The Dichotomy of U.S. Economic Indicators: What You Need to Know

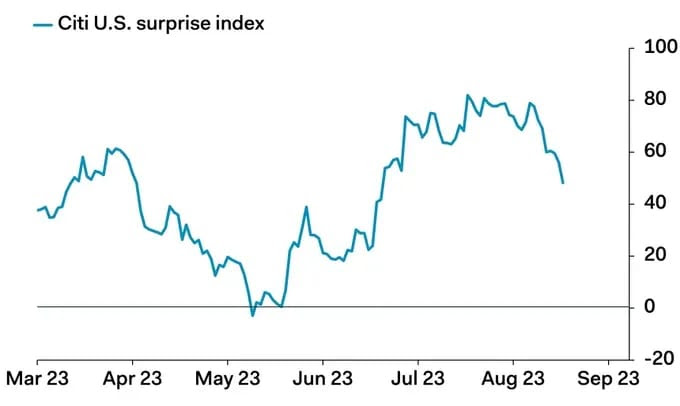

As we find ourselves navigating the late summer of 2023, an air of cautious optimism permeates the financial markets. Encouraging economic data is being met with open arms, yet a deeper dive reveals potential reasons for concern. The situation appears to be a double-edged sword, as dissected below.

The Cooling Labor Market

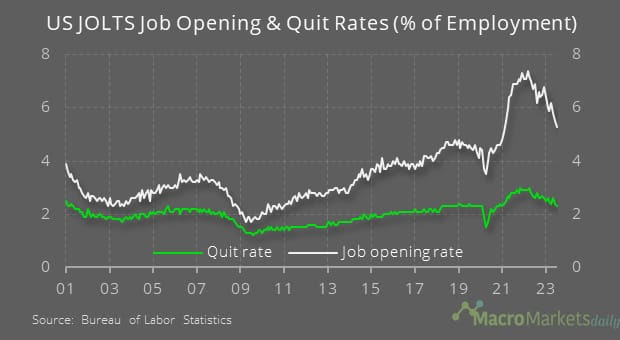

Recent data from the U.S. Labor Department suggests that the employment landscape is undergoing a transformation. Job Openings and Labor Turnover Survey (JOLTS) data for July reveals 8.8 million job openings, a dip from market expectations of 9.4 million and the lowest count since March 2021. This marks the third consecutive month of decline, shedding over 2.5 million job openings, a historically significant contraction. Furthermore, the “quits” rate has realigned itself with pre-pandemic levels, which might indicate a stabilization or stagnation, depending on your point of view.

The Resilience of the U.S. Housing Market

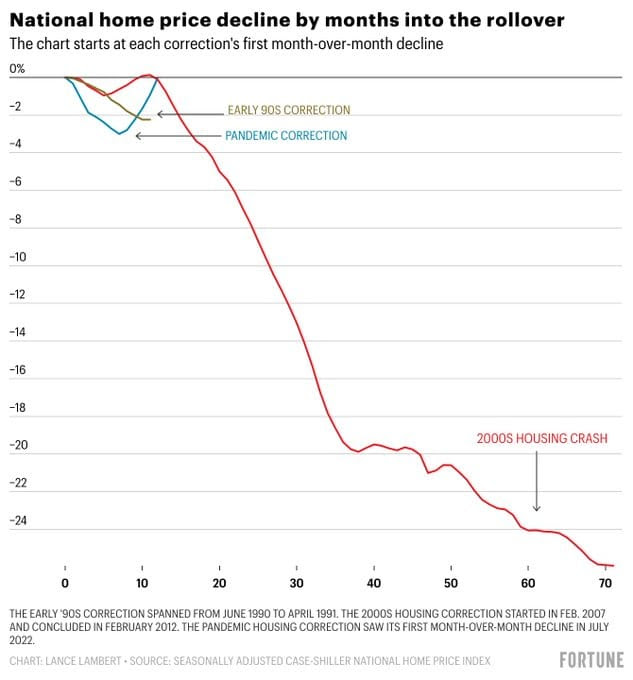

Amid this employment uncertainty, the U.S. housing market shows an unexpected resilience. According to the Case-Shiller National Home Price Index, values in the 20 largest U.S. cities continued their upward trajectory for the fifth consecutive month in June. Year-on-year, there’s been a 1% drop, but the index is merely 0.02% away from the all-time high set in June 2022. Interestingly, the current trend suggests that the housing market recovery is outpacing historical benchmarks.

Crypto Wins a Round Against the SEC

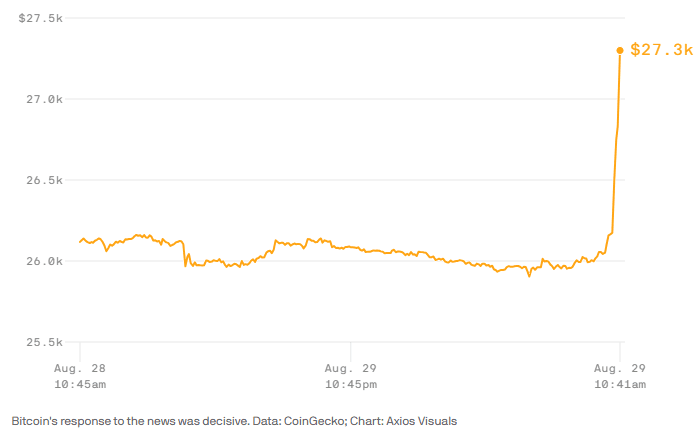

In what might be considered a milestone moment, a D.C. circuit court recently overturned the Securities Exchange Commission’s (SEC) decision to deny Grayscale’s Bitcoin ETF proposal. The court labeled the SEC’s rationale as “incoherent,” sending ripples across the crypto markets. Bernstein estimates that Bitcoin ETFs could constitute 10% of the crypto market value within three years if allowed to proceed.

Google’s Foray into Corporate AI

Hot on the heels of OpenAI’s release of ChatGPT Enterprise, Google is entering the arena with a suite of AI-powered tools aimed at corporate clients. Priced at $30 per month per user, Google’s offerings serve as direct competition to Microsoft’s AI-powered Microsoft 365 tools. The suite also includes access to other AI innovations, presenting a diversified range of options for businesses.

Oil Inventories in Flux

In a surprising development, U.S. crude oil inventories plummeted by 11.5 million barrels in the week ending August 25, significantly exceeding the expected 2.9 million barrel decline. With Hurricane Idalia on the horizon, targeting regions that account for significant portions of U.S. oil and natural gas production, this trend may not be a one-off incident.

Closing Thoughts

As we step into the fall of 2023, the U.S. economy seems to be at a complex crossroads. While there are signals of cooling in the labor market, other sectors like housing and cryptocurrencies offer glimmers of resilience and opportunity. How these contrasting dynamics will play out remains to be seen.

Safe Trading

Team of Elite CurrenSea

Leave a Reply