US Economic Resurgence: A Deep Dive into the Latest Market Trends

The Industrial Rebound: US Factory Output Surges

In a surprising turn of events, US factory output made a remarkable comeback in April. Industrial and manufacturing production exceeded expectations, with increases of 0.5% and 1% respectively.

This surge was primarily driven by the most significant leap in auto production since October 2021. Furthermore, capacity utilization climbed to a five-month high of 79.7%. However, recent ISM and regional survey data hint at a potential slowdown in manufacturing.

Homebuilder Sentiment Soars: A Return to Neutrality

US homebuilder sentiment has reached a ten-month high in May, hitting the neutral mark of 50 for the first time in almost a year.

This marks the fifth consecutive month of growth for the index. The driving force behind this gain is a combination of a shortage in existing supply and a robust demand for new construction, which currently accounts for 33% of the former, a significant increase from the historical average of 13%.

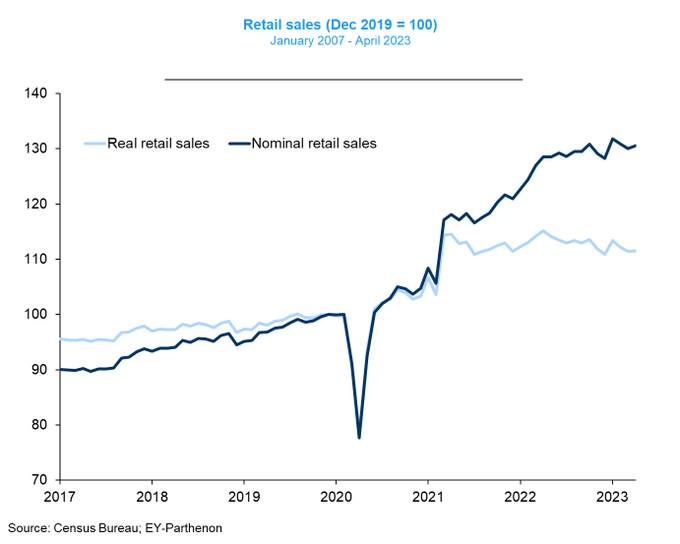

Retail Sales Rebound: A Steady Hold Amid Rising Prices

Following consecutive months of decline, retail sales made a comeback in April, albeit less than anticipated. Consumer spending, which accounts for approximately two-thirds of GDP, increased by 0.4% on the month.

This steady hold in consumer spending persists despite rising prices and high interest rates, with seven out of 13 categories witnessing growth. However, on an inflation-adjusted basis, retail sales have remained flat for approximately two years.

Alphabet’s AI Advancements: A New Era for Biotech and Pharma

Less than a week after announcing several AI advancements, Alphabet has launched two new AI-powered tools aimed at revolutionizing the biotech and pharma industries.

The Target and Lead Identification Suite assists in predicting and understanding protein structures, while the Multiomics Suite aids researchers in managing and analyzing large volumes of genomic data. Both tools aim to accelerate the drug development process.

Tesla’s Annual Shareholder Meeting: Key Takeaways

Tesla held its annual shareholder meeting recently, with several key outcomes. Despite concerns over his independence, former executive JB Straubel was elected to the company’s board of directors.

Elon Musk and Chairwoman Robyn Denholm were also reelected to the board. However, shareholders rejected proposals to prepare a key-person risk report and to issue a report on eradicating child labor from its cobalt supply chain. Musk also announced plans to deliver the first Cybertrucks later this year.

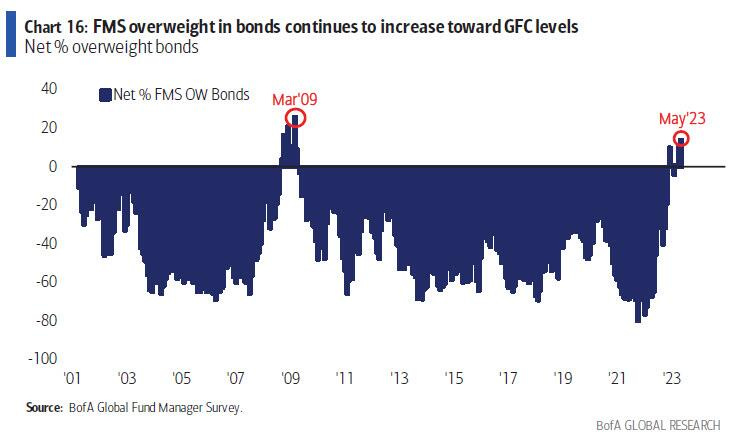

BofA Global Fund Manager Survey: A Glimpse into the Future

Bank of America’s latest Global Fund Manager Survey revealed some interesting insights. 65% of respondents expect a weaker economy ahead, with most respondents underweight US equities.

The most crowded trade is considered to be long big tech and short US banks. Respondents are most overweight bonds, staples, and cash, with bond allocations now at their highest since 2009.

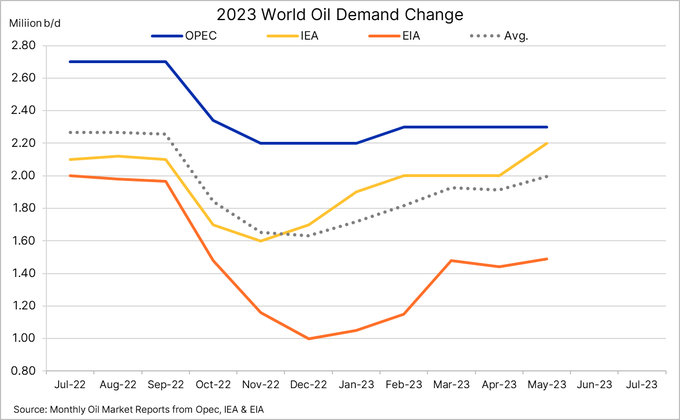

IEA’s Global Oil Demand Forecast: A Chinese-led Recovery

The International Energy Administration (IEA) has raised its global oil demand forecast to 102 million barrels per day, citing a strong recovery in Chinese demand as the leading factor.

However, recent industrial output and retail sales data in the region have fallen short of expectations. Meanwhile, US inventories of crude oil increased by approximately 3.7 million barrels last week.

Safe Trading

Team of Elite CurrenSea

Leave a Reply