NVIDIA’s Success and Economic Signals: A Comprehensive Analysis

In the ever-evolving world of technology and economics, recent developments are painting a complex picture. NVIDIA’s triumphant quarter, changes in U.S. business activity, new insights into the labor market, and much more are all part of this comprehensive look at current economic and business trends.

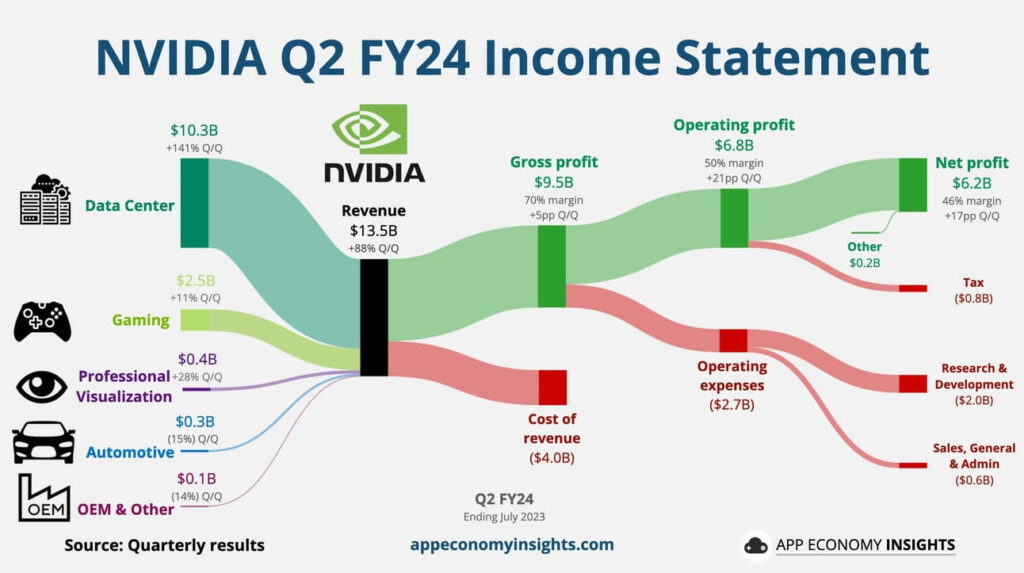

Turning Data Centers Into Gold Mines

NVIDIA’s journey in less than a decade has been remarkable. Once a marginal component, its data center business has now become the main source of sales. NVIDIA’s recent earnings report not only beat Wall Street estimates but knocked them out of the park, with revenues 30% and profits 21% above consensus. Analysts are now eyeing a $1 trillion market opportunity, signaling the dawn of a new computing era.

Short-sellers in Despair

Having risen +225% YTD, NVIDIA’s Q2 earnings report met high expectations. The booming demand for AI chips led to record revenue from its data center, rising 171% from a year ago. NVIDIA is projecting revenues of $15.68 to $16.32 billion for the current quarter, far above analysts’ expectations of $12.6 billion.

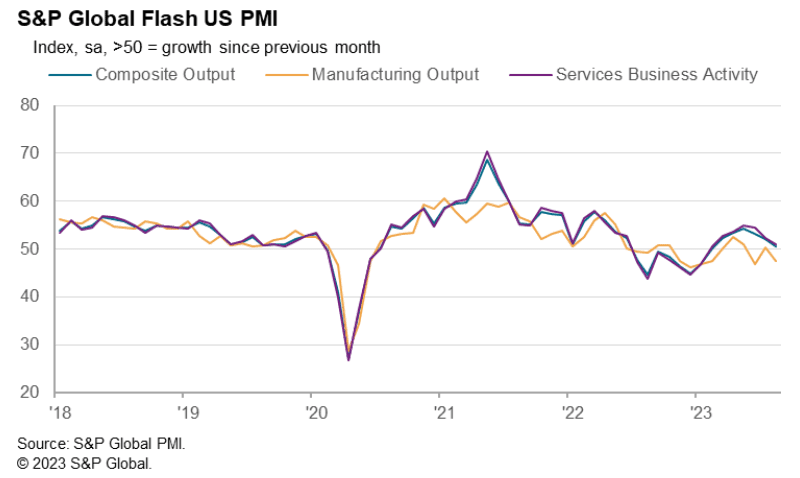

S&P Global: Business Activity in the U.S.

Business activity in the U.S. slowed significantly in August. S&P Global’s flash purchasing managers indices show a fall to 50.4 from 52, indicating contraction. Manufacturing has contracted for 7 of the last 8 months, and services expansion is now at its slowest in 6 months. Global PMIs paint a similar picture of contracting manufacturing and softer services.

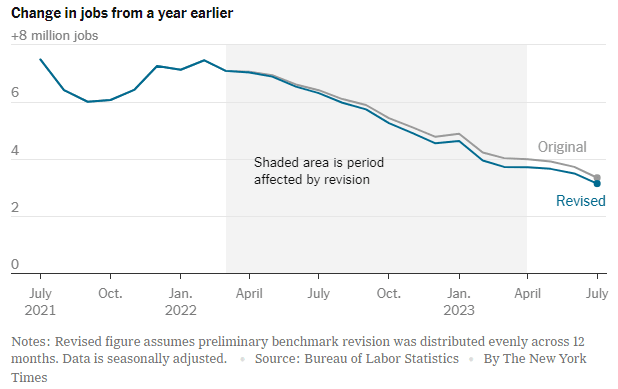

The New York Times: Labor Market Reality Check

Revised data from the Bureau of Labor Statistics (BLS) reveals 306k fewer jobs in March than initially reported. Even after revisions, the labor market remains hot with at least 2.8 million more jobs than before the pandemic.

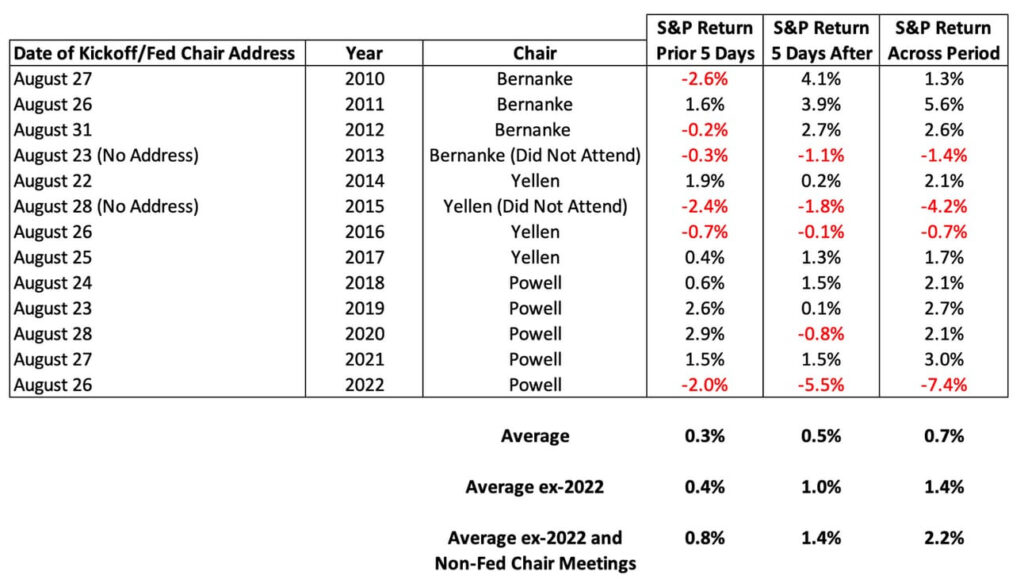

DataTrek Research: Jackson Hole Symposium Insights

Stocks typically see an average pre-conference gain of 0.4% over the 5 days preceding the Jackson Hole symposium and an average gain of 1% in the 5 days following.

U.S. Crude Inventories

US crude inventories are at their lowest since December 2022, with more than double the expected draw last week. However, oil prices fell due to production boosts from Iran and possible easing of sanctions in Venezuela.

Safe Trading

Team of Elite CurrenSea

Leave a Reply