What Netflix Q1 Earnings Call Means For Short-Term Traders?

Netflix, Inc. (NFLX) recently released their Q1 2023 earnings report, providing insight into the streaming giant’s performance over the first quarter of the year.

In this report, the company highlighted several key areas, including subscriber growth, revenue, and content strategy.

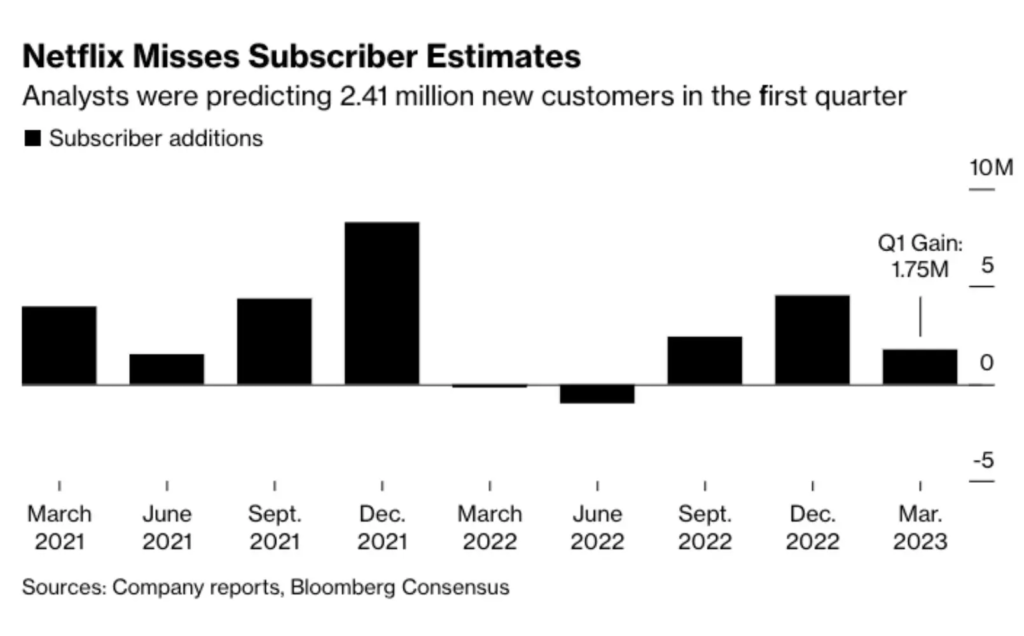

Firstly, the report revealed that Netflix added a total of 4.4 million subscribers during Q1 2023, which was lower than the expected 5.9 million. However, the company noted that this was largely due to the ongoing pandemic and its impact on the global economy.

In terms of revenue, Netflix reported a total revenue of $8.5 billion, which was slightly higher than the expected $8.3 billion. The company also reported an operating income of $1.9 billion and a net income of $1.5 billion.

In addition to subscriber growth and revenue, Netflix also provided updates on its content strategy. The company noted that it plans to invest more in original content, as well as expanding its partnerships with major studios and production companies.

Overall, while the subscriber growth was slightly lower than expected, Netflix’s revenue and income figures were positive. Additionally, the company’s plans to invest more in original content and expand partnerships are likely to be viewed positively by investors and analysts.

However, it’s worth noting that competition in the streaming market continues to increase, with the launch of new services from major players like Disney and Apple. As such, Netflix will need to continue to innovate and adapt to maintain its position as a leader in the industry.

Buy Camp:

- Continued growth in revenue and earnings

- Strong performance in international markets

- Plans to invest in new content and expand offerings

Sell Camp:

On the other hand, some potential factors for selling Netflix stock include:

- Disappointing subscriber growth in Q1 2023

- Concerns about increased competition in the streaming market

- Uncertainty around the impact of potential regulatory changes or shifts in consumer behavior.

In terms of how the general market might react to the contents of this report, it’s likely that investors will focus on the subscriber growth figures and the company’s content strategy.

If the subscriber growth continues to lag behind expectations, it could lead to a dip in the company’s stock price.

Considering the shaky ground the economy is standing on, as well as the recent rally in both Netflix stock and SP500 as a whole, our team is eyeing short-term sell bets on the stock. Trades should keep in mind though, shell US continues printing money to fight off the banking crisis, there is a big change for a short-term upside to the stock market (SP500 is a good bet here) and Netflix stock in particular.

Team of Elite CurrenSea

Leave a Reply