Q2 Earnings – The Wake of an Unpredictable Storm

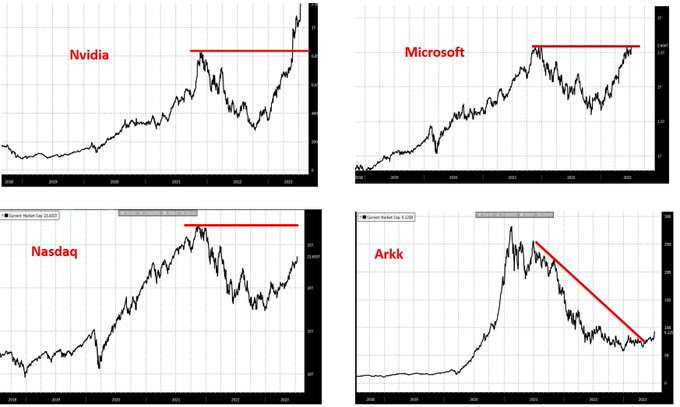

As we look back on the last quarter, we notice an unmistakable pattern – earnings day moves 3.6x the average daily move. It leaves us with a burning question – are we expecting a similar trend this season?

China’s Economic Rebound – A Disappointment in Disguise

Our eyes then turn towards the East where China, the world’s second-largest economy, projected a promising economic rebound. Unfortunately, the reality has been underwhelming.

The GDP’s meager growth of just 0.8% in Q2, propelled by lackluster retail sales and a decline in private sector investment, resulted in an annual economic growth of just 6.3%, falling short of the 7.3% forecast. A combination of deflation, a +20% youth unemployment rate, and a significant drop in property investment are to blame for this economic deceleration.

The Recession Shuffle – Economists Retract Predictions

Meanwhile, economists are recalibrating their recession expectations. A recent WSJ poll reveals that the chance of a recession occurring within the next year dropped to 54% from an initial 61%, marking the largest decline since August 2020. The decline in inflation and a clearer path to economic recovery have sparked this newfound optimism.

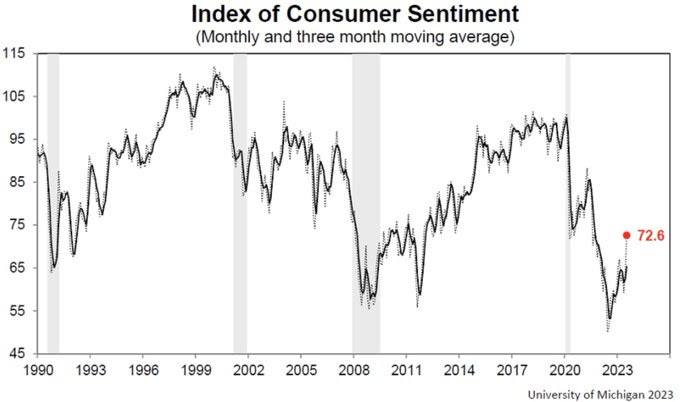

Consumer Confidence – A Ray of Sunshine Amid Economic Clouds

Economists are not alone in their optimism. The University of Michigan’s Consumer Sentiment Index for July marked its highest level since September 2021. The surge in consumer sentiment, the most significant since 2006, is propelled by declining prices and a robust job market. On the flip side, inflation expectations saw a marginal increase to 3.4% from 3.3%.

JPMorgan – Banking on Success Amid Unprecedented Times

American banking giant JPMorgan posted record quarterly profits in Q2 with a net income of $14.5 billion, a 34% YoY increase in revenue. This was driven by solid loan growth and higher interest rates, leading to a 44% rise in net interest income. The bank increased its 2023 net interest guidance for the third time to a whopping $87 billion.

ARK Innovation ETF – A Struggling Titan

Once the talk of the town following its historic post-Covid rally, ARK Innovation ETF ($ARKK) is grappling with investor retention. The fund has seen $717 million in net redemptions over the last year, cutting its assets under management (AUM) by approximately 2/3 to ~$9 billion.

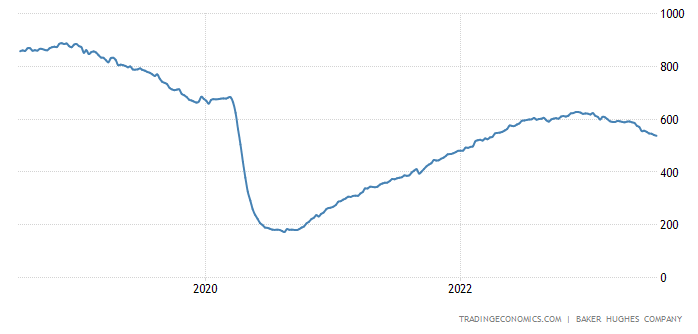

The Baker Hughes Indicator – A Dip in Future Output

The Baker Hughes oil & gas rig count, a leading indicator of future output, recorded its 10th drop in 11 weeks. Total oil rigs are now at their lowest since April 2022. This decline is primarily driven by falling oil prices.

Safe Trading

Team of Elite CurrenSea

Leave a Reply