The Paradox of Prosperity: Why a Robust Job Market Spells Trouble for Stocks

In an unpredictable turn of economic events, we’re witnessing a peculiar scenario where a robust job market appears to be causing ripples in the stock market. Here’s how this paradoxical situation is unfolding.

The Paradoxical Divergence: Service Vs Manufacturing Sectors

The market dynamics continue to puzzle investors as the service sector seems to be outpacing the manufacturing one. The Institute for Supply Management’s (ISM) services purchasing managers index leaped more than expected in June, marking the most significant expansion since February. Positive upticks were recorded in business activity, new orders, and employment, painting a picture of a robust economy. However, this development has not entirely been good news for the stock market.

The Jobs Conundrum

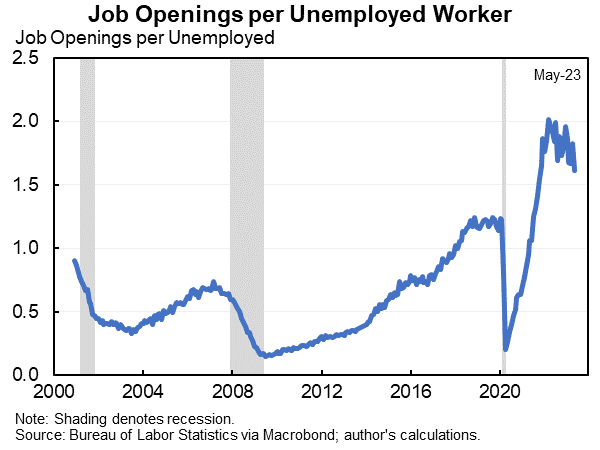

New job data does nothing to soothe the Federal Reserve doves. The ADP reported that June saw nearly half a million new jobs—over twice the anticipated figure. True to the trend, the services sector led these gains. Interestingly, job openings dropped by 496k to 9.8 million in May, reducing the ratio of vacancies to unemployed workers to 1.6—the lowest since October 2021 but still above pre-pandemic levels. Now, all eyes are on the forthcoming Nonfarm Payrolls report to affirm the strength indicated in the earlier data.

Wall Street’s Mixed Feelings towards AI Stocks

Two AI giants, Alphabet and Microsoft, are receiving disparate treatments on Wall Street. Alphabet has recorded the lowest buy ratings in over three years, accompanied by a recent series of downgrades from Loop Capital, UBS, and Bernstein. On the other hand, Microsoft is basking in the glow of upgrades, earning the title of Morgan Stanley’s top large-cap software pick. If the bank’s new price target is anything to go by, Microsoft could soon join the ranks of the $3 trillion behemoths.

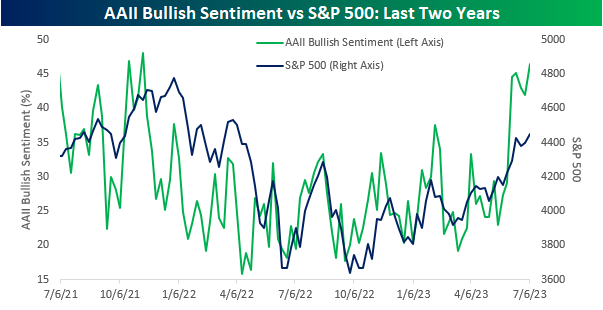

Battle of Sentiments: Retail Vs Institutional Investors

Retail exposure is reportedly at “max bull” levels according to Vanda Research. The recent AAII data confirms this, revealing a bullish sentiment peaking for the first time since November 2021. However, the NAAIM Exposure Index, which measures active manager exposure to US equities, paints a different picture, showing a fall over the past month from 90 to 83.

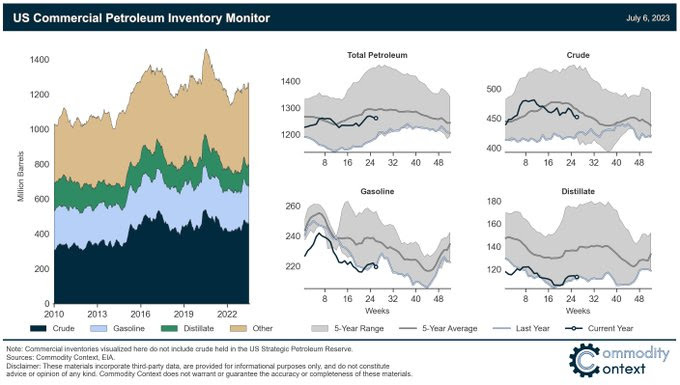

The Crude Reality

Crude oil is set to register its second straight weekly gain. Last week saw a supportive dip across all major products. API data suggests that crude stocks have been on a three-week descent, and overall petroleum inventories have decreased by 2.8 million barrels.

Safe Trading

Team of Elite CurrenSea

Leave a Reply