Financial Markets Weekly Performance Analysis vs Portfolio Flagship August 21-25 ’23

In this week’s analysis, we are going to discuss the following markets

- Indices – S&P, Nasdaq, FTSE 100, DAX

- Cryptos – BTC, ETH, BNB

- Commodities – Gold, Silver

- Forex majors – EUR/USD, GBP/USD, USD/JPY

Indices Market for 21 – 25 August 2023

This week, the major stock markets were mainly influenced by economic indicators such as New Home Sales, Core Durable Goods, and Initial Jobless Claims. Among the indices, the Nasdaq Composite performed the best, gaining 3.65%. The DAX, on the other hand, saw a marginal increase of 0.05%. The S&P 500 and FTSE 100 also moved similarly, showing gains of 1.7%. Let’s take a closer look at the reasons behind these movements.

USA Indices

Nasdaq Composite

New Home Sales went up from 684k to 714k, suggesting that people were more confident about the stable economy and spent more. This positive consumer spending usually leads to higher performance in major US indices. The Nasdaq Composite was also influenced by the rise in Core Durable Goods, which particularly benefits technology companies in the index. Additionally, Initial Jobless Claims decreased from 240k to 230k, showing increased demand for jobs in the US market, which is favorable for the Nasdaq and S&P 500.

Strong demand for oil was evident as oil inventories decreased from -5.960M to -6.135M. This is often associated with economic growth and increased industrial activity in the US. Overall, most of the economic fundamentals indicated steady and positive growth in the US, aligning with the major stock indexes’ performance.

Tech stocks had a good week, with positive performances across major companies in the Nasdaq. Nvidia, Tesla, and Apple saw gains of 6%, 3.8%, and 0.75% respectively. As a result, the Nasdaq showed the highest increase of 3.65%, driven by the positive sentiment from both individual stocks and economic indicators.

The S&P 500

Manufacturers and industrial companies in the S&P 500 responded positively to the rise in core durable goods. The growing economy and increased demand for energy, indicated by reduced oil inventories, benefited certain sectors within the S&P index. Another contributing factor was the decrease in Initial Jobless Claims, which led to a 1.7% appreciation in the index.

Within the S&P 500, Microsoft, Amazon, Google, and Meta Platforms saw gains ranging from 0.64% to 2%.

EU and UK indices

FTSE 100

Despite negative indicators from the UK, the FTSE 100 managed to rise by 1.75%. The weakened GBP often leads to higher stock prices for FTSE companies. The UK’s economic activity showed contraction, which could impact businesses and retail sales. However, the stock market wasn’t heavily affected due to the weakened British pound.

Most FTSE stocks saw around a 1% increase, with Centrica plc showing the highest gain of 1.8%.

DAX

Unlike other indices, the DAX didn’t exhibit a bullish trend due to various fundamental factors. The German GDP didn’t grow beyond 0%, contributing to a bearish sentiment. The German IFO business climate index also worsened, signaling a decline for the fourth consecutive month. This impacted both the DAX’s price and the performance of its constituent stocks.

The DAX’s sideways movement was reflected in stocks like Siemens, SAP, Deutsche Telekom, and Airbus, which saw mixed results from -1% to 1.65% range.

Indices technical weekly performance numbers (USD)

| Monday Open Price | Friday Open Price | % Change | |

| S&P500 | 4,380.28 | 4,455.16 | 1.71 |

| Nasdaq Composite | 13,347.26 | 13,834.31 | 3.65 |

| FTSE 100 | 7,257.82 | 7,385.10 | 1.75 |

| DAX | 15,573.95 | 15,582.95 | 0.058 |

Crypto Markets for 21 – 25 August 2023

After a rough previous week for cryptocurrencies, things started looking up. ETH was the only one sliding slightly, down by -1.45%. BTC remained stable throughout the week, showing that the crypto markets were recovering from the fear, uncertainty, and doubt (FUD) that had hit them before. This FUD, often triggered by significant negative news, can have a big impact on crypto markets. One such news was the report of SpaceX selling its BTC holdings.

Adding to the stabilization, the Colombian Peso introduced its stablecoin on the Polygon network. This move, along with other governments using stablecoins on different blockchains, boosted confidence in the crypto market.

BTC

Bitcoin was on the path to recovery after the previous week’s sharp decline, which was influenced by the news of SpaceX selling its crypto assets acquired in 2021-22. The FUD factor can significantly affect crypto markets, even if the news is unverified or speculative. On a positive note, Oman’s $1.1 billion investment in Bitcoin mining brought some wind to BTC’s sails, as it aligned with the country’s future vision. This played a role in stabilizing the situation after the turbulence of the previous week.

ETH

ETH experienced a 1.45% decrease, making it the second-largest cryptocurrency worldwide. While it was rebounding and finding its footing, it still saw a slight decline compared to other cryptocurrencies in this analysis. There was also news about ETH co-founder Vitalik Buterin moving 600 ETH to the US exchange Coinbase. Although such moves are not unusual, they can still create a bearish sentiment. Despite ETH’s strong position in the market, news like this can impact its value.

BNB

As usual, BNB remained one of the most stable cryptocurrencies, largely due to Binance’s significant presence as one of the world’s largest crypto exchanges. Even with MasterCard and Visa stepping back from their partnership with Binance, BNB managed to gain 1.2%.

Crypto technical weekly performance numbers (USD)

| Asset | Monday Open Price | Friday Open Price | % Change |

| BTC | 26,188.69 | 26,170.45 | -0.07 |

| ETH | 1,685.02 | 1,660.67 | -1.45 |

| BNB | 216.63 | 219.24 | 1.20 |

Gold and Silver for 21 – 25 August 2023

One of the main reasons behind the upward movement of precious metals, aside from minor fundamental indicators, was the fear, uncertainty, and doubt (FUD) surrounding cryptocurrencies. Given that BTC is often seen as a digital equivalent of gold by investors, it’s not surprising that some investors decided to shift their portfolios towards tangible gold and other precious metals instead of digital assets.

Gold

Normally, gold’s value drops when the US dollar strengthens, and the reverse is true as well. However, this week was different. Despite the dollar gaining strength against other currencies, gold’s value held steady and even managed to gain 0.82%. The US monetary policy, which was favorable for the dollar, had a bearish impact on gold. Despite this, the overall medium-term outlook remains bearish for gold, while in the short term, investors seem to have confidence in traditional precious metals. From a fundamental perspective, both Core Durable Goods and Crude Oil Inventories had a positive impact on gold and silver.

Silver

There’s a common pattern between gold and silver: when gold drops, silver tends to drop even more, and the same goes for gains. This week, silver’s price increased by 3.34%, indicating that investors were feeling secure in the realm of precious metals.

Commodities technical weekly performance numbers (USD)

| Monday Open Price | Friday Open Price | % Change | |

| Gold | 1,900.07 | 1,915.65 | 0.82 |

| Silver | 23.3452 | 24.1252 | 3.34 |

Forex Market for 21 – 25 August 2023

The EUR/USD major pair experienced a 0.52% drop, influenced by a strong dollar fueled by positive US economic indicators. Meanwhile, the GBP/USD, the second most traded major pair, declined by 1%, reflecting the impact of a robust dollar and a weakened pound due to pessimism in the UK’s economic sector. The USD/JPY pair remained stable, with the yen holding its position against the stronger dollar, supported by favorable Japanese economic indicators.

EUR/USD

EURUSD decreased slightly by 0.52%, indicating the influence of a strong dollar. This response in the Forex market was expected as the US economy displayed signs of strength with reduced new jobless claims, heightened energy demand, and positive new home sales data. Coupled with the likelihood of the Federal Reserve raising interest rates, the overall sentiment leaned heavily in favor of a strong dollar.

GBP/USD

Investors found that their dollars could buy 1% fewer British pounds over the weekend, as the GBP/USD major pair fell by 1%, highlighting the impact of a strong dollar and a weakened pound. The S&P Global/CIPS UK Composite PMI, S&P Global/CIPS UK Manufacturing PMI, and S&P Global/CIPS UK Services PMI all displayed figures lower than previous numbers and below 50, indicating a bearish sentiment in the UK’s economic sector. This contributed to the weakening of the GBP. The contraction in the British economy was reflected in the devaluation of the pound, despite relatively stronger stock markets in the UK.

USD/JPY

The yen maintained its position against the dollar, as indicated by the bullish BoJ Core CPI (YoY) figure of 3.3%, up from the previous 3%. However, a smaller perceived inflation rate among consumers led to a slight devaluation of the yen against the dollar. The au Jibun Bank Japan Services PMI presented a positive reading of 54.3, measuring the performance of the Japanese services sector. Overall, data indicated stability surrounding the yen, with USD/DJPY moving marginally by 0.34. Nevertheless, the Tokyo Core CPI displayed a slight bearishness, ultimately influencing the fate of this major pair.

Forex technical weekly performance numbers (USD)

| Monday Open Price | Friday Open Price | % Change | |

| EUR/USD | 1.0876 | 1.0819 | -0.52 |

| GBP/USD | 1.2742 | 1.2605 | -1.075 |

| USD/JPY | 145.305 | 145.805 | 0.34 |

Performance Comparison Chart of $1000 investment

How much money would you make or lose last week if you were to invest $1000 in each of the sectors discussed above?

Let’s pick the winning asset from each sector and compare its performance with the flagship automated trading system from Elite CurrenSea. Elite CurrenSea offers a wide range of trading systems and portfolio management solutions, and Portfolio Flagship is its current bestseller. The robot has been tested on real markets with consistent gains every single week.

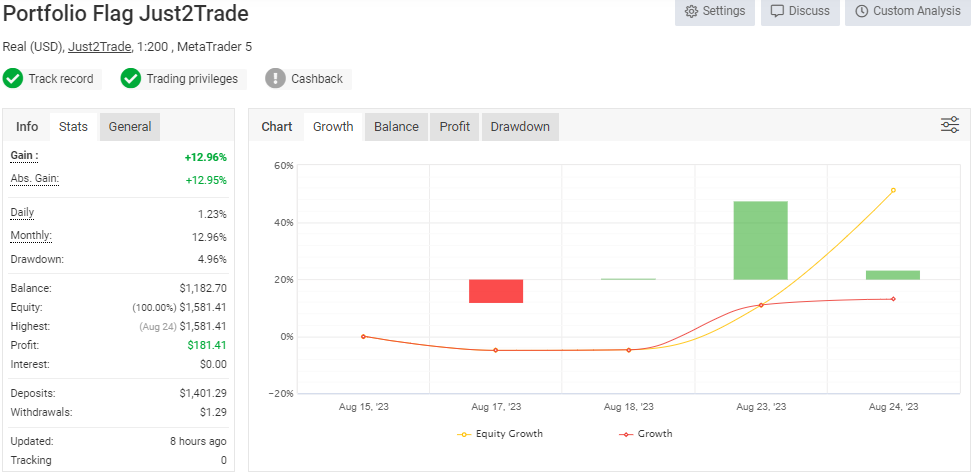

Portfolio Flagship Trading System Live Results For 21 – 25 August 2023

Another trading system from Elite CurrenSea which is also a flagship with its superb performance is called Portfolio Flagship and is a solid performer with 6.15% gains in 5 days which is an astonishing result.

The $ 1,000 investment potential results for the past week

| Portfolio Flagship | indices | Commodities | Cryptos | Forex | |

| Growth | 6.15% | 3.65% | 3.34% | 1.20% | 0.34% |

| PnL on $1000 | $61.5 | $36.5 | $33.4 | $12 | $3.4 |

As we can see, Portfolio Flagship was in the 1st place by the past week’s performance, the indices were in the 2nd place with commodities following closely on the 3rd. Cryptos and Forex only took 4th and 5th. The one tendency readers would have noticed is how stable Portfolio Flagship systems are when it comes to performance. Every single week, while other assets are showing mixed results, the automated system shows persistent gains.

Safe Trading

Team of Elite CurrenSea

Leave a Reply