The Market Pulse: Deciphering the FED, Inflation, and Volatility Risks

Navigating the complexity of today’s economic landscape requires a keen understanding of various forces at play, including inflation, housing costs, investor sentiment, and emerging opportunities. Here’s an insightful look into the current market pulse.

Inflation Metrics and the Fed’s Response

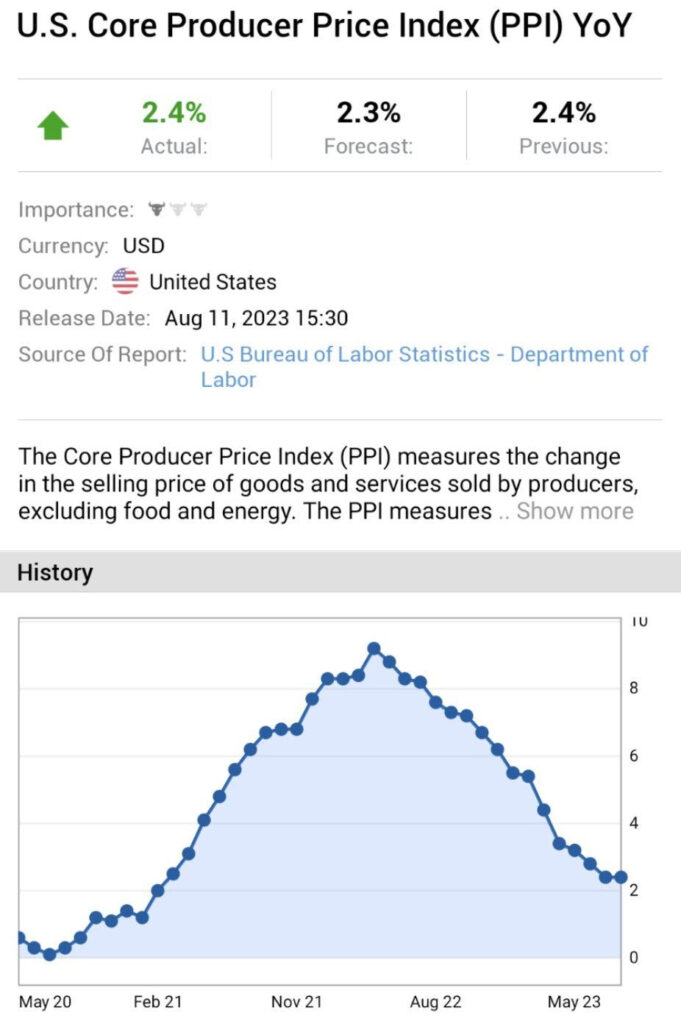

The Federal Reserve’s (FED) preferred inflation gauge, the Producer Price Index (PPI core), reported a slight increase, coming in at 2.4% versus the expected 2.3%. Subsequently, the market’s expectation for a 0.25% rate hike in September has diminished to a mere 10% probability. This leads to the question – can we trust these figures?

Inflation Details and Market Reaction

CPI’s Positive Indicators

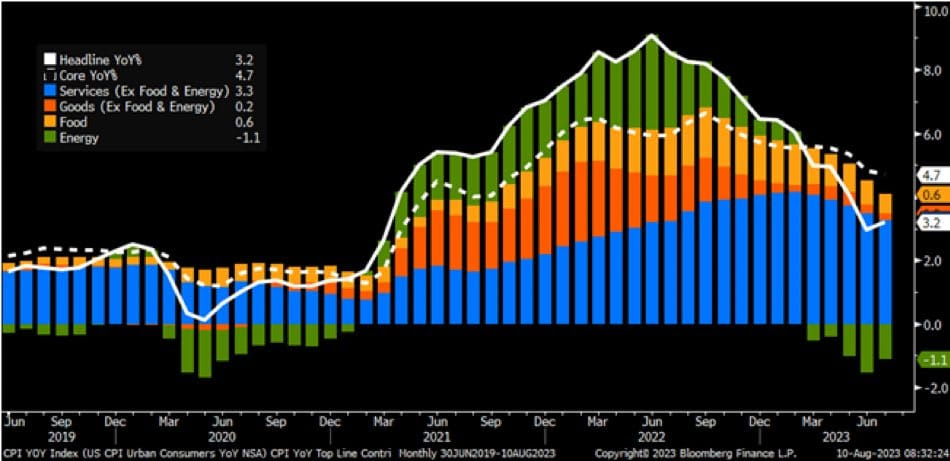

It’s hard to find significant issues with the recent Consumer Price Index (CPI) data. Both headline and core inflation rose in line with July expectations. The latter demonstrated the smallest sequential monthly increases in over two years. Factors driving inflation lower include energy, food, and used car prices.

Shelter Component Remains a Concern

Contrarily, the shelter component of inflation remains persistently high, despite a continued slowing down. Shelter costs accounted for more than 90% of the overall price increase. But due to its lagging nature, this trend may actually foreshadow lower inflation ahead. Real-time housing cost indicators (such as Zillow and Redfin) forecast lower prices in the coming months.

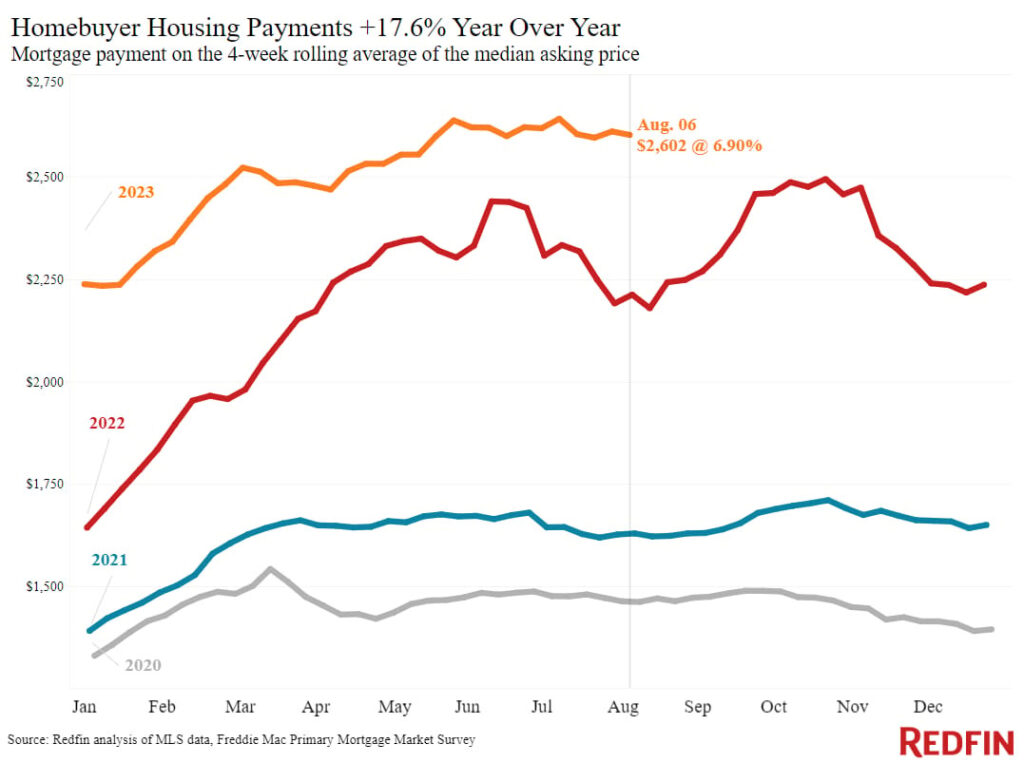

Redfin’s Insight into Housing Costs

Redfin’s latest housing market update highlights low demand and lower supply exerting upward pressure on prices. With new listings down 17% YoY and total homes listed for sale falling by 18%, median home sale prices saw the largest annual increase (3%) since November. Moreover, monthly mortgage payments have soared 17% YoY, hovering just around 1% below the record high from last month.

Investor Sentiments and Market Trends

A Shift in Retail Investor Outlook

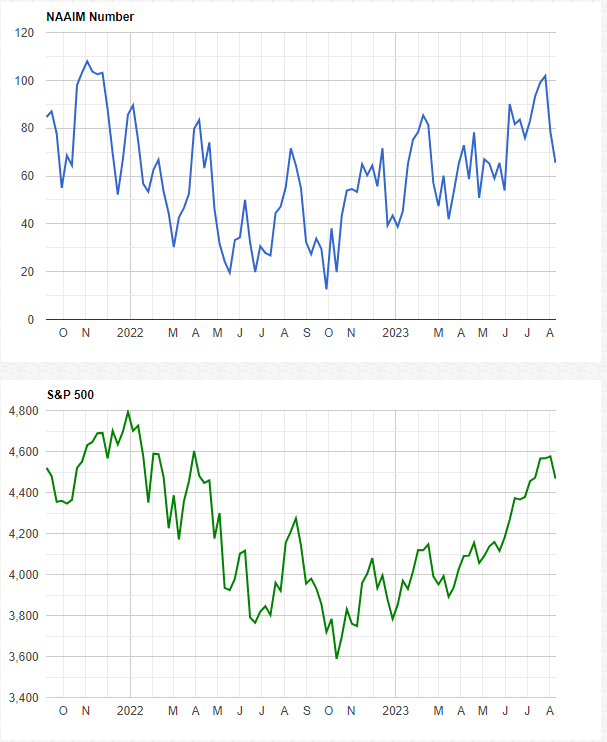

Quoting Real Money’s Helene Meisler, “nothing like price to change sentiment.” The AAII Sentiment Survey revealed a slight bearish turn, with bullish votes falling to 44.7%. Interestingly, active managers have sharply reduced equity exposure, marking the first sequential decline since February.

Volatility Risk and Potential Sell-Off

Goldman Sachs warns that positioning across volatility targeting strategies is at its peak, hinting at an asymmetric risk to the downside. A mere 1% move in the S&P 500 could be the catalyst for an “enormous” sell-off, according to Nomura. So far this year, the S&P has experienced 42 days of such movements.

Emerging Opportunities in Carbon Capture

Finally, the Department of Energy (DOE) is extending $1.2 billion towards carbon capture projects. This burgeoning technology, known as direct air capture (DAC), offers a path to net zero by extracting carbon dioxide from the atmosphere. Recipients of this funding, including Warren Buffett-favorite Occidental Petroleum, will develop DAC hubs that promise to capture over 2 million metric tons of CO2 annually.

Conclusion

From unexpected inflation numbers to the potential risks in volatility, the market’s pulse reveals a complex picture. The key for investors will be to interpret these signals accurately and align their strategies accordingly.

Safe Trading

Team of Elite CurrenSea

Leave a Reply