Shaping the US Economic Landscape: From Rolling Recession to Rolling Recovery

In a world of perpetual change and adjustment, the U.S. economy’s trajectory provides an intriguing narrative, recently transitioning from what experts term a ‘rolling recession’ to a burgeoning ‘rolling recovery.’

The Transformation: Navigating a Rolling Recovery

Economic virtuoso Ed Yardeni posits a seismic shift in the U.S. economic terrain, steering it from what he calls a “rolling recession” to a flourishing “rolling recovery.” This declaration comes as key sectors, including residential real-estate, emerge from an extended slowdown that lasted eight consecutive quarters.

The Bright Spot: Residential Real-Estate Bounces Back

Highlighting this turning point was the residential real-estate sector, which saw a sharp surge of 12% in new home sales in May. This upswing marks a hopeful and highly anticipated return to growth after a lingering recession.

FOMC’s Stance: Seeking Unity Amid Differences

June’s FOMC minutes bring mixed sentiments to the fore, showing a consensus on the recent pause but revealing emerging divisions within the committee. Federal Reserve Chair Jerome Powell faces the growing challenge of keeping the FOMC united in the upcoming months as voices advocating for additional rate increases gain traction.

Student Loans: Temporary Reprieve on the Horizon

The issue of student loan debt continues to mount. With the looming threat of payment resumption, 20% of borrowers are set to struggle, according to the Consumer Financial Protection Bureau. In a bid to mitigate the impending crisis, the Biden administration has put forth new provisions aimed at offering borrowers more flexibility.

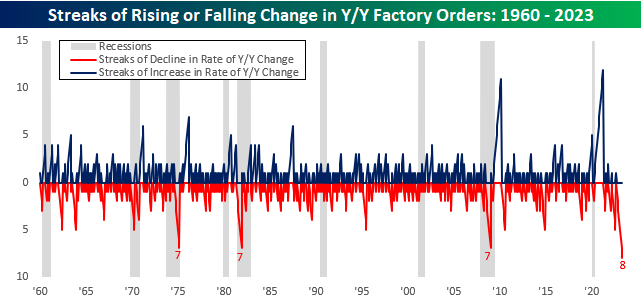

Manufacturing Woes: Factory Orders Underwhelm

Factory orders in May missed the mark, registering a meager 0.3% rise against an expected 0.8% increase. Excluding transportation, orders recorded their 4th consecutive monthly decline. Higher interest rates by the Fed seem to have left a clear imprint on demand..

Auto Sales: Surge in Pent-Up Demand

The auto industry in the US is experiencing a whirlwind of better-than-expected sales due to years of pent-up demand. Boosted by improvements in semiconductor supply and refined supply chains, automakers are posting strong Q2 sales numbers.

AI Development: A Dip in ChatGPT’s Popularity

Despite the ongoing AI hype, OpenAI’s ChatGPT is witnessing a slump in attention, marked by a 38% fall in downloads in June. This coincides with a legal battle sparked by authors accusing OpenAI of using their books to train ChatGPT without consent.

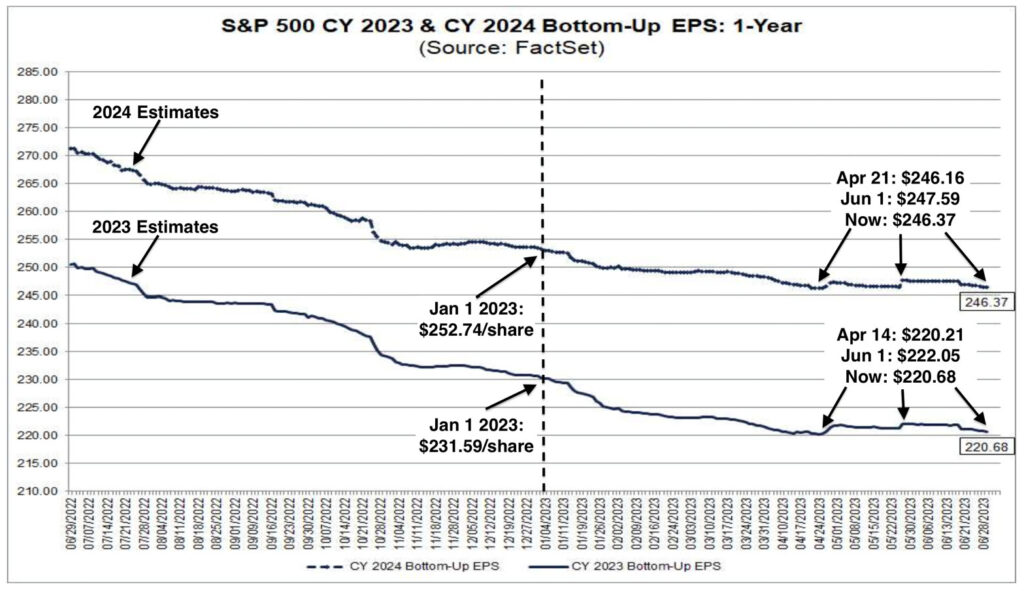

Stock Market Optimism: Wall Street’s Biggest Bull Raises S&P 500 Target

In the realm of stock market predictions, Fundstrat’s Tom Lee—Wall Street’s biggest bull—has upped his S&P 500 price target from 4,750 to 4,825. This suggests a projected upside of approximately 9%.

Safe Trading

Team of Elite CurrenSea

Leave a Reply