Navigating the Economic Winds: An In-Depth Look at the June-July Market Trends

With a dizzying array of economic indicators and corporate news, it’s easy to lose sight of the larger market trends. Let’s delve into the mid-year market developments of 2023 to decode the financial signals and unravel the complex world of economics.

CPI Inflation: A Welcome Surprise

June brought a surprisingly lower Consumer Price Index (CPI) inflation, with figures coming in at 3.0% against the anticipated 3.1%. This was a significant drop from the May value, which stood at 4.0%. This favorable turn of events is reflected in the core index, which fell below 5%. My expert prognosis? The Federal Reserve may proceed with a July interest rate hike, potentially the last one this year.

Upbeat Forecast for Small Businesses

In more positive news, recent data from the National Federation of Independent Business (NFIB) signal an encouraging climate for small businesses. The Small Business Optimism Index made its most substantial rise since August 2022, peaking to a seven-month high this June.

In a pleasant twist, the smallest proportion of businesses since March 2021 reported increased selling prices. However, we should expect nearly a third of small businesses to raise their prices over the next quarter. With an improved outlook on business conditions and higher earnings expected in the near future, the atmosphere is looking brighter for smaller firms.

The Housing Market: Stability on the Horizon

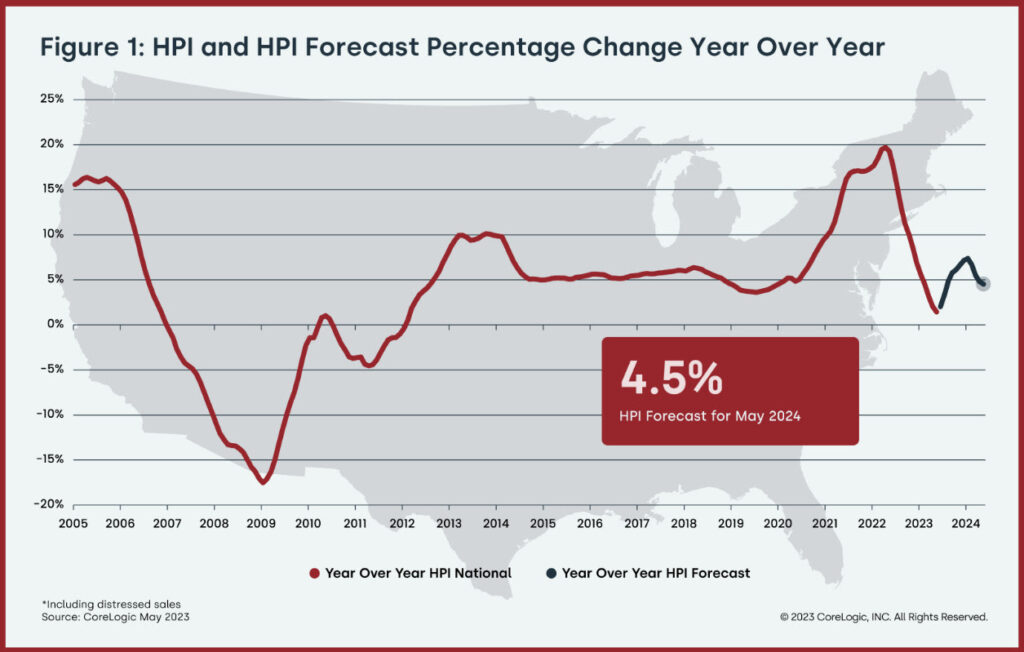

As per data from CoreLogic, it seems that home prices are reaching a trough. Although the growth rate for single-family home prices in May was the lowest annual level recorded since 2012, the firm anticipates an upward swing over the next year. Its Home Price Index Forecast envisions a 4.5% increase in home prices through to May 2024.

On a similar note, Black Knight reports that US home prices soared to an unprecedented high in May, with a growth of 0.7%.

Major Developments in Tech

In a major setback for the Federal Trade Commission (FTC), a US judge denied the attempt to block Microsoft’s $75 billion acquisition of Activision Blizzard. The judge reasoned that Microsoft had little motivation to pull the game “Call of Duty”—which stood central to the regulatory obstacles—from any platform. Following this ruling, TD Cowen now estimates an 80% chance for the deal’s successful completion, a dramatic rise from the initial 40% prediction.

Nasdaq 100: A Time for Rebalance

The Nasdaq 100 is poised for a “special rebalance” with the current overconcentration of six companies accounting for over half of the index. Although the market anticipates selling pressure, historical precedents from 1998 and 2011 suggest that the bull market should remain unscathed. The revised weightings will be announced on July 14 and implemented ten days later, on July 24.

Bullish Momentum in Stock Market

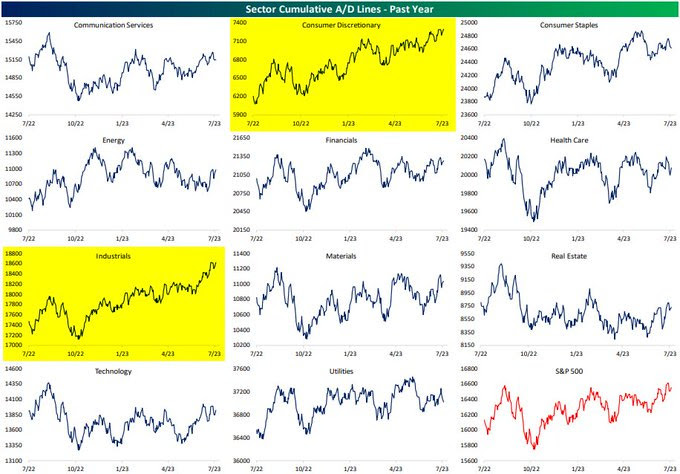

The stock market rally seems to be spreading its wings. Over the past month, the equal-weight S&P 500 has outshined its market cap-weight counterpart (1% vs -0.4%). Indicative of bullish momentum, the strongest cumulative advance/decline line readings are coming from the Discretionary and Industrials sectors—two of the most cyclical sectors. Simultaneously, small caps are observing back-to-back weeks of inflows, as the Russell 2000 achieves a golden cross for the second time this year.

Energy Consumption Forecast: A Slowdown Ahead?

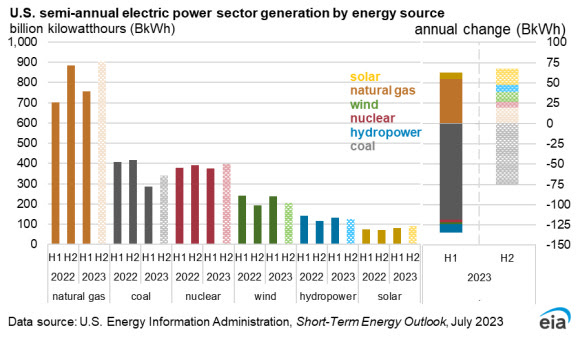

The Energy Information Administration’s latest Short-Term Energy Outlook report anticipates a decline in US power consumption in 2023. The prediction suggests a 1.5% decrease from 2023’s record 4,048 billion kilowatt-hours. With an expected rise in the shares of natural gas and renewable energy sources, and a steady decline in coal’s share through 2024, the energy landscape continues to evolve.

Safe Trading

Team of Elite CurrenSea

Leave a Reply