Navigating Unsettled Waters: A Deep Dive into Financial Shifts

The financial winds are changing, and the flags of caution are being hoisted by the very institutions that navigate them. But it’s not just about being alert—it’s about understanding what’s happening, why it’s happening, and what we can anticipate next.

The Downgrade Domino Effect

In a move that has raised eyebrows, the S&P has decided to downgrade multiple U.S. banks, suggesting strenuous conditions. This decision isn’t a standalone act. Last month, Moody’s took a similar step by downgrading 10 banks, and just last week, Fitch signaled a potential downgrade for several major banks, including the giant JPMorgan Chase. The dominoes are starting to tumble, and the banking sector could be in for turbulent times.

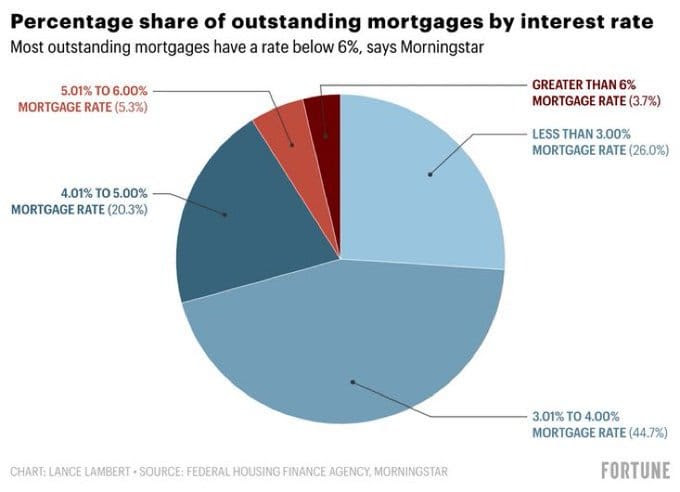

Mortgage Maze: Navigating Rising Rates

For many Americans, the dream of homeownership feels increasingly out of reach. Data from Mortgage News Daily reveals a sharp spike in 30-year fixed mortgage rates, which have surged to a staggering 7.48%—a figure that hasn’t been witnessed in over two decades. Such highs, up nearly 17% from last year, have sent shockwaves through the existing home sales sector. However, on the flip side, new home sales remain robust, primarily due to incentives from builders offering mortgage rate buydowns.

BRICS: Reshaping Global Dynamics

The BRICS nations—Brazil, Russia, India, China, and South Africa—are convening in Johannesburg for their annual meet-up. Representing over 40% of the global populace, the BRICS bloc continues to pique interest, with 40 other countries expressing a desire to join this powerful group. The allure? These nations envision BRICS as a credible alternative to the Western-centric economic setups, hoping to leverage it for economic growth. A significant discussion point this year is the drive towards “de-dollarization”, shifting transactions away from the U.S. dollar and towards their national currencies.

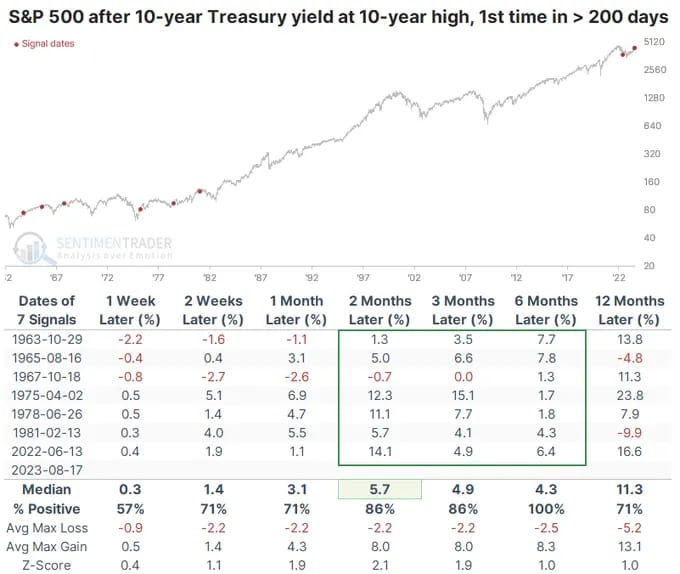

Treasury Trepidation: The Yield Curve Tells a Story

U.S. government debt is under the scanner, with yields on both 10- and 30-year Treasuries soaring to levels not seen since the 2000s. The surging yields, though often seen as a bearish indicator, might not spell doom for stocks. Historically, stocks have shown growth six months after such yield hikes.

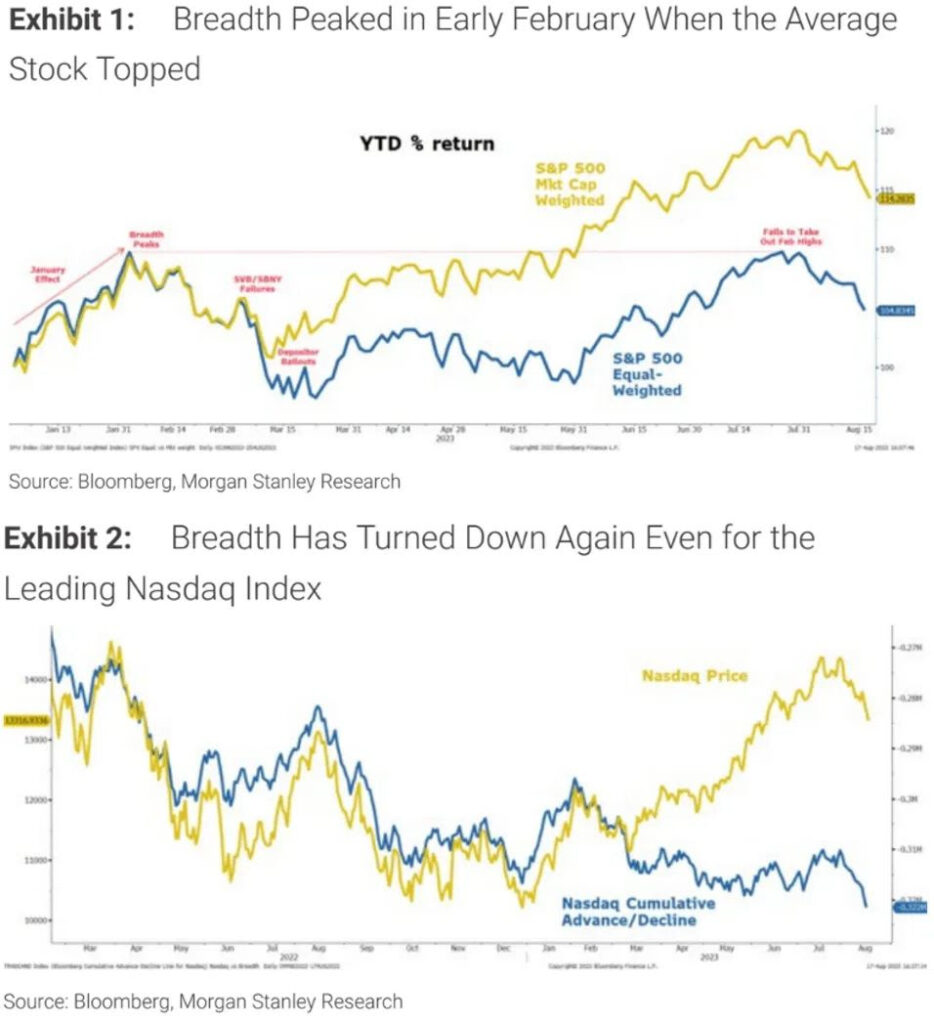

Market Dynamics: The Rise and Fall

Market indices often serve as the pulse of the economy. Recent trends indicate a divergence in the performance of the equal-weighted S&P 500 compared to its market-cap-weighted counterpart. Further, the Nasdaq’s advance/decline line, which was on an upswing, reversed its course this August.

Gasoline Glitch: Demand Slips as Prices Soar

Consumer trends around gasoline consumption show a dip for the first time since March. The culprit? Rising gas prices, which have seen a near 9% jump over the last seven weeks.

Safe Trading

Team of Elite CurrenSea

Leave a Reply