Tech Tides: U.S.-China Tech Race, Financial Shocks, and Musk’s Starlink Stance

In a world rapidly being reshaped by technology, the U.S. and China find themselves at the forefront of a new “technology race”, while Wall Street grapples with fluctuating treasury yields and Elon Musk faces geopolitical scrutiny.

U.S. vs. Huawei: The Underlying Tech Battle

According to sources like Bloomberg, the U.S. Commerce Department has recently announced an investigation into Huawei’s new smartphone chip—a piece of groundbreaking tech made entirely in China. This comes after several restrictions were placed on Huawei and China over the past couple of years, aimed at hindering technological advancements in such areas.

Despite these restrictions, Huawei discreetly unveiled a phone with technology many believe the U.S. wanted to keep out of China’s reach. This move puts a dent in the diplomatic efforts of the Biden administration. Following this news, Chinese semiconductor stocks experienced a whopping 20% increase, likely due to speculations of the Chinese government’s heightened support. On various Chinese social media platforms, Huawei’s chip is seen as a testament to the nation’s resilience against American policies.

Insight: Just as the “space race” of the 1960s captured the world’s attention, the U.S. and China now stand at the threshold of a “technology race”. The debate in Washington DC will intensify around the effectiveness of the Commerce Department’s sanctions against Chinese technology, especially given the timing of China’s smartphone reveal.

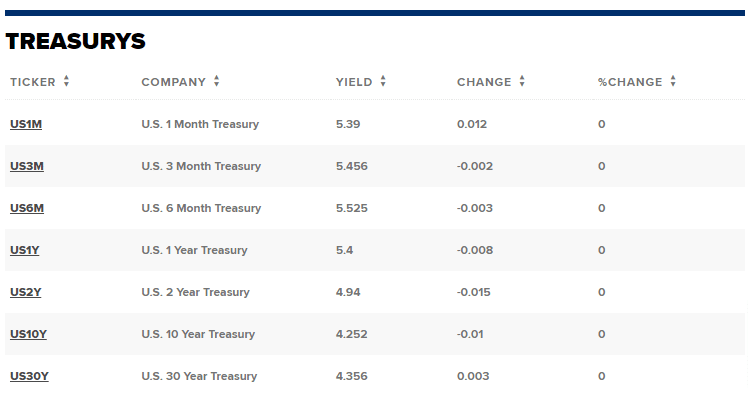

Treasury Yields: Investors in a Bind

Per CNBC, U.S. Treasury yields witnessed a dip on a recent Friday morning. This trend emerges amidst growing concerns from investors about the likelihood of further interest rate hikes, given the recent economic data.

With a multitude of economic indicators being considered, the persistence of inflation and an uneasy labor market are on the forefront. Reports have shown a notable drop in jobless claims, coupled with an unexpected rise in labor costs for Q2. Amidst these fluctuations, the underlying concern revolves around the Federal Reserve’s future moves concerning rate hikes.

Insight: The potential for persistently high or even increasing rates is causing anxiety among investors. History has shown that such economic dynamics often lead to downturns, affecting both businesses and consumers.

Elon Musk’s Starlink Dilemma in Ukraine

In a twist of geopolitical entanglements, Elon Musk finds himself in the midst of a controversy. Ukraine has expressed its displeasure with the tech mogul’s decision to deactivate the Starlink satellite network over Crimea. Originally, 500 Starlink terminals were provided by Musk to support Ukraine at the conflict’s onset, but this stance quickly shifted. Musk’s rationale? “Starlink was not meant to be involved in wars…”

Insight: As Musk continues his endeavors to revolutionize tech, the ramifications of his products and decisions on global politics become increasingly evident.

Market Glimpse: What’s Next?

With so many variables at play, will the stock market conclude in losses this week? Noteworthy earnings reports from Kroger and NAAS Tech are anticipated.

Visual Insights: Three Charts Steering Today’s Conversations

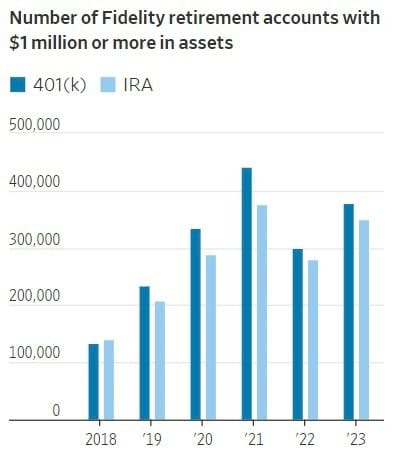

Fidelity’s Million-Dollar Accounts Bounce Back

The number of Fidelity accounts holding $1 million or more have seen an encouraging rise in 2023, making a resilient recovery from the slump in 2022.

Insight: Such rebound patterns can often be indicative of broader market optimism and the efficacy of wealth management strategies.

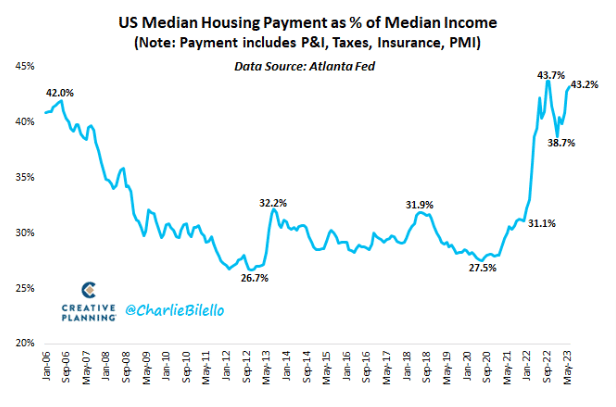

Skyrocketing Housing Payments

The U.S. Median Housing Payment as a percentage of income has ascended to alarming peaks, mirroring figures last seen in 2006.

Insight: Historically, spikes in this ratio have often preceded financial strain in the housing market. The escalating costs, relative to income, might hint at potential affordability challenges for average American households.

The Surge in Orange Juice Futures

The futures market for orange juice has witnessed significant upward momentum recently. With predictions of an intense hurricane season ahead, there’s speculation that this chart is only set to soar even higher.

Insight: Natural disasters have a cascading effect on commodity prices. A turbulent hurricane season could disrupt supply chains, leading to increased prices for commodities like orange juice.

With these charts in focus, investors and market enthusiasts can gain a deeper understanding of current economic trends and their potential implications. Whether it’s the resilience of investment accounts, the strain in the housing market, or the volatility of commodity prices, visual data provides a clearer snapshot of the market’s pulse.

Safe Trading

Team of Elite CurrenSea

Leave a Reply