The Resilient Market: A Tale of Ups, Downs, and Unforeseen Surprises

In a turbulent world of financial markets where predictions often fall flat and the unexpected becomes the norm, we continue to witness remarkable stories of resilience, surprising anomalies, and persistent challenges that define our investment landscape.

Defying Economic Headwinds: The Market’s Unexpected Resilience

There was a time, not too long ago, when inflation seemed to run rampant, interest rates hit the ceiling, bonds were screaming caution, and a recession loomed large. Yet, against all odds, here we are, a little over 20 months later, the S&P 500’s bear market is nearing full recovery, falling just 260 points short. It’s a tale of market resilience that deserves attention.

Underreporting in the Banking Sector: When Honor Systems Fail

It turns out that the concept of the ‘honor system’ doesn’t quite align with the reality of the banking sector. The FDIC has cast accusations of misreporting deposit data at several banks in the aftermath of the banking crisis last March. According to S&P, there was a substantial increase in banks restating their Q4 numbers, more than triple from the previous year. These banks underreported to reduce their liability for the “special assessment” proposed by the FDIC in May, which has now called for corrections to be made.

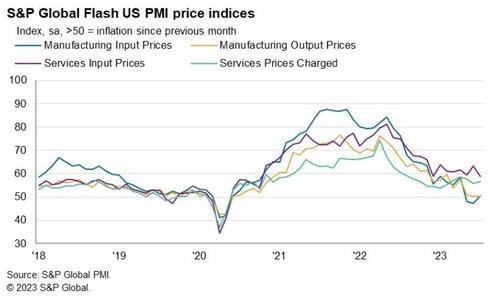

A Slowdown in Private Sector Business Activity: An Unsettled Picture

Private sector business activity in July expanded at its slowest pace since February. Manufacturing activity saw an unexpected increase but still remains in contraction, while services, despite missing estimates, continue to expand, albeit at its slowest pace since February. With price pressures being a cause for concern, especially in services, the picture appears unsettled.

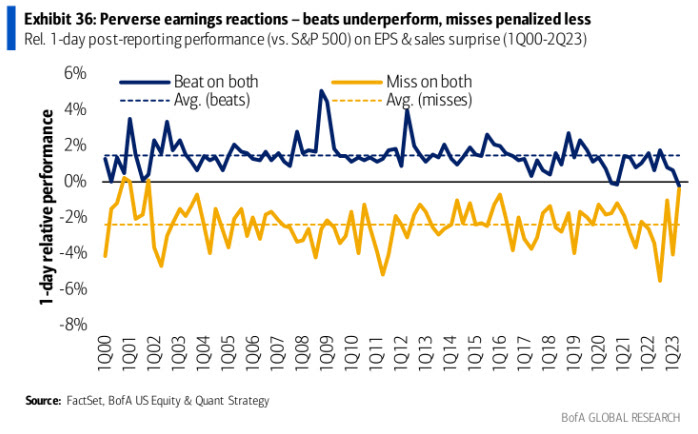

Stock Market Anomalies: Rewarding the Underachievers

In a surprising twist, stocks that beat earnings estimates are underperforming those that missed. To put it bluntly, overachievers are being punished more than their underperforming counterparts. Such an earnings reaction has never been seen before in Bank of America data dating back to 2000.

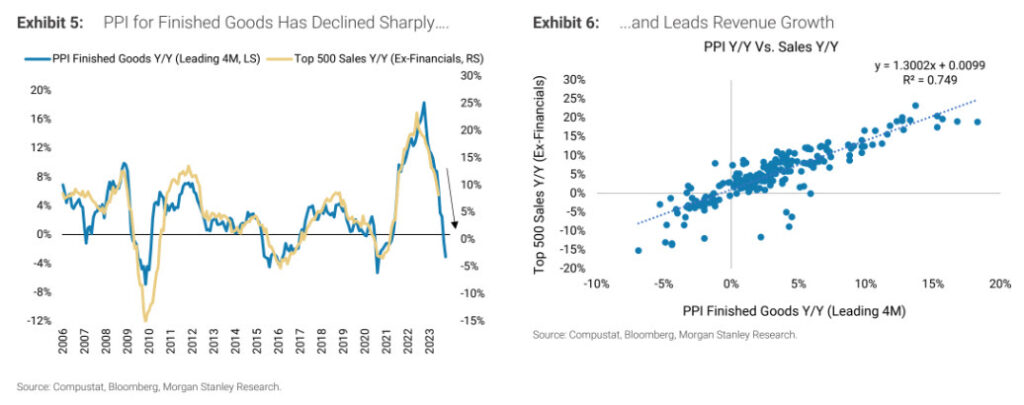

Morgan Stanley’s Mike Wilson: The Persistent Bear

Despite several headlines claiming Morgan Stanley’s Mike Wilson has capitulated, it seems he is far from abandoning his stance. In fact, Wilson warns that progress on inflation now poses a threat to sales growth and that falling prices could lead to reduced pricing power and lower margins. With 2023 EPS revisions reversing and resuming their downward trajectory, Wilson remains firmly bearish.

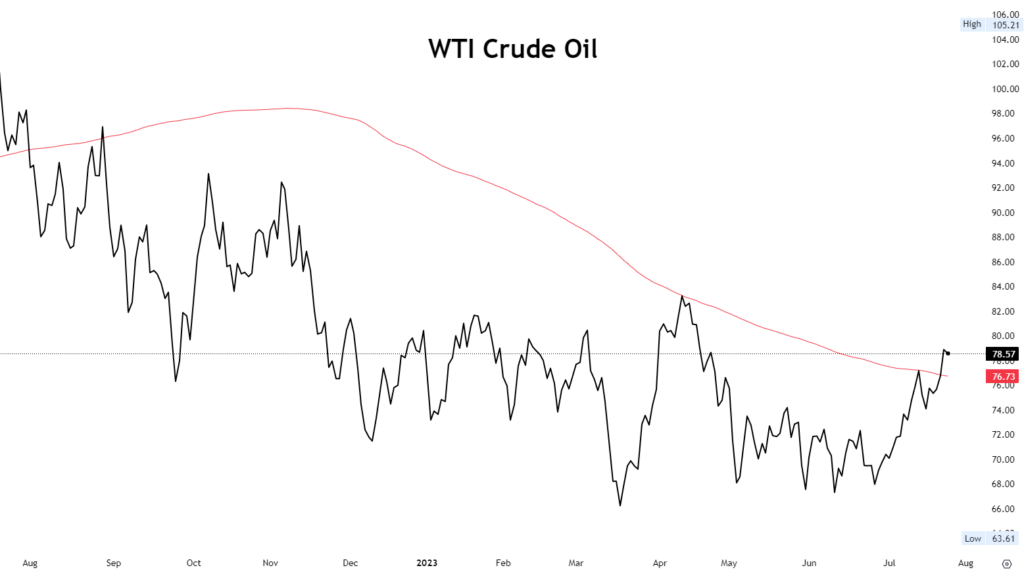

WTI Crude: Riding the High Wave

WTI crude closed above its 200-day moving average recently for the first time since late August. US oil prices have now hit their highest since April. This uptick is driven by tight supplies, Chinese stimulus, and a weaker dollar.

Safe Trading

Team of Elite CurrenSea

Leave a Reply