The Economic Scene: Housing Woes, BofA’s Predictions, and OPEC’s Movements

In an economic climate marked by fluctuating trends and unforeseen shifts, the U.S. housing market, major financial institutions, and even global tech giants find themselves navigating treacherous waters.

The United States Housing Market Feels the Squeeze

With the typical U.S. homebuyer currently wrestling with a 20% hike in monthly payments compared to last year, the sting of high mortgage rates is causing noticeable tremors in the market. The steep rise is forcing sellers to retreat, sparking a staggering 19% drop in available homes, the most dramatic decline witnessed in a year and a half.

But that’s not all. The 30-year yield, a major influence on mortgage rates, is also climbing steadily.

Bank of America – Changing Course Amid Economic Headwinds

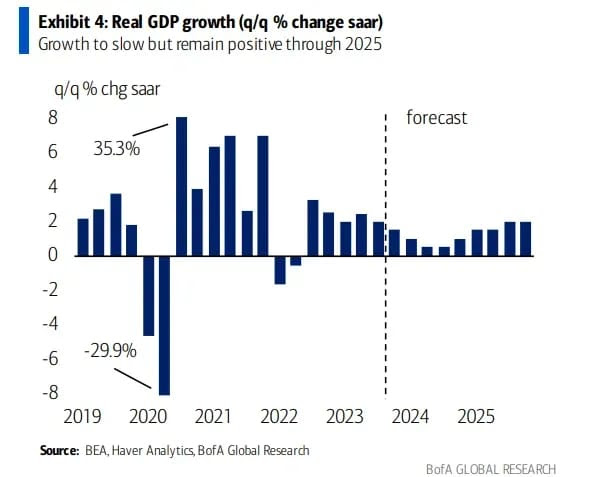

Top economists and Federal Reserve officials are not alone in their about-face on imminent recession warnings. Earlier this week, Bank of America (BofA) reversed its previous economic downturn forecast. Instead, the banking giant now projects a softer landing, with a 2% GDP growth rate for this year, followed by an expansion of 0.7% in 2024, and 1.8% in 2025.

Despite these hopeful revisions, BofA warns there’s still a long journey to bring inflation back to its target. It predicts PCE prices won’t drop to 2% until the second half of 2025 and anticipates the first rate cut in June 2024.

US Services Sector – The Sturdy Pillar Amid Recessionary Winds

In the face of numerous recession alarms, the US services sector has proven resilient. It stands as a pivotal battleground for the Fed’s ongoing struggle to rein in inflation. The sector, marking its seventh consecutive month of growth in July, did so at a slower pace than in June and under forecasted figures.

Despite this, inflationary pressures persist, as evidenced by the prices paid subindex surging beyond expectations. Still, these costs remain within their historical range.

Labor Productivity and Costs – A Balancing Act for Inflation

A surprise rise in productivity, coupled with a slowdown in unit labor costs, heralds potential relief from inflationary pressures. Labor productivity clocked its fastest growth since Q3 2020 last quarter, soaring at an annual rate of 3.7%.

Conversely, unit labor costs only grew by an annualized 1.6%, significantly below the predicted 2.6% and showing a significant decrease from the prior quarter’s 3.3% rise. This balance between increased productivity and decreased labor costs could help contain the effect of wage hikes on inflation.

Apple and Amazon – Charting Paths Through Turbulent Waters

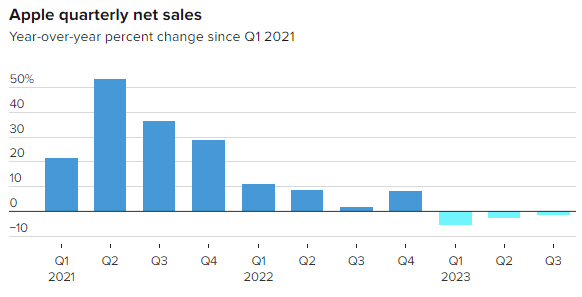

Apple exceeded low expectations for Q3, although the company’s revenue declined for the third consecutive quarter due to sluggish demand for phones, computers, and tablets. Despite a drop in annual sales across all categories, Services and Other Products reported growth.

Amazon, on the other hand, is reaping the benefits of aggressive cost-cutting and operational streamlining, posting its biggest earnings beat since Q4 2020, and returning to double-digit growth after a period of more modest expansion.

Oil Market Dynamics – The Saudi Lollipop Effect

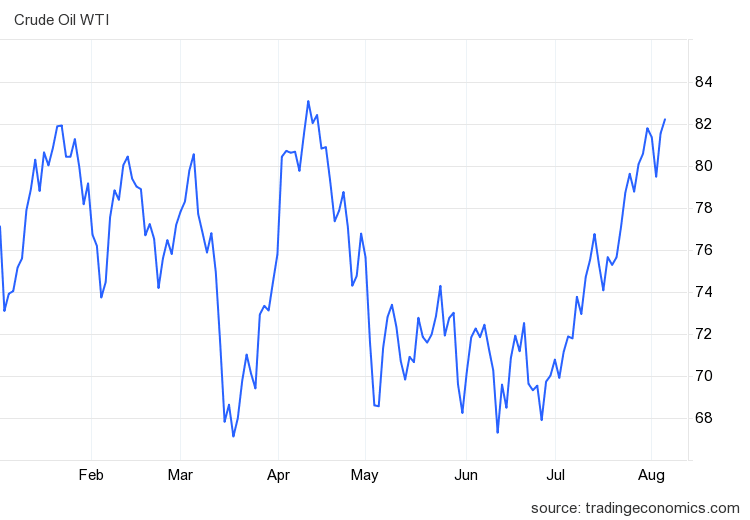

Saudi Arabia, the OPEC leader, extended its production cuts to September in a bid to support oil prices, which are hovering near year-to-date highs and poised for their sixth consecutive weekly gain, a trend not seen since early 2022.

Safe Trading

Team of Elite CurrenSea

Leave a Reply