The Bull, The Mouse, and The Sun: A Comprehensive Look at July’s Financial Landscape

As we navigate the whirlwind financial landscape of 2023, it’s clear that this year is shaping up to be one of significant shifts and surprises, from the Fed’s unrelenting stance on interest rate hikes to the Nasdaq’s impressive start, and a new epoch in renewable energy.

The Market’s Pulse: Unemployment and The Fed’s Determination

In an unexpected turn of events, new filings for unemployment benefits took a downward plunge by 12,000 to 237,000 last week, contradicting the anticipated increase to 250,000. However, the rising four-week moving average, which marked a 12.5% increase for the fourth consecutive week, serves as a cautionary sign. The Federal Reserve, unperturbed by the labor market’s complexities, remains steadfast in its plan to raise interest rates by 25 basis points.

The Wage Paradox: Lower Unemployment but Slowing Wage Growth

Despite the unexpected dip in unemployment, wage growth tracked by the Atlanta Fed showed a subtle deceleration. While wage growth remains significantly higher than pre-pandemic levels, this drop, witnessed both among job-switchers and job-stayers, could potentially assuage some of the Fed’s inflation concerns.

Producer Prices and Their Subtle Impact

June witnessed a less-than-anticipated rise in both headline and core producer prices, presenting a stark contrast to the otherwise turbulent year. The Consumer Price Index (CPI) report’s positivity coupled with the dip in producer prices provides the Fed with a compelling argument to reconsider the frequency of their rate hikes.

Bob Iger’s Strategic Playbook: A Disney Revolution

Disney’s on-again-off-again CEO, Bob Iger, hinted at potential strategic shifts for the company. After having his contract extended, Iger is considering selling or spinning off some of the company’s linear TV assets, including Disney Channel, ABC, and FX networks, while keeping options open for a strategic partnership or ownership stake in ESPN.

Prime Day Sales: Amazon’s Record-Breaking Feat

Amazon’s Prime Day turned out to be the single largest sales day in the company’s history. Despite the numbers falling short of sales growth expectations, the record-breaking spending of $12.7 billion over two days led to a 2.5% rally in shares.

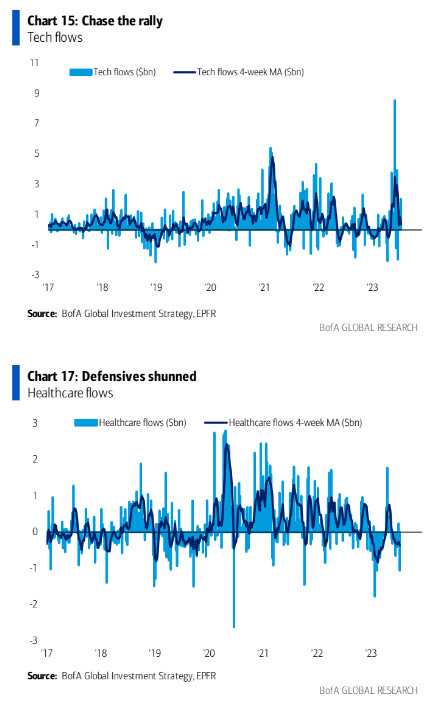

The Global Equity Flow: BofA’s Analysis

Global equities have seen an accelerated inflow over the past seven weeks, with the technology sector leading the way, as reported by the Bank of America. This surge, however, saw an outflow led by the healthcare sector.

The Rise of Green Energy

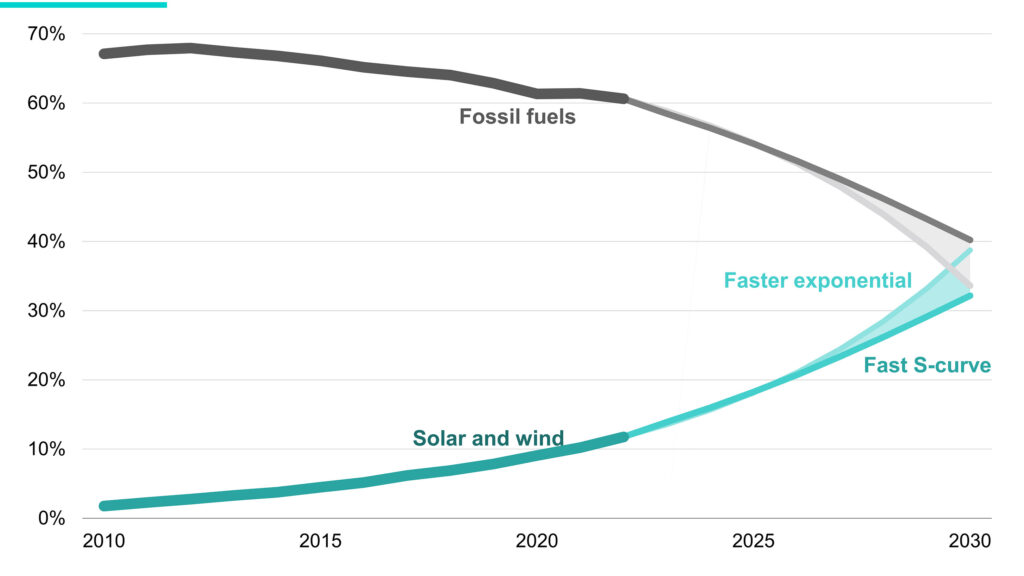

According to a new report by the Rocky Mountain Institute, wind and solar energy are projected to generate more than one-third of the world’s electricity by 2030. This is a result of a predicted annual growth rate of 15-20% for these energy sources for the rest of the decade.

Safe Trading

Team of Elite CurrenSea

Leave a Reply