Redefining the Market: U.S.-China Tech Tensions, Gambling Partnerships, and More

As we dive into the most recent financial reports, July’s CPI numbers show a mixed bag on inflation, while new executive orders and industry shakeups reveal an evolving landscape in technology and entertainment. From the White House’s measures on Chinese investment to the reshuffling in the gambling industry, let’s explore what these changes mean for investors and the economy.

Inflation’s Mixed Messages

July’s CPI report unveils a +3.2% Y/Y inflation rate, falling slightly short of the expected 3.3% but up from June’s 3%. The Federal Reserve, with Jerome Powell at the helm, aims for 2%, and we’re still not on target.

U.S. Takes a Stand Against Chinese Tech

Subduing Investments in China

President Biden has signed an executive order limiting U.S. investments in specific Chinese technologies, such as military, quantum computing, semiconductors, AI, and cyber capabilities. Targeting mainly startups and firms generating over 50% of revenue from restricted sectors, the order aims to fortify national security against potential threats. Implementation is due next year, alongside mandatory reporting of investment activities in the region.

China’s Retort

China, understandably, didn’t take kindly to this move. Accusing the U.S. of “artificially hindering” global trade, China’s Commerce Ministry called for respect for the market. Labeling the investment restrictions as “economic coercion and technological bullying,” China has hinted at potential reciprocal actions.

Disrupting the Smartphone Industry

Mode Mobile, one of America’s fastest-growing companies, is about to change how we view smartphones. With 150x revenue growth from 2019 to 2022, Mode is launching the “EarnPhone,” enabling consumers to earn & save through activities like music, games, and even charging. Investors are clamoring for shares in this Pre-IPO Equity Offer.

Changes in the Gambling Industry

Penn Entertainment and Barstool Sports have parted ways after a $550 million partnership, with Barstool bought back for just $1. Penn’s new alignment with ESPN in a $2 billion, 10-year deal marks a fresh start for the company and a new revenue stream for ESPN/Disney.

Coinbase Breaks New Ground

Coinbase, the crypto giant, has launched its Base blockchain, becoming the first publicly-traded company to create its distributed ledger technology. Built on Ethereum, Base facilitates various crypto functions, boasting a pipeline of 100 dapps.

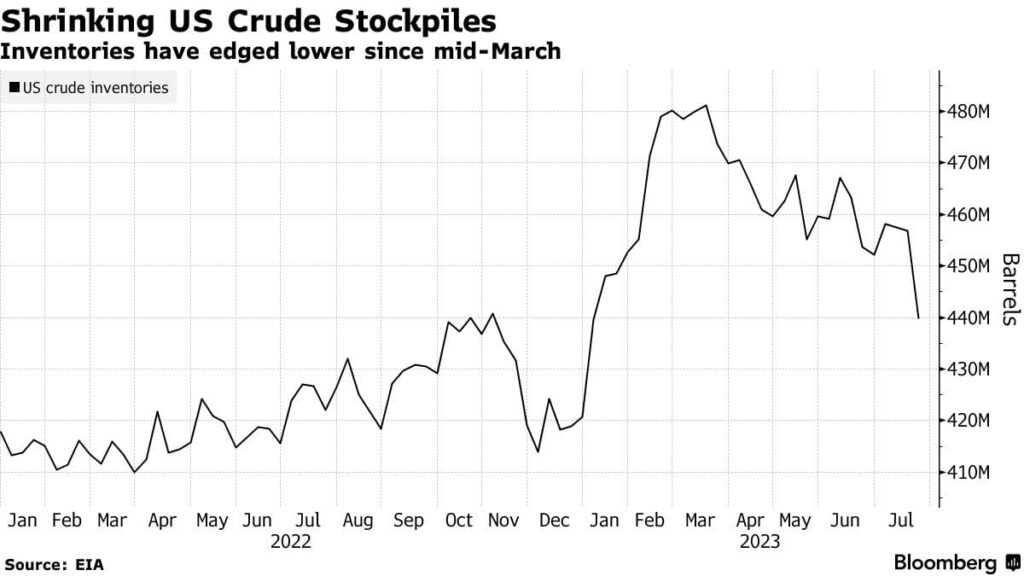

Oil Market’s Steady Climb

Oil prices have reached new YTD highs, spurred by concerns over supply outweighing demand. U.S. crude inventories have declined for nearly five months, aiding energy stocks and exploration and production firms to emerge as this quarter’s top performers.

Conclusion

The complexities of July’s market dynamics underscore a financial world in flux. With changes in inflation, a stern stance on Chinese technology, disruptions in smartphones, shakeups in gambling, innovative strides in crypto, and shifts in the oil market, the economic terrain continues to evolve.

Safe Trading

Team of Elite CurrenSea

Leave a Reply