Parsing Mixed Economic Signals: What Investors Need to Know

In an economy rife with conflicting signals, understanding the nuances of key indicators like GDP, GDI, and labor market trends is more crucial than ever. This comprehensive analysis delves into what’s really happening in the U.S. market landscape.

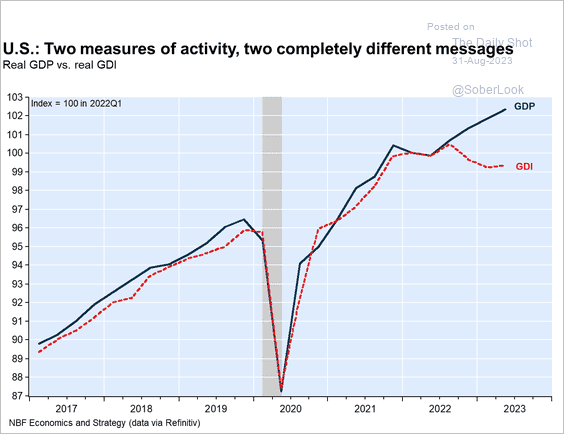

Why the Mismatch between GDP and GDI?

You’ve heard it before: Gross Domestic Product (GDP) and Gross Domestic Income (GDI) should theoretically measure the same economic output. Yet, recent data paints different pictures, leaving market participants scratching their heads. Let’s dive into what’s causing this incongruity.

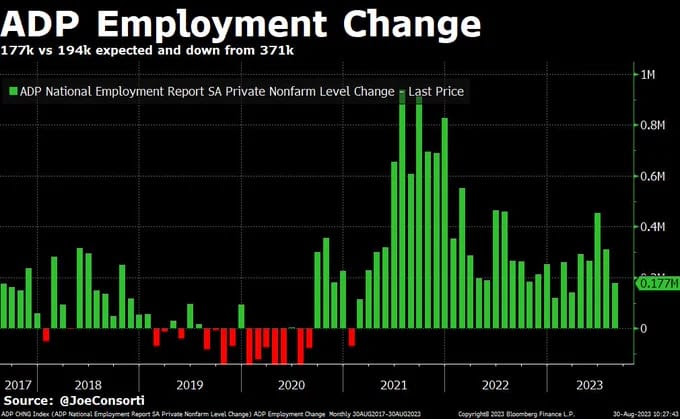

A Cooling Jobs Market: What the Data Tells Us

The August jobs report revealed that U.S. private businesses hired 177,000 workers, falling short of the estimated 194,000 and marking a sharp decline from July’s revised figure of 371,000. The ADP data dovetails with the JOLTs figures released on Tuesday, indicating a sudden slowdown in labor demand. The good news? Markets seem to appreciate the cooler job market, seeing it as a sign that the Federal Reserve might hold off on raising interest rates.

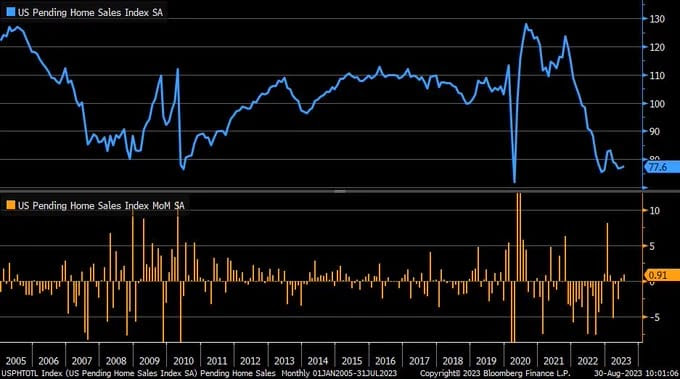

The Resilient Housing Sector: Defying Expectations

In contrast to the jobs market, the housing sector appears to be on firmer ground. Pending home sales for July increased by 0.9%, outpacing expectations of a -0.6% decrease. This upward trend might indicate a reversal in the trajectory of existing home sales, which have fallen in 10 of the past 12 months.

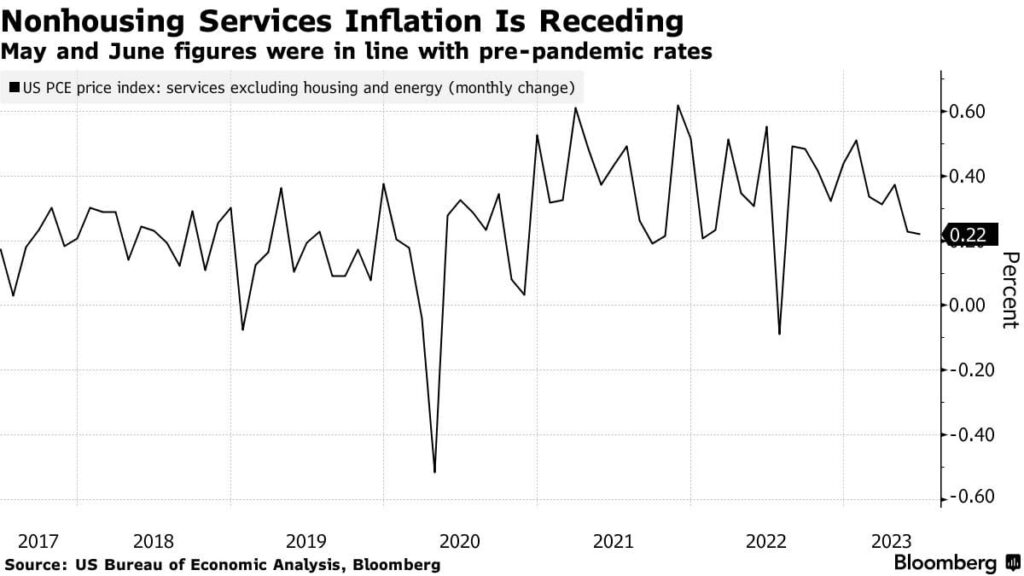

The Inflation Conundrum: Rising Stocks and the PCE

Jerome Powell recently highlighted that a specific component of the Personal Consumption Expenditures (PCE) index, services excluding housing and energy, has been rising modestly but is expected to spike due to the recent surge in stock prices. As stock valuations rise, so do the costs of portfolio management services, which are included in this measure.

The Hidden Costs of Swiping: Fee Hikes from Visa and Mastercard

Both Visa and Mastercard have announced plans to hike fees for merchants accepting their credit cards, starting in October and April respectively. The potential downstream effect for consumers is an increase in retail prices, as businesses look to offset these higher costs.

The Global Oil Landscape: U.S. Inventories and OPEC+

While OPEC+ is mulling over extending production cuts, the U.S. experienced a whopping 11.5 million-barrel drop in oil inventories last week, drastically outpacing the estimated 2 million barrel decline. This shift might lead to adjustments in output and possibly reverse recent declines in WTI prices.

Safe Trading

Team of Elite CurrenSea

Leave a Reply