Navigating the Financial Currents: A Deep Dive into Today’s Market Movements

As global markets adapt to an ever-changing financial landscape, let’s break down recent shifts from China’s financial stress to the US consumer resilience amid inflation.

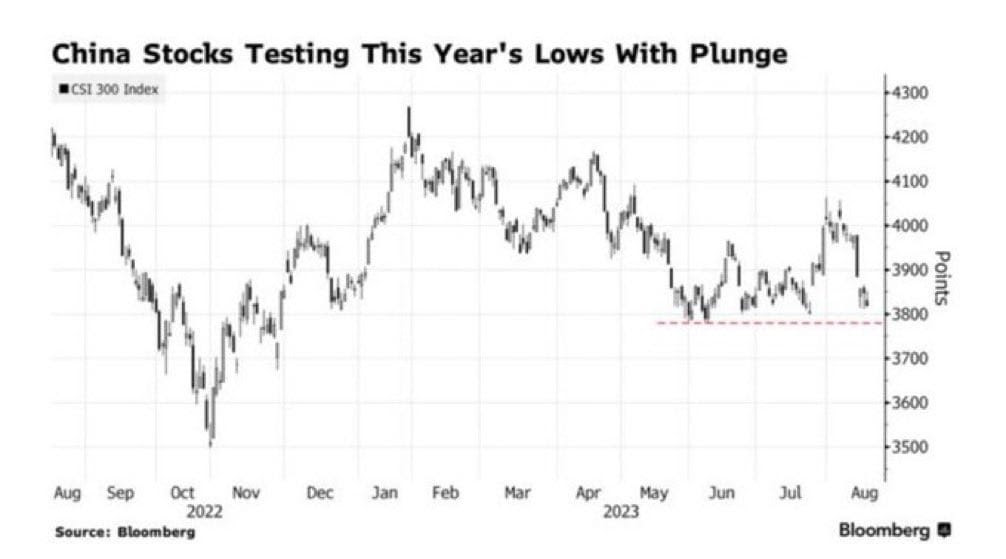

China’s Financial Tension

China’s financial dynamics appear strained, to the point where some investment funds have been advised against net selling of stocks. It begs the question: Are free markets at risk?

US Consumers Brush Off Inflation Concerns

Despite the looming shadow of inflation, American retail sales for July surpassed expectations. With a surge of 0.7%, led notably by a 1.9% growth in e-commerce – thanks in part to Amazon’s Prime Day – it’s evident that the US consumer isn’t backing down. When adjusted for factors such as food, autos, and gas stations, the growth figures remain equally impressive.

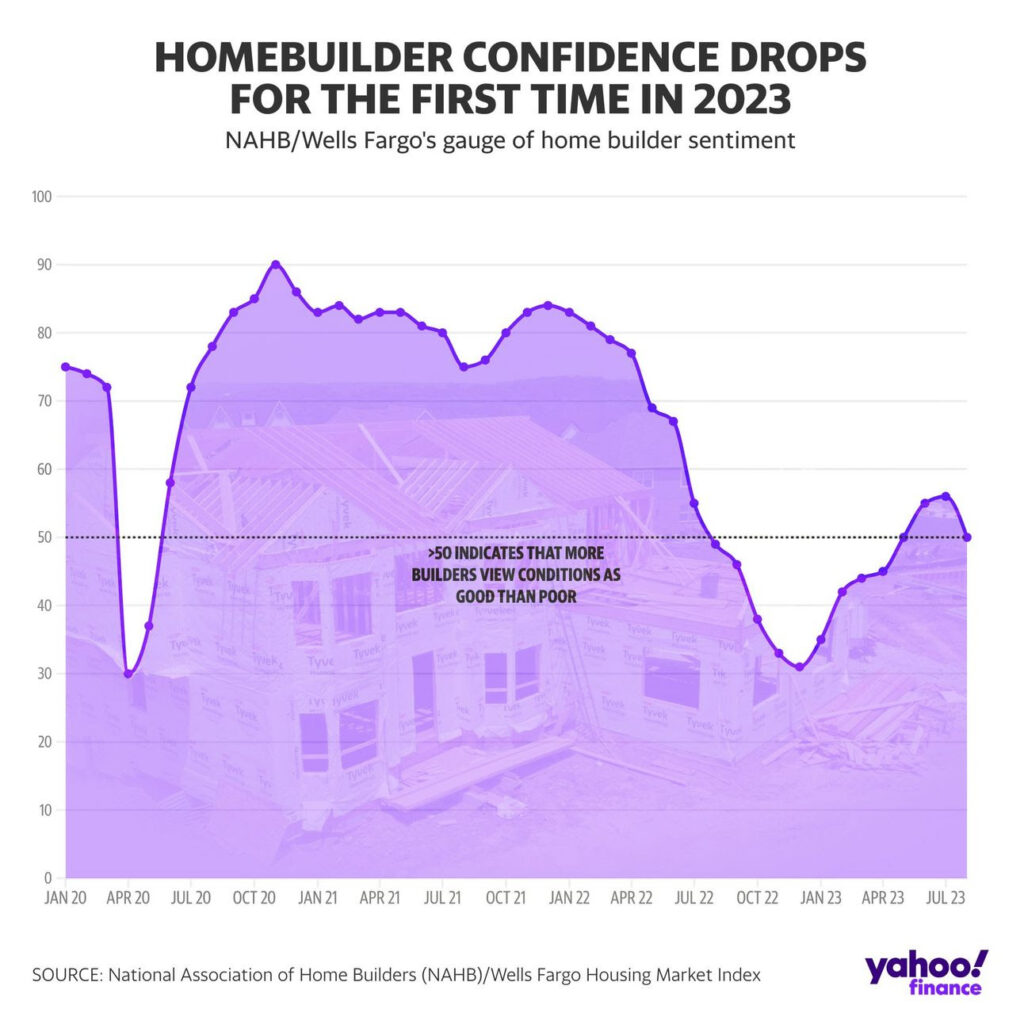

The Changing Landscape of Housing

After a consistent rise in homebuilder confidence throughout the year, August saw an unexpected dip in the NAHB Housing Market Index. Concerns driving this sentiment include escalating construction costs, workforce shortages, materials scarcity, and surging mortgage rates, which now exceed 7%.

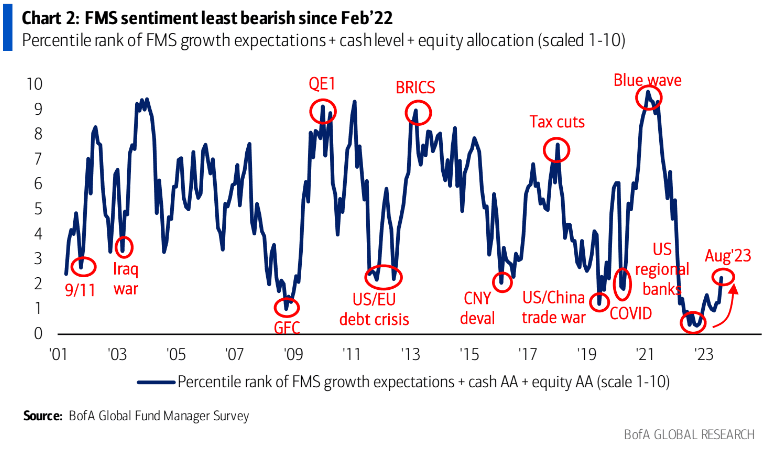

Global Fund Managers’ Renewed Optimism

Bank of America’s most recent Global Fund Managers Survey painted a hopeful picture: cash reserves are at their lowest since November 2021, and the commitment to equities has surged impressively. There’s been a significant shift towards tech, with a reduced focus on REITs. Moreover, there’s an overwhelming sentiment that recessions are not on the horizon for the coming 18 months.

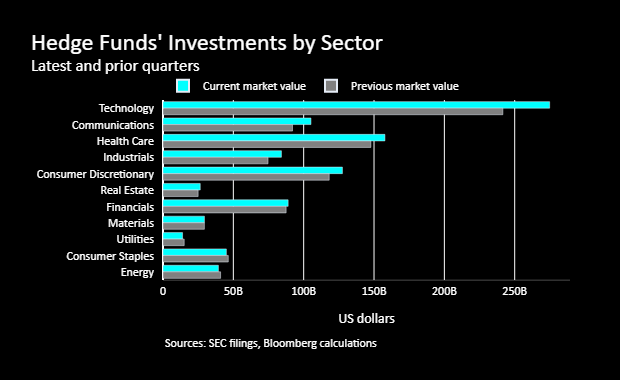

Hedge Fund Movements: Tech Reigns Supreme

Bloomberg’s second quarter analysis reveals a continued inclination towards tech, with Meta standing out as the top choice for hedge funds. Conversely, the energy sector seems to have lost some favor. Beyond tech, funds are increasingly turning to healthcare and discretionary stocks while maintaining a cautious approach to utilities and real estate.

US Crude Inventory: A Balancing Act

There’s a gradual reduction in US crude stockpiles, as evidenced by recent data from the American Petroleum Institute. Although stockpiles have surged by almost 18 million barrels this year, the net reduction since April is estimated at around 30 million barrels. This trend is counterbalanced by the Department of Energy’s recent barrel additions to the Strategic Petroleum Reserves.

Safe Trading

Team of Elite CurrenSea

Leave a Reply