Top Hedge Funds Ranking & Verdict

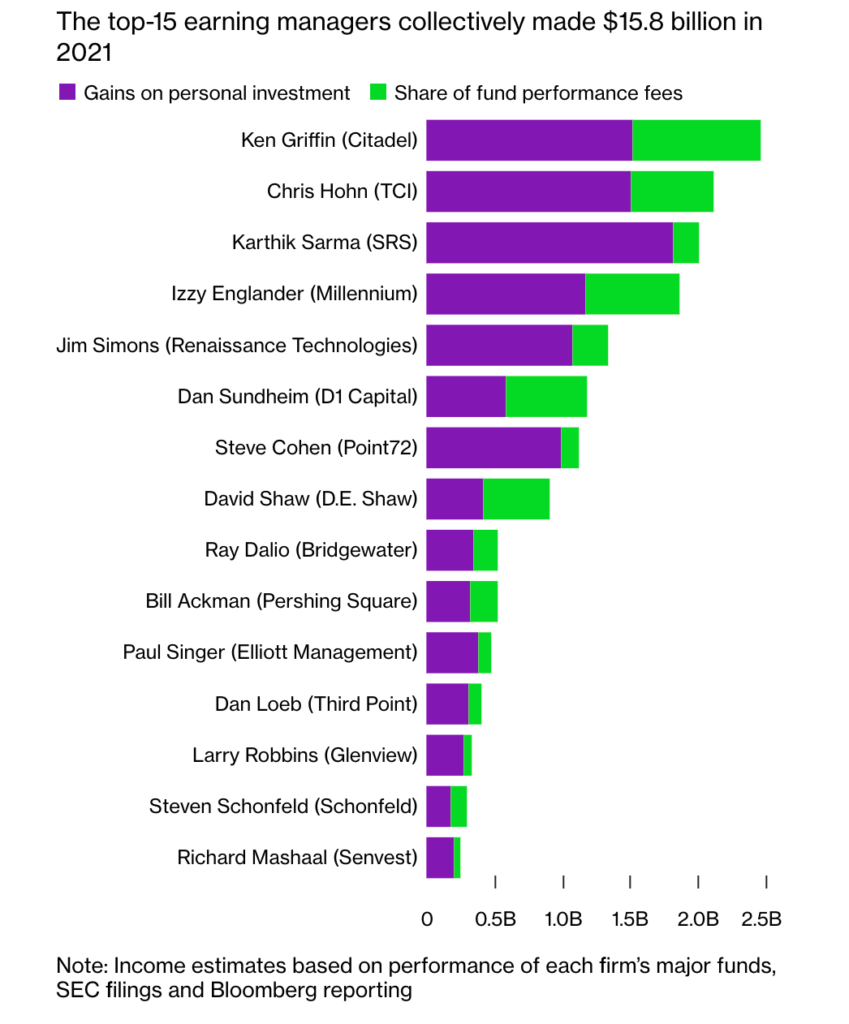

Past couple of years have been volatile not only for your pops and moms vacation plans, while the largest fund manager has generated recorded gain of $23bln in 2020, the amount dropped to 15.8bln in 2021.

The drastic difference in returns from year to year is a landmark of the industry with only a handful of funds managing to bit the SP500% on a longer timeframe.

Therefore, let’s take a look at what unites and set apart these funds, how they manage the capital, and whether it’s really worth your while following the big wigs.

Within the scope of this article, we are taking a broader prospective on the guru investors so we take a look at their most significant achievements and controversies, while ranking them based on their annualized returns and methods.

| Investor/Fund | Approx. Average Annual Return | Years of Significant Activity |

Approx. Days Active (based on years)

|

| Warren Buffett (Berkshire Hathaway) | 20% | 1965 – present | 21,170 |

| George Soros (Quantum Fund) | 30% | 1973 – 2011 | 13,870 |

| Peter Lynch (Fidelity Magellan Fund) | 29% | 1977 – 1990 | 4,745 |

| Stanley Druckenmiller (Duquesne Capital) | 30% | 1981 – 2010 (outside money) | 10,585 |

| Ray Dalio (Bridgewater Associates) | 13% (Pure Alpha) | 1975 – present | 17,520 |

| Jim Simons (Renaissance Technologies) | 66% (Medallion Fund) | 1988 – present | 12,784 |

| Paul Tudor Jones (Tudor Investment Corporation) | 19% | 1980 – present | 15,695 |

| Bill Ackman (Pershing Square Capital Management) | 14% | 2004 – present | 6,935 |

| David Tepper (Appaloosa Management) | 25% | 1993 – present | 10,957 |

| Rank | Investor | Annualized Return | Biggest Win | Biggest Loss | Investment Philosophy | Reputation |

| 1 | Jim Simons | 66% | Medallion Fund | Not widely known | Quantitative Investing | Strong |

| 2 | Warren Buffett | 20% | Coca-Cola | Kraft Heinz | Value Investing | Legendary |

| 3 | Ray Dalio | 12% (All Weather) | 2008 Crisis | 2020 Pandemic | Risk Parity | Renowned |

| 4 | David Tepper | 30% (Avg. 1993-2013) | 2008 Bank Bets | Energy-Related Losses | Distressed Debt Investing | Successful |

| 5 | Seth Klarman | 20% (Avg. since 1983) | Sycamore Networks | PG&E | Value Investing, Margin of Safety | Respected |

| 6 | Paul Tudor Jones | N/A | 1987 Black Monday | 2016 U.S. Election | Contrarian, Macro Trading | Successful |

| 7 | Michael Burry | N/A | Subprime Mortgage Crisis | Not widely known | Deep Value Investing | Well-Regarded |

| 8 | Carl Icahn | N/A | Netflix | Blockbuster | Activist Investing | Influential |

| 9 | John Paulson | N/A | Subprime Mortgage Crisis | Gold Investments | Event-Driven Investing, Merger Arbitrage | Mixed |

| 10 | Bill Ackman | N/A | Canadian Pacific Railway | Valeant Pharmaceuticals | Activist Investing, Concentrated Value | Controversial |

| 11 | Larry Fink | N/A | Technology, ESG | Energy Sector | Long-Term Growth, Sustainability | Influential |

| 12 | Steven Cohen | N/A | Technology Stocks | 2008 Financial Crisis | High-Frequency Trading | Mixed |

Please note that these figures are approximate, and the actual number of days active could be different.

Additionally, some of these investors or fund managers may still be active but in different capacities or with different focuses, such as managing their own wealth or philanthropic activities.

All the information is based on the most appropriate source we could find circa 2021.

Warren Buffett:

The “Oracle of Omaha,” Warren Buffett is the chairman and CEO of Berkshire Hathaway. He is known for his value investing approach, focusing on companies with strong fundamentals and a competitive advantage.

- Biggest positive trade: Buffett’s investment in Coca-Cola in 1988 has yielded multibillion-dollar returns.

- Biggest negative trade: Berkshire Hathaway’s investment in Kraft Heinz led to a significant write-down in 2019.

- Trading philosophy: Value investing, focusing on long-term investments in fundamentally strong businesses.

- Harshest criticism: Critics argue that Buffett’s investment style is outdated and not adaptable to the rapidly changing business landscape.

George Soros:

George Soros, the founder of Soros Fund Management, is famous for his macro investing approach and his Quantum Fund, which achieved significant success throughout the years.

- Biggest positive trade: In 1992, Soros made a famous bet against the British pound, which earned him over $1 billion.

- Biggest negative trade: Soros reportedly lost around $1 billion during the 2016 U.S. presidential election due to bearish bets that went wrong.

- Trading philosophy: Macro investing, focusing on global economic trends and using leverage to capitalize on opportunities.

- Harshest criticism: Critics accuse Soros of market manipulation and destabilizing economies through his aggressive trading strategies.

Peter Lynch:

Peter Lynch, who managed the Fidelity Magellan Fund from 1977 to 1990, is famous for his “invest in what you know” philosophy, which helped the fund achieve an impressive 29% annual return during his tenure.

- Biggest positive trade: Lynch’s investment in La Quinta Motor Inns, a hotel chain, yielded a return of over 30 times the initial investment.

- Biggest negative trade: Lynch’s investment in Chrysler in the late 1980s led to significant losses as the company faced bankruptcy.

- Trading philosophy: Investing in easy-to-understand businesses with strong growth potential.

- Harshest criticism: Critics argue that Lynch’s approach might lead to overlooking innovative or disruptive companies in favor of more traditional businesses.

Stanley Druckenmiller:

Stanley Druckenmiller, the founder of Duquesne Capital, is known for his top-down investing approach, focusing on macroeconomic trends to inform his investment decisions.

- Biggest positive trade: Druckenmiller’s bet against the British pound alongside George Soros in 1992 earned them over $1 billion.

- Biggest negative trade: Druckenmiller admitted that his failure to capitalize on the 2020 U.S. dollar rally was the “biggest miss” of his career.

- Trading philosophy: Top-down investing, focusing on macroeconomic trends and utilizing both long and short positions to maximize returns.

- Harshest criticism: Critics argue that Druckenmiller’s high-risk, high-reward approach can lead to significant losses if his macroeconomic predictions are incorrect.

Ray Dalio:

Ray Dalio, the founder of Bridgewater Associates, is famous for his “All Weather” investment strategy and the “Pure Alpha” fund, which has consistently outperformed the market.

- Biggest positive trade: Dalio’s Bridgewater Associates profited from the 2008 financial crisis by accurately predicting the housing market collapse.

- Biggest negative trade: In 2020, Bridgewater’s flagship Pure Alpha fund suffered significant losses due to the impact of the COVID-19 pandemic on markets.

- Trading philosophy: Risk parity and diversification, focusing on uncorrelated asset allocation to achieve consistent returns.

- Harshest criticism: Critics argue that Dalio’s risk parity approach can underperform during periods of high inflation and rising interest rates.

Jim Simons:

Jim Simons, the founder of Renaissance Technologies, is a pioneer in quantitative investing. His Medallion Fund has achieved remarkable returns using complex algorithms and data-driven strategies.

- Biggest positive trade: The Medallion Fund’s consistent high returns are a testament to its successful quantitative strategies, with annual returns averaging around 66%.

- Biggest negative trade: Specific negative trades are not widely known, as Renaissance Technologies is highly secretive about its investment strategies and performance.

- Trading philosophy: Quantitative investing, utilizing complex mathematical models and algorithms to identify and capitalize on market inefficiencies.

- Harshest criticism: Critics argue that Simons’ approach can lead to overreliance on technology and potentially overlook the human element and qualitative factors that influence market behavior.

Paul Tudor Jones:

Paul Tudor Jones, the founder of Tudor Investment Corporation, is a renowned macro trader and hedge fund manager known for his contrarian and opportunistic investment approach.

- Biggest positive trade: Jones famously predicted and profited from the 1987 stock market crash, known as Black Monday.

- Biggest negative trade: In 2016, Jones’ fund reportedly suffered losses from bearish bets on the U.S. presidential election outcome.

- Trading philosophy: Contrarian investing and macro trading, utilizing a combination of technical and fundamental analysis to identify market opportunities.

- Harshest criticism: Critics argue that Jones’ contrarian approach can lead to significant losses if market trends do not reverse as anticipated.

Bill Ackman:

Bill Ackman, the founder of Pershing Square Capital Management, is known for his concentrated investment approach and high-profile activist campaigns in companies he believes are undervalued.

- Biggest positive trade: Ackman’s investment in Canadian Pacific Railway led to significant gains after implementing operational improvements and a change in management.

- Biggest negative trade: Ackman’s investment in Valeant Pharmaceuticals resulted in massive losses due to the company’s accounting scandal and plummeting stock price.

- Trading philosophy: Concentrated, value-oriented investing with a focus on shareholder activism to unlock value in underperforming companies.

- Harshest criticism: Critics argue that Ackman’s activist approach can be disruptive and counterproductive, leading to negative consequences for the companies he targets.

David Tepper:

David Tepper, the founder of Appaloosa Management, is a renowned distressed debt investor and hedge fund manager, known for his ability to spot undervalued assets during market crises.

- Biggest positive trade: Tepper’s investments in the distressed debt of banks during the 2008 financial crisis resulted in significant returns as the market recovered.

- Biggest negative trade: In 2016, Tepper’s fund reportedly suffered losses from the declining value of energy-related investments.

- Trading philosophy: Distressed debt investing and value-oriented approach, focusing on opportunities arising from market dislocations and crises.

- Harshest criticism: Critics argue that Tepper’s approach can lead to overexposure to risky assets during periods of market stress, potentially resulting in significant losses.

Seth Klarman:

Seth Klarman, the founder of Baupost Group, is a value investor often compared to Warren Buffett. His disciplined approach and focus on margin of safety have earned him a reputation as one of the most successful investors in the industry.

- Biggest positive trade: Klarman’s investment in Sycamore Networks during the dot-com bubble led to substantial gains after the company went public.

- Biggest negative trade: Baupost’s investment in PG&E, a California utility company, resulted in losses due to the company’s bankruptcy caused by wildfire-related liabilities.

- Trading philosophy: Value investing with a focus on margin of safety, seeking undervalued and out-of-favor investments to minimize downside risk.

- Harshest criticism: Critics argue that Klarman’s conservative approach can lead to missed opportunities in fast-growing or innovative industries.

Carl Icahn:

Carl Icahn, the founder of Icahn Enterprises, is a legendary activist investor known for taking large positions in companies and pushing for changes to unlock shareholder value.

- Biggest positive trade: Icahn’s investment in Netflix in 2012 led to significant gains as the company’s stock price soared in the following years.

- Biggest negative trade: Icahn’s investment in Blockbuster resulted in substantial losses as the company failed to adapt to the changing movie rental landscape and eventually filed for bankruptcy.

- Trading philosophy: Activist investing, focusing on unlocking shareholder value through strategic changes and operational improvements.

- Harshest criticism: Critics argue that Icahn’s confrontational tactics can create animosity and tension within the companies he targets, potentially harming long-term prospects.

Michael Burry:

Michael Burry, the founder of Scion Asset Management, is famous for predicting and profiting from the subprime mortgage crisis. He is known for his deep value investing approach and contrarian outlook.

- Biggest positive trade: Burry’s bet against the subprime mortgage market in 2007 resulted in significant profits as the housing market collapsed.

- Biggest negative trade: Specific negative trades are not widely known, as Burry tends to keep a low profile regarding his investment activities.

- Trading philosophy: Deep value investing and contrarian outlook, focusing on undervalued and underappreciated investment opportunities.

- Harshest criticism: Critics argue that Burry’s contrarian approach can lead to overexposure to struggling industries or businesses with limited growth potential.

John Paulson:

John Paulson, the founder of Paulson & Co., is famous for his bet against the subprime mortgage market, which earned him billions during the 2008 financial crisis. He is known for his event-driven and merger arbitrage strategies.

- Biggest positive trade: Paulson’s bet against the subprime mortgage market in 2007 resulted in massive profits as the housing market collapsed.

- Biggest negative trade: Paulson’s investments in gold and gold miners during the early 2010s led to significant losses as the commodity’s price fell.

- Trading philosophy: Event-driven investing and merger arbitrage, capitalizing on corporate events and market dislocations.

- Harshest criticism: Critics argue that Paulson’s aggressive investment strategies can lead to high volatility and large losses when bets do not pay off.

Larry Fink:

Larry Fink, the founder and CEO of BlackRock, is responsible for creating the world’s largest asset management firm, overseeing more than $9 trillion in assets. He is known for his emphasis on sustainable investing and long-term growth.

- Biggest positive trade: BlackRock’s investments in technology and ESG-focused companies have yielded strong returns in recent years.

- Biggest negative trade: BlackRock’s exposure to the energy sector during the 2014-2016 oil price collapse led to losses for some of its funds.

- Trading philosophy: Long-term growth investing with a focus on sustainability and risk management.

- Harshest criticism: Critics argue that BlackRock’s size and influence could lead to conflicts of interest and potentially harm market competition.

Steven Cohen:

Steven Cohen, the founder of Point72 Asset Management and former head of SAC Capital, is known for his high-frequency trading strategies and strong focus on technology and data analysis.

- Biggest positive trade: Cohen’s investments in technology companies, such as Nvidia and Amazon, have generated significant returns over the years.

- Biggest negative trade: SAC Capital faced substantial losses during the 2008 financial crisis, leading to the firm’s eventual closure and the creation of Point72.

- Trading philosophy: High-frequency trading, utilizing technology and data analysis to capitalize on short-term market movements.

- Harshest criticism: Critics argue that Cohen’s high-frequency trading approach can contribute to market volatility and instability, as well as potential ethical issues related to SAC Capital’s past insider trading charges.

Safe Trading

Team of Elite CurrenSea

Leave a Reply