Freetrade has a high investor protection amount, set at £85,000. It is also regulated by a top-class FCA in the UK. You should know that Freetrade does not disclose its finances, and it isn’t listed on any stock exchange.

Freetrade is regulated by the Financial Conduct Authority (FCA) – a top-tier financial authority.

If you’re wondering, is Freetrade safe? We advise that you evaluate two key factors: what is the broker’s background; and how you are protected if something goes wrong.

Background

Freetrade is a vibrant company established in 2015. Till date, it has continued to deliver top-class service to its customers. Its impressive track record and is regulated by a reputable financial authority make it a safe choice.

Protection

You must pay close attention to the investor protection amount that your broker can provide. The regulator is an equally important factor that must be considered when selecting your desired broker. The investor protection amount and corresponding regulator differ from one broker to another.

Users and customers of Freetrade are all covered by the UK investor protection scheme (FSCS) and by Freetrade Limited. The FSCS investor protection scheme was put in place to protect investors against losing cash and securities in case the broker goes bust. The FSCS has a protection limit of £85,000 – which is significantly higher than what is offered by most other investor protection schemes

What Other Review Sites & Customers Say About Freetrade

To provide you with a more context about this broker, we will take a look at what other traders have to say about Freetrade. Keep in mind that the reviews – by their nature – are subjective, yet the overall sentiment should be clear and straightforward.

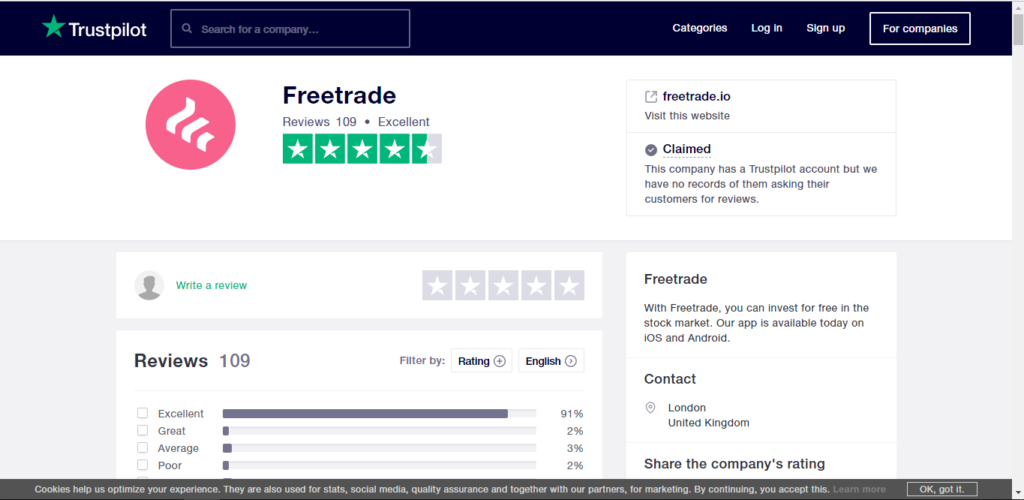

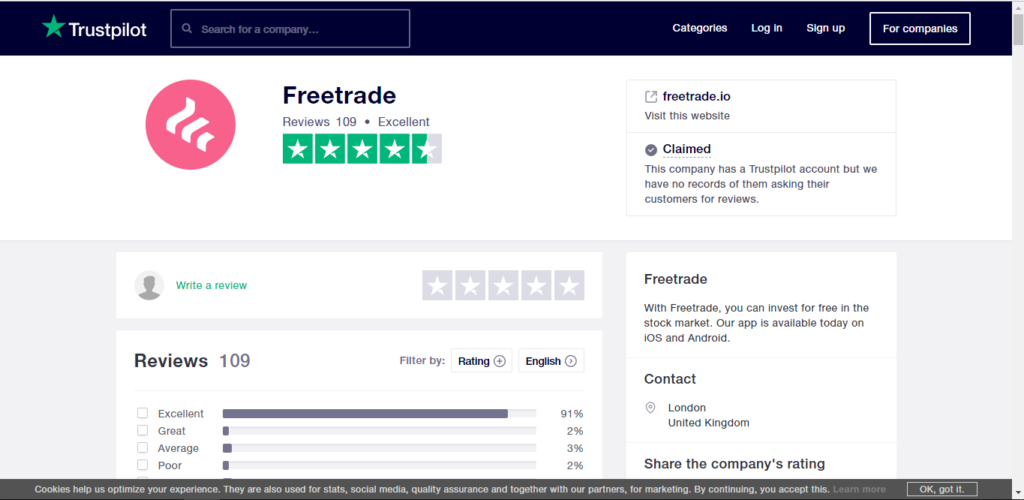

Trustpilot 4.6/5.0

Trustpilot rates Freetrade to be an excellent broker. It scored an overall of 4.6 stars out of a possible 5.5. While you will find a lot of glowing customer reviews about the Freetrade app some of the comments show that certain customers are not satisfied with glitches that disrupt the trading experience. You should pay more attention to this for an informed opinion on freetrade’s app functionalities.

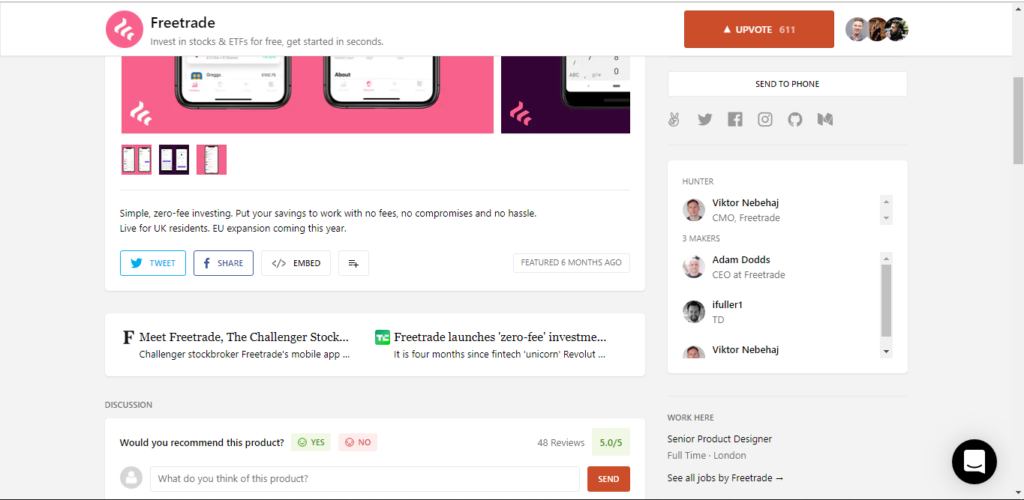

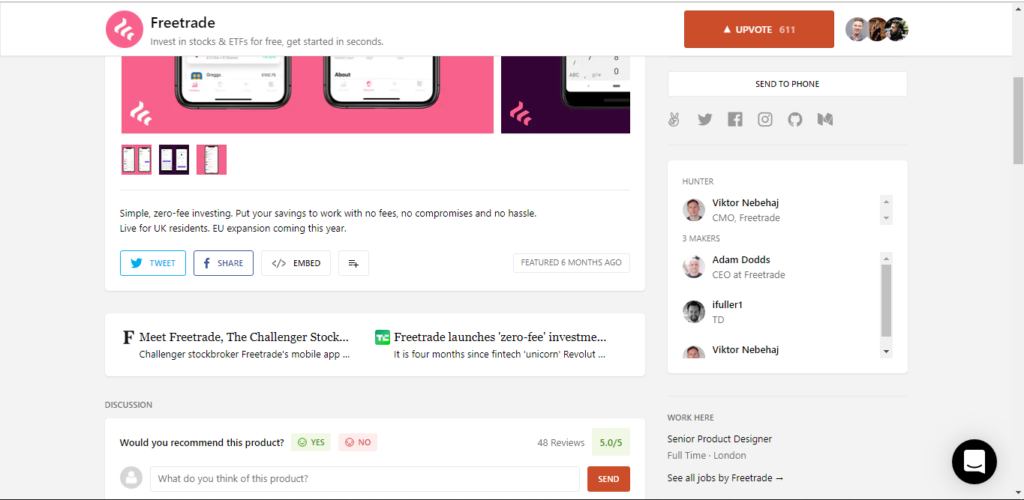

Producthunt 5.0/5.0

Freetrade has a perfect review rating on the Producthunt review site. Customers all have beautiful things to say about the UX and easy navigation features and are pleased with its services.

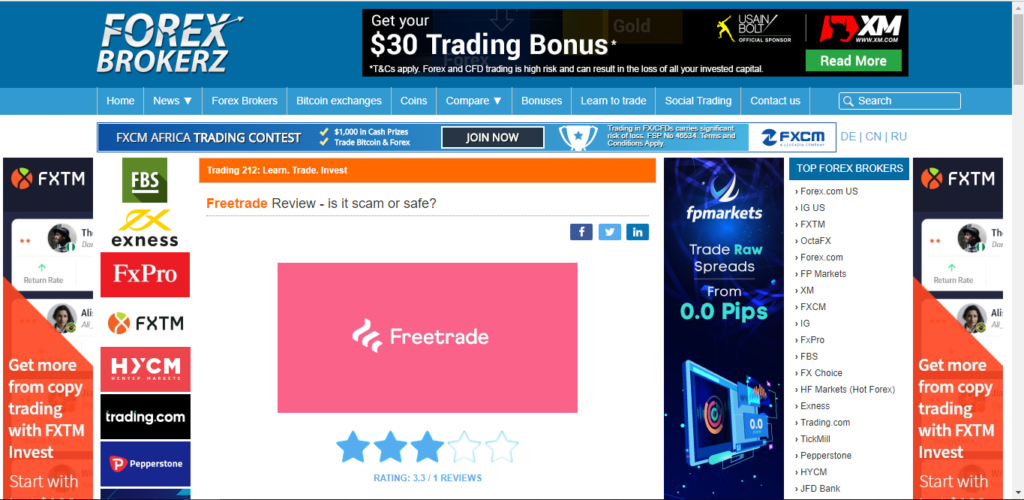

ForexBrokerz 3.3/5.0

Freetrade score an impressive 3.3-star rating on the ForexBrokerz review site. This score would be a perfect example of the subjective nature of reviews as further investigation would show that some clients found issues with the service.

Conclusion

Freetrade has a great fee structure. There’s no inactivity fee, and you get free stocks and ETFs. The account opening feature is fully digital, fast, and easy to complete. It also comes with a state-of-the-art mobile trading platform that is easy to operate.

Freetrade has a couple of shortcomings that are worth mentioning. It has a limited product portfolio on offer for investors, as you can only trade with stocks and ETFs in the UK and US markets. It could use a more sophisticated research tool and a more comprehensive educational tool. You are limited to using bank transfers more moving money, as credit/debit cards are not supported on the platform.

In all, Freetrade is the ideal choice if you want to trade with US and UK stocks or ETFs for free on a user-friendly platform.