Navigating The Financial Frontier: A Deep Dive into FED Projections, The EU’s Tug-of-War with Google, and The Impending AI Revolution

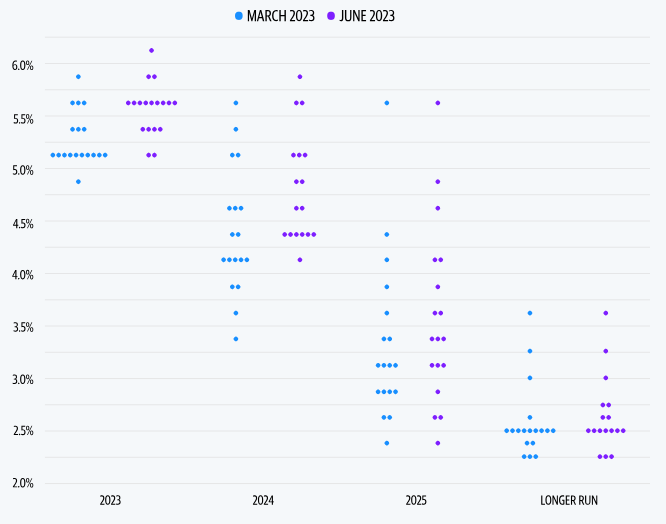

Fed Chair Jerome Powell recently expressed his thoughts on the current economic situation, causing a stir in the market. Acknowledging that the Federal Reserve’s forecasts have missed the mark on inflation for the past two years, Powell suggested that rate cuts aren’t on the cards for at least another couple of years. But given the recent track record, can we confidently trust these projections?

Housing Market Pulse: Mortgage Demand Stirs

As of 4 PM EST on June 14, 2023, applications for mortgages surged 7.2% during the week ending on June 9, making it the first hike in over a month.

The spike coincided with a small drop in mortgage rates (from 6.81% to 6.77%), marking the second week of decline. But with rates still significantly higher than pre-pandemic levels, purchase activity is down by 27% YoY.

US Economy Watch: Wholesale Prices Dip

The US experienced a surprising drop in wholesale prices last month, with the headline PPI dropping by 0.3%, beating expectations of a 0.2% increase.

Main drivers behind this were large decreases in the cost of energy goods, particularly gas prices, and food.

Federal Reserve Update: No Change in Interest Rates

After ten consecutive increases, the Federal Reserve decided to keep interest rates unchanged in June, signaling a hawkish pause in their policy, as most FOMC members advocate for further tightening to curb inflation.

Google vs. the EU: Accusations of Ad Industry Dominance

The European Union has accused Google of abusing its dominance in the advertising tech industry, alleging the tech giant has utilized its position to gain an unfair advantage while charging competitors steep fees for services.

AI Regulation: EU Clamps Down

In the EU, stricter rules for AI are in the works. Newly proposed legislation includes banning biometric surveillance and requiring AI-generated content to be disclosed.

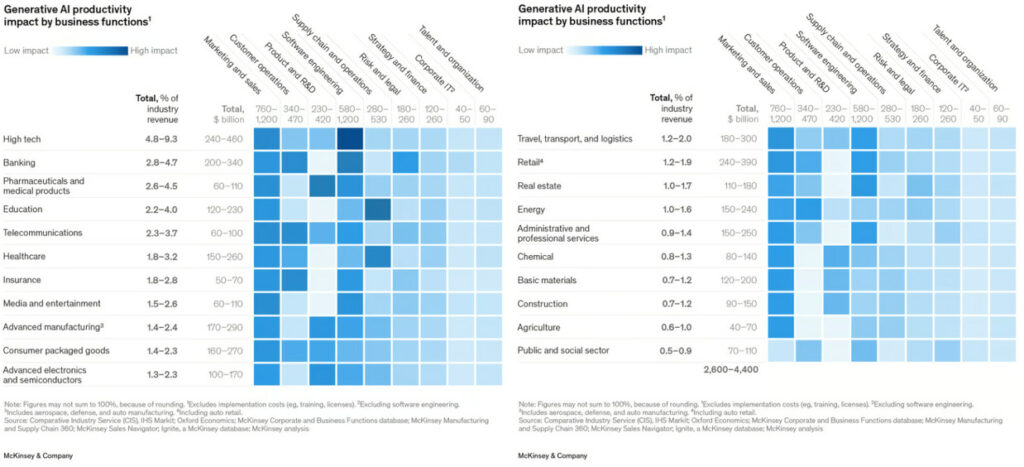

AI Boom: A Potential Trillion-Dollar Windfall

A recent McKinsey report suggests the ongoing AI boom could potentially contribute up to $4.4 trillion annually to the global economy, attributing this to predicted productivity increases.

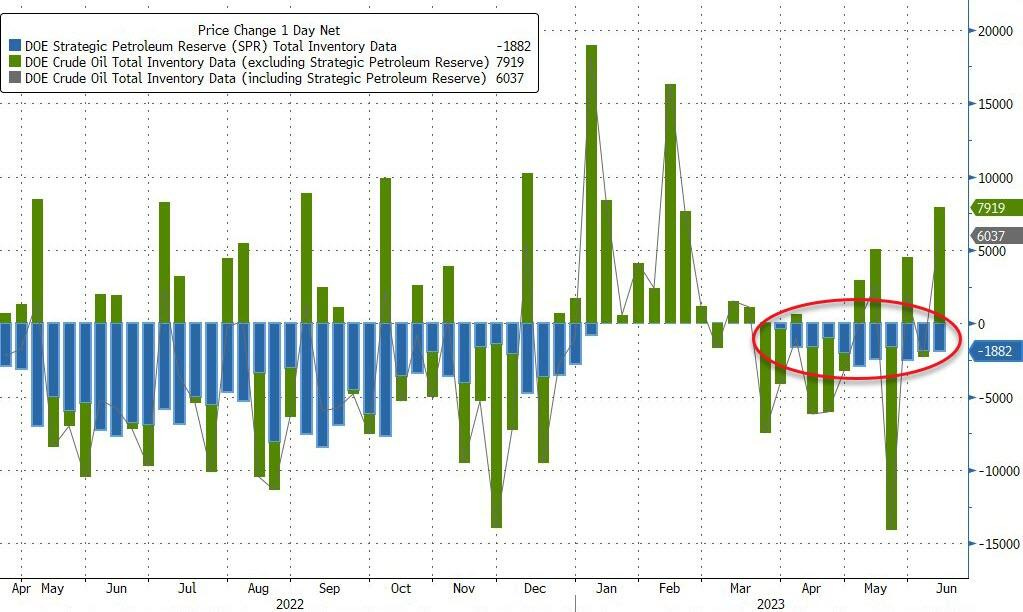

US Crude: Inventory Levels Rise Unexpectedly

The US saw an unexpected rise in crude inventories last week, climbing nearly 8 million barrels against analysts’ prediction of a 510,000 barrel draw.

Safe Trading

Team of Elite CurrenSea

Leave a Reply