Unpacking Financial Phenomena: From Tech Fund Inflows to Global Equity Outflows

In a landscape where tech funds are soaring and consumer spending is robust, contrasting trends are emerging in Chinese equities and global oil markets. Let’s delve into the diverse financial developments shaping our world.

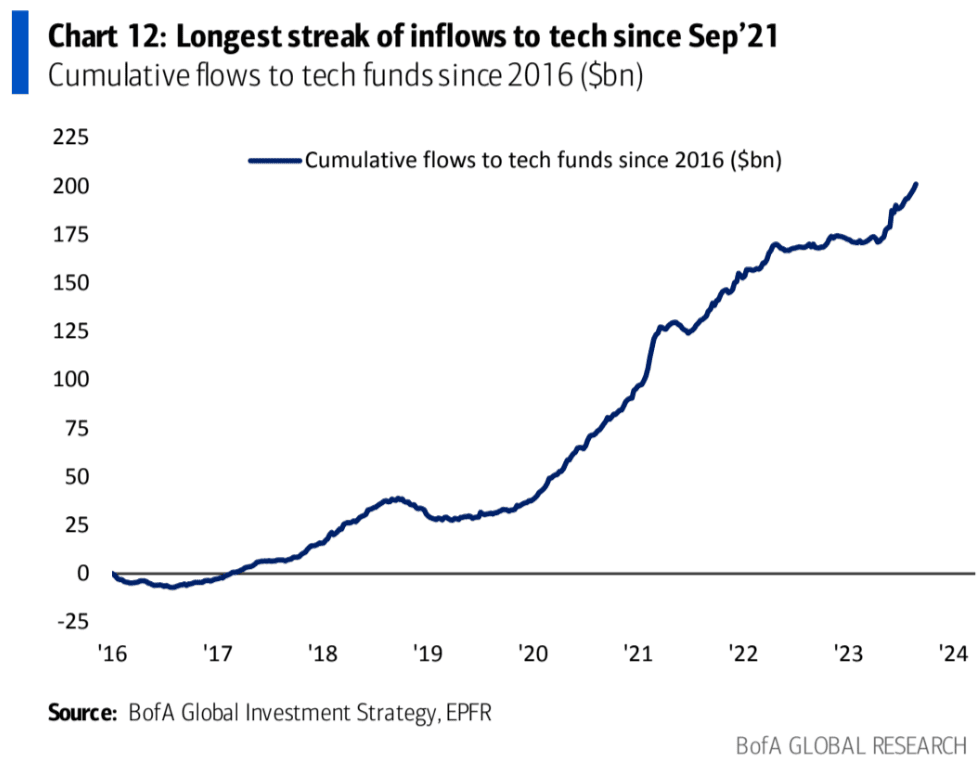

Unbroken Momentum for Tech Funds

Technology-focused investment funds are riding a wave of success, recording ten consecutive weeks of inflows. Notably, this is the longest streak witnessed since September 2021.

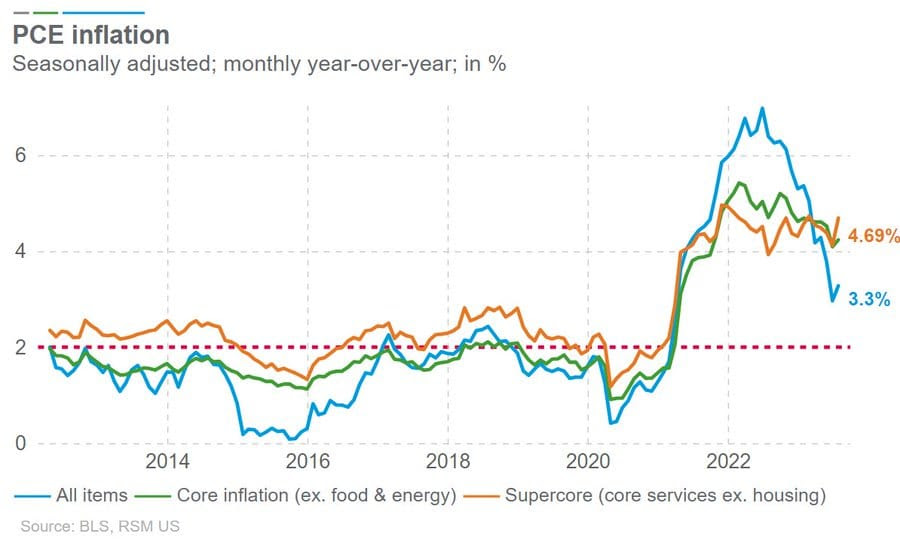

The Fed’s Take on Inflation

The Federal Reserve’s favored inflation gauges, the PCE and core PCE price indexes, signaled encouragement in July. Both metrics increased at the same rate as the previous month, rising 0.2% and 0.3%, respectively. These gains mark the smallest consecutive monthly increases since late 2020. On an annual basis, PCE prices jumped by 3.3%, while core PCE surged by 4.2%. Interestingly, the ‘supercore’ segment—core services excluding housing and closely monitored by the Fed—showed a stubborn 0.46% increase in July, amounting to a 4.7% YoY gain, heavily swayed by rising stock prices.

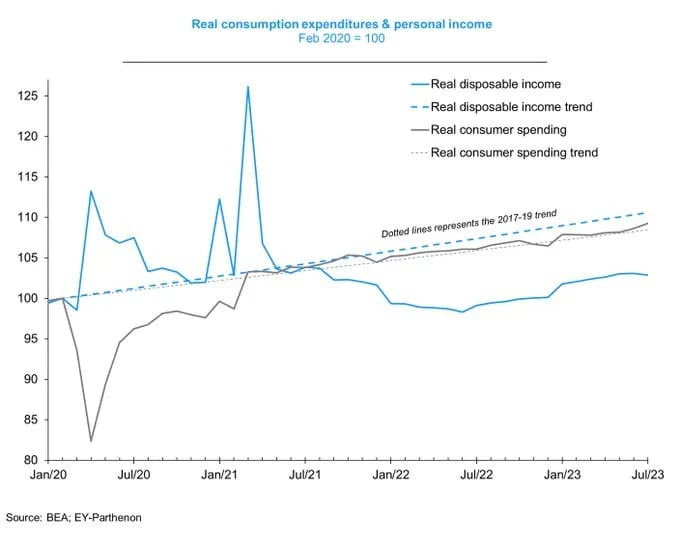

Consumers Keep the Cash Registers Ringing

Despite marginal price increases, consumer spending hasn’t hit the brakes. Household expenditure surged by 0.8% in July, marking the fastest pace since January. Concurrently, real disposable income, adjusted for inflation, declined for the first time in over a year. Most likely, consumers are tapping into their savings, as the personal savings rate slid from 4.8% to 3.5%, the most significant dip since early 2022.

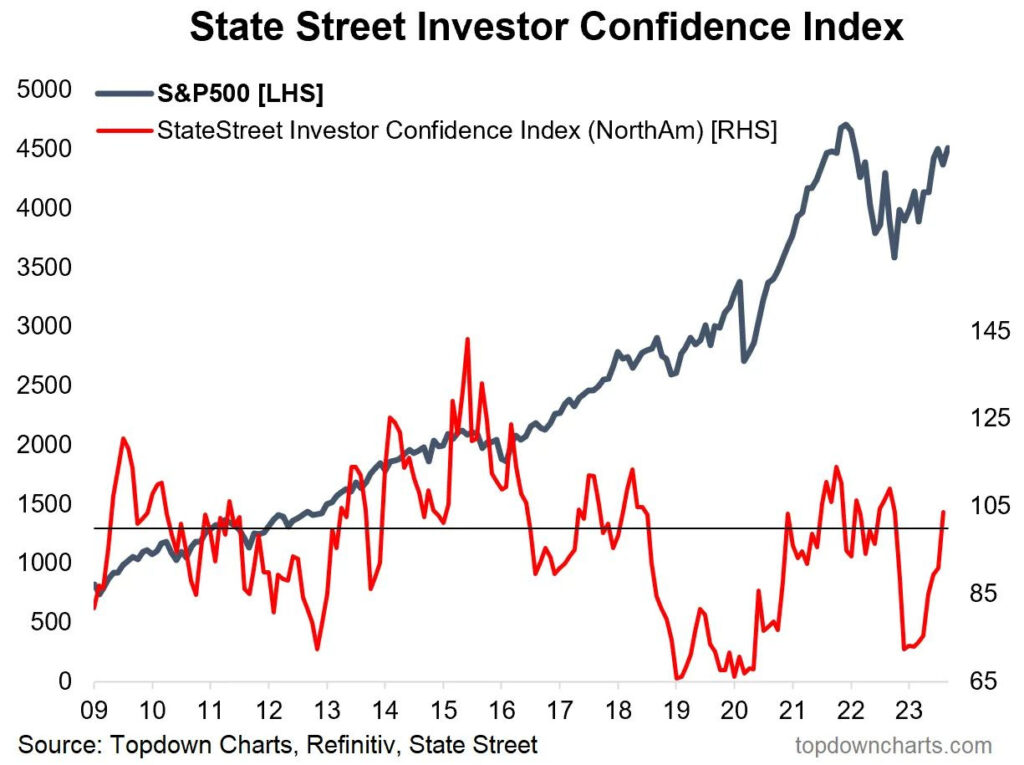

A Closer Look at Investor Sentiment in the U.S.

In the past 10 days, the S&P 500 has ascended roughly 3%. While individual investors displayed tepid enthusiasm, according to the American Association of Individual Investors (AAII), professional money managers increased their exposure to equities significantly, as indicated by the NAAIM index. State Street’s Investor Confidence Index revealed that institutional investor confidence in August saw the largest monthly jump since December 2020.

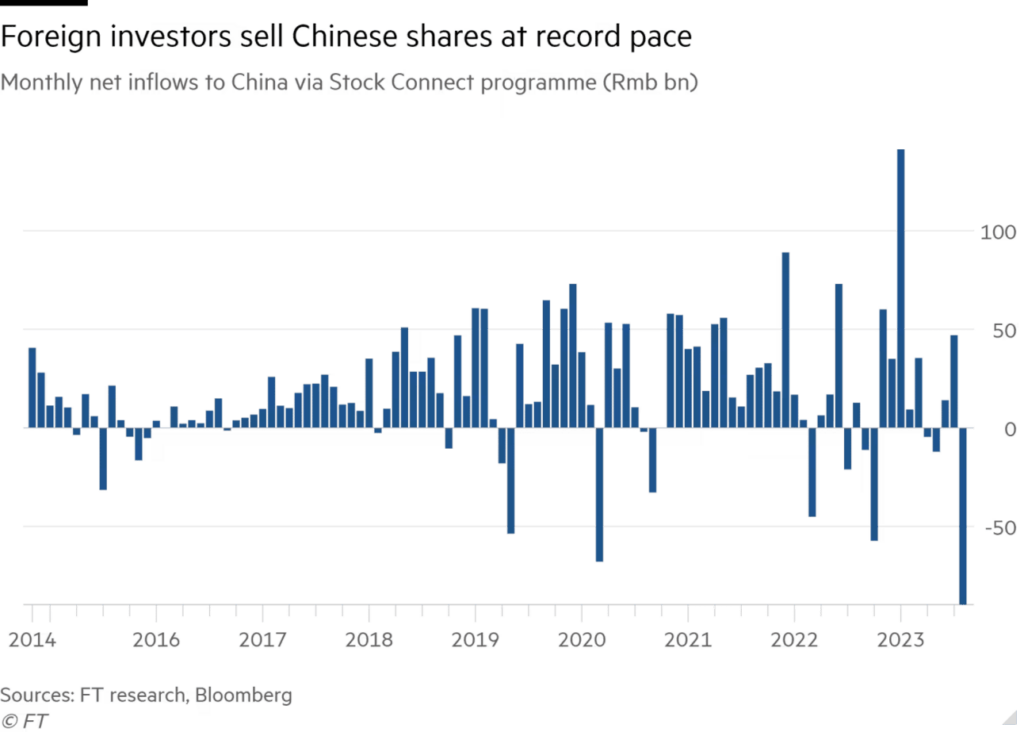

A Contrary Trend in Chinese Equities

On the other end of the spectrum, foreign investors liquidated a staggering $12 billion worth of Chinese stocks in August. Hedge funds also retreated, reducing their positioning in the region to a five-and-a-half-year low. However, dip buying has emerged, with China’s largest stock-focused ETF experiencing record inflows last month.

OPEC+ and Russia Tighten the Oil Spigot

In a development set to impact global oil markets, Russia and OPEC+ have decided to cut back on crude oil exports. While details will be forthcoming, the move implies that both Russia and Saudi Arabia will prolong voluntary production cuts into October.

Safe Trading

Team of Elite CurrenSea

Leave a Reply