Money Markets Inflows Grow As The Public Ways In on the Global Recession

Hey there savvy trader!

Money market funds are looking like a safe bet right now. These funds invest in low-risk assets like short-term government bonds, which can be easily cashed out of.

With the recent banking crisis shaking investor confidence in bank deposits, many are flocking to these lifeboats at record speed.

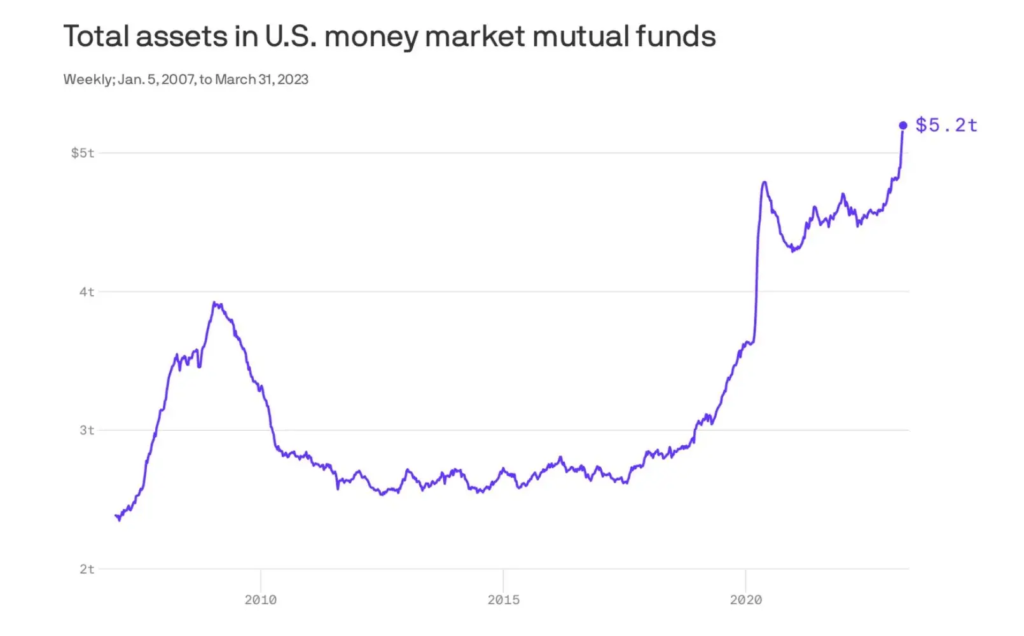

Plus, these funds offer decent returns, especially compared to deposit accounts, making them even more appealing. In just three weeks, over $300 billion poured into these funds, swelling holdings to a record-breaking $5.2 trillion at the end of March.

And Barclays predicts that another $1.5 trillion will flow into money market funds over the next year.

But there could be trouble brewing. An economist who predicted the global financial crisis issued a warning recently, suggesting that more banking issues could lie ahead. Hedge funds that shorted banking stocks made a killing last month, with over $7 billion in profit, the biggest windfall since the financial crisis.

Another financial fiasco would not bode well for the global economy, which is already facing its fair share of challenges.

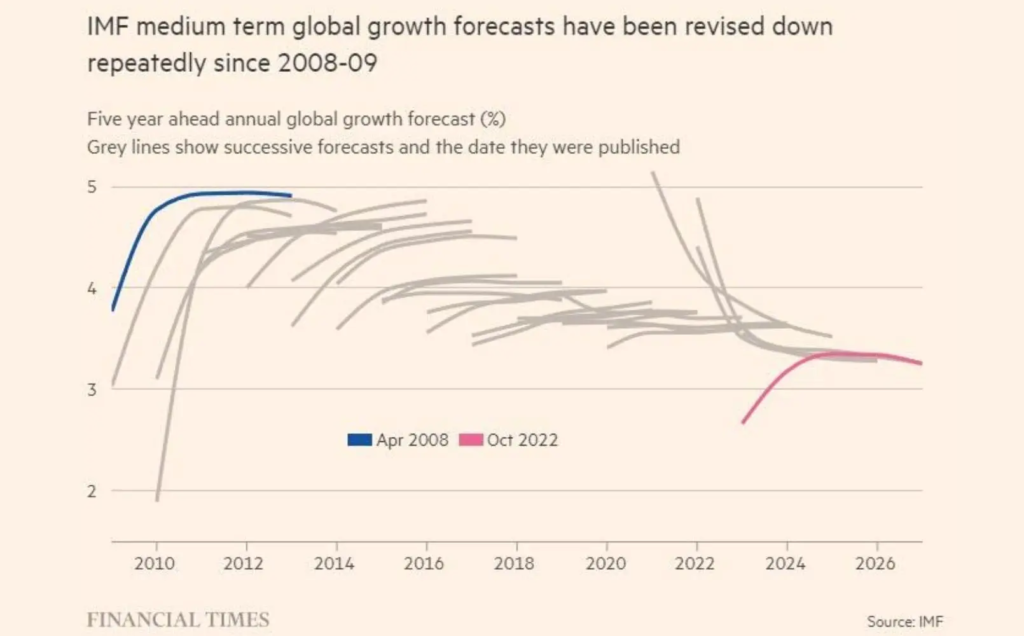

The International Monetary Fund predicts global economic growth of just 3% over the next five years, with over 90% of advanced economies set for a slowdown.

Keep an eye on those money market funds, but be prepared for potential bumps in the road.

Safe Trading

Team of Elite CurrenSea

Leave a Reply