The Mighty U.S. Dollar & The Apple Tumble: A Financial Dive

In a dynamic financial landscape marked by a surging U.S. dollar and tech giants facing international challenges, it’s essential to dive deep into the key events that are shaping our investments and global markets.

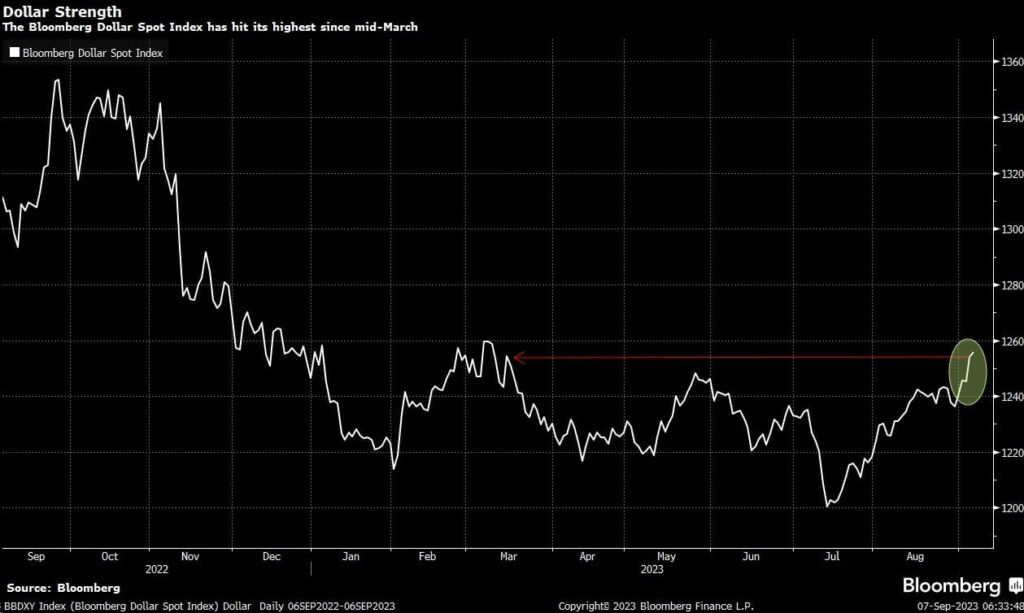

The U.S. Dollar’s Record Climb

Despite international uncertainties, the U.S. dollar continues its meteoric rise. Thanks to robust data from the U.S. services sector, accounting for a significant 2/3 of the economy, August witnessed an unexpected 6-month high. While this surge benefits the U.S. dollar, the repercussions are felt globally, especially in Europe and Asia.

- Inflationary Concerns: Businesses report paying more for essential resources, possibly hinting at sustained inflation.

- A Historical Streak: The Bloomberg dollar index is on track for an unprecedented 8 consecutive weeks of gains – a streak not witnessed since 2005.

- Global Impact: As Europe grapples with an unstable economy and China faces slowing growth, their currencies feel the heat, especially the yuan which recently plummeted to a 16-year low.

- Banking Decisions: There’s anticipation that central banks in Europe and Asia will make more aggressive rate cuts than the U.S. Federal Reserve to bolster their struggling economies, potentially further weakening their currencies.

Insight: The resilient U.S. economy presents a stark contrast to other major global economies. Strong economic data suggests that traders expect U.S. interest rates to remain high, pushing more investments into safer avenues like money market funds.

Apple’s Stock Stumbles

Recent geopolitical decisions have caused turbulence for the tech giant, Apple. Following China’s decision to ban iPhones for government officials, Apple’s stock dipped significantly, a trend that may exacerbate if this ban extends to government-affiliated organizations.

- The Tech War Intensifies: Amidst the ongoing tech war, China’s strategy to reduce reliance on U.S. technology is evident. Simultaneously, the U.S. limits chip exports to China.

- Apple’s Reliance on China: Accounting for 19% of Apple’s revenue, China has been instrumental in Apple’s growth story over the last decade. Furthermore, a vast majority of iPhones are manufactured there.

Insight: For Apple to bounce back, it’s not just about the next iPhone model but a redefinition of its value proposition. With the iPhone 15’s imminent release, stakeholders are watching closely.

GameStop’s Remarkable Comeback

GameStop, once the darling of meme stocks, showcased a resilient quarter. Contrary to most expectations, the company’s revenue stood at $1.16B, surpassing the estimated $1.14B. Thanks to aggressive cost-cutting measures, the net loss was substantially reduced.

- GameStop’s Revival: From a 2021 high of $86.87, the stock has corrected to $18.75. The pivotal question now is – can it return to profitability?

- Company Health Check: Newly appointed Chairman Ryan Cohen brings hope, and the company boasts a robust balance sheet with ample cash reserves and minimal debt.

- Wall Street’s Myopia?: Only a couple of analysts currently cover GameStop. Is the financial world overlooking its potential?

Insight: As the company strives for profitability, its journey is not just a business tale but also the subject of the new film, “Dumb Money,” set to premiere at Toronto’s film festival.

Looking Ahead

Keep an eye on the U.S. oil inventory, expected to decrease by 2.1M barrels. Additionally, forthcoming U.S. jobless claims and productivity statistics are on the horizon. Plus, Apple’s iPhone 15 is about to make its grand debut.

Safe Trading

Team of Elite CurrenSea

Leave a Reply