Tackling The Financial Tempest: Unpacking The Latest in U.S. Economy

Navigating the complexities of modern finance, today we delve into the pressing matters of a potential Fed rate hike, the record $33 trillion U.S. debt, and the concerning descent of U.S. housing starts.

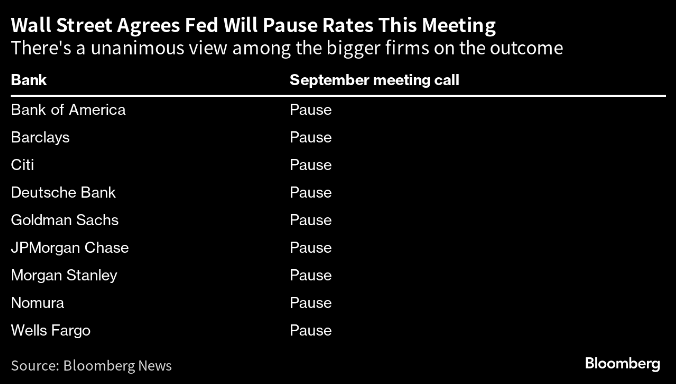

Odds Against a Rate Hike

Despite growing speculation, the chance of a Fed rate hike today remains slim at just 1%. With most predictions hovering around a steady hold at 5.5%, the looming indicators can be categorized under:

- Hawkish Indicators: Persistent inflationary growth, a marked surge in oil prices, and a resilient retail sector.

- Dovish Indicators: A lagging employment sector and heightened concerns about the housing market.

Recent events, including potential strikes and government shutdowns, further cloud the economic horizon.

Insight: An additional rate hike before the close of the year might be prudent, especially considering inflationary trends observed globally.

U.S. Debt’s Staggering Rise to $33 Trillion

In the span following the resolution of the debt ceiling crisis, the national debt has grown by an alarming $3 trillion. This is paired with an equally startling 50% federal spending increase from 2019 to 2021.

The Burden of Rising Interest Rates Interest rates are experiencing their most considerable escalation since 2009, causing the debt service costs to rise concurrently.

A Fiscal Challenge Ahead The downward trajectory of federal tax receipts coupled with the surging deficit calls for a financial strategy re-evaluation.

Insight: If we were to equate the U.S. with a corporate entity, this financial trajectory would demand an immediate leadership revamp and strategy overhaul.

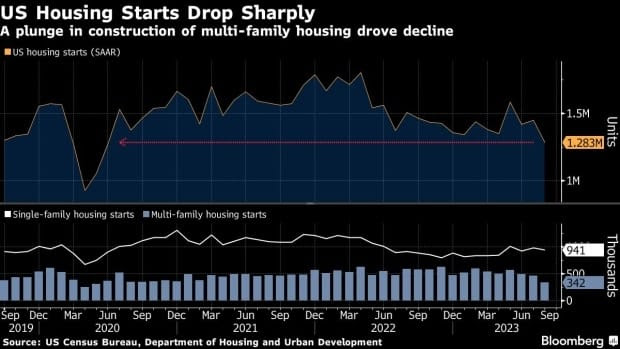

Housing Starts at Their Lowest Since 2020

Data reveals a concerning 11.3% drop in U.S. housing starts, pointing to a significant disparity between housing demand and supply.

The Dilemma of Low Supply & Rising Costs Current mortgage rates, having risen above 7%, are causing housing to become increasingly unaffordable.

Insight: These rapid interest rate hikes suggest the need for caution. The evident trends are more than mere markers; they hint at potential underlying issues that might have broader economic implications.

Upcoming Economic Decisions

- A pivotal decision from the FED awaits this Wednesday.

- The Bank of England’s decision is expected on Thursday.

- Friday sees the Bank of Japan making its rate announcement.

Safe Trading

Team of Elite CurrenSea

Leave a Reply