The Financial Mosaic: Understanding Employment Recession, Credit Card Surge, and Market Trends

Introduction: A Seemingly Paradoxical Economy

In a scenario that defies conventional wisdom, BlackRock, the world’s largest money manager overseeing more than $9.1 trillion in assets, warns of a potential “full employment recession.” Yes, that’s a scenario where the economy contracts, but everyone still has their jobs. In this post, we’ll dive into various factors that shape this complex picture, from credit card trends to small business optimism and more.

The Surge of the Plastic – U.S. Credit Card Usage

💳 Increasing Credit Card Adoption

Today, roughly 69% of Americans have a credit card, compared to 65% in December 2019 and 59% in December 2013. According to the New York Fed’s latest Household Debt and Credit Report, there are 700 million more credit card accounts than before the pandemic hit. Credit card balances have increased by 4.6% during the quarter, crossing the $1 trillion mark for the first time ever.

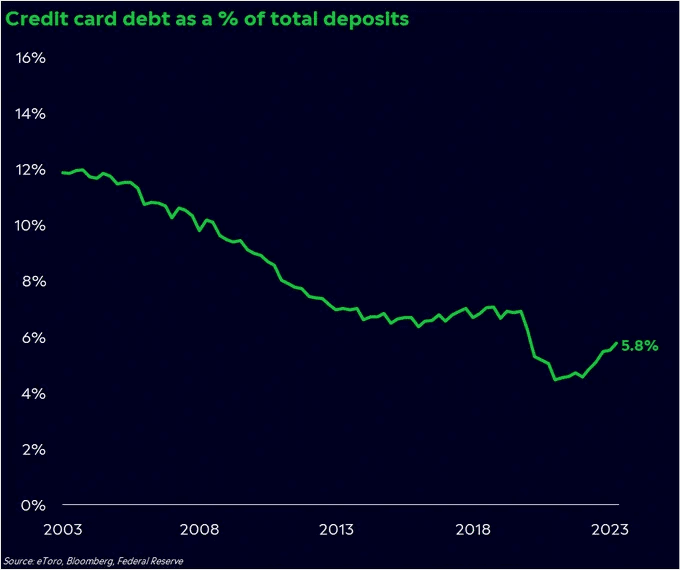

Low Debt Relative to Deposits

While the headlines may make it seem alarming, credit card debt as a percentage of total deposits remains historically low at 5.8%.

Small Business: A Brightening Horizon

🌥️ A Positive Trend in Optimism

NFIB’s Small Business Optimism Index has risen for three consecutive months, with July’s figure reaching 91.9 from 91 in June, the highest since November. Though the business outlook remains negative, expectations have reached the best level since August 2021.

Changing Concerns for Small Businesses

Inflation is no longer the most critical issue for small businesses, now replaced by the quality of labor. Plans to raise prices have dropped to their lowest since January 2021.

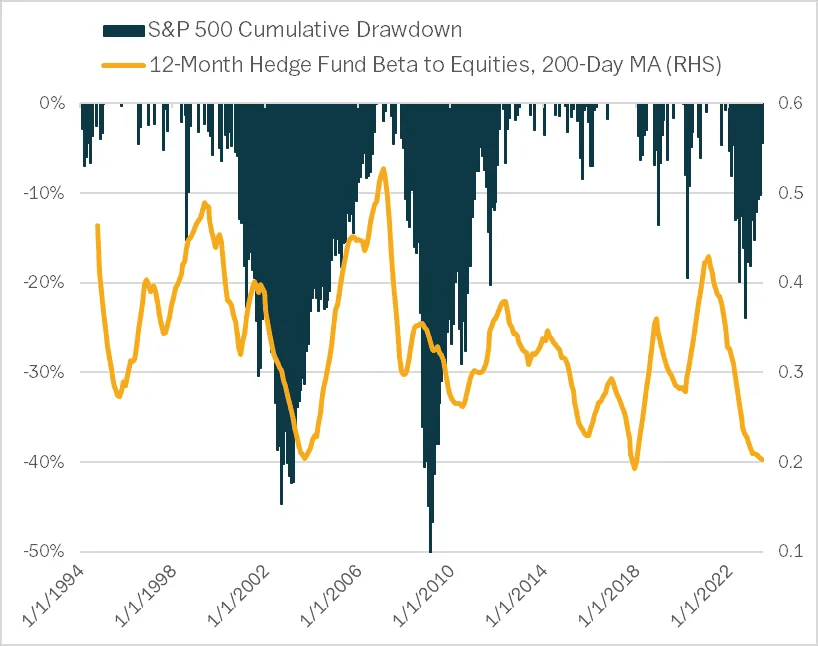

Investment Trends: The Equity Scene

🔍 Equity Positioning Among Investors

Investors are mostly overweight equities, with exposure levels showing aggregate equity positioning in the 70th percentile. Discretionary investors lead at the 68th percentile, while mutual funds and hedge funds remain underweight.

Credit Rating: Agencies Flexing Their Muscle

📉 Downgrades and Concerns

Less than a week after Fitch lowered America’s credit rating, Moody’s has expressed concerns over the country’s banks. The firm downgraded 10 small banks and warned of potential downgrades for larger lenders.

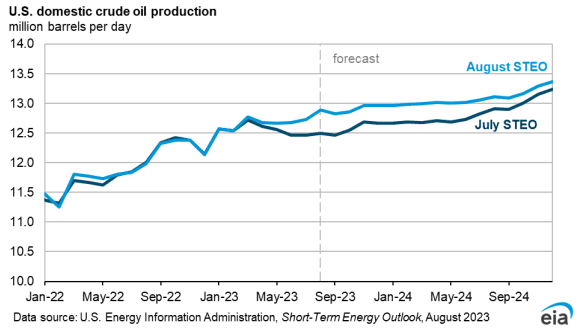

Oil Market Update: EIA’s New Predictions

🛢️ Revised Oil Price Forecast

The US Energy Information Administration (EIA) has revised its oil price forecast for the latter half of 2023, now expecting Brent to average $86 per barrel. The EIA predicts that oil production will average 12.8 million barrels per day (bpd) in 2023 before exceeding 13 million bpd by early 2024.

Conclusion: A Complicated Mosaic

The economic landscape presents a multifaceted picture, ranging from a rise in credit card usage without alarming debt levels, to increased optimism among small business owners, and dynamic equity and oil markets. Navigating this landscape requires vigilance and a nuanced understanding of these seemingly contrasting trends.

Safe Trading

Team of Elite CurrenSea

Leave a Reply