Morgan Stanley Top Three Trading/Investing Ideas

Morgan Stanley has come up with a framework that can assist you in finding investments that are likely to perform well during times of stock market turbulence.

In uncertain times like these, it is difficult to predict the future of the stock market, and hence it’s always a good idea to diversify your portfolio. This can be done by investing in assets that can perform well when stocks are not performing well.

What Questions Should You Ask?

Most investor portfolios are dominated by stocks, and thus, it is essential to hold assets that can perform well when stocks are struggling.

However, finding such assets can be quite tricky. Hence, Morgan Stanley provides five questions that you should ask yourself to find opportunities that have the most potential to successfully diversify your portfolio:

- Does it diversify?

- Can it diversify consistently?

- How well does it perform when stocks are having a bad time?

- Is it cheap?

- How expensive is it?

How Morgan Stanley asses these ideas?

The first three questions can help you identify a well-rounded diversifier, while the latter two can help you identify a diversified trade that is attractively priced. It is difficult to find an asset that scores highly on all five factors, and hence there are always trade-offs involved.

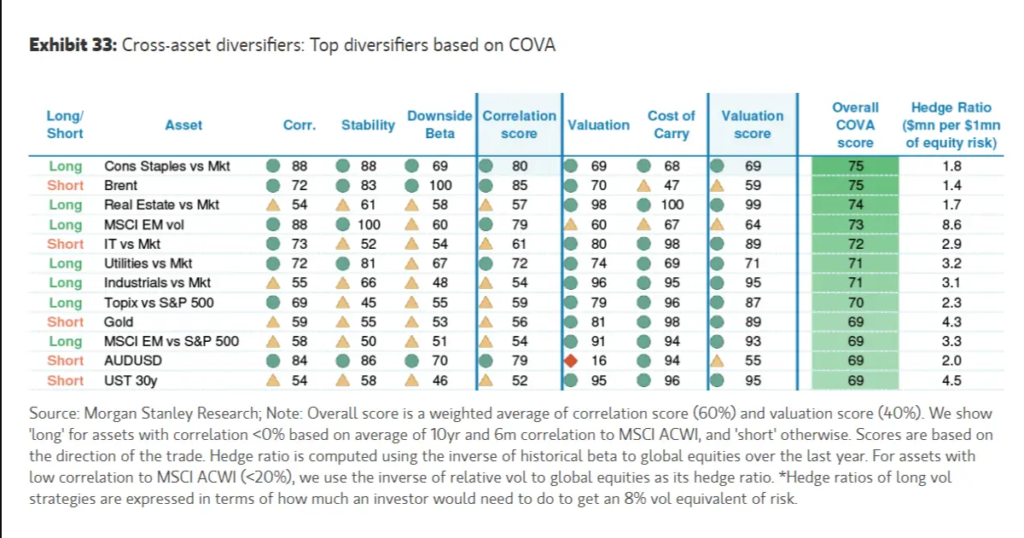

Morgan Stanley has a handy method for scoring and ranking different assets as potential diversifiers. The big bank identified specific desirable features and selected metrics to measure each one.

For each metric, the asset will receive a score from 0 (bad diversifier) to 100 (great diversifier). The first three measures estimate how reliable the asset is likely to be as a diversifier, while the last two measures capture whether or not you’re paying an attractive price for the diversifier.

Morgan Stanley then adds all those scores up to find a final score, giving 60% weighting to the first three measures and 40% to the latter two.

The bank recalculates those scores each month, providing a monthly list of the most attractive diversifying trades for your portfolio.

Top Thee Investing Ideas for the foreseeable future

Morgan Stanley identified the following as the most attractive diversifying trades for your portfolio:

- Go long on consumer staples stocks and short the market.

- Short oil.

- Long real estate stocks and short the market.

It’s important to note that these components are dynamic, meaning different assets will be more effective at different times.

Take bonds, for one: they diversified stocks extremely well over the past decade – but that stopped last year when both stocks and bonds were hit by high inflation. So when you're comparing potential hedges, look for one that's likely to work well in… Click To TweetThe best way to go about this technique is to implement the top three to five trades recommended by the framework. By diversifying across different hedges, you can maximize your chances that it’ll work well during crunch time.

When considering the top three trading ideas that Morgan Stanley has identified, it’s important to note that each trade has its own unique set of risks and benefits.

For example, going long on consumer staples stocks and shorting the market is likely to be a reliable diversifier due to its high correlation score, stable correlation, and high downside beta. However, its overall valuation score is nothing special. Click To Tweet

One way to execute the trade recommended by Morgan Stanley is to use the Consumer Staples Select Sector SPDR exchange-traded fund (ETF) (ticker: XLP, expense ratio: 0.10%) and short the SPDR S&P500 ETF (ticker: SPY, expense ratio: 0.10%). If that’s not possible, you can buy the ProShares Short S&P500 (ticker: SH, expense ratio: 0.88%) or use a contract-for-difference (CFD).

On the other hand, shorting oil is a high-octane hedge that can provide significant benefits in times of turbulence. Click To TweetThe trade has the highest overall correlation score, indicating that it should be extremely efficient at hedging a potential drawdown in stocks. Still, its valuation is only mildly attractive, and it has a high cost of carry, making it a risky bet.

Long real estate stocks and shorting the market have the opposite hedging properties of the short brent trade. While this trade may not work reliably if stock markets tank, it scores extremely well in terms of valuation and cost of carry.

Morgan Stanley also recommends the following trades

- Long utilities and shorting the market,

- Long industrials and shorting the market,

- Long emerging market stocks and shorting US ones,

- Shorting the Australian dollar versus the US dollar.

These trades have their own unique set of risks and benefits, and it’s important to choose the trades that best fit your market views.

In conclusion, diversifying across different hedges is the best way to maximize the chances that the framework will work well during crunch time.

By implementing the top three to five trades recommended by the framework, you can protect your portfolio against an imminent market crash, reduce risk, and add longer-term diversification to your portfolio at the cheapest possible price.

Morgan Stanley’s transparent, rule-based technique can be applied to hedge any other risk you have on your radar.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply