Trading EUR/USD & Equities in the Second Half of 2023 While Navigating Inflation, Interest Rates, and Uncertainty

Investing in 2023 is still contingent upon two factors: when and how quickly will inflation subside, and how long will central banks keep interest rates high? In this blog post, we will dive deeper into these factors and provide insights on how to navigate the uncertainties in the market.

Understanding Inflation Trends

Headline inflation is currently decreasing, while core inflation remains sticky. This is primarily due to energy prices reverting to their pre-war and pre-pandemic levels. However, the energy price spikes have already done their damage, as the rest of the economy had to adapt to these changes.

The chain reaction began with raw material producers experiencing a supply and demand mismatch and raising prices. This, in turn, affected manufacturers and middlemen suppliers, who also increased their prices. Ultimately, retailers and consumers faced higher prices across the board.

Economists expect core inflation to slow down eventually, as the bullwhip effect from high inventories built up during 2021 and until mid-2022 will likely cause a decrease in demand. However, this process will take time, and we will continue to see headline inflation going down, with core inflation following suit with a certain time lag.

Interest Rates: The Key Question for Investors

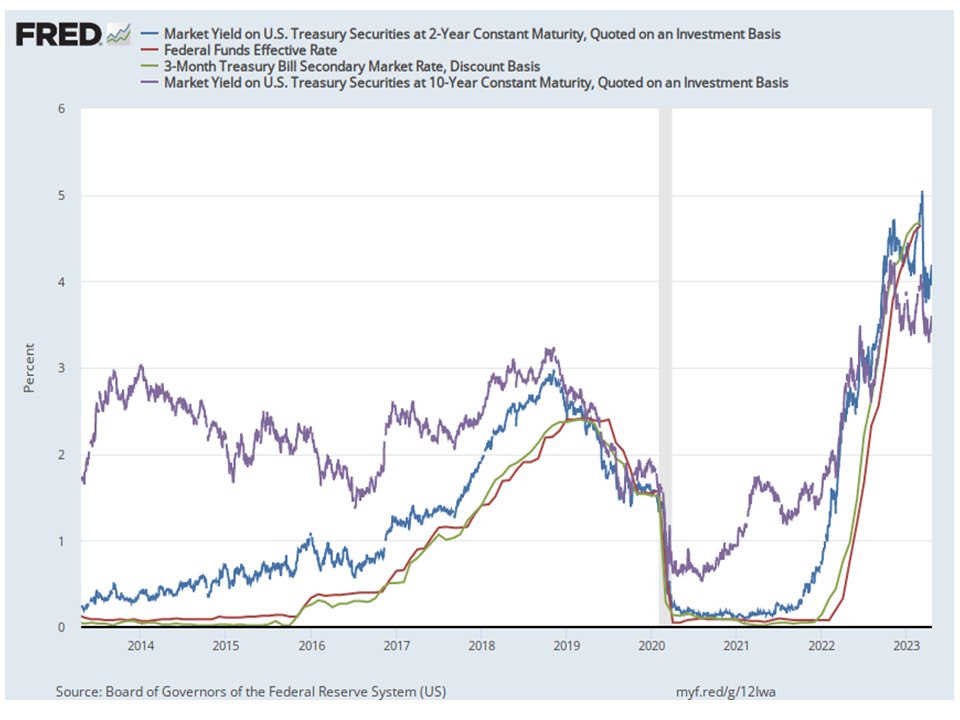

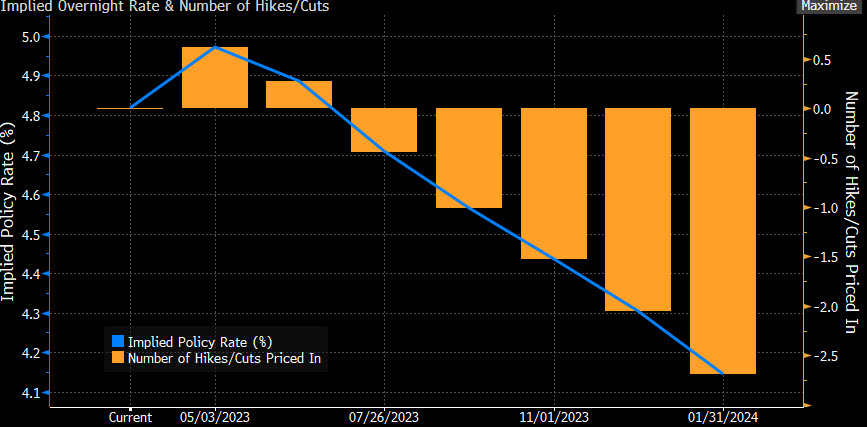

The central question for investors revolves around interest rates. Many have updated their expectations for Federal Reserve (Fed) rate hikes following the banking panic in March, when Silicon Valley Bank (SVB) failed.

Despite the Fed’s insistence on maintaining a “higher for longer” stance, the market continues to price in rate cuts. This is largely due to the loss of confidence in the Fed’s forward guidance, which was late in recognizing the inflation threat in 2021 and has, according to many, hiked too much during this cycle.

The Fed now faces a conundrum when it comes to rate cuts: will they cut rates to facilitate a soft landing, or will they cut rates in response to investor expectations of a recession before the end of the year?

Equity and Bond Market Perspectives

The equity market currently appears to believe in the soft-landing scenario, while the bond market reaction suggests the possibility of a recession hedge. The S&P 500 has been experiencing a sideways market, bouncing between 3800 and 4200 since October.

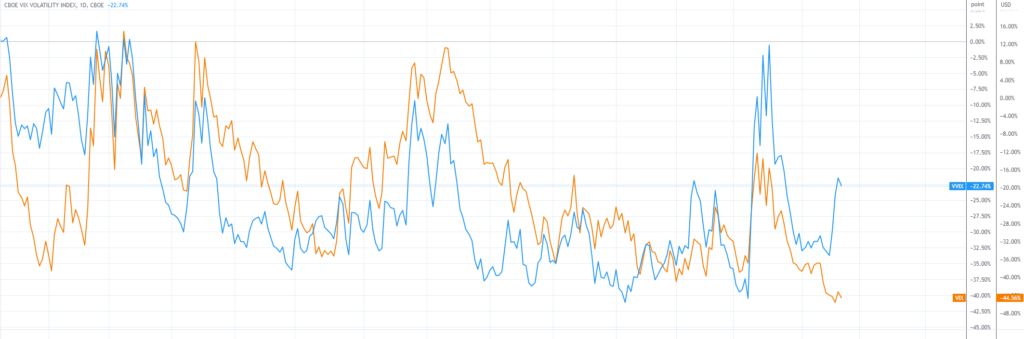

The Volatility Index (VIX) is positioned for a 4-5% correction, which is contingent on Q1 earnings, and the VVIX, which measures the volatility of volatility, is signaling a potential increase in market volatility.

Rallies and Shorts

Recent market rallies have been driven by shorts being closed out. When volume is suppressed, buy orders dominate the market, sending it up in brief but powerful rallies and forcing the shorts to close.

Shorts need active risk management, which leads to buy orders dominating the market. The market won’t engage in a sell-off until most shorts are squeezed out, which is unlikely during peak bearishness.

Portfolio Positioning for Uncertainty

In times of uncertainty, it is advisable for investors to adopt a defensive stance, going long on cash, short on risk, and focusing on short-term trades. Investors should assign probabilities to the following macro scenarios:

- Soft landing (10-15%): inflation returns to 2%, labor markets remain resilient, no recession, and the Fed lowers rates gradually as markets maintain a bull run.

- Recession (55-60%): triggered by a negative surprise in earnings, with the economy facing headwinds due to higher interest rates. This is the scenario the bond markets appear to be bracing for.

- Higher for longer (30-35%): the Fed keeps interest rates high during the entire year without triggering a recession. However, uncertainty will persist, and the market will likely continue to exhibit a sideways trend.

How to Position Your Portfolio

To position your portfolio in light of these scenarios, consider the following strategies:

- For the recession scenario, short US equities or hedge your long positions.

- To benefit from either the soft landing or recession scenarios, go long on US bonds.

- For the higher-for-longer scenario, go long on gold and China-related investments.

Assign the highest weight to the scenario you believe is most likely, and be prepared to adjust your strategy if any of the other scenarios start to materialize.

Currency Hedging: A Final Consideration

Lastly, consider a currency hedge to protect against fluctuations in the value of the US dollar. If the Fed maintains a higher-for-longer approach, the US dollar might reverse back up, but if a recession is triggered, the US dollar will likely decline further.

If you are planning to have a significant exposure to US dollars, a short position on USD/EUR could provide a suitable hedge for the time being.

In conclusion, the investment landscape in 2023 is characterized by uncertainties surrounding inflation and interest rates.

Adopting a defensive stance and carefully considering macro scenarios can help investors navigate these turbulent waters and safeguard their portfolios.

We are trading the above-statement via our managed accounts, and will be making calculated bets on either of the three scenarios.

Safe Trading

Team of Elite CurrenSea

Leave a Reply