The Financial Forecast: U.S. Inflation, ARM’s IPO Spectacle, and Europe’s Rate Dilemma

In the ever-evolving financial landscape, this week offers some remarkable insights: from surprising inflation rates in the U.S. to ARM’s grand IPO entrance, and Europe’s rate-hike drama.

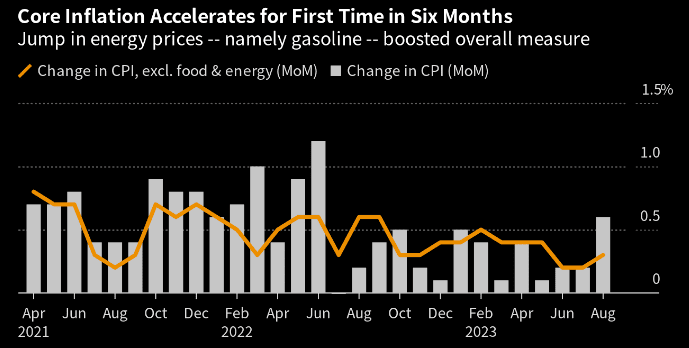

U.S. Inflation: An Unexpected Turn

The latest data is in, and it’s bringing some unexpected news. The U.S. Consumer Price Index has climbed to a sizzling 3.7% in August, beating the 3.6% predictions and significantly higher than July’s 3.2%.

On the Rise: Rent, motor-vehicle insurance, air travel, new-car prices, energy costs, especially gasoline which soared by over 10%, utility bills, and grocery prices, although at the slowest rate in two years.

On the Decline: Prices of used cars and, intriguingly, tickets to concerts and movies.

The Silver Lining: Shelter costs, comprising approximately 30% of the CPI, rose by a mere 0.3%, marking the smallest gain since early last year. If this trend holds, there’s hope for inflation to stabilize.

Insider Insight: The looming Federal Reserve meeting next Wednesday will be the focal point of many, especially with the rising pressure on them to adjust rates in response to this inflationary trend.

ARM’s $54B IPO: Setting the Stage for 2023

The tech giant ARM is set to make its grand entrance into the public domain. Expected to raise a commendable $4.9 billion, the company’s valuation is projected at a staggering $54.5 billion, surpassing all other IPOs this year.

Behind the Buzz: ARM’s chips are everywhere—from 99% of smartphones to cars and PCs. Moreover, their positioning in the burgeoning AI chip market offers substantial growth potential.

The Historic Perspective: Softbank’s failed attempt to offload ARM to Nvidia for $40 billion in 2020 might seem like a setback. Still, given today’s valuation, it might have been a blessing in disguise.

Insider Insight: Though the IPO market in 2022 hasn’t reached the blazing heights of 2021, ARM’s debut is undeniably the most anticipated this year.

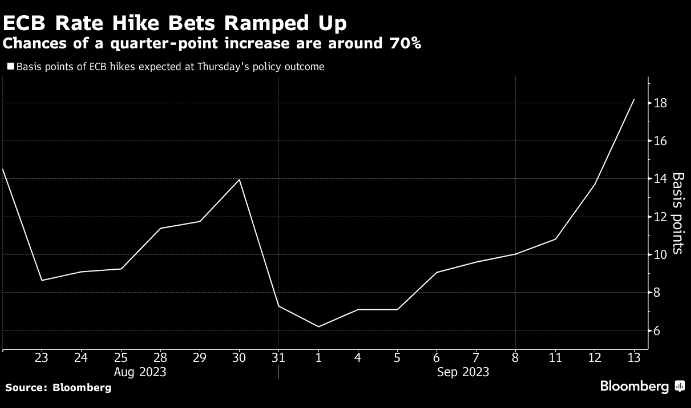

Europe’s Economic Crossroads: To Hike or Not To Hike

Today might be the day the European Central Bank opts for a rate increase, given that the likelihood now stands at a robust 70%, up from 20% just a month ago.

The Economic Landscape: Year-to-date growth stagnates at a mere 0.5%, inflation remains stubborn at above 3%, and the relentless oil prices only add to the fiscal strain. Additionally, the economic slowdown in China is impacting exports negatively.

Insider Insight: Both the U.S. and Europe grapple with the twin challenges of persistent inflation and stagnant growth, but Europe seems to be feeling the heat more intensely.

Safe Trading

Team of Elite CurrenSea

Leave a Reply