USD/JPY Predictions of the Second Half of 2023

US hard landing predictions intensify

In their latest global macro monthly update, ING Bank said, “Everything, everywhere, almost all at once,” they discuss how the US bank failures have led to tighter credit conditions, reducing the need for the Fed to tighten. In line with market general consensus on 25bp hike on May 3rd, the prediction is that the Federal Reserve will still have the opportunity to cut rates later this year.

While the Fed is currently focused on battling inflation, we believe that by the second half of the year, clear signs of disinflation will emerge, allowing the Fed to address the economic slowdown. We expect three consecutive quarters of US GDP contraction, from 3Q23 to 1Q24.

As per NFIB small business sentiment report, which showed loan availability at its worst in a decade. Declining profit growth and tighter credit conditions are likely to impact business investment trends this year.

Following last month’s US bank failures, the market is pricing in one final Fed hike in May before a 60bp easing cycle by year-end.

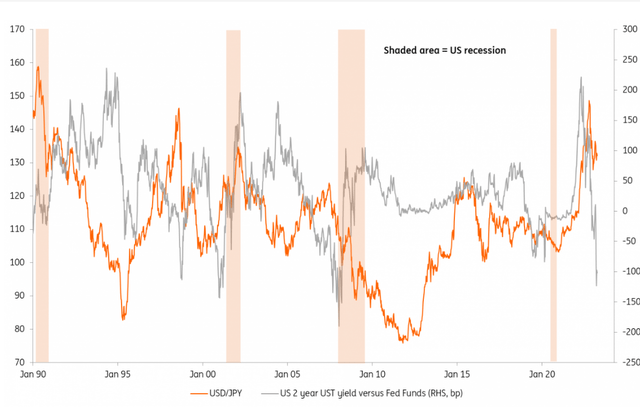

Additionally, US two-year Treasury yields are now trading around 100bp below the upper end of the Fed funds target, a historically deep discount usually seen before a recession. This discount may correct when the Fed lowers the policy rate.

USD/JPY: The main instrument.

Our chart suggests that USD/JPY might have been trading weaker, given the strong expectations of a Fed easing cycle. However, it still trades above 130, likely due to the high overnight dollar rates of 4.80% and investors’ hesitation to be significantly short dollars amid another potential US banking crisis.

We expect the USD/JPY to be the primary FX vehicle for expressing views on a US recession. Japan’s large net foreign asset position, resulting from decades of current account surpluses, insulates the yen in a deleveraging environment, which could occur if financial stability risks re-emerge.

We also believe the market underestimates the possibility of the Bank of Japan adjusting its Yield Curve Control policy to the five-year part of the JGB curve in June. The forward market currently prices 10-year JGB yields at 0.50/55% over the next six months, which would likely trade higher, with a stronger yen, if the BoJ stops targeting the 10-year JGB maturity.

The FX options market currently prices a 31% chance that USD/JPY trades at 120 by year-end. We think the chances are higher (our year-end forecast is 120) and that USD/JPY will be the best vehicle for hedging a US recession.

We love trading USD/JPY and its among the most profitable instruments within Portfolio Flagship, you can tap into unravelling of the US hike cycle in relation to Japanese economy by investing in our managed account via RannForex or VT Markets.

Safe Trading

Team of Elite CurrenSea

Leave a Reply