U.S. Economy’s Job Growth, Scientific Breakthroughs, and Investment Trends: A Comprehensive Analysis

The financial world is a bustling stage, with the U.S. economy’s surprising jobs report, breakthrough scientific discoveries, innovative companies in healthcare, and trends in investments all making headlines. Let’s take a closer look at these significant developments.

U.S. Job Market: A Closer Look

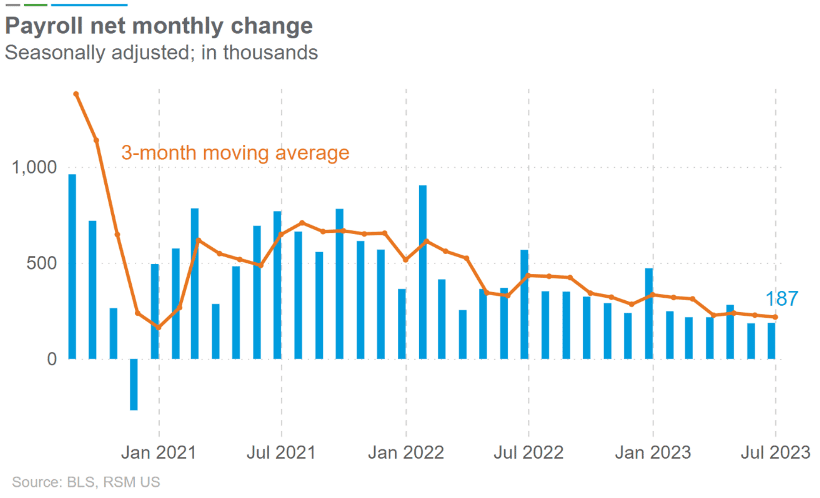

Job Growth Slows Down

The U.S. economy added fewer jobs than expected in July, with job growth slowing to 187k, a decrease from June’s 185k. After exceeding estimates for 14 consecutive months, payroll data has come in softer than expected for two consecutive months, with July’s figures lowering the three-month average to 217k. However, the rate remains twice the amount required to keep up with the working-age population’s growth, and unemployment remains near a 50-year low at 3.5%.

Wages Remain Stubborn

Despite progress in the Fed’s efforts to cool the labor market, average hourly earnings increased by 0.4% in July, above market expectations, and earnings grew annually by 4.4%. With continued labor market strength posing a risk for higher prices, consumer resilience suggests an increased chance of a “soft landing” outcome.

A Scientific Breakthrough: LK-99

LK-99, a rock made from lead, oxygen, phosphorus, and copper, has the science community buzzing. Its potential to conduct electricity at room temperature without resistance could revolutionize many applications. The claims are still under verification, and real-world applications may be years away.

Stem Cell Sector: Innovation and Impact

The Pioneer of Stem Cell Nutrition

Stemtech Corporation is leveraging its early leadership position in the stem cell therapy market, set to reach $25.8 billion by 2027. Through diversified products that support wellness and combat aging, they are on a mission to reverse the impacts of aging.

Investment and Market Trends

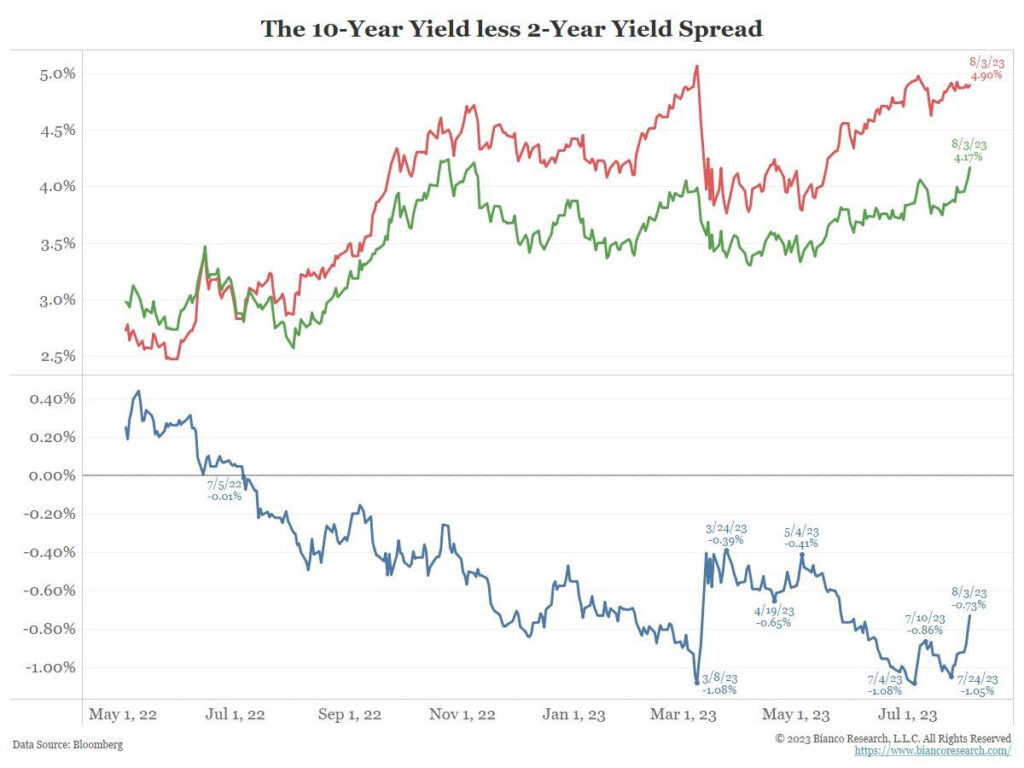

Inverted Yield Curve

The 2s/10s yield curve has been inverted for over a year, with 10-year Treasury notes yielding less than 2-year notes. The trend is reversing as yields rise on the 10-year, while the positive economic data has paused 2-year Treasury yields.

Taking the Market’s Temperature

Recent data shows an increase in leverage, massive inflows to tech funds, aggressive retail investor buying, and meme stocks outperforming. Investors remain bullish.

Oil Market Overview

Oil prices hover around four-month highs due to Saudi Arabia’s extended production cuts and Ukraine’s drone attack on Russia’s key oil export hub. Baker Hughes’s crude oil rig count has also fallen.

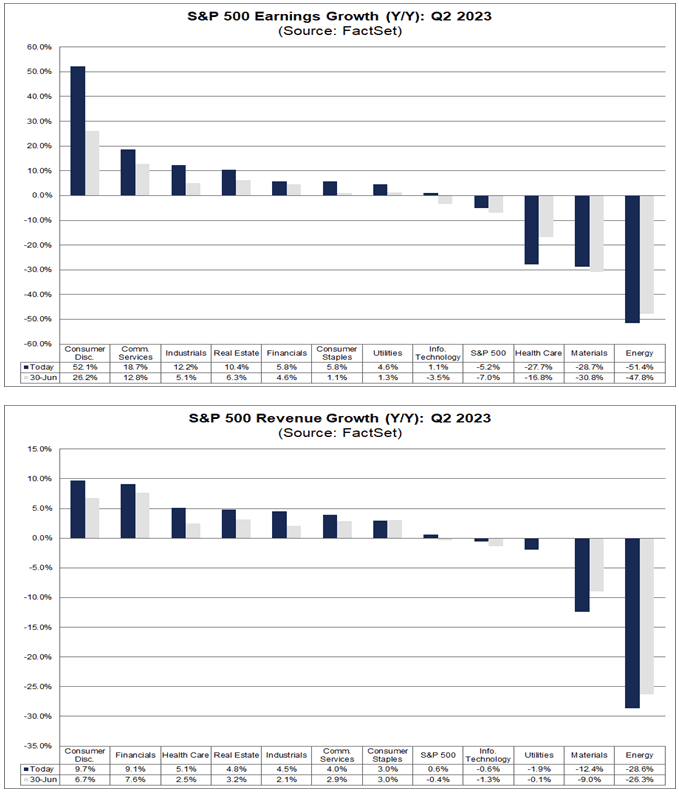

The Earnings Landscape

With 84% of the S&P 500 reported, 79% have topped EPS estimates and 65% have beaten revenue estimates. Blended earnings and revenue growth rates stand at -5.2% and -0.6%, respectively, with expectations that Q2 marked the bottom for earnings.

Conclusion

From promising developments in the labor market to innovations in stem cell therapy and shifts in investment trends, the financial and scientific landscapes continue to evolve. Stay tuned for more updates and insights in the coming weeks.

Safe Trading

Team of Elite CurrenSea

Leave a Reply