Trending in Wall Street: Inflation War, Labor Market Shifts, and a Surging Economy

As the tides turn on Wall Street, and amidst the rhythm of economic fluctuations, key indicators are pointing to a possible victorious battle against inflation by the FED, altering labor markets, and signaling shifts in various sectors, including banking regulations, energy, and automotive industries.

Federal Reserve and the Inflation Index

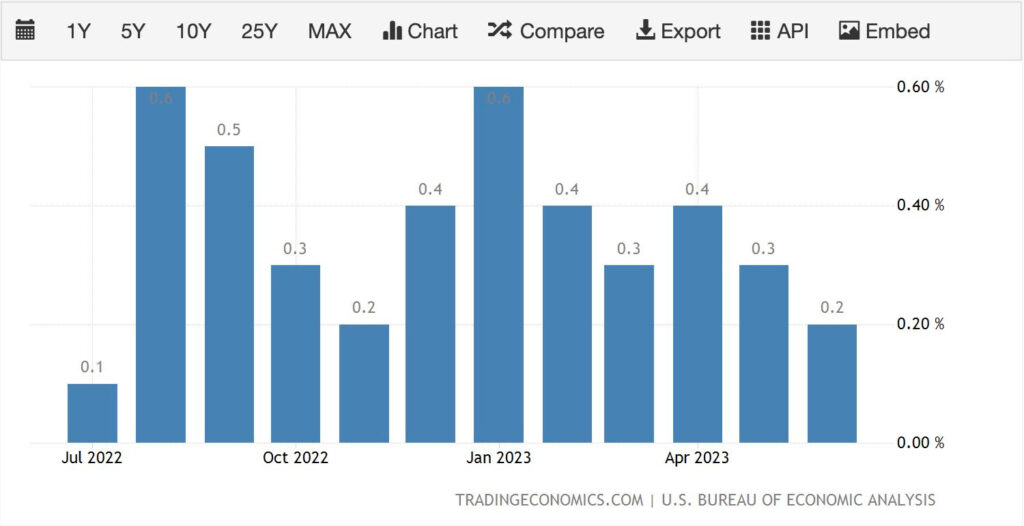

The war against inflation may be witnessing a promising turn in favor of the FED. Their main measure, the Personal Consumption Expenditures (PCE) Inflation Index, recorded a surprising below expectation level at 4.1%. This is the lowest rate since 2021, suggesting a shift in the inflationary trajectory that could potentially mark the start of a new trend.

Reinforcing the Bulwarks of Banking

Rainy day funds at America’s financial giants could potentially be in for an increase. U.S regulators are proposing new rules that would require banks with assets over $100 billion to up their capital requirements by approximately 20%. This would mean the larger the bank, the larger the capital buffer. Although contested by the banking industry, these measures aim to mitigate operational risks spanning lending, trading, and more.

Unraveling Labor Market Trends

A mirror reflection of a “very tight” labor market, in the words of Fed Chair Powell, is the fall in initial jobless claims, which have plummeted to a five-month low. It appears workers are not remaining unemployed for long; continuing claims have dropped to the lowest in half a year. In an indication of high labor demand, approximately 5% of U.S job postings now feature a signing bonus, more than double the pre-pandemic average.

U.S Economic Momentum

Despite recession fears, the U.S economy is powering full steam ahead. With a Q2 GDP growth of 2.4%, it far exceeded the expected 1.8%. This robust expansion was driven by the largest growth in business spending in six quarters, and resilient consumer behavior. Concurrently, core PCE prices – a measure keenly observed by the Fed – fell more than expected to 3.8%.

Tesla’s Customer Service Controversy

Elon Musk’s Tesla finds itself in the middle of a brewing storm. A new investigative report alleges the creation of a “Diversion Team” by Tesla to address thousands of customer complaints, primarily over lower-than-expected driving range.

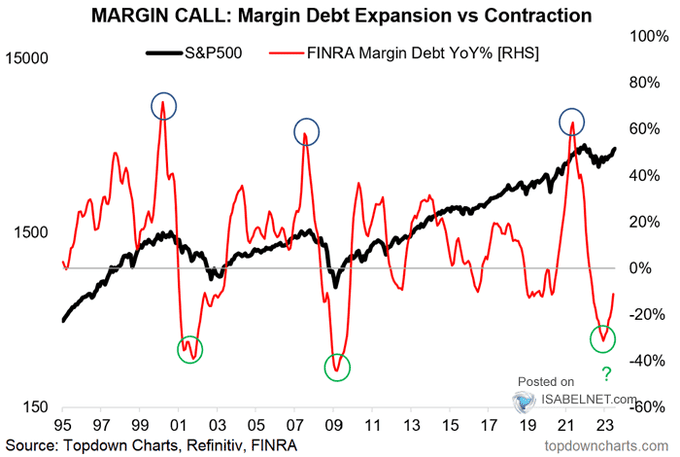

Equity Markets – Bullish Optimism Amidst Increased Risk Appetite

The recent end to the Dow’s 13 straight winning sessions—its longest streak since 1987—hasn’t dented optimism among retail and institutional investors. Active managers’ exposure to equities reached its highest since November 2021, and a reversal higher in margin debt indicates a higher risk appetite among investors.

Surge in U.S Oil Prices

In the energy sector, U.S oil prices are marching towards their fifth consecutive weekly gain, driven by seasonally low inventories and refinery outages resulting from extreme heat. Meanwhile, gas prices have hit a three-month peak.

Safe Trading

Team of Elite CurrenSea

Leave a Reply