The Evolving Market Landscape: A Deep Dive

In a rapidly shifting financial landscape, understanding market nuances becomes paramount. Here’s an in-depth look at the prevailing economic narratives and the hidden tales they contain.

The S&P 500’s Valuation Expansion: Is it Sustainable?

Year-to-date returns for the S&P 500 are staggering, with over 86% coming purely from valuation expansion. Now trading at a forward P/E ratio of 19x, this surpasses the long-term average of 15.6x, and even the 17x we saw at the end of 2022. But is such an expansion sustainable?

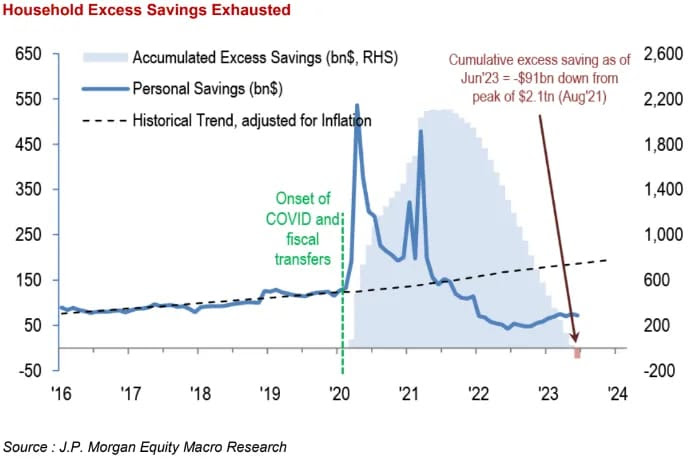

US Households: Reading Beyond the Headlines

The above chart has been making waves on social media lately. And with credit card debt crossing the $1 trillion mark for the first time, sensational headlines are abound. Yet, there’s more to the story. US household liquidity remains robust, with cash and checkable deposits nearing peak levels. Importantly, the doomsday predictions conveniently omit that these reserves are estimated to last until May 2024. Additionally, credit card delinquency rates mirror pre-Covid figures. In short, always season your news consumption with a pinch of discernment.

China’s Financial Conundrum

China’s local governments find themselves between a rock and a hard place. Sluggish revenues post-Covid and property sector downturns have left many struggling. Though financial regulators have championed more loans and the central bank has tweaked rates, these moves may not be the fiscal antidote China needs.

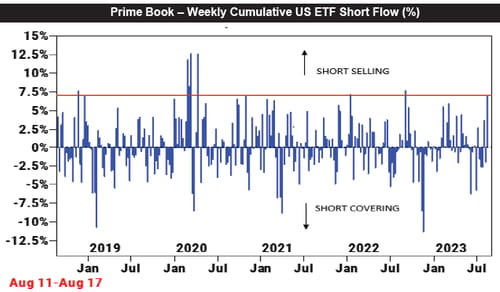

Hedge Funds: The Return of the Shorts

July saw extensive active de-grossing in hedge funds, mostly due to short covering. But now, risk appetite seems to be resurging. Goldman Sachs reveals an intriguing trend: over the past week, hedge funds have shorted US ETFs at an unprecedented pace, with short sales outnumbering longs nearly 1.6 to 1.

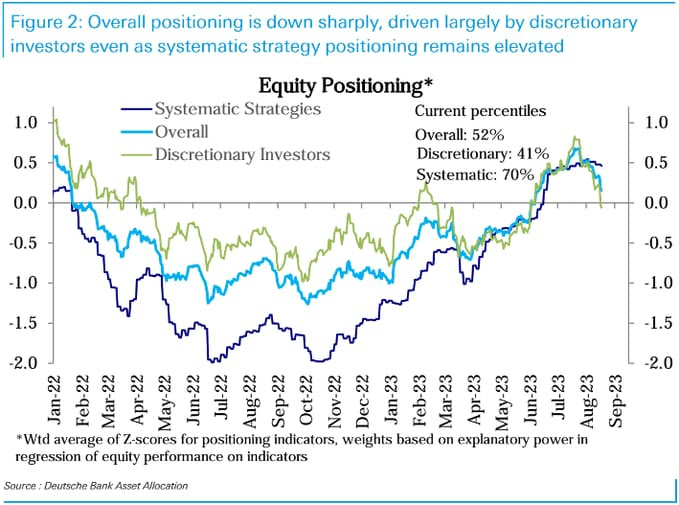

Equity Exposure: The Pullback

Discretionary investors are showing signs of caution, pulling back from equities. With total net call volume diving and put volumes spiking, US equity funds have witnessed $5.2 billion in outflows.

Oil Dynamics: Demand Meets Tightened Supply

With OPEC+ tightening its reins on supply, China is tapping into its record crude inventories. As demand remains steady, the pressure on supply could potentially steer oil prices upward.

Safe Trading

Team of Elite CurrenSea

Leave a Reply