Zeus EA Draw-Down Is Removed and Profits Booked

Dear Traders,

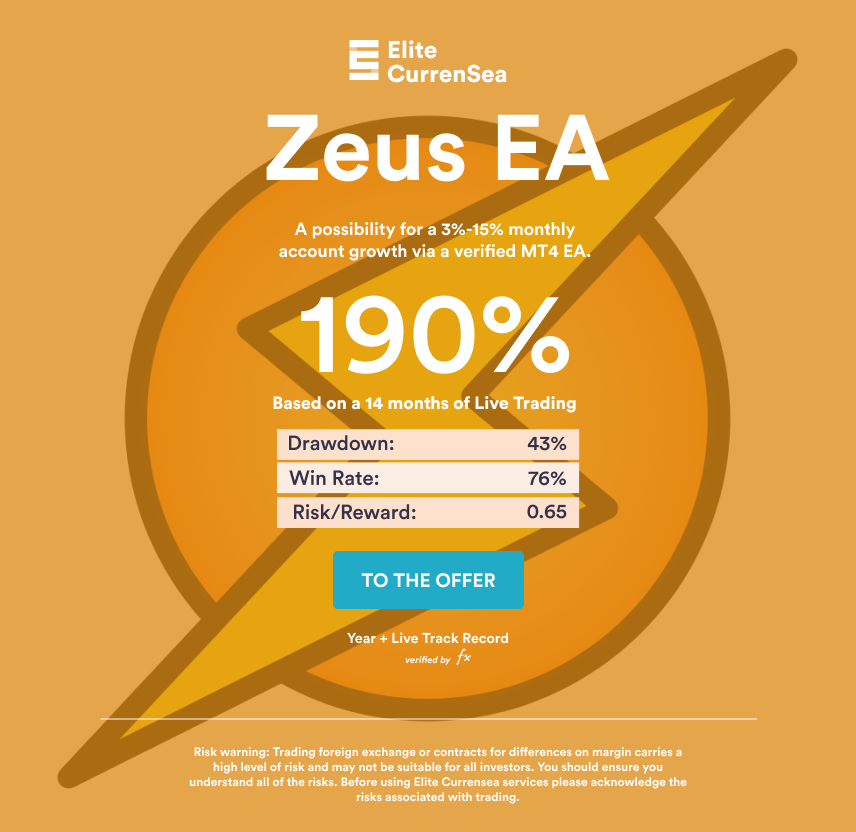

one of our Zeus EA accounts had a sizable floating loss. Logically, many traders were slightly worried about this open draw-down. But today there was good news.

The Zeus EA cleared the hurdle and even managed to book profits. This article reviews the past week in more detail.

Zeus EA Solves Sturdy Draw-Down

The Zeus EA had a substantial draw-down in the past trading days on one of our accounts. The draw-down, however, was not visible on other accounts. Why is that?

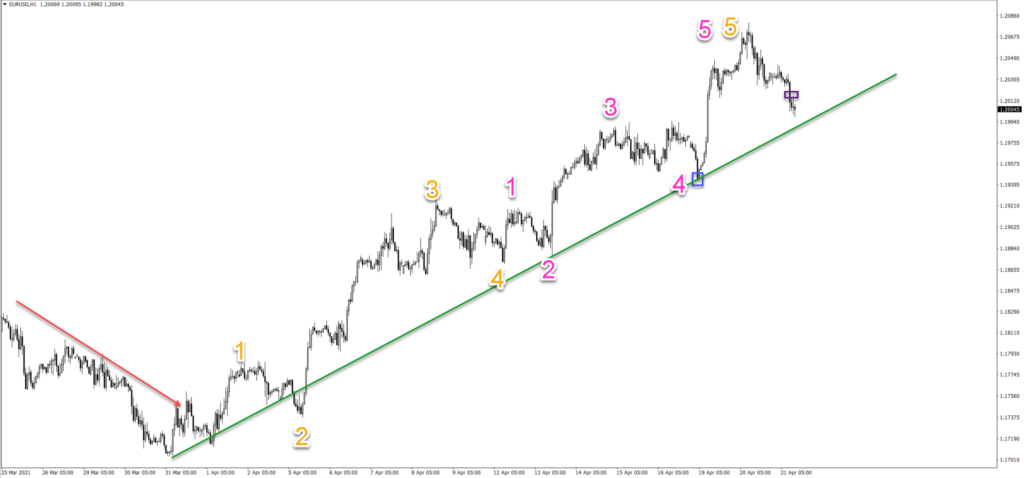

The main reason is simple to explain: the take profits were missed by 1-2 pips on the account with a draw-down (blue box in the image below). Our other accounts did not miss the target and therefore did not experience any draw-down at all.

Broker differences like this can occur, especially during the Asian session. Liquidity is thin during these nightly hours (GMT time zone) and prices can sometimes vary slightly depending on liquidity providers.

The image above shows the spot (blue box) where the bearish retracement missed one of the targets.

How Did Zeus EA Go into Draw-Down?

The Zeus EA is a with-the-trend scalping system. It aims to scalp small wins with the trend but sometimes the trend changes. This is when the Zeus EA defense mode kicks in.

In recent trading, the EUR/USD was in a downtrend (red arrow). The trend change (green line) from down to up indicated that the Zeus EA was stuck in some bearish positions that were losing. Hence the floating loss and draw-down.

Once it’s in a defense mode, the Zeus EA tries to exit the old trend by hedging and closing the positions from the old trend. Usually it just needs a small retracement of only 50 to 70 pips to fully exit the old trend. Such small pullbacks always occur in trends.

The issue with the draw-down only occurred because a couple of those retracements simply missed the exit spot by a slim margin (see blue box for one of them).

The good news is that the EA recovered fully in the next attempt earlier today (green box). With that decline in the EUR/USD price, the next target zone was simply hit.

The bearish retracement was simply a matter of time due to many reasons – as mentioned in our EUR/USD and GBP/USD video today too:

- Divergence pattern between tops

- 5 waves (pink) completed in wave 5 (orange)

- 61.8% Fibonacci resistance on the daily chart

- Bullish momentum losing steam

The Zeus EA is a fully automated approach but we do add our own analysis if a draw-down occurs. And our analysis confirmed that the EA was on its way to recovering. This indeed happened in trading earlier today.

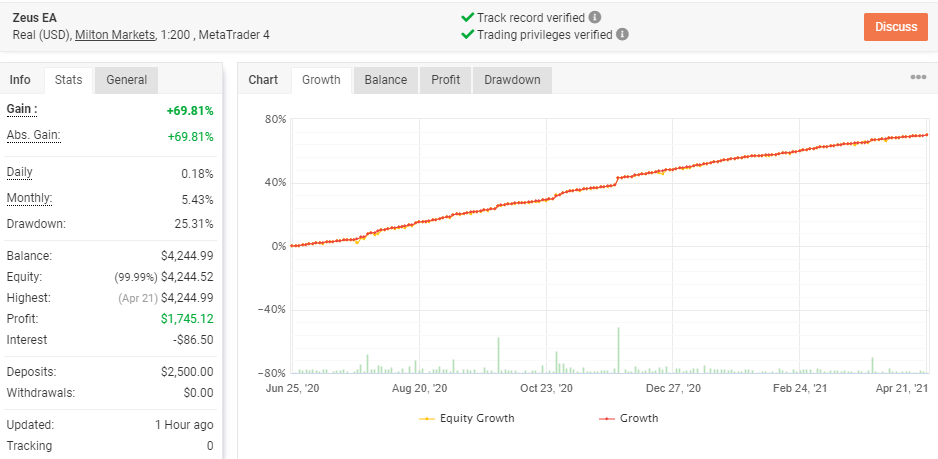

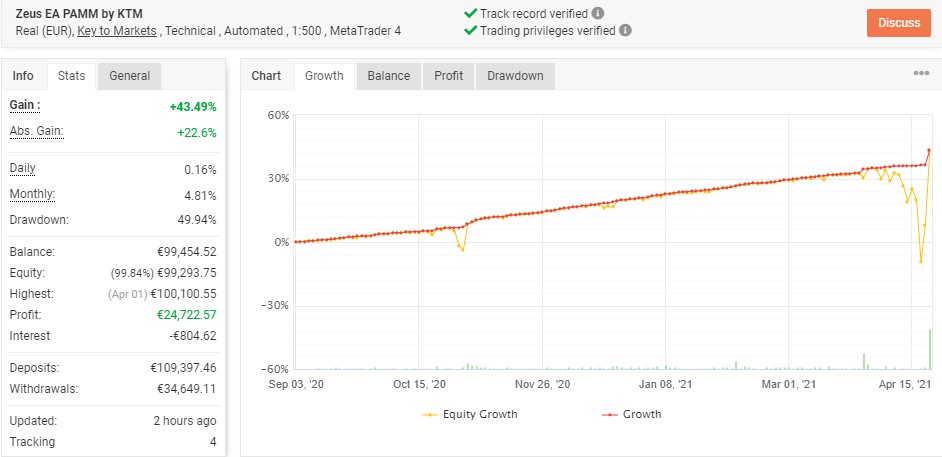

Comparing Two Zeus EA Accounts

The EUR/USD made a strong close and reverse. The strong uptrend was followed by a strong uptrend. This is however not the main reason for the difficulties.

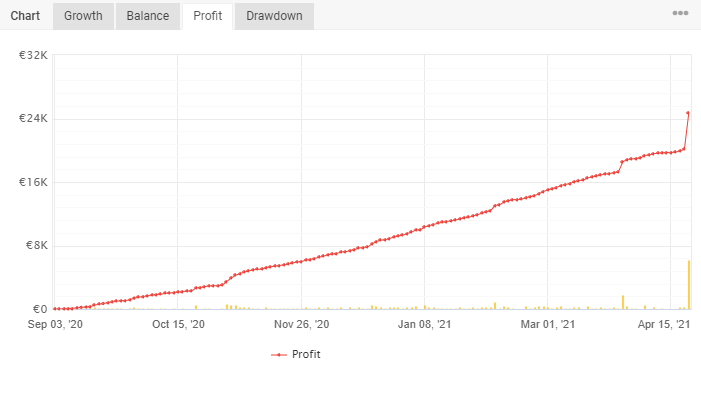

The image below shows two different accounts. One had no draw-down and the other account went through a large floating loss.

The main factor was the fact that some targets were missed by razor thin margin. The next pullback solved the issue and removed the draw-down.

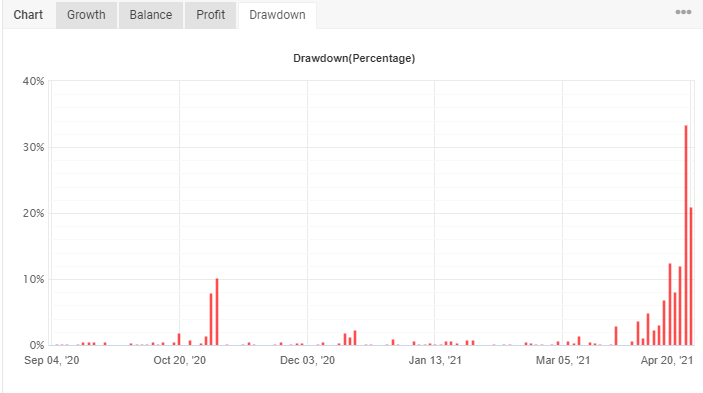

As you can see in the image above, the floating loss made the equity curve dip below 0% for a short while. This means all the profits from before were temporarily lost in the floating loss and draw-down of around 30% (see image below).

But the recovery was quick and swift. Actually, the EA managed to book some great profits at the end of the day after the DD (see below).

How Dangerous Are Draw-downs?

Draw-downs are a normal part of high leverage trading. And something that is really unavoidable. This is valid even for a very consistent EAs such as Zeus.

So far, Zeus EA had very minor draw-downs. But you can see that even a consistent approach as Zeus can sometimes run into trouble.

As traders, we need to be ready for such moments and realize that they can occur. This is why it’s critical to trade with capital that we can afford to lose. And we should always fee comfortable with the capital that is being risked.

Most draw-downs with the Zeus EA are mild. This draw-down was stronger and reached the 30% mark. But overall, the draw-down was still within the parameters that we believe are safe.

Draw-downs that exceed 50-70% can become problematic and dangerous for account survival. It is advised to avoid those very deep draw-downs as much as possible.

Thank you all for supporting Elite CurrenSea where you can by talking about us with other traders or leaving reviews on FPA or Trustpilot.

Good trading,

Chris Svorcik

Leave a Reply