the crypto market may be due for a rebound. First, prices became more volatile last week, with Coinbase’s weekly Bollinger bands becoming wider than ever. Second, the price “wicked” way outside the bottom Bollinger band, to an intra-week low of $41 before finishing the week at about $68 – meaning buyers were buying the dip with conviction. Third, this all happened during a record spike in trading volume, which shows extreme panic selling.

While this capitulation is encouraging, it is too early to say whether the bottom has been reached. And if that was the bottom, the price may easily go back down to retest it a few times before mounting its next bullish assault.

Looking closer at the daily chart, it appears that a trading range is forming between $41 and $74. For traders looking for a short-term opportunity, a break above the $74 high could signal a coming rally. However, it’s important to use a stop-loss to manage your risk.

Should you invest in Coinbase?

When it comes to Coinbase, investors are far less excited than they were when it was first listed. However, this could be seen as a contrarian play. For example, Cathie Wood’s Ark Invest – which invests in innovative companies with high growth potential – recently bought $30 million worth of Coinbase stock during the dip. I think she might be onto something here.

Though it may not have been received well by customers, Coinbase has made a new disclosure: in the event of bankruptcy, customer coins may be treated as company debt in order to keep creditors at bay. While this news may not be received well, it’s important to remember that Coinbase is a US public company that deals in cryptocurrency. This means that the company has regulatory duties that may slow down the launch of new products.

Coinbase is playing the long game with regulation, and that could pay off big later on. Given the recent events with Terra Luna, authorities are likely to take a more critical stance on cryptocurrency. However, when it comes to compliance, Coinbase has a jump start on competitor exchanges like Binance and FTX, so it should weather the regulatory storm better than most.

Even if you’re planning to copy an investment strategy, make sure you’re comfortable with a lot of volatility and have a long-term investment horizon.

Leave a Reply