Exness is a leading forex broker that offers a variety of trading platforms to suit the needs of its clients. These include the popular MetaTrader 4 platform, as well as the more advanced MetaTrader 5 platform. In addition, Exness offers its own proprietary trading platform, which is designed for more experienced traders. Exness also offers a mobile trading app, which allows traders to access their accounts and trade on the go. In addition to forex trading, Exness also offers options trading, which gives traders the ability to trade on a wide range of underlying assets.

Exness

Summary

- Low trading fees

- Fast and digital account opening

- Great customer support

- Offers wide range of account types

- Limited educational content

- Commission as low as $7 on Raw Spread account (0 spread markup)

- Spreads from 0.3 pips on Standard account.

- No inactivity fee

- No deposit and withdrawal fee

- Some payment systems charge withdrawal fees

- Forex

- CFDs on Shares

- CFDs on Indices

- CFDs on Commodities

- CFDs on Cryptocurrencies

- Doesn’t offer real stocks

- Doesn’t offer bonds

- Doesn’t offer futures

- Doesn’t offer crypto coins

- Fast Onboarding (fully digital)

- Customer-friendly

- None

- No fees on deposit

- No fees on withdrawals

- Most deposit options are instant

- E-wallet withdrawals are instant

- Some payment systems charge withdrawal fees

- Crypto D/W methods take up to 72 hours

- Offers MetaTrader 4 and MetaTrader 5

- Offers Mobile Application

- Offers Exness Terminal by Exness (WebTrader)

- None

- Live chat available

- Email option available

- Phone call option available

- CS is available 24/7

- None

- Demo Trading

- Specialized training

- Educational Videos

- Economic Calendar

- Academy Program

- None

- Regulated by FSA, CySEC, FCA in the UK, FSCA, CBCS, FSC in British Virgin Islands and FSC in Mauritius

- Offers negative balance protection

- Keeps funds in segregated accounts

- Is a member of The Financial Commision Compensation Fund

- None

👍We recommend Exness broker due to low fees and great number of regulatory bodies under which the Exness Group operates. Moreover, account types are suitable for different types of traders and there’s various asset classes offered for trading.

- With a minimum deposit of 10 USD, Exness has excellent customer service, a wealth of instructional materials, and simple account setup.

- The product offering is limited to Forex and CFDs, while the trading experience is limited to MetaTrader 4, MetaTrader 5 and WebTrader (macOS/Windows/iOS/Android).

With Exness, there are no management fees, and you can open an account for free (though your deposit will be between $10 and $200, depending on the account you open). Note that there are no fees for deposits or withdrawals, but there may be miner’s fees for crypto payments, Perfect Money, Skrill, and USDT deposits.

| Assets | Fee Level |

| CFDs on US Stock | Average |

| CFDs on EU Stocks | Average |

| EUR/USD | Low |

| Inactivity FEE | No |

Let’s first go through the fess terminology:

- Trading Fees occur when you trade (spreads, commissions, financing rates, and conversions)

- Financing or overnight rates (SWAPS) are charged when you hold your leveraged positions for more than 24 hours. Leveraged position means that you borrow money from the broker to trade.

- Non-trading fees are withdrawal fee or inactivity fee, hidden fees.

To put things in a proper context we compare Exness with the competing services, based on product offering, fee structure and customer profile.

Non-trading fees

| Exness | XM | Axi | |

|---|---|---|---|

| Account fee | No | No | No |

| Inactivity fee | No | No | No |

| Withdrawal fee | $0 | $0 | $0 |

Except for a slight difference depending on your country, non-trading fees are low to non-existent. You won’t be charged for inactivity, as well as a deposit of over €100.

Trading Fees

| Assets | Fee Level | Fee Terms |

| CFDs on US Stocks | 0 except for Zero Spread accounts which can be found here |

All accounts except for Zero Spread – no fees Zero Spread: Commission per lot per side |

| CFDs on EU Stocks | 0 except for Zero Spread accounts which can be found here |

All accounts except for Zero Spread – no fees Zero Spread: Commission per lot per side |

| EUR/USD | Standard + Pro = 0 Raw Spread + Zero Spread = 3.5 USD |

Raw Spread + Zero Spread = 3.5 USD Commission per lot per side |

| Inactivity FEE | 0 |

Forex Fees

Forex trading offers $7 round turn spread per lot and 0 spread markup on Raw Spread account. There’s 1 pips average spread on EUR/USD when trading using a Standard account, which is very affordable compared to the competition. It’s important to note that spread markups and average spreads mean very different things. Spread markup is a fee charged by a broker for trading. As a result, spreads might be higher in a live trading environment. Average spreads take into account live trading as well as spread markups.

Forex Fees are low in comparison to XM & AxiTrader.

| Exness | XM | AxiTrader | |

| EUR/USD benchmark fee | $5.9 | $17.1 | $13.8 |

| GBP/USD benchmark fee | $4.5 | $13.8 | – |

| AUD/USD benchmark fee | $5.0 | $13.9 | $9.5 |

| EUR/GBP benchmark fee | $7.1 | $12.2 | $11.0 |

Stock & Index CFD fees

Stock & Index CFD are similar to XM & AxiTrader.

| Exness | XM | AxiTrader | |

| Apple CFD benchmark fee | $2.6 | $3.4 | – |

| Vodafone CFD benchmark fee | $2.6 | $5.6 | – |

| S&P 500 CFD Benchmark | $0.5 | $2.4 | $1.7 |

| Europe 50 CFD Benchmark | $0.5 | $2.4 | $1.2 |

Financing Rates

Financing fees are accumulated when you decide to hold your trading position long. The longer you stay in the trade, the more you are charged with. Which is precisely why CFDs are great instruments for speculating short term, whereas real stocks provide better options for investing long term.

Yearly financing rates on $2,000

| Exness | XM | Axi | |

|---|---|---|---|

| Apple financing rate | 2.6% | $3.4 | - |

| Vodafone financing rate | 2.6% | $5.6 | - |

Exness offers Major, Minor and Exotic Forex pairs for trading. 98 pairs are available in total using Standard account. In addition, there’s up to 35 crypto currency pairs available as CFDs. 101 stock CFDs. 10 Indices, 3 Energies and 10 Metals as CFDs.

Markets & Products General

| Exness | XM | Axi | |

|---|---|---|---|

| Stock | - | - | - |

| ETF | - | - | - |

| Forex | 98 | 48 | 34 |

| Fund | - | - | - |

| Bond | - | - | - |

| Options | - | - | - |

| Futures | - | - | - |

| Cfd | 134 | 122 | 51 |

| Crypto | 35 | 5 | 3 |

Account opening with Exness broker is ultra fast and only takes a couple of minutes. The webpage is user-friendly and super intuitive.

Account Eligibility

Exness is a global broker that accepts clients from all over the world except for the residents or nationals from the following countries:

- The USA

- American Samoa

- Baker Island

- Guam

- Howland Island

- Kingman Reef

- Marshall Islands

- Northern Mariana Islands

- Puerto Rico

- Midway Islands

- Wake Island

- Palmyra Atoll

- Jarvis Island

- Johnston Atoll

- Navassa Island

- Martinique

- Vatican City

- U.S. Virgin Islands

In addition, Exness does not accept clients who are residents of following countries:

Canada, Cuba, Uruguay, Australia, New Zealand, Vanuatu, North Korea, Malaysia, Russia, Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Belarus, Luxembourg, Malta, Monaco, Norway, Netherlands, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Seychelles, Sudan, South Sudan, Iraq, Iran, Syria, Yemen, Israel, Palestinian Territory, Gibraltar, Curaçao.

Exness min Depo

The minimum amount required to open Standard and Standard Cent trading accounts with Exness is $10. However, minimum deposit can vary across deposit options. For instance, the minimum amount for Perfect Money is $50. You will need at least $10,000 in order to deposit funds using Wire Transfer. All other payment options are starting from $10.

Raw Spread, Zero and Pro accounts require $200 minimum initial deposit.

Opening up an account on Exness is easier than ever.

- Go to Exness.com

- Select Open Account.

- Choose your nation of residency; this will determine which payment services are accessible to you.

- Please enter your email address.

- Make a password for your Exness account using the suggestions provided.

- Enter a partner code (optional) to link your Exness account to an Exness

- If you are not a citizen or resident of the United States, check the box.

- Once you’ve entered all of the necessary information, click Continue.

Account Types

Exness provides a variety of account types to fit different trading styles. They are divided into two main categories: Standard and Professional. Each account type has its own conditions for commission, margin call, and leverage, among others.

| Standard Accounts | Professional Accounts |

|

|

Standard Accounts

Standard accounts are suggested for all traders since they are the simplest and most accessible.

| Standard | Standard Cent | |

| Minimum deposit | Depends on the payment system | |

| Leverage |

MT4: 1:Unlimited (subject to conditions) MT5: 1:Unlimited |

MT4: 1:Unlimited (subject to conditions) |

| Commission | None | |

| Spread | From 0.3 pips | From 0.3 pips |

| Maximum number of accounts per PA: |

Real MT4 – 100 Real MT5 – 100 Demo MT4 – 100 Demo MT5 – 100 |

Real MT4 – 10 |

| Minimum and maximum volume per order order |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 cent lots (1K cents) Max: 200 cent lots 24 hours a day |

| Maximum volume of concurrent orders |

MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 000 MT5 Real: Unlimited |

Pending orders: 50 Market orders: 1 000 This amount combines both pending and market orders open concurrently. |

| Margin call | 60% | 60% |

| Stop Out | 0% | 0% |

| Order Execution | Market Execution | Market Execution |

Professional Accounts

Professional accounts, which allow quick order executions and are suited for more experienced traders, stand out from all other account kinds offered.

| Pro | Zero | Raw Spread | |

| Minimum initial deposit | Starts from USD 200 (depends on your country of residence) | ||

| Leverage |

MT4: 1:Unlimited MT5: 1:Unlimited (both subject to conditions) |

||

| Commission | None |

From USD 0.2/lot in one direction. Based on the trading instrument |

Up to USD 3.5/lot in one direction. Based on the trading instrument |

| Spread | From 0.1 pips | From 0.0 pips |

From 0.0 pips Floating (low spread) |

| Maximum number of accounts per PA |

Real MT4 – 100 Real MT5 – 100 Demo MT4 – 100 Demo MT5 – 100 |

||

| Minimum and maximum volume per order |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

||

| Maximum volume of concurrent orders |

MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 000 MT5 Real: Unlimited |

||

| Margin call | 30% | ||

| Stop Out | 0% | ||

| Order Execution |

Instant: Forex, Metals, Indices, Energies, Stocks Market: Cryptocurrency |

Market Execution | |

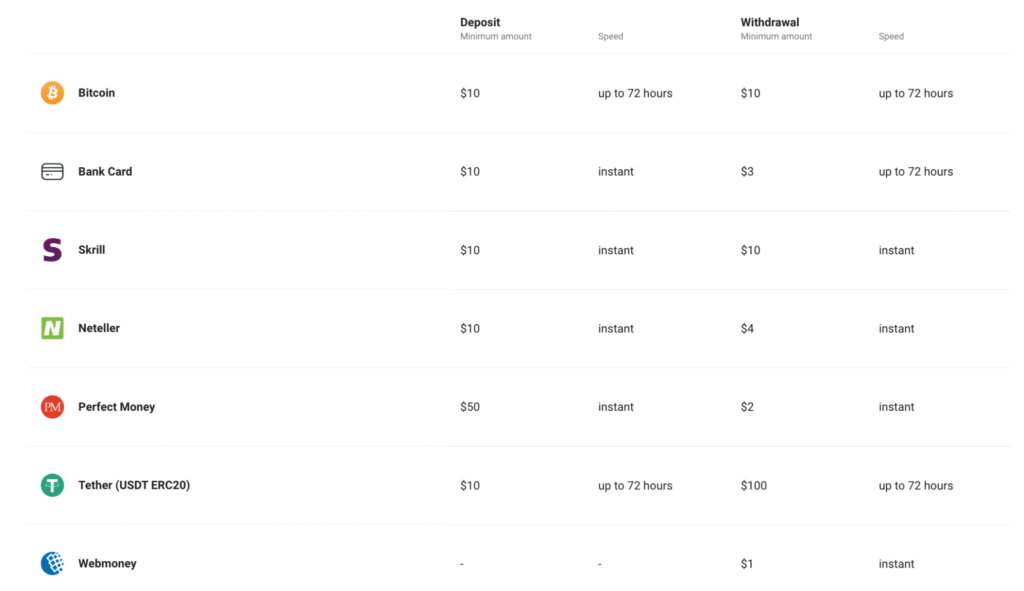

Deposits and withdrawals are exceptionally easy with Exness. Most Withdrawal methods with the exception of Bank Card and Crypto options are instant.

Among the available funding options are:

- Bitcoin (deposits and withdrawals take up to 72 hours)

- Bank Card (Instant deposit. Withdrawals take up o 72 hours)

- Skrill (Instant)

- Neteller (Instant)

- Perfect Money (Instant)

- USD Coin (deposits and withdrawals take up to 72 hours)

- Tether (deposits and withdrawals take up to 72 hours)

- Wire Transfer (minimum deposit is $10,000 and withdrawal is not available)

- WebMoney (Instant)

Deposit options

| Exness | Axi | XM | |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

Withdrawal fees and options

| Exness | XM | Axi | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

| Withdrawal fee | $0 | $0 | $0 |

Exness provides access to widely used MetaTrader platforms and Exness online terminal. MT4 and MT5 provide strong and reliable trading experience. On the downside, the interface isn’t particularly modern looking. Moreover, you can download mobile versions of the MT platforms as well as Exness Trader App.

Exness has received a lot of awards for its customer experience. It was the first broker to exceed $1 and $2 trillion benchmarks in monthly trade volume.

Great customer service is a backbone of every company. Exness understands this simple rule well and offers superb customer support available 24/7. The CS is available in 15 languages via live chat, email and phone. What’s more, the help center provided by the broker unsweres most of the general questions traders have.

Exness has exceeded the expectations that everyone has when it comes to brokerages providing educational services. The brokerage has opted to create a separate domain education.exness.com where they collect all of their huge data of information webinars analysis an so on.

Exness provides a wide range of educational material to its clients. The list includes: analytical tools, trader’s calculator, economic calendar, currency converter, VPS hosting and Trading Central WebTV. In addition, traders can download tick history, which is very helpful for backtesting trading strategies.

Exness group offers unlimited leverage for trading Forex. As a result trading balance becomes susceptible to going negative. To counter this, the broker provides negative balance protection to all of its clients. What’s more, the customer funds are kept in segregated accounts. In addition, Exness group is a member of The Financial Commision Compensation Fund that settles disputes between brokers and their clients.

One of the biggest indicators of your broker’s trustworthiness is the level of regulations, under which the broker operates. Exness group is authorized and regulated by a number of regulatory bodies. The list includes:

- Seychelles Financial Services Authority (FSA)

- Cyprus Securities and Exchange Commission (CySEC)

- The Financial Conduct Authority in the United Kingdom (FCA)

- South Africa Financial Sector Conduct Authority (FSCA)

- Central Bank of Curacao and Sint Maarten (CBCS)

- Financial Services Commission in British Virgin Islands (FSC)

- Financial Services Commission in Mauritius (FSC)

In a nutshell

Exness is a great broker that offers access to trading various asset classes. The broker is well regulated in 7 jurisdictions and provides competitive fees. Account opening is fast and user-friendly. There are various account types to choose from depending on your trading style and experience. Trading platforms are industry standard and customer service is outstanding.

The minimum initial deposit required to open an account is starting from $10, which makes the broker widely accessible, on the downside high leverage offered by the broker might cause many novice traders to lose everything quickly.

What makes this broker unique is the fact that most deposit and withdrawal methods are instant. No inactivity fees and fees on deposits and withdrawals (some intermediary institutions might charge you when withdrawing funds).

Brief Overview

| 🏛 Country of regulation | Cyprus, United Kingdom, South Africa, Curacao and Sint Maarten, British Virgin Islands, Mauritius |

| 💸 Trading fees class | Low |

| 💸 Inactivity fee charged | No |

| 💸 Withdrawal fee amount | $0 |

| 💸 Minimum deposit | $10 |

| ⏰ Time to open an account | A couple of minutes |

| 💳 Deposit with credit card | Yes |

| 👛 Depositing with electronic wallet | Yes |

| 🎮 Demo account provided | Yes |

| 📊 Products offered | Forex, CFDs on: Stocks, Indices, Commodities, Crypto |