OPEC Cuts Oil Prices, What Does it Mean for WTI & Your Trading?

OPEC+’s supply cut – and the resulting oil price spike – was completely unexpected, and served as a clear reminder of how uncertain the current macroeconomic environment is. With so many potential paths for the economy, the best thing you can do is diversify your assets to give yourself a better chance at surviving multiple scenarios. So make sure you aren’t just holding stocks, and consider treasury bonds (to protect against a hard landing), gold (to protect against a stagflationary scenario), commodities (to benefit from reflation), and a small amount of bitcoin (to protect against the unintended consequences of monetary and fiscal stimulus).

OPEC+ announced a surprise cut of 1.66 million barrels of output per day from May until the end of the year, sending shockwaves through global oil markets. While the group cited its need to “support the stability of the oil market” as motivation, the move came during a period of decent market fundamentals and relatively high oil prices. The decision caught the world off guard and resulted in oil prices boasting their biggest daily gain in over a year. The price of shorter-term contracts also rose above that of longer-term ones for the first time since December, indicating that traders are worried about the risk of supply falling below demand.

What’s The Logic Behind Oil Prices Cut?

Several factors could be driving the cartel’s decision. It might want to show the US that the world doesn’t revolve around the land of Red, White, and Blue anymore, a possible sign of retaliation after US officials recently ruled out fresh crude oil purchases to replenish the country’s Strategic Petroleum Reserve. The cut could also be a reminder to short-sellers about the risks of betting against falling prices, or a simple attempt to fatten up its revenue so the group’s members can splash out on other projects. Or maybe it’s anticipating such a drop in demand that it wants to pre-emptively limit the downside in prices.

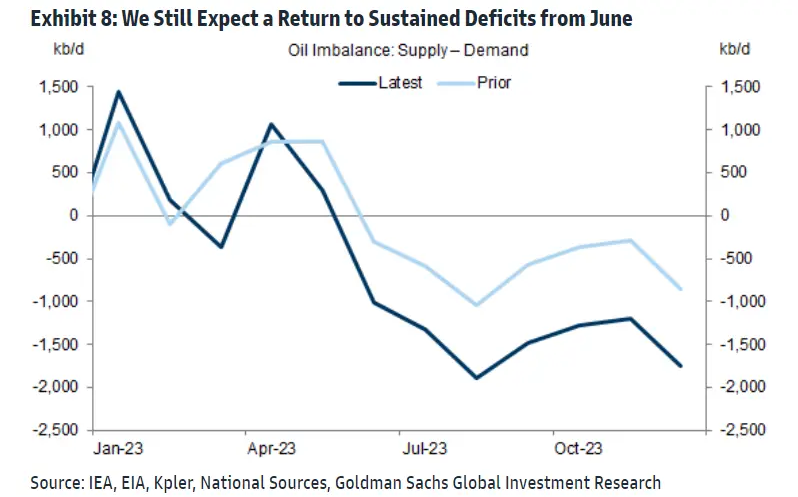

The reality’s probably a mix of all those explanations, but in any case, the end result is the same. Oil prices are likely to stay propped up in the near term, but probably won’t shoot the lights out – unless the global economy gets a lot stronger. The cut should suck the surplus supply out of the market, in turn pushing world oil markets into a deeper deficit later this year. The gap’s likely to widen over the rest of the year, fueling prices as a result.

OPEC+’s output slash is probably a harbinger of weaker demand. Historically, supply-driven deficits haven’t lit a fire under oil prices in the same way as demand-driven ones. That’s why the base case scenario here looks more like slightly higher prices, rather than crazily higher ones. The upside risks arguably trump the downside ones, however. OPEC+’s greater-than-ever pricing power may allow it to intervene in markets to prevent further price falls (i.e. creating an “OPEC put”). Meanwhile, a stronger global economy – including freshly invigorated China – would bring about an extra appetite for fuel, exacerbating the deficit and sending prices much higher.

What Are the Implications?

Higher oil prices can have major knock-on effects. They not only pump up headline inflation but also tend to influence investors’ expectations of future inflation. And sure, as long as the price gains stay limited, they might not actually impact the Federal Reserve’s inflation-fighting decisions. But the threat of mounting oil prices may force the Federal Reserve and European Central Bank to consider more hikes, even if they are concerned about stress in the banking system or a looming recession. In essence, the higher the oil prices, the bigger the potential hit to consumer spending and companies’ profit. And in turn, that pulls up the risk of a simultaneous negative shock to growth and stubbornly high inflation, leading to the dreaded “stagflationary environment” which has historically been bad for stocks.

OPEC+’s supply cut – and the resulting oil price spike – was completely unexpected, and served as a clear reminder of how uncertain the current macroeconomic environment is. With so many potential paths for the economy, it would be advisable to diversify assets to give a better chance at surviving multiple scenarios. Investors should consider treasury bonds, gold, commodities, and a small amount of bitcoin to protect against the unintended consequences of monetary and fiscal stimulus.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply