The Market’s Tightrope: NVIDIA’s Earnings, Housing Trends, Bank Ratings, and More

In an increasingly volatile and unpredictable market, a close examination of key players and trends is vital. From NVIDIA’s soaring earnings to the U.S. housing market’s puzzling decline, we dive into the financial phenomena that are shaping our economic landscape.

NVIDIA’s Unprecedented Growth

Stakes couldn’t be higher for NVIDIA as earnings are expected to hit $2.07, up an astonishing +305% from $0.51 last year. NVIDIA has been the best-performing stock in the S&P 500 this year, rising by +212%. The question on everyone’s lips is simple: what if they miss? Some experts fear that failure to meet expectations could bring down the entire stock market.

The Housing Market’s Unexpected Turn

The U.S. housing market is facing a unique crisis. Sales of existing homes fell 2.2% in July, marking the lowest level since January. On an annual basis, this translates to a drop of ~17%. Meanwhile, median sales prices rose 1.9% from a year earlier to $407,000, the first YoY increase in 6 months. High mortgage rates seem to be keeping both sellers and homebuyers at bay, as illustrated in the chart above. Current homeowners enjoy an effective rate of ~3.6%, while new homebuyers face a rate that’s more than double.

Ratings Cut for Five U.S. Banks

Earlier this week, Standard and Poor’s made a significant move by cutting ratings for five U.S. banks, including Associated Banc Corp, Comerica, KeyCorp, Valley National, and UMB Financial. Outlooks for River City Bank and S&T Bank were also lowered to negative. S&P cited higher interest rates shifting customer deposits as the main reason behind the downgrades, causing a squeeze on liquidity.

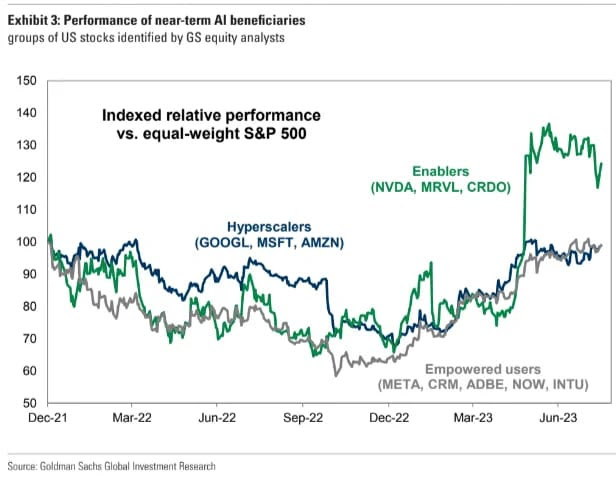

AI Revolution and Its Beneficiaries

According to Goldman Sachs, just 11 publicly-traded companies are near-term beneficiaries of the AI revolution. They fall into three categories: enablers, hyperscalers, and empowered users. Together, this group has outperformed the equal-weight S&P 500 by 62 percentage points, showing positive EPS revisions.

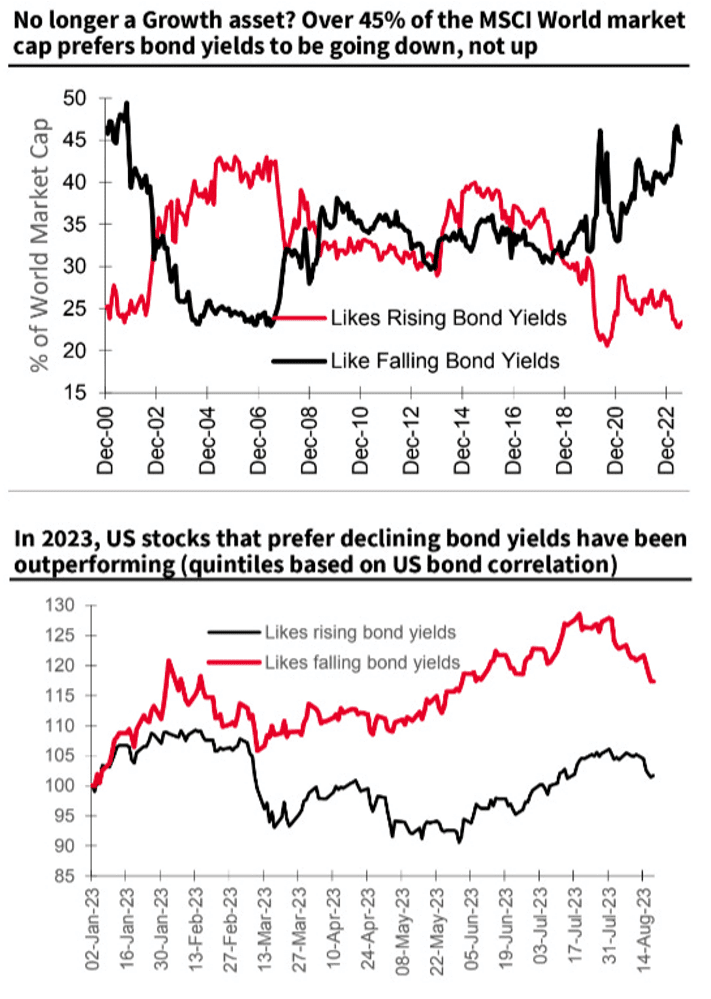

Bond Yields and Equities: A Changing Relationship

Societe Generale’s research reveals a shifting relationship between equities and bond yields. While 45% of the world’s market cap prefers falling bond yields, the best-performing U.S. stocks this year have been those negatively correlated to rising bond yields. The impact of fading recessionary fears may be one of the contributing factors.

Iran’s Growing Oil Production

Iran’s intention to continue raising its oil production is causing tension within OPEC. The country has already increased production by ~50% since 2021 and now aims to pump out 3.4 million barrels a day. Goldman’s predictions point to a potential boost in oil prices through the end of the year, with Brent expected to finish at $86 per barrel.

Safe Trading

Team of Elite CurrenSea

Leave a Reply